LoanX Vs. P2P Lending : Where To Invest?

Chahat Porwal

Chahat Porwal

KEY TAKEAWAYS

The article compares LoanX, a securitized debt instrument (SDI), with P2P Lending, highlighting their differences in regulation, borrower types, and security features.

LoanX is regulated by RBI or SEBI and offers a pool of loans with security features like cash collateralization and overcollateralization, while P2P Lending is regulated under the NBFC-P2P License and involves unsecured, one-to-one lending.

LoanX products are credit-rated by agencies like ICRA and CRISIL, whereas P2P loans rely on CIBIL scores and do not require credit ratings.

LoanX offers structured investment with potential returns of 12% - 14% IRR, while P2P Lending offers higher potential returns of 9% - 18% IRR but with higher risks.

Investors should consider their risk tolerance and investment goals when choosing between LoanX and P2P Lending, emphasizing the importance of thorough research and consulting financial advisors.

Hi there! Welcome to our ALTXtra series, where we decode alternative investments. P2P Lending has become one of the largest areas in alternative investments, with an estimated AUM of around INR 6,000 Crores.

However, the P2P category has faced its share of issues, with the RBI recently investigating the instant liquidity model of certain platforms, leading to the closure of the model altogether. On 16th August 2024, RBI even released more regulations, which might make the P2P industry unviable all together. Read about the summary in a Linkedin post Yash did here.

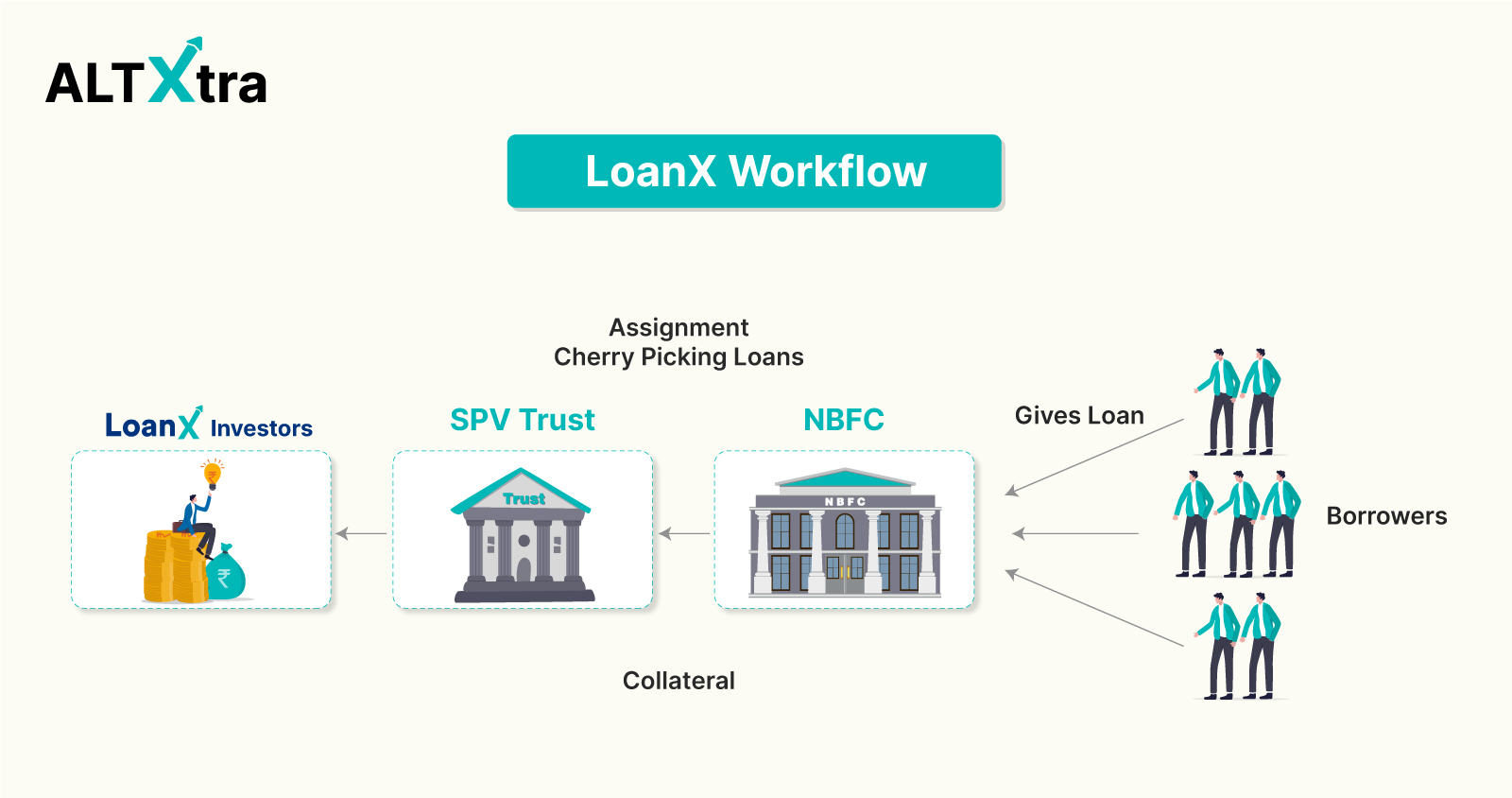

In this article, we want to introduce our readers to another product, LoanX, which is essentially a Securitized Debt Instrument (SDI) where the underlying asset is a pool of loans. These loans are generally originated by NBFCs in either secured or unsecured formats to individuals or businesses. To read more about SDIs, please check this previous article in this series.

LoanX is very similar to P2P Lending, as you, a retail investor, still invest in a pool of loans. However, there are some subtle but important differences in how the products operate. We will compare both to help you in your decision-making process.

Please note that LoanX is a Grip Invest’s branded product. When we mention LoanX in this article, you can think of it as an SDI backed by a pool of loans. These types of products are sometimes available on other OBPP platforms as well. To read more about SDIs, please check this previous article in this series.

If you prefer video format more, please checkout our video on this topic here:

Key Differences Between LoanX And P2P

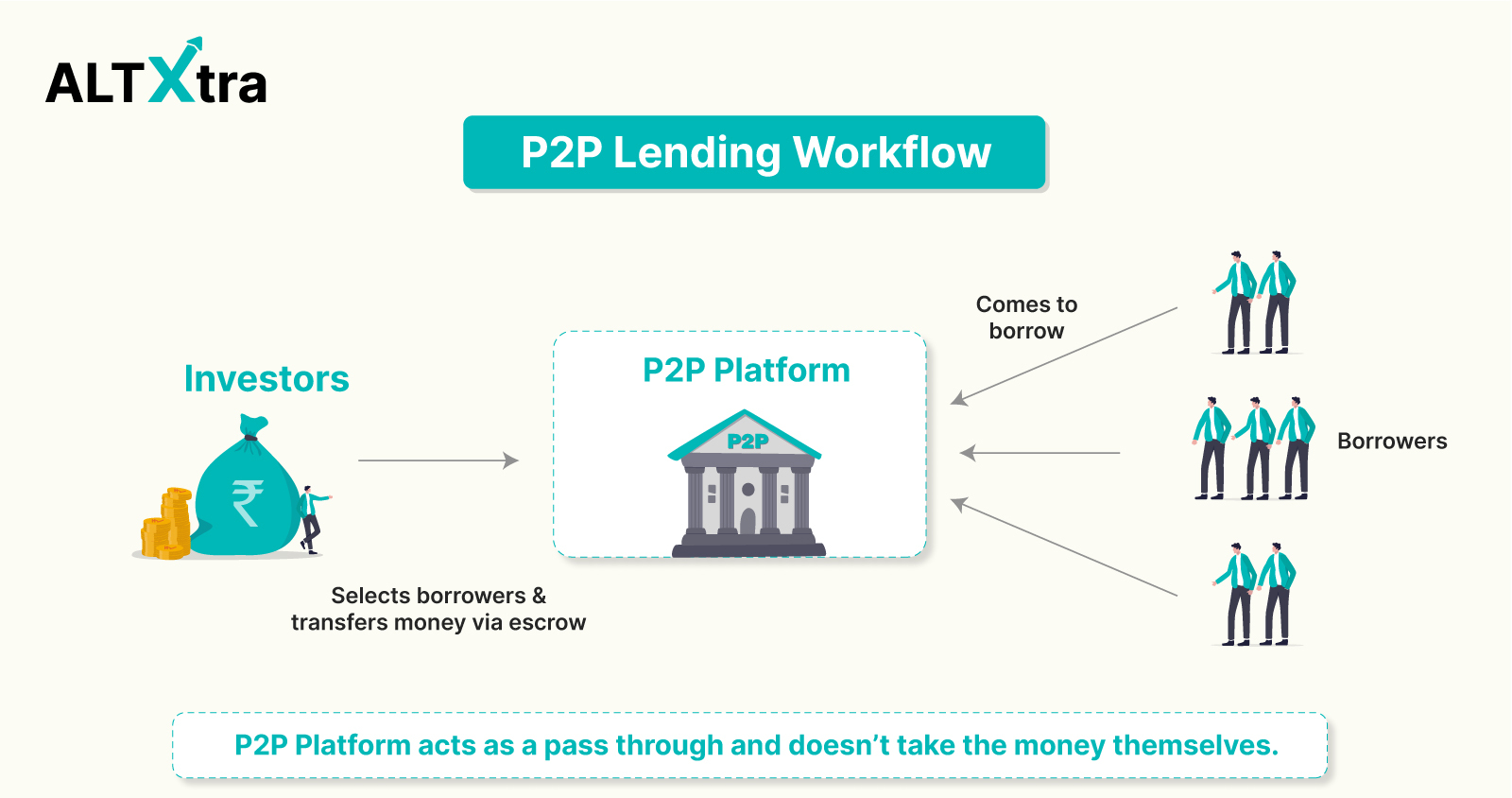

Workflows

Regulation

LoanX is a type of SDI regulated by either RBI or SEBI rules. It can only be offered by OBPP platforms online.

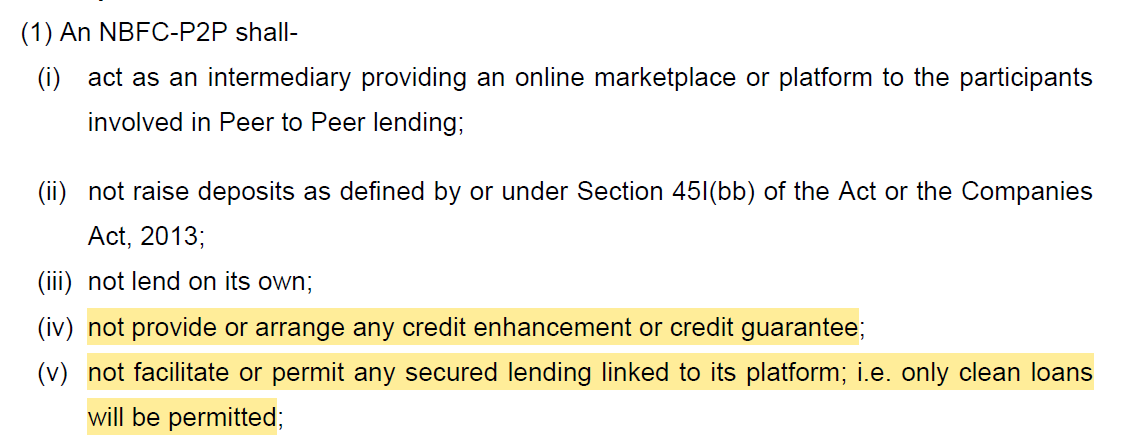

P2P Lending is regulated under the NBFC-P2P License issued by RBI.

| Characteristic | LoanX (SDI) | P2P Lending |

| Regulator | RBI or SEBI | RBI |

| Regulation | Securitisation of Standard Assets Directions, 2021 | NBFC-P2P Regulation, 2017 |

Type of Borrowers

LoanX is like a pool of loans packaged into a single product. It can include individual borrowers or businesses. These loans can be either secured (like car loans or home loans) or unsecured. The downside is that you can't choose individual borrowers; when you invest, you invest in the pool selected by the arranger, which is Grip Invest.

P2P Lending is a one-to-one lending model, meaning an investor can choose which borrower to lend to. All P2P Lending is unsecured. The advantage here is that you have the freedom to select your own borrowers. However, some platforms have severely limited this even after the introduction of 16th August 2024 guidelines.

| Characteristic | LoanX (SDI) | P2P Lending |

| Type of Borrower | Individual/Businesses | Individual/Businesses |

| Secured/Unsecured | Secured & Unsecured | Only Unsecured |

Sourcing of Borrowers

In LoanX, the pool of loans is carefully selected from an established NBFC by an arranger like Grip Invest, based on criteria agreed upon by Grip and the NBFC. These NBFCs are usually 10-15 years old and have well-established credit risk assessment processes to determine which borrowers to lend to.

In P2P Lending, the P2P platform has its own criteria for which types of borrowers are allowed to borrow from investors. These platforms are relatively newer than NBFCs and may or may not have strong credit risk assessment processes.

| Characteristic | LoanX (SDI) | P2P Lending |

| Source of Loans | Originated by NBFC generally 10-15 years old and have robust credit-risk assessment processes. | Borrowers selected as per P2P platform credit risk assessment criteria. |

Credit Rating of Products

Each LoanX product must be rated by a SEBI-regulated rating agency like ICRA, CRISIL, or IndiaRatings. The agency publishes their rating rationale and methodology publicly, which everyone can read.

P2P loans do not need to be credit-rated. Instead, they use the CIBIL score. The P2P platform will show you the borrower's CIBIL score along with other information to help you decide. However, not every borrower will have a CIBIL score, especially if they are in the "New to Credit" category.

| Characteristic | LoanX (SDI) | P2P Lending |

| Credit Rated | Yes, overall rating assigned to the loan pool by agencies like ICRA, CRISIL, etc | No, but individual borrowers may have CIBIL scores. |

Security Structure

This is probably the most important point, so I will break it down further:

LoanX: This product has several security features, such as:

Cash Collateralization: The NBFC that provides the pool of loans usually posts a certain percentage of the overall pool size as cash collateral to cover any defaults in the pool.

Excess Interest Spread: Typically, the NBFC issues the loan at a higher rate than what is passed on to the trust and investors. For example, if the Bank/NBFC gives loans at 13% interest and passes on 12% to investors in the form of LoanX, the extra 1% buffer can be used to cover NPAs if needed and repay investors.

Overcollateralization: Let's say the total loan book is INR 30 Crore, but a LoanX product is created for only INR 27 Crore. The remaining INR 3 Crore is kept as collateral within the trust, posted by the NBFC. If Non-Performing Assets (NPA) increase, the interest and principal repayments from these extra loans are used so the investor doesn't face a default.

Securitization Rules: The NBFC cannot post loans into the pool that are already Non-Performing Assets. They also need to hold the loan for 6-9 months before they are allowed to securitize it. This ensures they provide quality loans and not bad loans just to increase business.

P2P Lending: This product has no known security features and is a pure form of unsecured lending. Additionally, there are no regulations specifying which types of borrowers can use the P2P platform. The platform does not share any risk with the lender, as this is not permitted by law.

Many P2P platforms used to offer fixed deposit-like products where they used to pseudo-guarantee returns to users. The 16th August 2024 guideline has put a stop to this practice. To read more about the changes, you can checkout this article here.

| Characteristic | LoanX (SDI) | P2P Lending |

| Security Features | Yes, in the form of cash collaterals, excess interest spread, overcollateralization. | None |

Tenure

LoanX products would generally have a tenure from 12 months - 48 months

P2P Loans would generally have a tenure from 1 month - 36 months.

Returns

LoanX products offer anywhere between 12% - 14% IRR.

P2P Loans offer anywhere between 9% - 18% IRR depending on the risk you take.

Liquidity

LoanX products are received in your demat account held with any broker. You can sell them back to the platform (if they offer this service) or in the secondary market through your broking account. However, liquidity is currently very limited, even though the option exists.

In the latest guidelines, P2P platforms cannot provide exit via secondary sale of loans.

| Characteristic | LoanX (SDI) | P2P Lending |

| Tenure | 12-48 months | 1-36 months |

| Returns | 12% - 14% IRR | 9% - 18% IRR |

| Liquidity | Held in demat, listed on exchange. May be available | Not allowed by RBI |

Taxation

The interest income from LoanX products is taxed according to your tax slab rates. The interest is paid to the investor after deducting TDS at 25%.

If you manage to sell the LoanX security for a capital gain, you will need to pay taxes on that gain, which depends on how long you held the security. It's best to consult a tax advisor for these situations.

The interest income from P2P Lending is also taxed according to your tax slab rates. There is no TDS deducted on this instrument.

There is no concept of capital gains in P2P Lending.

| Characteristic | LoanX (SDI) | P2P Lending |

| Interest Income Taxation | As per individual slab rates | As per individual slab rates |

| Capital Gains Taxation | < 12 Months: As per individual slab rates. >12 Months: 10% without indexation benefit. | Not Applicable |

| TDS | 25% | Nil |

Conclusion

In conclusion, both LoanX and P2P Lending offer unique opportunities for retail investors to diversify their portfolios with high-yield investments. LoanX, as a securitized debt instrument, provides a structured and regulated investment with multiple security features, making it a potentially safer option for those looking for stability and transparency. On the other hand, P2P Lending offers higher potential returns and the flexibility to choose individual borrowers, albeit with higher risks due to the unsecured nature of the loans.

Ultimately, the choice between LoanX and P2P Lending will depend on your risk tolerance, investment goals, and preference for security versus potential returns. As always, it is advisable to conduct thorough research and consult with a financial advisor before making any investment decisions. But we hope this article has given you a fair comparison between both the products.

Thank you so much for reading and thank you to Grip Invest for powering the AltXtra series. There are a lot more interesting pieces to come out of this and hopefully, you all will enjoy them. If you have any feedback, please don't hesitate to reach out to us at ALT Investor or Grip Invest.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Chahat Porwal directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by