SDIs vs. Bonds vs. FDs

Yash Roongta

Yash Roongta

KEY TAKEAWAYS

The article compares Securitized Debt Instruments (SDIs), bonds, and fixed deposits (FDs), highlighting their differences in terms of risk, return, tenure, and regulation.

SDIs are backed by a diversified pool of underlying assets, offering better risk-adjusted returns compared to bonds, which are concentrated on a single issuer.

Fixed deposits are the safest option with guaranteed returns but offer the lowest interest rates, making them suitable for conservative investors.

SDIs and bonds provide higher returns than FDs but come with higher risks, including potential defaults, requiring careful evaluation of risk tolerance.

It’s noteworthy to understand the importance of the security structures and tax implications of each investment type to make informed financial decisions.

Hi there, welcome back to our AltXtra series! In the last article, we took a deep dive into securitized debt instruments (SDIs). We explored the parties involved in creating SDIs and provided practical examples of how they work and how SDIs might be a good addition to your portfolio.

In this article, we'll discuss the key differences between SDIs, bonds, and fixed deposits (FDs) to help you make informed decisions about fixed-income investments. If you haven't read our previous SDI article yet, we highly recommend checking it out first! Click here to access it.

If you prefer videos more, you can checkout this new format we have tried in this series.

Introduction

First and foremost, here is a brief introduction to these financial instruments:

Securitized Debt Instruments (SDIs): These are assets backed by an underlying pool of loans, leases, bonds, invoices, etc. Grip Invest offers various products in this category, with LoanX (a pool of loans) being the most prominent.

Bonds: Corporate entities issue bonds to raise capital in the form of loans, which are used to achieve business objectives such as starting new projects or scaling existing businesses.

Fixed Deposits (FDs): While likely familiar, FDs are deposits made with a bank or a deposit-taking NBFC. These are considered very stable investments in India and are protected up to INR 5 Lakhs under the DICGC. FDs with NBFCs generally are not protected.

| Criteria | SDIs | Bonds | Fixed Deposits (FDs) |

| Nature | Backed by a pool of underlying assets (e.g., loans) | Debt raised by NBFCs or Corporates. | Bank or NBFC deposits. |

| Issuer | Originated by a Bank, NBFC or a corporate entity. | Governments, Municipal Corporations, NBFCs, Corporates | Commercial banks, Co-operative banks and Deposit taking NBFCs. |

Risk, Return, Tenure & Regulation

From a regulatory standpoint, all three instruments are regulated by either RBI, SEBI or the MCA to some extent. The distribution of some instruments online may require further licenses like OBPP (Online Bond Platform Provider) which Grip Invest does.

| Criteria | SDIs | Bonds | Fixed Deposits (FDs) |

| Regulation | Covered under the securitization guidelines issued by RBI in 2006 and the SDI guidelines issued by SEBI in 2008 | Covered by the Companies Act, 2013 for privately placed debentures and under SEBI rules for publicly placed debentures. | Covered under RBI Banking License. |

| Returns | Based on cash flows from underlying assets. Generally between 10% - 16% IRR. | Fixed or floating interest payments. Generally, between 9% - 18% IRR is for listed debt, and up to 18% IRR is for unlisted debt. | Fixed interest rate. Generally, it gives a maximum 9% interest rate. |

| Risk | You can lose money if too many underlying assets default too quickly and the security cover is not sufficient to cover these losses. | You can lose money if the issuer goes bankrupt and stops servicing the debt. | You can lose money if the bank defaults and your amount is greater than INR 5 Lakhs. For NBFC deposits, you can lose all your money if it goes bankrupt. |

| Tenure | Varies by structure and underlying assets (from 4 - 48 months) | 12 months to long-term (up to 30+ years for govt. bonds) | Ranges from a few months to several years (max. 10 years) |

| Liquidity | Tradable but has very less liquidity in India. | Decent liquidity for govt. bonds and A-rated corporate bonds; less liquidity for everything else. | Liquid, however. premature withdrawals incur a penalty. |

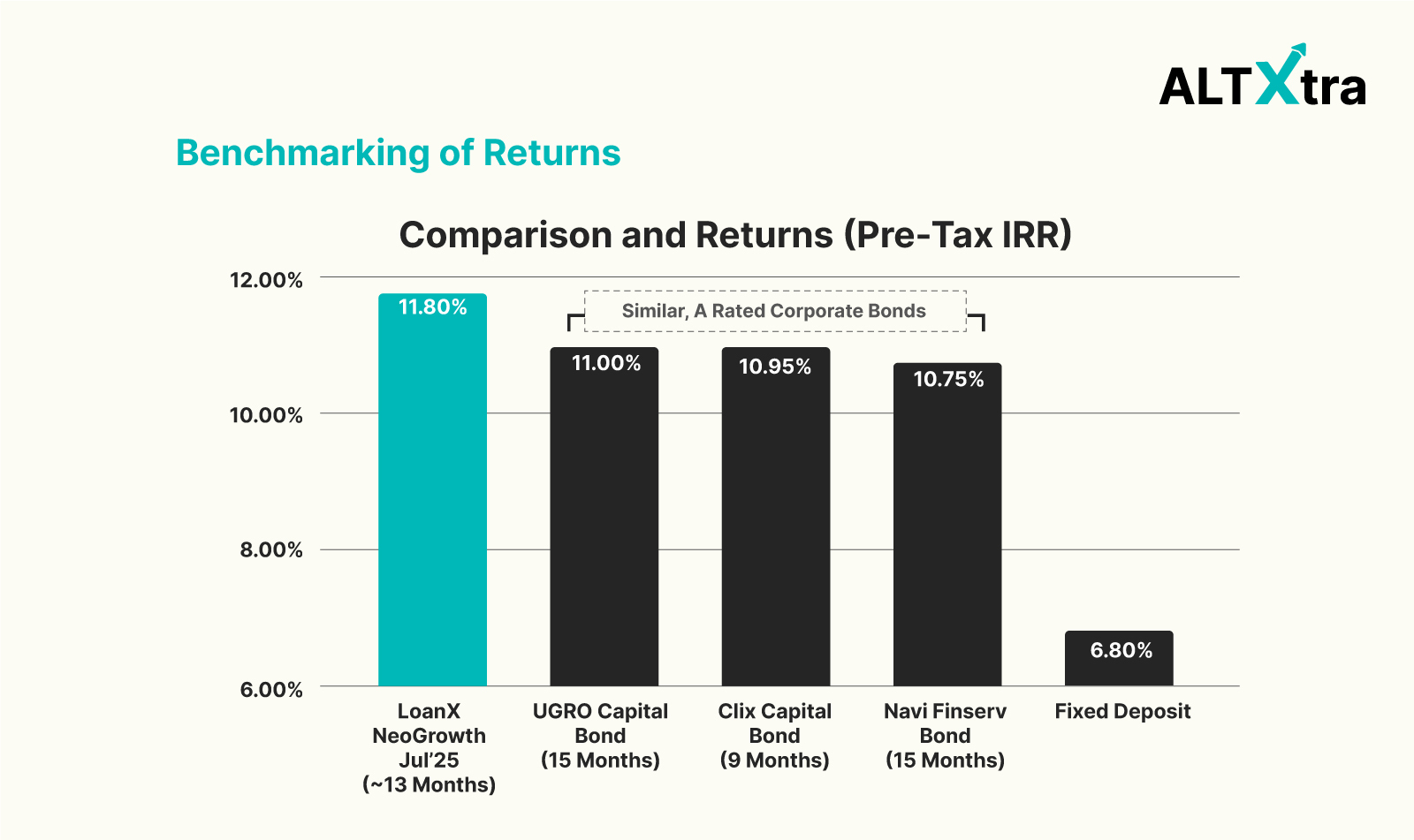

Risk Adjusted Returns

While fixed deposits offer the lowest risk, they also provide the lowest returns. Some small finance banks offer returns up to 9%, whereas larger private banks typically offer around 6-7% interest.

SDIs and bonds are riskier than fixed deposits but offer higher returns, ranging from 9% to 18%, depending on the level of risk assumed. SDIs and Bonds are suitable for those willing to take on additional risk to achieve inflation-beating returns on a post-tax basis.

While fixed deposits are well understood, let us look at some more of the differences between SDIs and bonds.

Diversified Underlying Pool

Within bonds and SDIs, SDIs offer better risk-adjusted returns compared to bonds because your risk is diversified across a pool of different income-generating assets that are not linked to the market. Your exposure is not limited to a single entity but spread across several individual borrowers, whereas in a bond, your exposure is concentrated on the issuer. Let's understand this with an example:

Option A: You invest in a LoanX (pool of loans) product by Grip Invest, where the underlying assets are a pool of car loans originated by an NBFC named CarGrowth.

Option B: You invest in a debenture issued directly by the NBFC CarGrowth.

In Option A, your risk is diversified across multiple borrowers in different regions with varying credit profiles. Even if some of them default, it will not significantly impact the investment, as there will be sufficient security cover in the form of cash collateral in the instrument. The performance of this option is, hence, independent of how CarGrowth NBFC performs in the future.

In Option B, your risk is concentrated with CarGrowth. If CarGrowth's business performance declines and its Non-Performing Assets (NPAs) increase, it may be unable to repay the entire debenture.

Security Structure For SDIs

SDIs possess a superior security structure compared to bonds. Some of the key features include:

Overcollateralization: For instance, if the total loan book is INR 30 Crore, an SDI is created for only INR 27 Crore, with the remaining INR 3 Crore kept as collateral within the trust by CarGrowth NBFC. If Non-Performing Assets (NPA) increase, the interest and principal repayments from these additional loans are used to prevent investor default.

Excess Interest Spread: Typically, CarGrowth NBFC issues car loans at a higher rate than what is passed on to the trust and ultimately to investors. For example, if the Bank/NBFC provides loans at a 13% interest rate and passes on 12% to investors in the form of SDI, the extra 1% buffer can be used to cover NPAs if necessary and repay investors.

Cash Collaterals: CarGrowth also posts a certain percentage of the overall SDI issuance amount as cash collateral. This cash can be utilized to cover pending payments to investors if NPAs accumulate.

Security Structure for Bonds

To be fair, secured bonds also have a good security structure but may not be as robust as SDIs. Secured bonds generally have key features like:

Hypothecation of Receivables: The issuer may hypothecate the receivables of loans it has made to borrowers into a designated trust. If a default happens, the assigned trustee can dip into the trust and repay the bond investors. Typically secured bonds offer coverage of 110-120% of the investment amount via such hypothecation.

Cash Collaterals: The issuer may post a certain percentage of the overall bond issuance amount as cash collateral. However, this cash will not be sufficient to cover the total amount if a default happens.

Personal Guarantees: Some issuing company promoters give their personal guarantees and assign their assets to a designated trust. In case of defaults, trustees can seize these and repay the bond investors.

Repayments & Taxation

Since all three instruments are fixed-income, they earn interest income. The interest income is taxed according to the marginal rates applicable to each investor. However, for SDIs and bonds, if capital gains are recognized, the tax treatment varies depending on whether they are listed or unlisted and the holding period. It is advisable to consult a tax advisor for precise taxation details of such investments.

| Criteria | SDIs | Bonds | Fixed Deposits (FDs) |

| Repayments | Interest + Principal is paid based on a defined cash flow schedule. | Interest + Principal is paid based on a defined cash flow schedule. The principal is usually paid at maturity | Interest is paid periodically if chosen, otherwise along with principal at maturity. |

| Prepayments | Some borrowers in the loan pool may prepay faster or later than expected, leading to unpredictable cash flow. However, that further reduces the risk of the investment. | The issuer has to follow the defined cash flow schedule | The bank has to follow the defined cash flow schedule. |

| Tax on Interest Income | As per marginal slab rates. | As per marginal slab rates. | As per marginal slab rates. |

| TDS | 25%* | 10% | 10% above a certain threshold. |

Conclusion

In conclusion, while securitized debt instruments (SDIs), bonds, and fixed deposits (FDs) each offer unique benefits and risks, selecting the appropriate investment depends on your financial goals and risk tolerance. FDs provide stability and guaranteed returns, making them ideal for conservative investors.

Bonds offer a balance between risk and return, suitable for those willing to take on moderate risk for potentially higher returns. SDIs go a step further, offering better risk-adjusted returns than bonds due to the diversified nature of assets and their superior security structure. However, SDIs do have some downsides, such as prepayment risk, where you may receive your investment back much faster than expected, requiring you to find another good opportunity to reinvest that money.

Both SDIs and bonds can still default despite their credit enhancements, so it is crucial to carefully evaluate the risk you are willing to take and consult a financial advisor if necessary.

Thank you for reading this comparison article, and thank you to Grip Invest for sponsoring the ALTXtra series. We have many more interesting pieces coming up, and we hope you will enjoy them. If you have any feedback, please don't hesitate to reach out to us at ALT Investor or Grip Invest.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Yash Roongta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yash Roongta

Yash Roongta

I am a CFA and FRM Charterholder. I used to work as a Portfolio Implementation Manager for Aviva Investors managing £3bn+in Assets Under Management in the UK. I am very passionate about educating people on how they can make more money with their existing investments sustainably.