What is Bitcoin Halving? A Comprehensive Guide on How It Works

Odewole Babatunde Samson (bigsam)

Odewole Babatunde Samson (bigsam)Table of contents

Introduction

One of the most pivotal events on Bitcoin's blockchain is a halving when the supply of new bitcoins—and the reward for mining them—is cut in half.

- What is Bitcoin halving?

- What is Bitcoin's supply limit?

- How does it work, and what do you need to know

These are some of the questions we will be answering in this article.

To explain what a Bitcoin halving is, we must first understand how the Bitcoin network operates and the basics of Bitcoin mining.

How the Bitcoin network operates

Bitcoin's underlying technology, blockchain, basically consists of a collection of computers (or nodes) that run Bitcoin's software and contain a partial or complete history of transactions occurring on its network. Each full node, or a node having the entire history of transactions on Bitcoin, is responsible for approving or rejecting a transaction in Bitcoin's network.

To do that, the node conducts a series of checks to ensure that the transaction is valid. These include ensuring that the transaction contains the correct validation parameters, such as nonces, and does not exceed the required length.

Each transaction is approved individually, only after all the transactions contained in a block are approved. After approval, the transaction is appended to the existing blockchain and broadcast to other nodes. More computers (or nodes) added to the blockchain increase its stability and security. As of late August 2022, 15,169 nodes were estimated to be running Bitcoin's code.

Although anyone can participate in Bitcoin's network as a node, as long as they have enough storage to download the entire blockchain and its history of transactions, not all of them are miners.

Bitcoin mining

Bitcoin mining is the process by which people use their computers to participate in Bitcoin's blockchain network as a transaction processor and validator. Bitcoin uses a system called proof of work (PoW). This means miners must prove they have put forth effort in processing transactions to be rewarded. This effort includes the time and energy needed to run the computer hardware and solve complex equations.

The term mining is not used literally but to refer to how precious metals are gathered. Bitcoin miners solve mathematical problems and confirm the legitimacy of a transaction. They then add these transactions to a block and create chains of these blocks of transactions, forming the blockchain.

When a block is filled with transactions, the miners who processed and confirmed them are rewarded with bitcoins. Transactions of greater monetary value require more confirmations to ensure security.

What is Bitcoin's supply limit?

To understand Bitcoin halving further, we must also understand the theory behind its supply.

The inventor of Bitcoin, Satoshi Nakamoto, believed that scarcity could create value where there was none before. Bitcoin was revolutionary in that it could, for the first time, make a digital product scarce—there will only ever be 21 million Bitcoins.

The idea of limiting Bitcoin's supply is in marked opposition to how fiat currencies such as the U.S. dollar work. Fiat currencies were initially created with firm rules—to create one dollar, the U.S. government needed to reserve a certain amount of gold, which was known as the gold standard.

Over time, these rules eroded as modernizing economies, during bouts of extreme financial uncertainty—like the Great Depression and World War II—printed more money to help stimulate struggling economies. Over time, these rules evolved into today's system, in which governments can (broadly speaking) print money whenever they'd like.

Satoshi Nakamoto believed that this devaluation of fiat money could have disastrous effects, and so, with code, prevented any single party from being able to create more Bitcoin.

What is Bitcoin halving?

After every 210,000 blocks mined or roughly every four years, the block reward given to Bitcoin miners for processing transactions is cut in half. This event is referred to as halving because it halts the rate at which new bitcoins are released into circulation. This is Bitcoin's way of enforcing synthetic price inflation until all bitcoins are released.

This rewards system will continue until around 2140, when the proposed limit of 21 million coins is reached. At that point, miners will be rewarded with fees for processing transactions, which network users will pay. These fees ensure that miners still have the incentive to mine and keep the network going.

The halving event is significant because it marks another drop in the rate of new Bitcoins being produced as it approaches its finite supply: the maximum total supply of bitcoins is 21 million. As of late August 2022, about 19.1 million bitcoins are already in circulation, leaving just around 1.9 million left to be released via mining rewards.

In 2009, the reward for each block in the chain mined was 50 bitcoins. After the first halving, it was 25, then 12.5, and then it became 6.25 bitcoins per block as of May 11, 2020. To put this in another context, imagine if the amount of diamond mined out of the Earth was cut in half every four years. If a diamond's value is based on its scarcity, then a "Halving" of diamond output every four years would theoretically drive its price higher.

- 2009 – Bitcoin mining rewards start at 50 BTC per block.

- 2012 – The first Bitcoin halving reduces mining rewards to 25 BTC.

- 2016 – Mining rewards go down to 12.5 BTC in the second Halving.

- 2020 – Mining rewards drop to 6.25 BTC in the third Halving.

- 2140 – The 64th and last Halving occurs, and no new Bitcoin is created.

As halvings continue, the rate of Bitcoin supply increase will slow until all 21 million BTC have been mined; according to predictions, the last fractions of Bitcoin will be mined in 2140.

How does Bitcoin halving work?

To understand how Bitcoin halving works, you first need to know the basics of creating cryptocurrency.

Bitcoins come into existence through a decentralized system in which people known as miners use high-powered computer systems to solve cryptographic puzzles to verify and validate transactions on the Bitcoin ledger, known as the blockchain. In return, they receive payment in the form of newly created bitcoins.

Bitcoin mining is a competition of sorts. Miners are racing to be the first to add new blocks to the blockchain. Each block added receives a certain number of new bitcoins as a reward. The originator of Bitcoin programmed the block reward to be cut in half at regular intervals.

The reward for mining a block is reduced by half for every 210,000 blocks added. It currently takes four years to add that many blocks, so Bitcoin halving has occurred at approximately four-year intervals. The latest and third Halving took place in May 2020. The next is expected in 2024.

Theoretically, no more will be produced once 21 million bitcoins have been created.

"Just like there's a limited amount of gold on Earth, the amount of Bitcoin is limited to 21 million. You could almost think of Bitcoin as a natural resource but for the internet. That's why it's called 'digital gold.' " says Buchi Okoro, CEO of Quidax, an African cryptocurrency exchange

How will halving affect Bitcoin price?

Bitcoin halving is important because it sends a clear signal when the released Bitcoin price rate drops. The coin supply release is capped at 21 million USD, which allows forecasting of the coin supply in circulation over different time periods. For example, the coin supply in October 2021 was 18.85 million USD. The remaining 2.15 million USD was released as a reward to the miners.

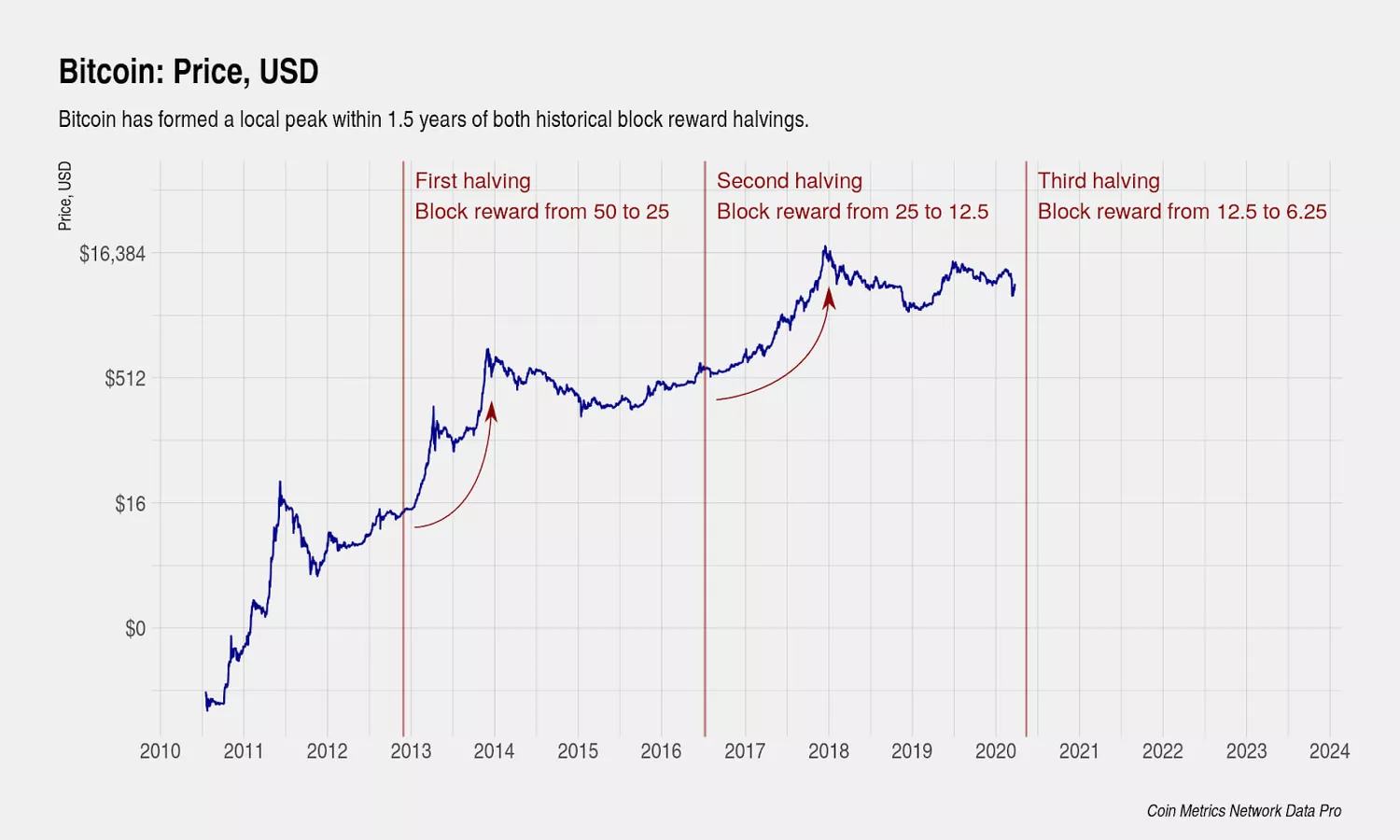

In addition, Bitcoin halving is one of the reasons for pushing the coin price as the volume of coins in circulation is cut every four years, causing the coin’s value to increase due to decreased supply or ‘shortage’, which increases the coin demand. Here's a summary of what happened around the first three halving events:

- First halving: In November 2012, the price of Bitcoin was about 11 USD at the time of the first halving. Within a year, it rose a hundredfold.

- Second halving: In July 2016, the Bitcoin network reached the milestone of 420,000 blocks, triggering a second halving. The price of Bitcoin fluctuated between 500 USD and 1,000 USD for a few months but ultimately rose to around 20,000 USD by December 2017.

- Third halving: The third halving happened in May 2020, coinciding with another bull run for cryptocurrency. At the time of this halving, Bitcoin traded at around 9,000 USD. It climbed to around 30,000 USD by the end of the year.

When Is the next Bitcoin halving?

The next Bitcoin halving is expected in early 2024. The coin supply will be released for 1,312,500 BTC, and the miners’ rewards will be reduced to 3.125 BTC. Bitcoin investors and traders should keep an eye out for any upcoming halvings, as they could cause some instability and disruption in the crypto market.

What happens when all Bitcoin is mined?

The last halving is predicted to occur in 2140, after which block rewards will not be in the form of bitcoins. Instead, miners will be rewarded with fees from network users who buy and sell bitcoins, so they are incentivized to continue processing transactions on the blockchain.

Will Bitcoin mining come to an end?

If the rewards keep halving like they do every four years at one point, the miner may feel it is not worth mining Bitcoins anymore. Bitcoin mining requires a certain amount of electricity and computer resources, and the miners might feel that the rewards don’t compensate them enough. They may switch to mining other digital assets or begin trading digital assets.

Many large organizations might continue to mine Bitcoin, leading to less network decentralization.

With Bitcoin's supply likely ending in 2140, demand might increase. By then, the digital assets market may be more stable and valued.

People who mined the coin early or purchased it first have a considerable advantage over others; the blockchain is built that way. Multiple digital wallets are available that can hold your BTC securely.

Even if the number of miners decreases or becomes null, Bitcoin will stay alive through trading and various digital asset transactions.

Bitcoin's halving is the main reason it is worth the amount it is today. Without halving, Bitcoin would still be worth only a couple of dollars.

In the past, many users bought coins at lower prices and sold them once they reached a good profit. These people haven’t benefited from BTC. Such people do short-term trading and earn profits from the rise and fall of various digital assets.

We can only wait and find out what the next Bitcoin halving will do and speculate based on various predictions.

Conclusion

Bitcoin halving is a much-hyped event that occurs at approximately four-year intervals, with the first one occurring in 2012. It's part of the virtual currency's programming to keep its total supply fixed.

As an investor, it's important to be aware of Bitcoin halvings, as they've historically caused significant fluctuations in the price. The next halving is expected in 2028.

Subscribe to my newsletter

Read articles from Odewole Babatunde Samson (bigsam) directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Odewole Babatunde Samson (bigsam)

Odewole Babatunde Samson (bigsam)

I am a self taught developer from Nigeria. A software engineer, technical writer and a fish technologist in making. I love diversity and always available to learning and acquiring new knowledge