Iran-Israel Ongoing War and Its Impact on Renewable Energy

Vaishali Garg

Vaishali Garg

On 3 October 2024, tensions between Israel and Iran reached a new height when Iran-backed Hezbollah launched a series of drone strikes against key Israeli military installations. This escalation followed months of rising conflict, with over 250,000 civilians already displaced from border areas. The conflict is rapidly affecting global oil markets, with crude oil prices climbing over 12% in just two weeks, largely due to fears that the Strait of Hormuz—a key oil artery—could be compromised.

Experts now warn that if the conflict continues to escalate, we could see disruptions in nearly 30% of the world’s oil supply, forcing countries to explore emergency alternatives. This situation is also accelerating the shift towards renewable energy, as the volatility of fossil fuel supplies becomes increasingly risky. Governments and investors are now looking at solar, wind, and green hydrogen as not just sustainable solutions, but necessary ones in a world where energy security is constantly under threat.

The Conflict Unfolding: Israel vs. Iran – A War with Global Ripples

Tensions between Israel and Iran are nothing new, but things took a sharp turn for the worse in late 2023. It all started with a series of missile strikes from Hamas and Hezbollah—both backed by Iran—targeting Israeli territories. Israel retaliated with heavy airstrikes, marking the start of one of the most intense military confrontations in recent history.

This conflict isn’t just about two countries fighting. This war is drawing in major global and regional players, including:

Israel: Directly engaged in military retaliation.

Iran: Supporting Hamas and Hezbollah militarily.

United States: Providing support to Israel.

Russia: Maintaining influence in the region, particularly in Syria.

Lebanon: Indirectly involved through Hezbollah’s operations.

Saudi Arabia: Monitoring the conflict closely, given regional stability concerns.

Syria: Involved due to Iran's presence and influence.

This conflict threatens to disrupt the global economy, especially energy markets, as oil supplies and trade routes are at risk.

The Impact on India: Economic Risks and Shifting Energy Alliances

The ripple effects of the Israel-Iran war are spreading far beyond the Middle East, and India is one of the countries feeling it most. India depends heavily on oil imports from the Gulf region, including Iran. With the Strait of Hormuz—one of the world’s most crucial oil shipping routes—at risk, India’s oil supply chain is under serious threat. If this route is blocked or disrupted, oil prices will skyrocket, pushing inflation higher and straining India’s economy.

India also has strategic agreements with Iran, such as the Chabahar Port project. This port gives India direct access to Central Asia and Afghanistan, bypassing Pakistan. If the conflict worsens, India’s trade routes through Iran could be jeopardized, putting pressure on its trade and connectivity goals.

Moreover, the war could also impact India’s renewable energy plans. India aims to become a global leader in renewable energy, with a target of 500 GW by 2030. However, disruptions in the global supply chain for materials like lithium, used in batteries, and components for solar and wind energy could delay these projects. Rising costs for fossil fuels may also force India to re-prioritize its energy spending.

Energy Stocks to Watch Amidst the Chaos

The conflict has shaken global markets, and many investors are pulling out of risky sectors. However, some energy stocks are emerging as strong bets during this uncertain time. As the global focus shifts from oil to renewables, certain stocks are gaining attention for their long-term growth potential. Here are five energy stocks to keep an eye on:

NextEra Energy (NEE): A major player in the wind and solar power industry, NextEra Energy has proven to be a stable performer even during geopolitical turmoil.

Enphase Energy (ENPH): This company specializes in advanced solar power systems and is well-positioned for growth as the world shifts towards cleaner energy.

SolarEdge Technologies (SEDG): SolarEdge provides solar inverters and other tech solutions for the solar power industry, making it a key player in the renewable space.

Brookfield Renewable Partners (BEP): With investments in hydroelectric, wind, and solar energy, Brookfield is a global powerhouse in the renewable energy sector.

Vestas Wind Systems (VWS): As one of the largest wind turbine manufacturers, Vestas is a solid bet for investors looking at the wind energy market.

While the overall market is shaky, these stocks could offer a safer haven as investors look for stability in the growing renewable energy sector. (livemint prescribed)

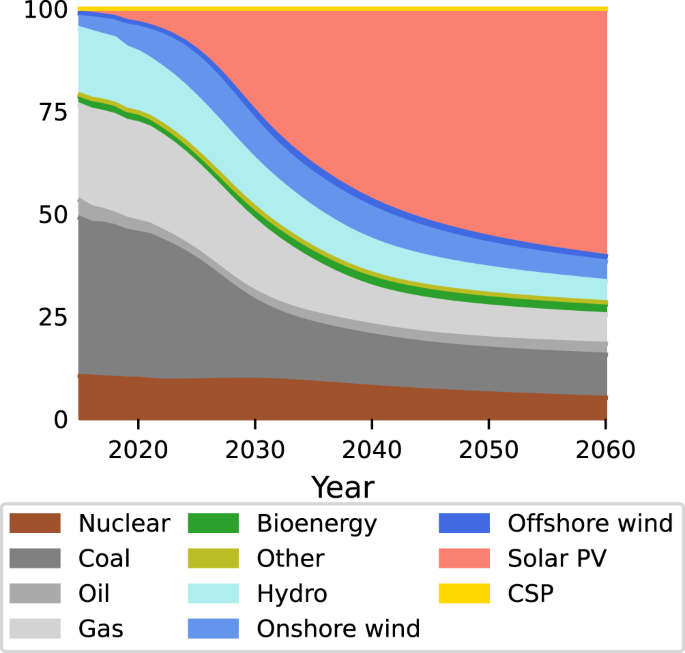

The War That Could Change Energy Forever

This war could very well be the tipping point for global energy. The world has already been slowly transitioning towards renewable energy, but the instability in the Middle East is speeding up the process. Oil prices are spiking, supply chains are being disrupted, and countries are being forced to rethink their reliance on fossil fuels.

As nations scramble to secure their energy supplies, many are turning to renewables. Unlike oil and gas, which are tied to specific regions and subject to geopolitical risks, renewable energy sources like wind and solar are available everywhere. They offer a cleaner, more secure alternative which is more reliable option to reduce global dependence on oil from conflict-prone areas like Iran and Israel.

Energy Security in Focus: Fossil Fuels' Uncertain Future

The Israel-Iran war has reignited fears about the stability of the global fossil fuel supply. With oil prices climbing past $90 per barrel and concerns over potential attacks on the Strait of Hormuz—through which 20% of the world’s oil flows—the future of fossil fuels looks more uncertain than ever.

Countries that rely heavily on imported oil and gas are being forced to consider alternatives. Renewable energy, once seen as a “nice-to-have,” is now being viewed as a critical part of national energy security strategies. Governments around the world are investing heavily in renewables, not just to fight climate change, but to secure their energy futures.

Trump's Take on the Conflict and Its Impact on the U.S. Election

Former U.S. President Donald Trump has been vocal about the conflict, calling for aggressive military action against Iran. He believes Israel should target Iran’s nuclear sites to cripple its military power. This strong stance contrasts with President Biden’s more cautious approach. He also said “There would have been no war, had I been the President.”

With the U.S. elections looming, the handling of the Middle East conflict could play a key role in shaping voter sentiment. Rising oil prices and economic uncertainty could become hot topics in the election, pushing energy security to the forefront of political debates.

Will Iran Withdraw From the Nuclear Non-Proliferation Treaty (NPT)?

There’s growing speculation that Iran, provoked by Israel’s actions, might withdraw from the Treaty on the Non-Proliferation of Nuclear Weapons (NPT) and develop nuclear weapons. If this happens, the conflict could escalate dramatically, leading to even harsher international sanctions on Iran. This would not only affect the energy markets but could also shift the geopolitical balance in the Middle East.

The Big Reveal: Investment Shifts and Renewable Energy Breakthroughs

The Iran-Israel war is causing investors to rethink their focus on oil, which is becoming more risky. Instead, they are putting more money into renewable energy. In 2024, investments in renewables like solar and wind are expected to hit $1.7 trillion, overtaking fossil fuel investments for the first time. With new advancements in green hydrogen and energy storage, renewable energy is looking like the safer, more reliable choice as the world moves away from unstable oil markets

Rising Action: The Threat to Oil vs. The Rise of Renewables

This conflict threatens about 20% of the world’s oil supply that passes through the Strait of Hormuz, pushing oil prices up by 12% in just a short time. As oil becomes more expensive and unreliable, more countries are turning to renewable energy like solar and wind. Unlike oil, renewables aren’t tied to risky regions and are available everywhere, making them a safer option for the future.

Conclusion: Why It Matters to You

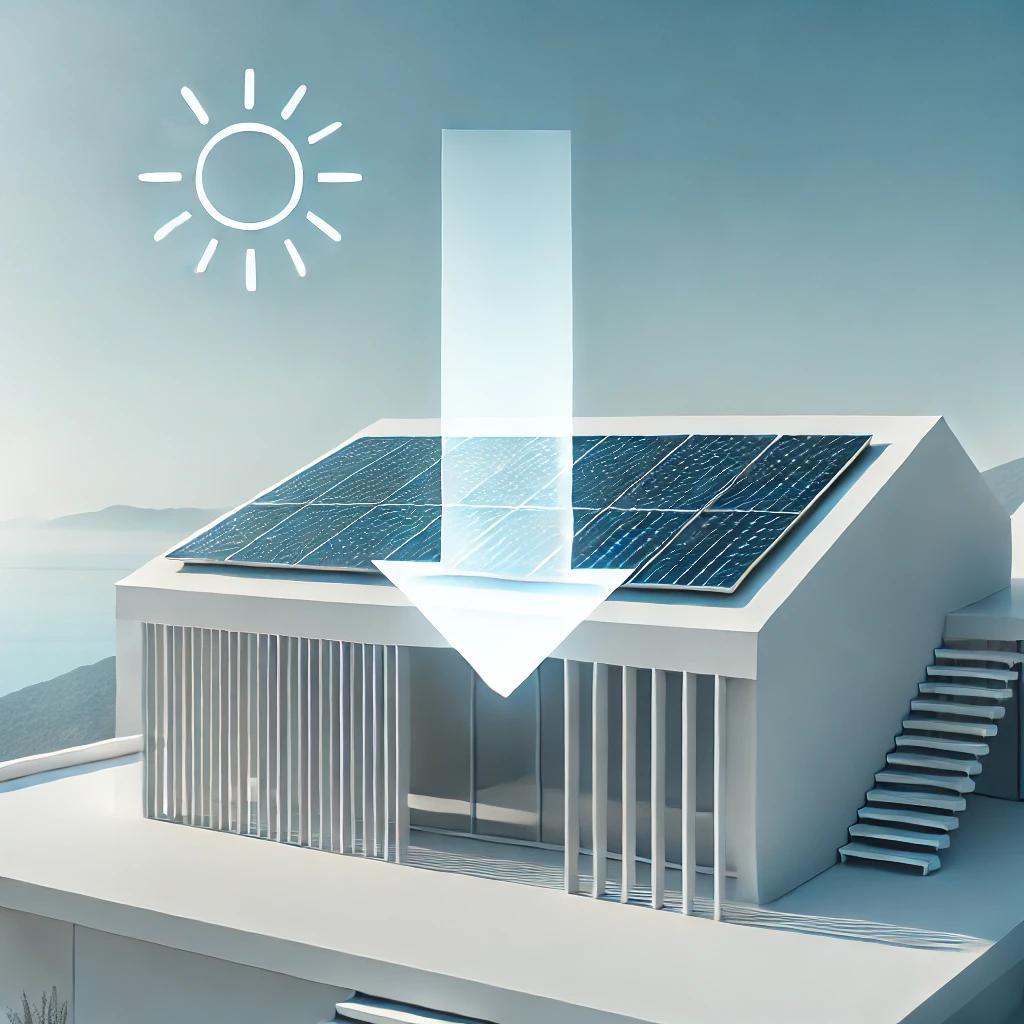

You may be wondering, “How does this conflict affect me?” The truth is, it impacts all of us. Rising energy prices mean higher costs for everything from fuel to electricity. Inflation could make everyday goods more expensive, and job markets could shift as industries adapt to the changing energy landscape.

But there’s hope. By investing in renewable energy—whether it’s installing solar panels on your roof or supporting clean energy policies—you can help secure a more stable and sustainable future. The world is changing, and now is the time to get ahead of the curve.

Cheers to a brighter tomorrow,

Contact Us | Subscribe for Updates | Follow Us on LinkedIn

Best regards,

The Renewable Leader Team

Upcoming Market Policies

61.9% of installed solar capacity is driven by the industrial sector.

Global renewable energy market to grow at 17.2% CAGR from 2024 to 2030.

Total market value projected to exceed $1.39 trillion by 2024.

China and India to add over 300 GW of new capacity by 2030.

Solar power to account for 30% of global market by 2024.

Capacity additions in 2024 expected to reach 42 GW, covering 25% of total electricity generation.

Fun Facts

Germany Leads in Solar Energy: Despite not being particularly sunny, Germany is one of the world's largest producers of solar power. It shows that solar panels can be effective even in countries with less direct sunlight.

Lowering Costs Every Year: The cost of solar energy has fallen by more than 90% in the last decade, making it more accessible and affordable for households and businesses globally.

Subscribe to my newsletter

Read articles from Vaishali Garg directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by