The Hidden Risks Of Investing In Unregulated Alternative Platforms

Yash Roongta

Yash RoongtaTable of contents

KEY TAKEAWAYS

The article discusses the risks associated with investing in unregulated alternative platforms, highlighting the lack of regulatory oversight, transparency, and legal protections that can lead to potential financial losses for investors.

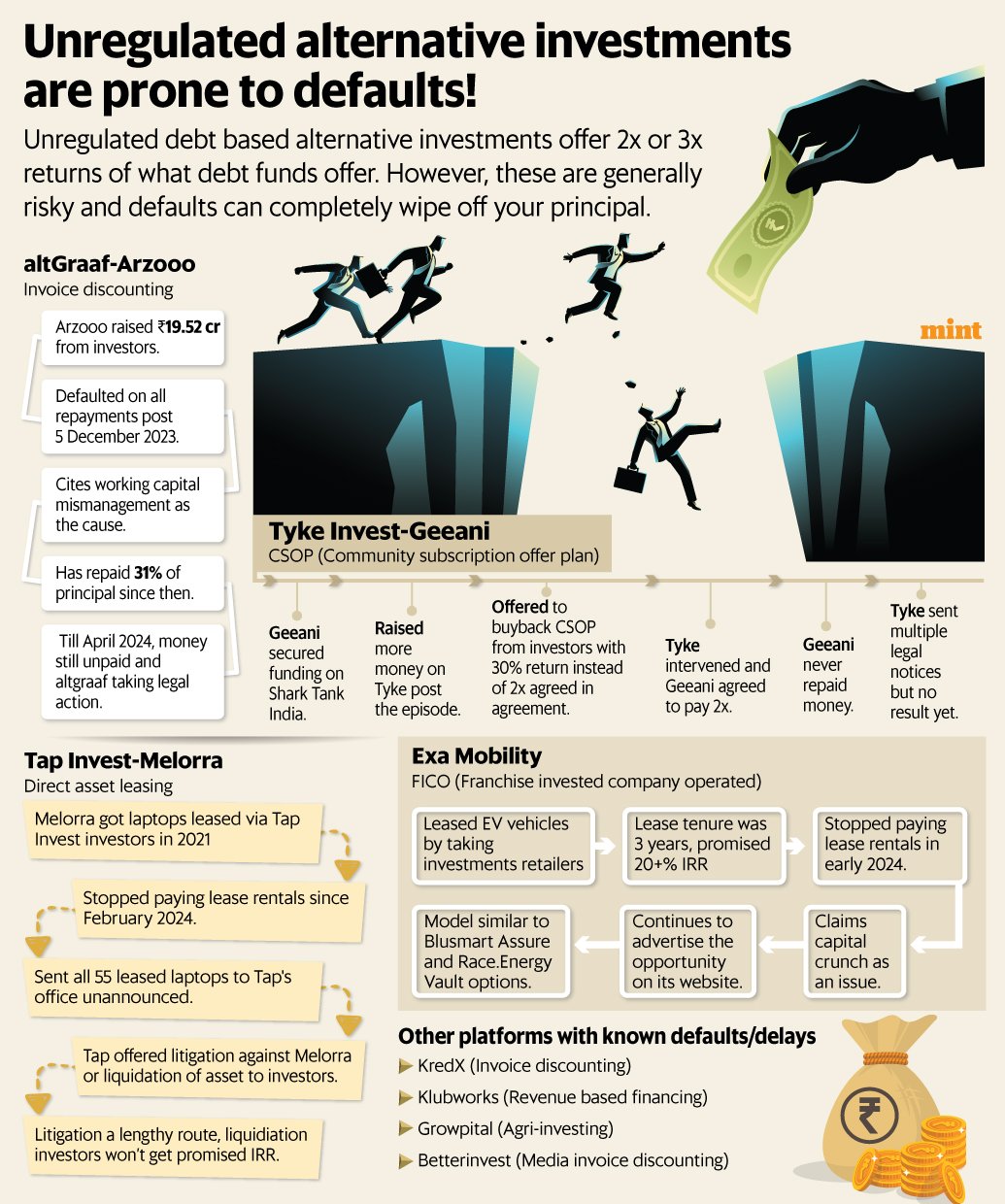

It provides examples of notable defaults on unregulated platforms, such as Grip Invest, Growpital, AltGraaf, and Tyke Invest, illustrating the challenges and risks faced by investors in these scenarios.

The importance of understanding the regulatory status of investment platforms and the associated risks before committing funds needs to be understood, with the article suggesting that regulated platforms offer better protection and recourse options.

It mentions that while unregulated platforms can offer enticing investment opportunities, the potential for fraud, mismanagement, and operational risks is higher compared to regulated platforms.

The article concludes by advising investors to prioritize the safety of their principal over higher interest rates and to make informed decisions by considering past defaults and the regulatory environment.

Hi there! Welcome to our AltXtra series, where we break down high-yield investments. In our last article, we explored SEBI’s OBPP regulation and how it provides transparency and security to your investment transactions as a retail investor. Today, we want to discuss some obvious downsides of unregulated alternative platforms.

But just to clarify, defaults can happen with regulated products, too. We're not saying all unregulated platforms are bad; we just want to give you all the information and tips you need to make an informed decision. More important than credit defaults i.e. where the investment goes bad, there are other risks with unregulated platforms that are important to understand.

Many of you might not know this, but Grip Invest began as an unregulated platform that offered a few leasing transactions through the LLP structure. In 2022, they transitioned to the SEBI regulated SDI instrument and then obtained the OBPP license once SEBI introduced it.

If you prefer videos, you can watch the below video on the same topic.

Which Platforms Are Unregulated?

Unregulated platforms are those that aren't overseen by any regulator in India, such as RBI, SEBI, IRDAI, and others. Many unregulated platforms are operational today, offering investors a variety of options. When it comes to regulated platforms in the alternatives category for retail investors, there are exactly three regulations available:

OBPP Regulation by SEBI, released on Nov 14, 2022

NBFC-P2P Regulation by RBI, released on Oct 4, 2017

SM REITs Regulation by SEBI, released on Mar 8, 2024

Any platform in the alternatives category that does not have one of the above licenses is currently operating either in a grey area or without regulation.

Risks Associated With Unregulated Platforms

Lets now talk about different types of risk you as an investor can face with such platforms:

Lack Of Regulatory Oversight: Without regulatory oversight, there's a higher risk of fraud and mismanagement of investor funds.

Limited Transparency: There may be insufficient disclosures about their due diligence process, operations, ownership structure making it challenging to assess the true risk of the investment opportunity or the platform.

Promoters With Negative Intent Or Lack Of Qualifications: Regulated platforms need to meet criteria for management quality, infrastructure, and net worth that represent their intent and capability.

Potential For Lower Returns Or Loss Of Capital: Some platforms may promise a higher return but deliver lower due to various reasons or even total loss of investment, and the legal agreements may be very vague, which may not protect the investor in such cases.

Comparison Challenges: There is no framework on what information should be disclosed and in what manner, making it difficult to assess the opportunity with other regulated or unregulated platforms.

Legal And Compliance Risks: Any current regulators may shut down or freeze the assets of unregulated platforms if they find any serious violations that may lead to losses for investors. We see this play out with the agri-investment platform Growpital and other platforms like CreditBulls.

Operational Risks: Unregulated platforms might lack robust operational infrastructure, increasing the risk of technical failures or data breaches.

Limited Recourse Options: In case of disputes, investors may have limited options for recourse or legal action compared to regulated environments. You cannot reach out to the regulator in such cases to help you recover your investment.

Notable Defaults On Unregulated Platforms

As previously mentioned, defaults can occur on both regulated and unregulated platforms. However, given the additional risks associated with unregulated platforms, we would like to provide a few examples of defaults in the unregulated space and their current status.

Grip Invest (Big Spoon - Asset Leasing)

We begin with our sponsor for this article. During the early days of Grip Invest, when it was not regulated by SEBI, Grip launched an asset leasing deal under an LLP structure for BigSpoon, a cloud kitchen start-up. The deal involved leasing kitchen equipment funded by retail investors on the Grip platform. In return, BigSpoon was to pay lease rentals to the investors who participated in the deal.

In September 2023, BigSpoon failed to pay the lease rentals on its leased kitchen equipment, prompting Grip to inform the involved investors. Grip initiated a lawsuit against BigSpoon and attempted to take control of the relevant leased assets. In some cases, they were successful, but in others, they faced resistance from the respective cloud kitchen owners. The lawsuit is still pending in court, and given the current state of Indian courts, it may take some time to reach a resolution. As it stands, full principal recovery may not be possible due to the depreciating nature of these assets. This case was covered by Yourstory here.

Since then, Grip has moved on to becoming a regulated OBPP platform and has faced no defaults in its regulated products.

Growpital (CIS Violation - Agri Financing)

Growpital, an unregulated agri-financing platform, had a simple proposition: multiple investors would pool money into an LLP company. Growpital would use that money to lease agricultural land and farm on it. The proceeds from the farm produce would then be used to pay back the investors with guaranteed tax-free returns.

On January 29, 2024, SEBI released an interim order freezing all bank accounts and operations of Growpital due to a violation of the Collective Investment Scheme. SEBI found that Growpital was openly breaking the rules it had set and asked Growpital for a clear explanation. Before this, Growpital had raised INR 192 Crores from investors, who are now in limbo due to the SEBI freeze. The founder of Growpital claims losses of INR 100 Crores due to the freeze, but because of poor recordkeeping and lack of clarity, SEBI does not believe them and is still investigating, and an outcome is soon expected.

Since then, Growpital has also been fined by MCA for a different violation; you can read more about it here.

AltGraaf (Arzooo - Invoice Discounting)

AltGraaf (an offshoot of Jiraaf) is an unregulated platform that offers investors invoice discounting and unlisted corporate debt opportunities. In November 2023, Arzooo, a B2B retail tech platform for electronics, raised almost INR 19.52 Crores through various invoice discounting deals on its platform.

The last raise was on November 28, 2023, and just 3-4 days later, Arzooo started defaulting on its repayments for previous deals. To their credit, AltGraaf managed to recover around 34% of the outstanding amount, but there have been no further recoveries since. Almost all investors are facing principal losses on their investments in this deal.

According to some reports, Arzooo has not even paid salaries or its own vendors. AltGraaf has filed a case against Arzooo in the Magistrate Court in Bengaluru, but it is unclear if the money will be recovered.

Since this incident, AltGraaf has started focusing on relatively safer bank guarantees and trade credit insurance-backed invoice discounting products. However, it continues to offer riskier options, including those in which you can lose 100% of your principal.

Tyke Invest (Geeani - CSOP)

Tyke Invest, another unregulated platform aiming to democratize startup investing through its Community Subscription Offer Plan (CSOP), helped raise money for Geeani, a manufacturer of green energy automotive products. The CSOP was oversubscribed by at least 1000% (10 times the initial target) when it raised funds in February 2023. Within 3-4 months, the company decided to buy back the CSOP agreement and had to pay twice the initial raised amount as per the agreement. However, they only offered 30% interest to investors.

Tyke intervened and got them to honor the 2X promise. Despite this, Geeani never paid the investors any money. Tyke sent multiple legal notices, but the Geeani founders cannot be traced, and it is unclear if the money will ever be recovered.

CSOP as an instrument has also had a troubled past, with multiple notices from the MCA in 2023, which imposed several penalties on companies that raised money via Tyke. For some time now, Tyke has not offered CSOP as an opportunity, so it is unclear what its plans are with it.

There have been many more defaults in this space, but if we cover them all, this article may feel like a book, which we don't intend to. However, I wrote a story for Mint very recently, in which I mentioned other notable defaults. Check out this infographic for more info.

Click here to read the full story on Livemint.

Conclusion

While unregulated alternative investment platforms can offer enticing investment opportunities, they come with significant risks that cannot be ignored. The lack of regulatory oversight, transparency, and legal protections can lead to potential financial losses and limited recourse options for investors. If the same defaults had happened on regulated platforms, the regulators have a transparent process for dealing with them, leading to better chances of recovery for the investor. The regulator also has more power to take action against regulated platforms for breach of regulations or negligence.

By understanding these downsides and learning from past defaults, I hope you can make more informed decisions about alternative investments. Always consider a platform's regulatory status and weigh the associated risks before committing your hard-earned money. Remember, keeping your principal safe is much more important than earning a higher interest rate.

Thank you for reading this article, and thank you to Grip Invest for powering the AltXtra series. We have many more interesting pieces coming up, and we hope you will enjoy them. If you have any feedback, please don't hesitate to reach out to us at ALT Investor or Grip Invest.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Yash Roongta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yash Roongta

Yash Roongta

I am a CFA and FRM Charterholder. I used to work as a Portfolio Implementation Manager for Aviva Investors managing £3bn+in Assets Under Management in the UK. I am very passionate about educating people on how they can make more money with their existing investments sustainably.