Satoshi Scoop Weekly, 25 Oct 2024

Cryptape

CryptapeTable of contents

- Crypto Insights

- SuperScaler vs. Ark: Convergence and Divergence of Shared UTXO Schemes

- Ark’s Collaboration with Boltz: Expanding Smart Contract Settlement on Bitcoin Through Virtual HTLC Combined with Off-Chain Execution

- Limitations of Lightning Network in Scaling Payments and a Mathematical Theory of Payment Channels Networks

- Notes and Commentary from Lightning Network Summit 2024

- Lightning Network + Stablecoins: The Road Less Noticed

- Decentralized Mining: DATUM vs. Stratum V2

- Using Chaum Blind Signatures in Anonymous Discount Coupons

- Bitcoin Ranks as the 6th Monetary Assets Worldwide

- Digital Asset Adoption to Reach 8% by 2025

- A16z’s 2024 State of Crypto Report

- Top Reads on Blockchain and Beyond

- Bitcoin's Domain-Specific Language

- Misunderstanding Bitcoin’s Value: the Dichotomy of Store of Value and Medium of Exchange

- Bitcoin's Exchange Theory of Value: Value Realized in Future Transactions

- Why Babylon's Use of Taproot is Successful

- RedStone Report: Restaking 2024 Ultimate Market Overview

- What if Slow Block Verification Attacks

- What is a Time Warp Attack and How to React

- Binance's Overview of Stablecoin Regulation

Crypto Insights

SuperScaler vs. Ark: Convergence and Divergence of Shared UTXO Schemes

SuperScaler was first introduced on the Delving Bitcoin forum (SuperScalar: Laddered Timeout-Tree-Structured Decker-Wattenhofer Factories). It is a shared UTXO scheme, similar to Ark.

This post summarizes the similarities and differences between SuperScaler and Ark. Their similarities include:

A Top level UTXO owned by multiple users.

A Top-level UTXO has child UTXOs arranged in a tree structure.

The leaves of the tree are “2 of 2 UTXOs”, where users have one key in a leaf, and the provider has the other; funds untouched by users revert to the service provider after a timelock period.

The differences lie in how the money is sent. The post also introduces the concept of 'decrementing timelocks' and analyzes the advantages and disadvantages of SuperScaler and Ark.

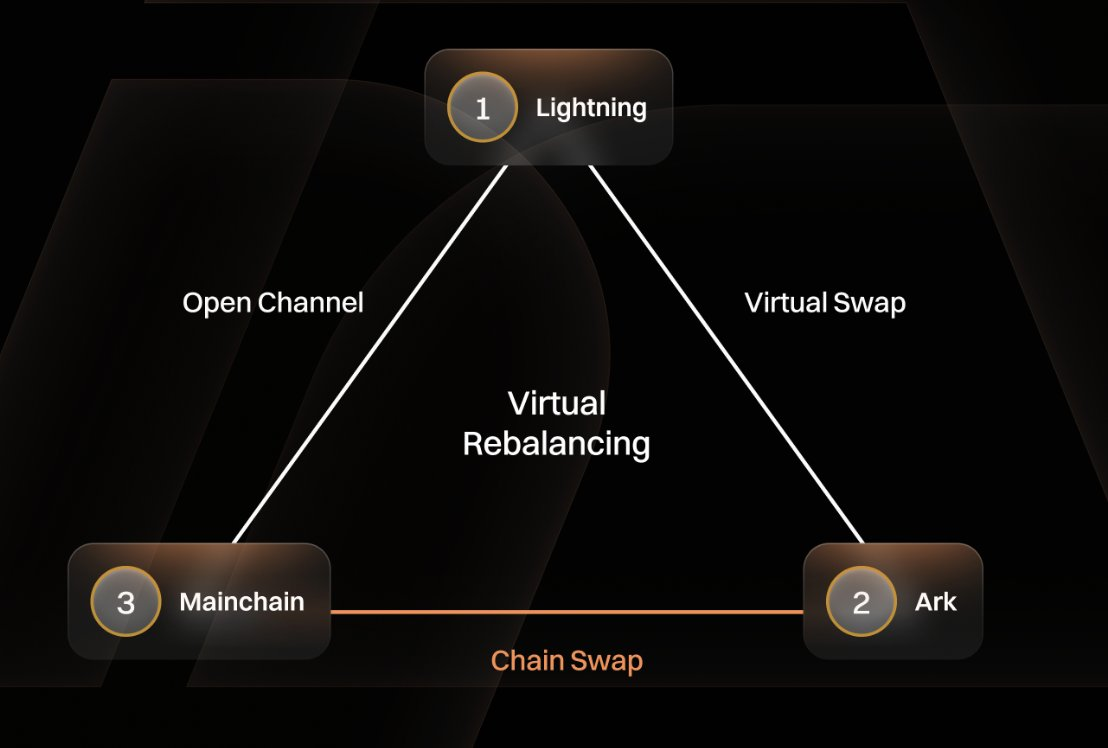

Ark’s Collaboration with Boltz: Expanding Smart Contract Settlement on Bitcoin Through Virtual HTLC Combined with Off-Chain Execution

The collaboration aims to implement seamless, cheaper, and faster off-chain lightning liquidity management using the Ark Node interface.

Ark natively supports Bitcoin script operations, allowing servers to virtualize many contracts used by existing Bitcoin products and services. The combination of virtual HTLC (vHTLC) and off-chain execution will enhance other script extensions on Bitcoin, and potentially scale smart contract settlements. Besides, virtual swaps provide participants with an interface for batch processing off-chain channel management operations, thereby closing the 'liquidity loop' of the Lightning Network.

Source: Ark Labs

Limitations of Lightning Network in Scaling Payments and a Mathematical Theory of Payment Channels Networks

Rene Pickhardt has compiled his research over the past year on the technical limitations of the Lightning Network in expanding payment capacity, mainly including the paper A Mathematical Theory of Payment Channel Networks.

This article provides a mathematical method to obtain more precise conclusions regarding the oversimplification of experimental assumptions due to the lack of precise data in running experiments of payment channel networks.

Notes and Commentary from Lightning Network Summit 2024

Over 30 Lightning Network developers and researchers convened last month in Tokyo for a (private) summit to discuss the Lightning Network and Bitcoin p2p-related consensus protocols.

Recently, agenda and meeting notes from Roasbeef are shared. Main topics included: Version 3 commitment transactions, PTLCs (Point Time Locked Contracts), state update protocols, SuperScaler, Gossip, Payment Delivery Limits.

Lightning Network + Stablecoins: The Road Less Noticed

In this podcast, Cipher, author of RGB++ protocol, outlined a solution to Bitcoin payment challenges using the strategy of "stablecoins + Lightning Network". This approach is a manifestation of Web5 (Web3 + Web2) — using Web3's payment network for transactions while employing Web2 technologies for other issues, allowing them to coexist harmoniously without interference. (The language of the podcast is available in Mandarin Chinese.)

Decentralized Mining: DATUM vs. Stratum V2

In late September, Ocean Mining released the "Decentralized Alternative Templates for Universal Mining" (DATUM) protocol aimed at decentralized mining. DATUM appears similar to Stratum V2 as both protocols enable miners to have better control over transaction selection/block template construction—a privilege historically reserved for mining pools. However, DATUM and Stratum V2 have significant differences:

Stratum V2 allows miners to construct their own templates and include the transactions they desire. Through a "negotiation" process, miners request mining pools to accept their templates if they win the next block.

DATUM allows miners complete control over block templates, and pools seem unable to reject these templates. DATUM enables miners to share only Merkle branches with the pool, not specific transactions. It's worth noting that pools and miners can implement similar setups using Stratum V2.

Using Chaum Blind Signatures in Anonymous Discount Coupons

There were recent discussions in the bitcoin++ conference Berlin about using ecash protocol beyond monetary transactions. Also, Wabisabi has implemented blind signatures in CoinJoin for coordination.

Inspired by this, the author believes that Chaumian blind signatures could also be applied to discount coupons, offering privacy that regular coupons do not have. Possible application scenarios include: providing paid Nostr Relays as an incentive to contributors of open-source projects, and market makers in Joinstr offering discounts to users.

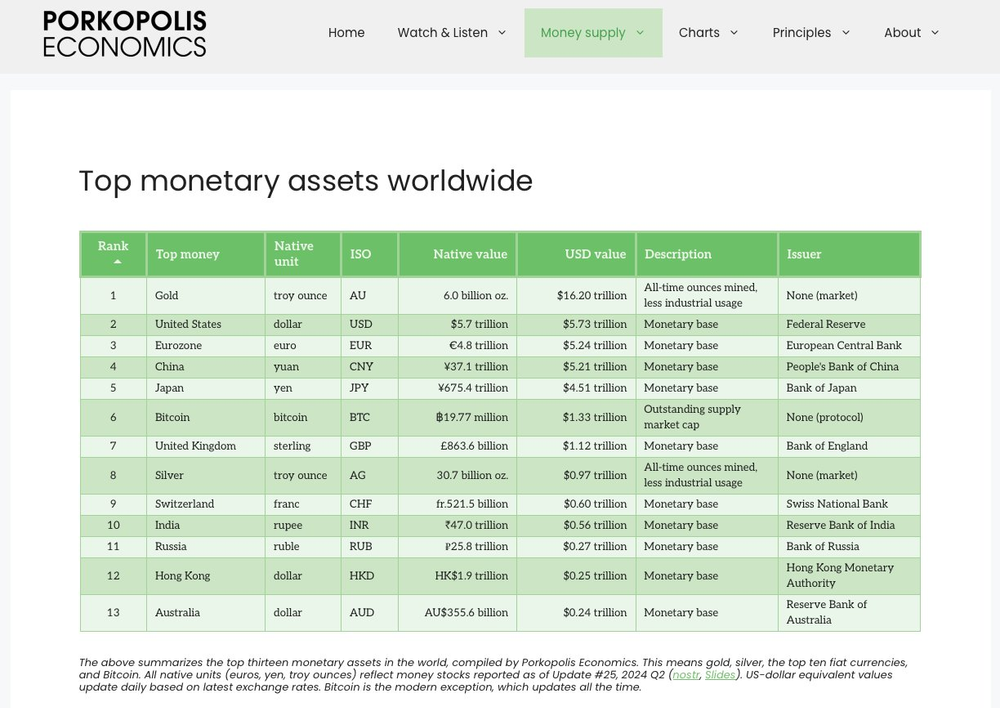

Bitcoin Ranks as the 6th Monetary Assets Worldwide

Porkopolis Economics shared shared the latest rankings of the world's top currency assets, with BTC ranking sixth, behind the Japanese yen.

Source: Porkopolis Economics

Digital Asset Adoption to Reach 8% by 2025

According to MatrixPort, the global adoption of cryptocurrencies is approaching a significant milestone, with 7.51% of the world's population currently using digital currencies. It is projected that by 2025, the adoption rate of digital assets will reach 8%.

A16z’s 2024 State of Crypto Report

Key takeaways:

Crypto activity and usage hit all-time highs

Crypto has become a key political issue ahead of the U.S. election

Stablecoins have found product-market fit

Infrastructure improvements have increased capacity and drastically reduced transaction costs

DeFi remains popular — and it’s growing

Crypto could solve some of AI’s most pressing challenges

More scalable infrastructure has unlocked new on-chain applications

Top Reads on Blockchain and Beyond

Bitcoin's Domain-Specific Language

This posts introduces a Bitcoin DSL (Domain-Specific Language) built on Rust, known as eDSL, and how it can help developers enter the Bitcoin ecosystem, similar to the significance of Solidity for Ethereum. However, the author acknowledges that eDSL is still in its early stages and far from becoming the 'Solidity of Bitcoin'; more DSLs will emerge and as their usability increases, developers will no longer need to program opcode-by-opcode.

Misunderstanding Bitcoin’s Value: the Dichotomy of Store of Value and Medium of Exchange

The author argues that Bitcoin has always been a medium of exchange (MoE); moreover, without exchange, there is no value, and Bitcoin's future as a store of value (SoV) depends on its acceptance as a medium of exchange. The dichotomy between Bitcoin as SoV and MoE is misunderstanding.

Bitcoin's Exchange Theory of Value: Value Realized in Future Transactions

This posts takes as its premise that "Bitcoin gains its value through exchange," arguing that while Bitcoin's value storage capability indeed depends on its fixed supply, its utility lies in future exchanges — value is realized at the moment of future transactions, when bitcoin coordinates the value transfer between economic participants. Therefore, as Bitcoin enables more trade, its value increases; and due to the nature and utility of money, trade naturally tends towards direct exchange for goods and services.

Why Babylon's Use of Taproot is Successful

The article affirms the application of Taproot by Babylon, a Bitcoin-based restaking system. When performing redemption operations from the same address used for staking, Babylon utilizes Tapscript and multiple spending paths in the Taproot tree, supporting the claim that Taproot was an ingenious and impressive upgrade to Bitcoin

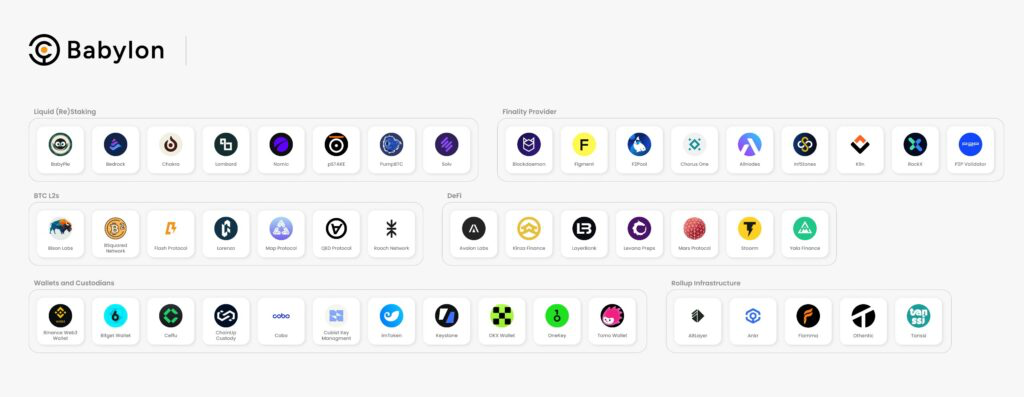

RedStone Report: Restaking 2024 Ultimate Market Overview

The report considers that since garnering attention at DevConnect 2023, restaking has evolved into a thriving ecosystem. In terms of Bitcoin's restaking, Babylon leads the charge with a growing ecosystem around it, including new Bitcoin Liquid Staking players like Lombard, Solv Protocol, PumpBTC, and others. The report also provides an overview of these projects.

Source: Bitcoin Liquid Staking Landscape

What if Slow Block Verification Attacks

The posts explores the question of how much of an advantage would performing a slow block validation attack actually give to an adversarial miner. The conclusion, derived through calculations, is that if a slow block verification attack occurred, the attacking miner would not suddenly become the dominant for all blocks, but they might become the only miner to include transactions in blocks. Consequently, the on-chain transaction throughput is expected to drop significantly, leading to a substantial decrease in the supply of block space. Therefore, if demand remains unchanged, the current rate for block space and transaction fees would soar.

What is a Time Warp Attack and How to React

The first half of this article is the response by David A. Harding on the Bitcoin Stack Exchange, explaining that a “Time Warp Attack” is a consensus-level vulnerability that the ”Great Consensus Cleanup“ soft fork proposal aimed to address. However, on Bitcoin testnet 4 where the Consensus Cleanup soft fork was applied, developer Zawy discovered a similar attack. The second half is an introduction to this attack method by murch on the Delving Bitcoin forum, along with his recommended mitigation strategies.

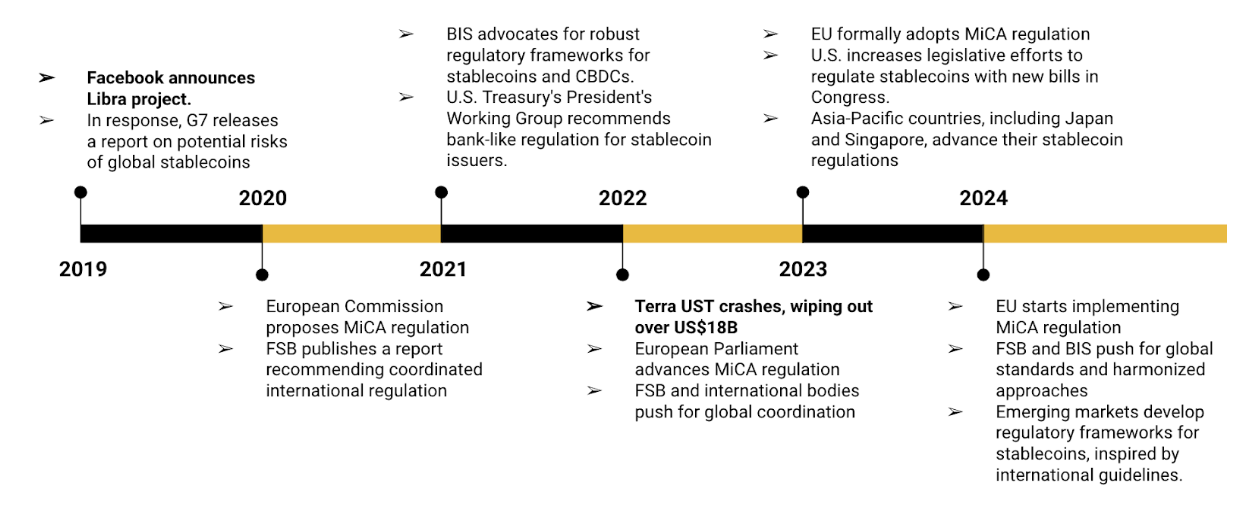

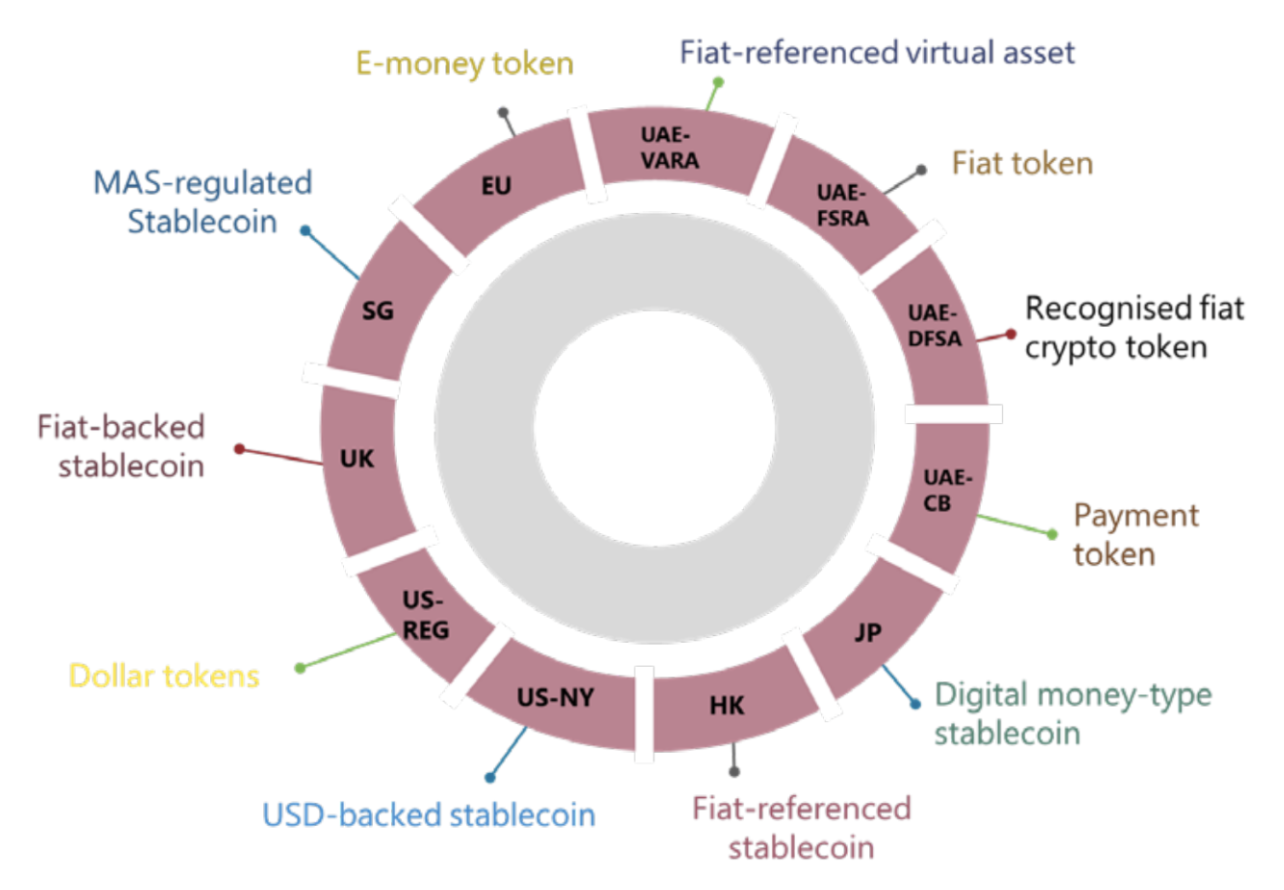

Binance's Overview of Stablecoin Regulation

The report collates the global stablecoin regulatory timeline since 2019, different definitions of stablecoins pegged to fiat currency in several regions, a comparison of regulatory language from six major regulatory bodies across different countries, and provides an overview of the regulatory situation in the EU, the US, the UAE, Singapore, Japan, and some other places.

Above: Timeline of global stablecoin regulation, Source: Binance Research

Above: Different terminology used to describe fiat-linked stablecoins, Source:Bank for International Settlements

Subscribe to my newsletter

Read articles from Cryptape directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by