Company Profile: IndiaBonds (SEBI OBPP Platform)

Vanya Gautam

Vanya Gautam

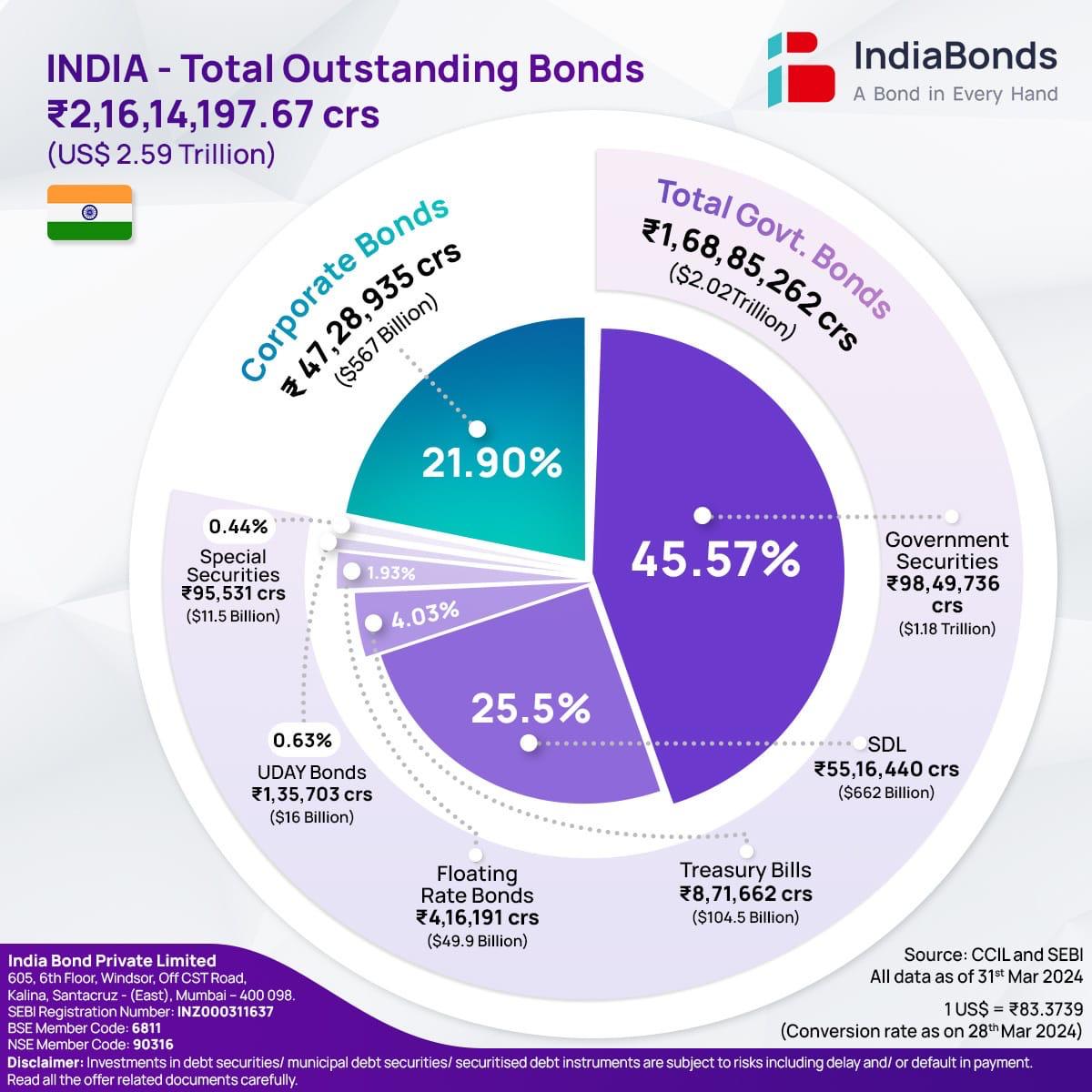

$2.59 trillion. That’s the mammoth value to which India’s bond market had climbed by the end of financial year 2023-24. Besides that, the inclusion of Indian bonds in JP Morgan and Bloomberg indices has been no less than a huge announcement this year for the Indian fixed-income markets, with the potential of being a game changer.

All this is a testament that the growth of India’s bond market seems to be finally happening and getting the much-deserved limelight.

And on top of all this, India’s market regulator SEBI (Securities and Exchange Board of India) had a few months ago given a big push to the corporate bond market by reducing the minimum ticket size for investments from Rs 1 Lakh to just Rs 10,000, thus opening the doors for retail investors to invest in India’s growing bond market.

These significant developments this year are the reason why you, as an investor, should not turn a blind eye towards the significant potential that India’s bond market has.

So today, let us deep dive and cover the journey of Indiabonds, which is an OBPP that aims to simplify the otherwise highly complex bond market for every Indian and empower them with fixed-income investments. It is a registered OBPP with both the NSE and BSE.

Like any other OBPP platform, IndiaBonds must follow SEBI's rules and regulations. To learn more about OBPP, please check this blog.

Corporate Structure & Founders

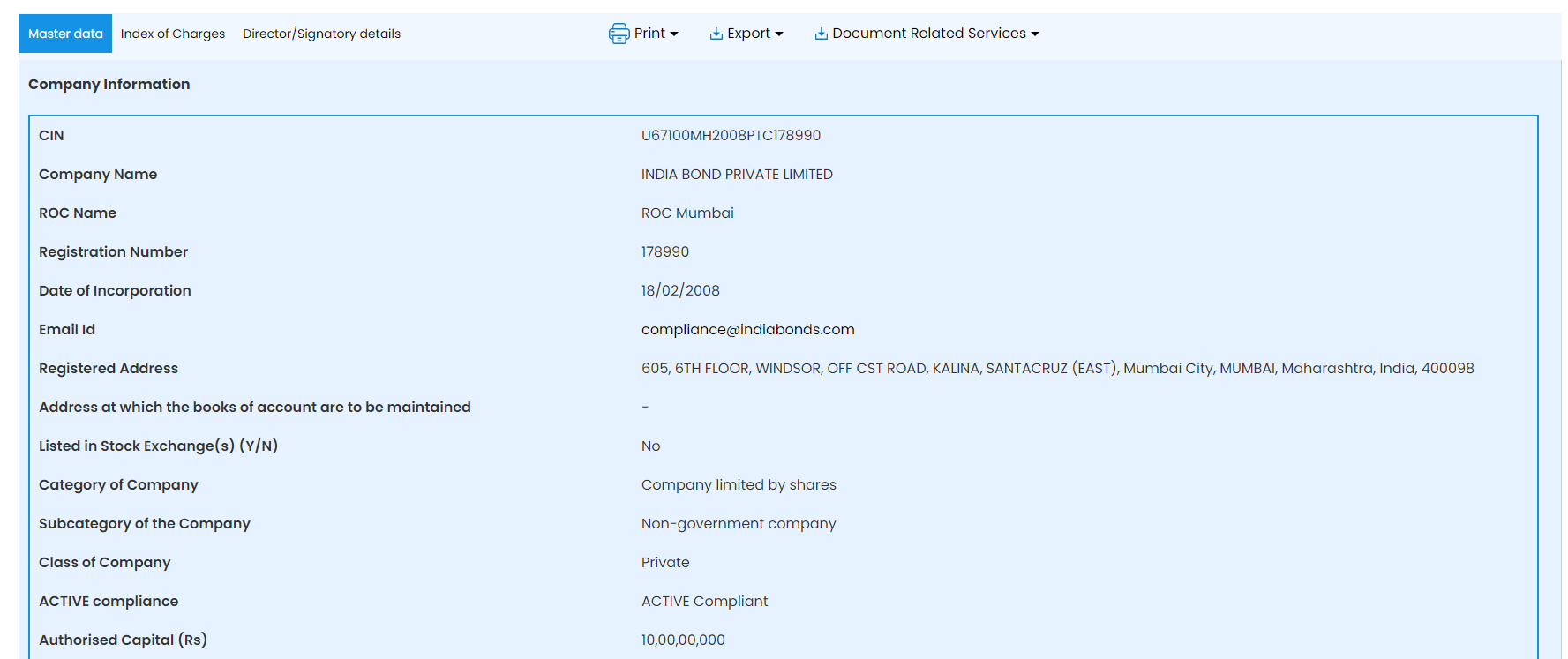

Founded in the year 2021, IndiaBonds (India Bond Private Limited) is a SEBI-registered and licensed OBPP in India. The Mumbai-based financial services provider aims to spearhead the digital revolution in India’s corporate bond market, and simplify the otherwise complex bond market for every Indian investor.

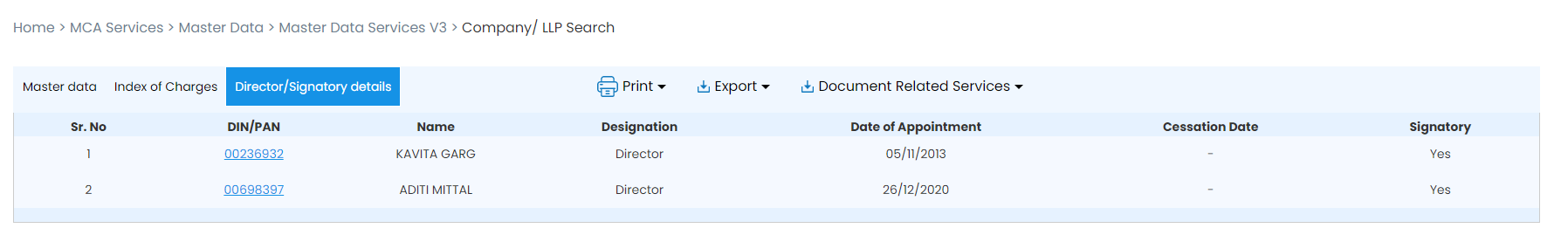

As per the MCA filings (accessed on 10th October 2024), IndiaBonds currently has two directors, Kavita Garg and Aditi Mittal.

Aditi Mittal (Co-Founder & Director)

Aditi brings in a rich experience of 20+ years in the Indian fixed-income markets. She is also a director of AK Capital, a financial services group started by her father, which she joined in the year 2005. Its noteworthy that AK Capital is amongst the oldest and leading merchant banking and investment advisory services provider in India.

Vishal Goenka (CEO & Co-Founder)

Vishal has more than 20 years of experience in fixed-income credit markets globally. He held various leadership positions across sales and trading at Deutsche Bank Singapore over 12 years, and also spent over six years as a credit trader at Merrill Lynch London. Given his experience he clearly knows his way around the bond market in India.

Kavita Garg (Director)

Surprisingly, not much information about Kavita could be found on the internet, including social media platforms like LinkedIn. But the MCA filings do show that she is heavily involved in the AK Capital Group companies.

The point of this section is to establish that the people running IndiaBonds do come from a very solid background and have the right skillset and experience to run a business like this. I personally think they might even be overqualified to run this business!

Business Model

Just like most SEBI-registered OBPPs in India, the business model of IndiaBonds revolves around being a distributor of bonds and earning a spread i.e. they buy at a lower price and sell at a higher price. Here’s the wide range of investment options available on its platform:

Privately Placed Listed Bonds

Public Issues through bond IPOs and NCDs

Government Securities (G-Secs)

Fixed Deposits (FDs)

54EC Bonds (Read about them here)

State Development Loans (SDLs)

In our opinion, IndiaBonds as an OBPP platforms offer the highest variety of options available to the end retail investor. They mostly have each and every bond that’s available in the secondary market.

Due to their strong connections with the AK Capital Group, they are well-positioned to offer competitive prices on these bonds while still making a decent profit on the spread. However, like any other business in finance, success largely depends on volume. The more you sell, the more you earn. IndiaBonds currently claims to have completed transactions worth over 2500 Crores, which is impressive. However, considering the size and potential of the debt market, there is still plenty of room for growth.

Can Defaults Happen?

Debt instruments in nature are less riskier than equity investments, but it highly depends on which kind of bond you have purchased. Now with so many options available in the market like NCD, MLD, Unlisted Corporate, Govt Bond, it can get very confusing on which option works best for you. But one thing which is always very helpful to know is the rating of the bond.

Source: Kundan Kishore

The higher the rating of the bond, the lower the credit risk. So in above table, if a Bond X is rated AA and Bond Y is rated BB, Bond X will be much more safer than Bond Y but will also yield less returns when compared. The beauty of debt market is there is something always available suiting the investors risk profile.

For Fixed Deposits done with a bank, any deposit upto INR 5 Lakhs is covered under the DICGC Insurance. However, any deposits done with a Deposit Taking NBFC will not be covered under this scheme and still faces a risk of default. Investors can get comfort by evaluating the credit rating of NBFCs in these cases.

What Do We Like About IndiaBonds?

Frankly most of the OBPP platforms operate by the rules and have very less differentiation, but here is what we like about IndiaBonds.

Regulated: IndiaBonds is a SEBI Regulated OBPP Platform. So chances of fraud or mis-selling are extremely low.

User-First Approach: They built out bond yield calculator and built a comprehensive bond directory with over 25,000 securities. They may not be selling all of these securities but they have ensured that the data on all of these are accurate and up to date. They have maybe tried to emulate the equity market which also has a lot of options to choose from.

Solid Leadership Team: The leadership team of IndiaBonds has the appropriate credentials to run and scale up their platform, with both the founders having a rich experience of 20+ years in fixed-income markets in India and globally.

Option To Sell: You can reach out to IndiaBonds to sell them any bond you hold even if you haven’t purchased it via them. The pricing may not be very competitive but the comfort for liquidity is definitely important to many.

BondCase: Very similar to smallcase but for bonds. Investors have access to predefined BondCases which they can view and buy multiple bonds in a single click. Investors also have an option to add or remove securities in pre-determined bond-cases as they wish.

Good User Interface: IndiaBonds has a good UI to display all relevant information to investors in a single screen. Trust us, this has been tough to crack for few other OBPPs.

For example, when you search for a bond like Hinduja Leyland Finance Ltd., IndiaBonds first shows (in green) how safe your investment is, helping you assess the risk.

Other key details displayed include the coupon rate, credit rating, interest payment frequency, maturity date, etc. There's also an investment calculator for the bond.

On the bottom right, there's a compare button to help you compare this bond with others, aiding in your investment decision.

What Do We Not Like About IndiaBonds?

While credit ratings are a useful metric for assessing a bond's risk for retail investors, it would be helpful if IndiaBonds showed the average default rate for that credit rating across the Indian debt markets. This information is regularly published by credit rating agencies and would give retail investors a better understanding of the default history for that rating.

All opportunities by IndiaBonds are shown in IRR (Internal Rate of Return), which can be misleading for bonds because it assumes all interest payments are reinvested at the same rate. This isn't always true, as TDS payments are deducted and cannot be reinvested at the same rate. However, this is an industry-wide issue and not specific to IndiaBonds alone.

Too many options available may not be very attractive for ordinary retail investors who know nothing about the fixed income market. It may infact confuse them given the low awareness around the product.

Conclusion

Honestly, there’s not much to complain about IndiaBonds. They indeed are doing commendable work as a trendsetter among the OBPPs. We have already mentioned what works in favor of them and what doesn’t, according to our research. The decision ultimately rests upon your shoulders to make an informed decision as a retail investor.

ALT Investor is very bullish about diversification, and feel that Indians need to break the traditional norm of investing only in PPF or FDs. They must diversify if their risk appetite allows them to, and find investment options that fill the gap between FDs and equities, and offer a middle-ground in terms of both risk and returns. Platforms like IndiaBonds are offering such an opportunity by making retail investors more familiar with India’s bond market, which in itself is showing signs of a bright future and huge potential.

Please note that this is an opinion blog and not an official research or investment advice. This blog aims to help retail investors make an informed decision in the bond market, and neither encourages nor discourages you from investing in any particular bond or any other asset class.*

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Thank you for your time. Hope this article turned out to be a good read for you. If yes, we would love it if you could join our Whatsapp community by clicking here. If you have any questions or feedback regarding this article, please mention in the comments below.

Subscribe to my newsletter

Read articles from Vanya Gautam directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by