What is staking on Starknet?

Akira

Akira

Retaining blockchain values remains one of the core values driving the Starknet ecosystem and it plays out in their recent plans to integrate staking into the list of things users can do to maximise the network. This development will be the first of its kind for Layer 2 solutions and it's set to go live on 26th Nov, 2024.

The roadmap to staking on Starknet has already been laid out. For now, locked tokens as well as StarkWare and the Starknet Foundation will not be eligible to participate in staking until a later period. Eligible participants, on the other hand, will be required to follow the provided criteria to enjoy rewards.

Before, we delve right into that, let's do a quick introduction of what Starknet staking is all about.

Starknet Staking

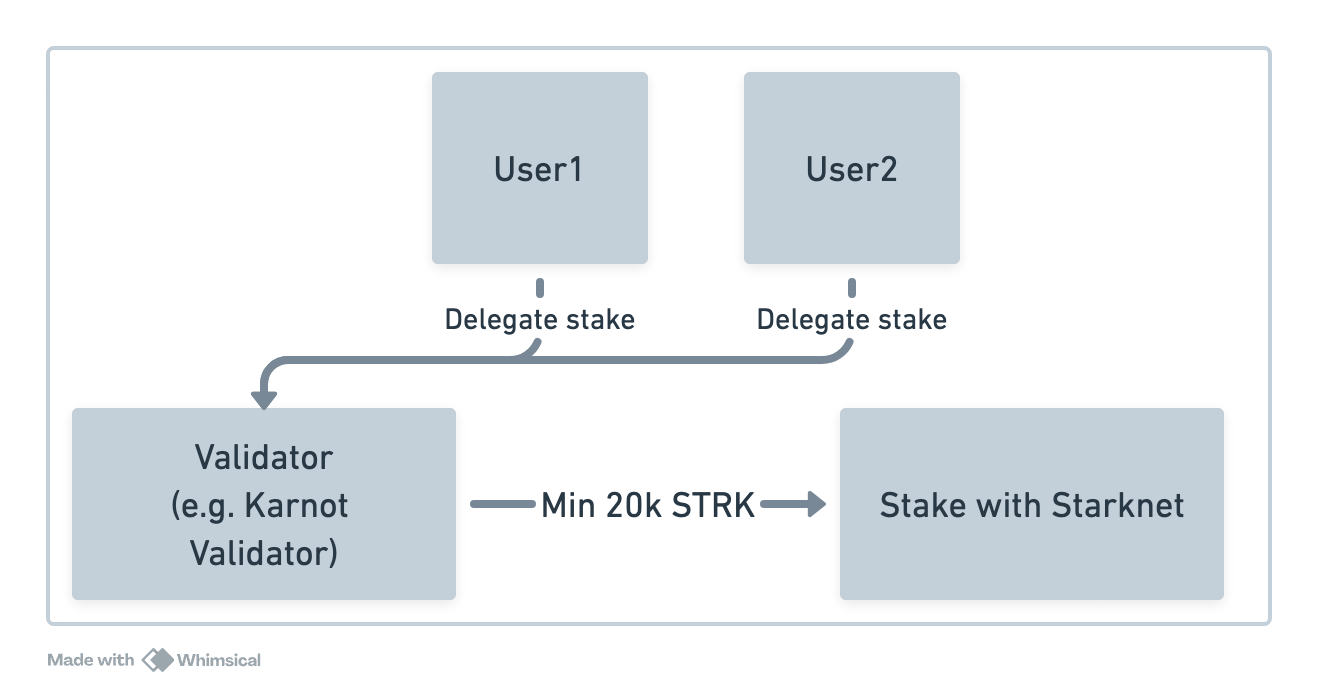

Staking on Starknet means locking up STRK tokens in the staking protocol to help improve the network and keep it safe. According to the staking protocol, anyone holding STRK can stake their tokens directly or delegate them, earning rewards based on their level of participation.

In this first phase, validators must stake a minimum of 20,000 STRK tokens and operate a full node, preparing for future phases that will bring additional responsibilities for network upkeep and security.

Other relevant details of Starknet's staking protocol are as follows:

Staking Rewards: Staking rewards will be based on the amount staked and the commission policy set by the validator

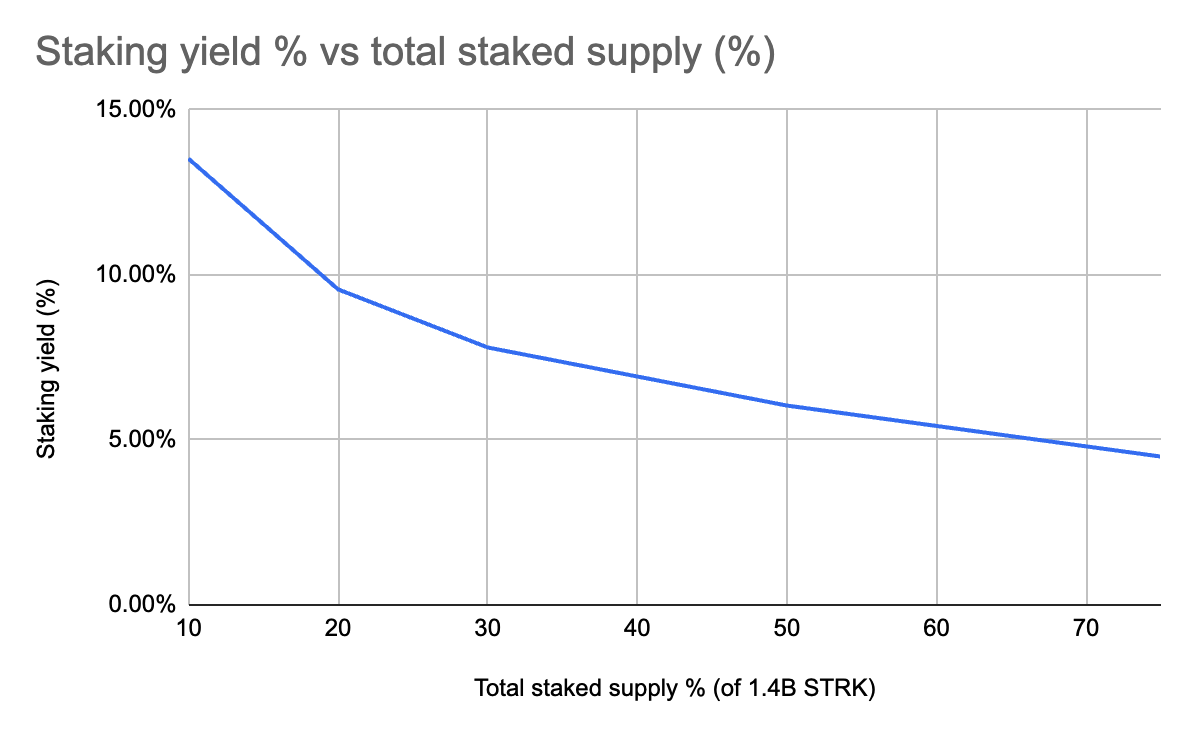

Minting Curve: The minting curve will modify rewards according to total STRK locked in the staking protocol. The curve will be implemented to strike a balance between inflation and participation. Yearly inflation cap is currently set at 1.6%. Generally speaking, this is low inflation and good target to have.

Withdrawal Security Lock Up: When you unstake, you will have to wait for 21 days to get your STRK.

With endur.fi’s xSTRK, our platform is optimized to minimize unstaking time, providing a smooth user experience. In most cases, you can instantly swap xSTRK for STRK on Ekubo (coming soon). Alternatively, if you want to avoid slippage, you can request an unstake and receive STRK within just 1-2 days

- Commission Policy (CP) Parameter: will be fixed by validation zero to one. This parameter determines how much portion of fees will the validator charge on the rewards.

Liquidity Staking

Now while the prospect of staking on Starknet is exciting for the community, there's one tiny detail to consider here, however. It's that even with rewards in view, STRK holders can't earn yields without losing liquidity.

This is where liquidity staking comes in.

The vehicle for this solution is Endur, a liquid staking token (xSTRK) that represents endurance and long term commitment to Starknet.

Conventional staking processes as we know it have some limitations:

Reduced Liquidity: Traditional staking locks up user funds, restricting access to liquidity and flexibility.

No Access to DeFi Without Liquid Staking: Without liquid staking options, users cannot use STRK tokens in DeFi applications while staked.

21-Day Unstaking Period: Unstaking STRK means your tokens will be locked for 21 days. During this period:

Zero Yields: You will earn no yield on your unstaked tokens.

No Token Access: Funds remain inaccessible, reducing your liquidity and options in the DeFi ecosystem.

Endur’s xSTRK to allow users to enjoy both rewards and liquidity. It will be trade-able while serving as the perfect representation of staked STRK. It's a win-win situation here.

With Endur, staking becomes more flexible and profitable, unlocking new use cases for xSTRK that let you experience DeFi as it was meant to be with native STRK.

Did you know? Endur’s smart contracts will be audited and ready for Staking launch. (Audit document: coming soon)

Disclaimer: Despite the advantages of Liquid Staking, this process carries inherent risks common to DeFi, including smart contract vulnerabilities and other potential issues.

Conclusion

The introduction of staking to the ecosystem is a big step towards decentralisation for Starknet and they're just getting started. In the future, this Layer 2 solution will also see stakers taking on more responsibility at a gradual pace for efficiency.

Subscribe to my newsletter

Read articles from Akira directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by