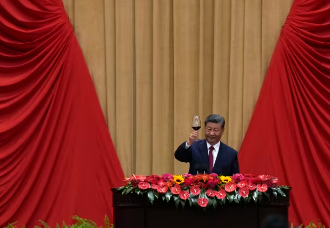

As China Marks 75 Years, Can Xi Restore Economic Stability?

Kingston

Kingston

As China prepares to celebrate its Golden Week holiday and the 75th anniversary of the People’s Republic, the ruling Communist Party has announced a series of measures to revive its struggling economy. These include support for the troubled property sector, financial aid for the stock market, cash assistance for low-income citizens, and increased government spending.

Following the announcements, stock markets in mainland China and Hong Kong experienced a significant rally, with the Shanghai Composite Index surging over 8% on the eve of the holiday, marking its best performance since the 2008 financial crisis.

Despite the optimistic market response, economists remain skeptical about the long-term efficacy of these measures. On September 24, the People's Bank of China (PBOC) unveiled plans to lend 800 billion yuan ($114 billion) to insurers and asset managers for stock purchases. Governor Pan Gongsheng also announced measures to lower borrowing costs and support share buybacks for listed companies.

Just days after the PBOC's announcements, President Xi Jinping convened a surprise meeting of top leaders, promising intensified government spending to bolster economic growth.

However, many experts highlight that these measures may not adequately address the deeper issues plaguing China's economy. With the nation set to miss its 5% annual growth target, concerns about declining confidence loom large. "In China, targets must be met, by any means necessary," emphasized Yuen Yuen Ang, a political economy professor at Johns Hopkins University.

The property market downturn, which began three years ago, remains a significant hurdle for the world's second-largest economy. Recent stimulus efforts have included increased bank lending, mortgage rate cuts, and lowered down payment requirements for second-home purchases. Yet, skepticism persists regarding their potential impact.

Economists argue that the underlying issue lies in a crisis of confidence rather than credit availability, with both businesses and households reluctant to borrow, regardless of interest rates.

At the Politburo session, leaders committed to prioritizing the stabilization of the property market and boosting consumption, yet specific details regarding the scale of government spending remain unclear. Qian Wang, chief economist for Asia Pacific at Vanguard, warned that inadequate fiscal stimulus could lead to investor disappointment and that without structural reforms, the fundamental issues within China's economy would persist.

Experts assert that addressing the challenges in the real estate sector is essential for broader economic recovery. Falling property prices have adversely affected consumer confidence, making it vital to ensure the completion of pre-sold homes.

An editorial from the state-controlled People's Daily acknowledged the challenges ahead but emphasized the potential for a promising future, citing President Xi's concepts of "high-quality development" and "new productive forces" as key to navigating this path.

While Xi aims to transition the economy away from reliance on property and infrastructure growth towards high-end industries, experts warn that the intertwined nature of old and new economic sectors could hinder this transformation if the old economy falters too quickly.

The outcome of these strategies will become clearer as China moves forward, balancing immediate relief measures with the need for lasting reforms.

4o mini

Subscribe to my newsletter

Read articles from Kingston directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by