A Guide to Stop Living Paycheck to Paycheck

Abhishek Mule

Abhishek MuleI was 19 when I officially started working. My career journey began in sales and marketing, and I was ecstatic with my first job because I was about to break my financial virginity. My first paycheck was 10K INR ( roughly $150) a month.

Though it wasn’t a lot, I was happy. I could finally cover my own expenses. For a 19-year-old in a third-world country, 10K/mo felt like a good start.

But, as with any new opportunity, new challenges arise.

One problem, in particular, is so common that it often feels deceptively simple to fix: saving money. But as you might already know, it’s harder than it seems.

You’ve probably read countless books, watched numerous YouTube videos, and listened to finance gurus share their wisdom on how to manage your money well. Yet, here you are, still struggling to save. I’ve been there too.

Here’s my most practical advice for you to start building financial security, even if your monthly expenses exceed your income.

Let’s dive in.

1. Don’t Keep All Your Money in One Bank Account

The biggest mistake most people make when they start earning is keeping all their money in one bank account. Why is this a problem? It becomes difficult to track where your money is going. Before you know it, you’ve spent more than you planned on things you didn’t need or could have postponed.

The solution? Multiple bank accounts, each dedicated to different purposes.

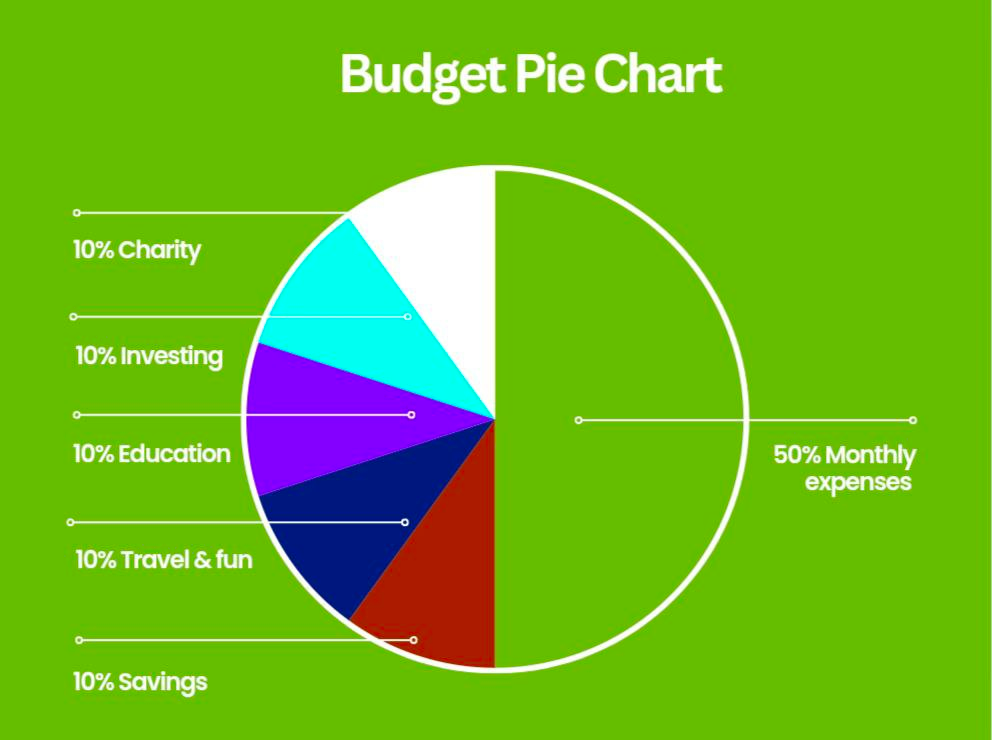

Personally, I divide my income into six accounts:

This method ensures you have control over every aspect of your financial life. For example, if you want to go on vacation, you’ll check your fun & entertainment account. If there’s not enough in that account, you know it’s not time for the trip yet. This system helps keep impulsive spending at bay, especially in today’s world where social media is one big sales funnel.

If your expenses are more than your income, don’t worry. I’ve got a solution for that too.

2. Deficit Budget

Let’s say you make 10K INR per month, but your expenses total 15K. This means you’re borrowing 5K each month. If you can borrow 5K, you can also 1K borrow to kickstart your saving habit.

Put 500 rupees in your monthly expenses account and divide the remaining 100 rupees each into the other five accounts. It may seem insignificant, but trust me, this simple habit works wonders over time.

This is the law of the universe: energy flows where attention goes. Focus on building this system, and after 21 months, you’ll see a significant change in your financial situation.

3. Track Your Monthly Expenses

Earning money and keeping it are two completely different skill sets. I’ve seen people with enormous amounts of money go broke because they couldn’t manage it. Getting rich and staying rich are not the same.

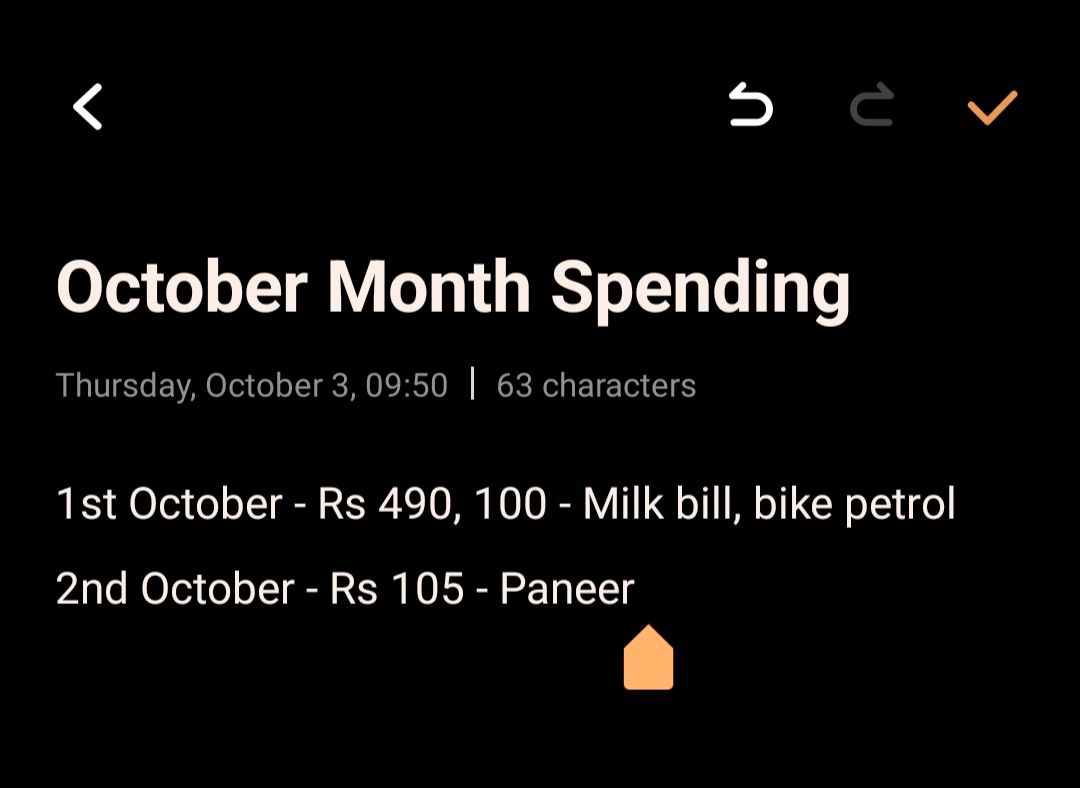

This is where tracking comes in. Use the Notes app on your smartphone to document every daily expense. At the end of each month, review your spending. Identify unnecessary purchases and plan how to avoid them next time.

Spending is a habit, and like any habit, it can be broken. By tracking your expenses, you take control and stop wasting your hard-earned money.

4. Maintain a Net Worth Tracker

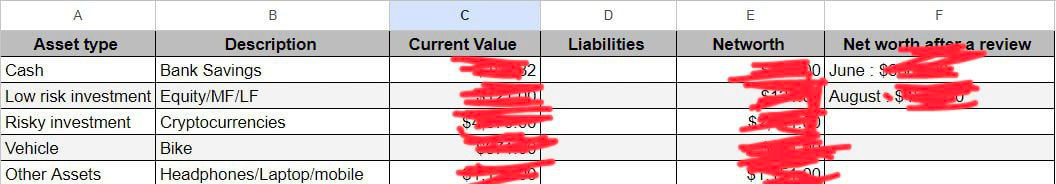

Create a simple google sheet to track your net worth. Make columns for cash, investments, and liabilities, and list everything you own. Review this sheet every three months to see where you stand.

You can use the following sheet as inspiration to create your own.

This quarterly check-in will give you a sense of purpose and motivation to keep improving your financial situation. It requires discipline, but if you stick to it, you won’t recognize your financial life a year from now.

To summarize: Use the proven 6-bank account strategy to track where your money is flowing. If your expenses exceed your income, adjust for a deficit budget to build the habit of saving. Track every expense by noting down each dime you spend and, at the end of the month, review unnecessary purchases to avoid repeating the same mistakes next month. Lastly, maintain a net worth tracker and review your progress every three months to stay on course.

Talk to you soon :)

Subscribe to my newsletter

Read articles from Abhishek Mule directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Abhishek Mule

Abhishek Mule

Exploring my curiosity and sharing everything I learn along the way