Traditional 401k vs. Roth 401k - Another Wrinkle

Adam

Adam

If you plan to access a 401k before normal retirement, choosing the type of 401k matters! If you plan to utilize a Roth IRA conversion to access 401k money early, the type of 401k you choose has tax and category implications that you may not be aware of.

A few definitions to begin:

Traditional 401k - pre-tax, deposited without any tax applied. The tax is deferred until withdrawals are taken. Deferred taxes.

Roth 401k - post-tax, deposited with taxes taken out (at your current rate). However, no tax is incurred on gains or principal at withdrawal. Tax once and done.

Roth IRA Conversion Ladder - Rolling over funds from a Traditional 401k -> to a Traditional IRA -> and converting to Roth IRA. Tax is taken at the time of conversion from Traditional IRA to Roth IRA. Funds cannot be accessed until 5 years after the conversion date

If you need more of a refresher, see JL-Collins article.

Now that your memory is jogged, let's focus on running this Roth IRA Conversion Ladder from a Roth 401k.

Roth 401k -> Roth IRA:

Because the money in the Roth 401k has been taxed already, the money in this vessel is categorized as part contributions and part earnings. When you convert this vessel to a Roth IRA, those categorizations remain the same. This is unfortunate because in a Roth IRA you are only allowed to withdraw contributions before retirement age.

With that, in addition to other tax considerations. Converting from a Roth 401k to a Roth IRA is not advantageous for those that are looking to access 401k money early. This conversion would only allow access to contributions; keeping gains locked up until normal retirement age.

Confused? Let's take a step back to the typical Roth IRA Conversion ladder, using a Traditional 401k.

Traditional 401k rollover -> to a Traditional IRA -> converting to Roth IRA

At the time of conversion to a Roth IRA, traditional 401k money needs to be taxed. Whether it's 60% contributions and 40% earnings, it's all taxed the same way.

Because of this, and the nature of this conversion, the conversion money is treated as one 'lump sum' and is dumped into the Roth IRA, categorized as a contribution.

This gives you full access to ALL of your money that was growing in your traditional 401k, contributions and earnings.

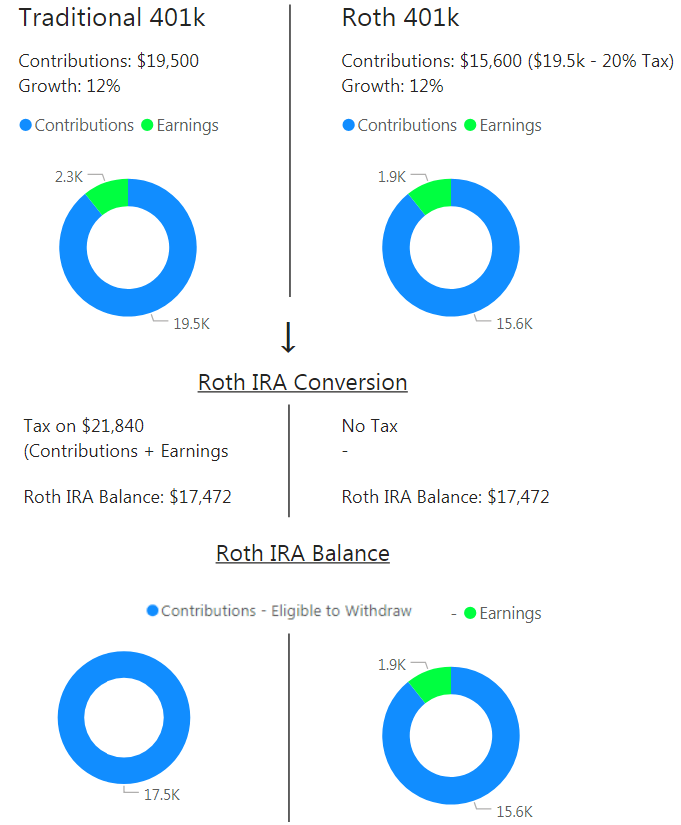

Run through this hypothetical with both a Traditional and Roth 401k, assuming 1 year of growth at 12%:

Conclusion:

If you were to contribute to a Roth 401k, and create a Roth IRA conversion, you would only be able to withdraw the original contribution amount of $15.6k, as opposed to $17.5k in a Traditional 401k. If retiring early is something you've entertained, think about utilizing a Traditional 401k over a Roth 401k. Again, in a Roth IRA conversion, a Traditional 401k is categorized as one bucket of contributions, allowing you to withdraw the entirety based on Roth IRA's withdrawal criterion. In a Roth IRA conversion, a Roth 401k is categorized as two buckets, contributions and gains. Given that you can only withdraw contributions in a Roth IRA before normal retirement age, choosing a Traditional 401k would allow access to more early withdraw-able funds.

Disclaimer: I am not affiliated with any financial institution and I am NOT a financial adviser. Please do your own due diligence when researching financial decisions and or consult with a professional. Also note: My views are my own and my current employer does not support or endorse this or any position on this website.

Subscribe to my newsletter

Read articles from Adam directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by