The Psychology of Investing: Mastering Your Emotions in the Market

Arnab Kabasi

Arnab Kabasi

Investing is often seen as a numbers game—picking the right stocks, analyzing trends, and predicting market moves. But what if the most important factor in successful investing isn’t data, but your emotions? The psychology of investing plays a crucial role in whether you achieve financial success or make impulsive decisions that undermine your goals. Mastering your emotions is key to navigating the market and building long-term wealth.

Here’s a deeper look at how emotions impact investing and strategies to help you keep your cool during market fluctuations.

1. Understanding the Role of Emotions in Investing

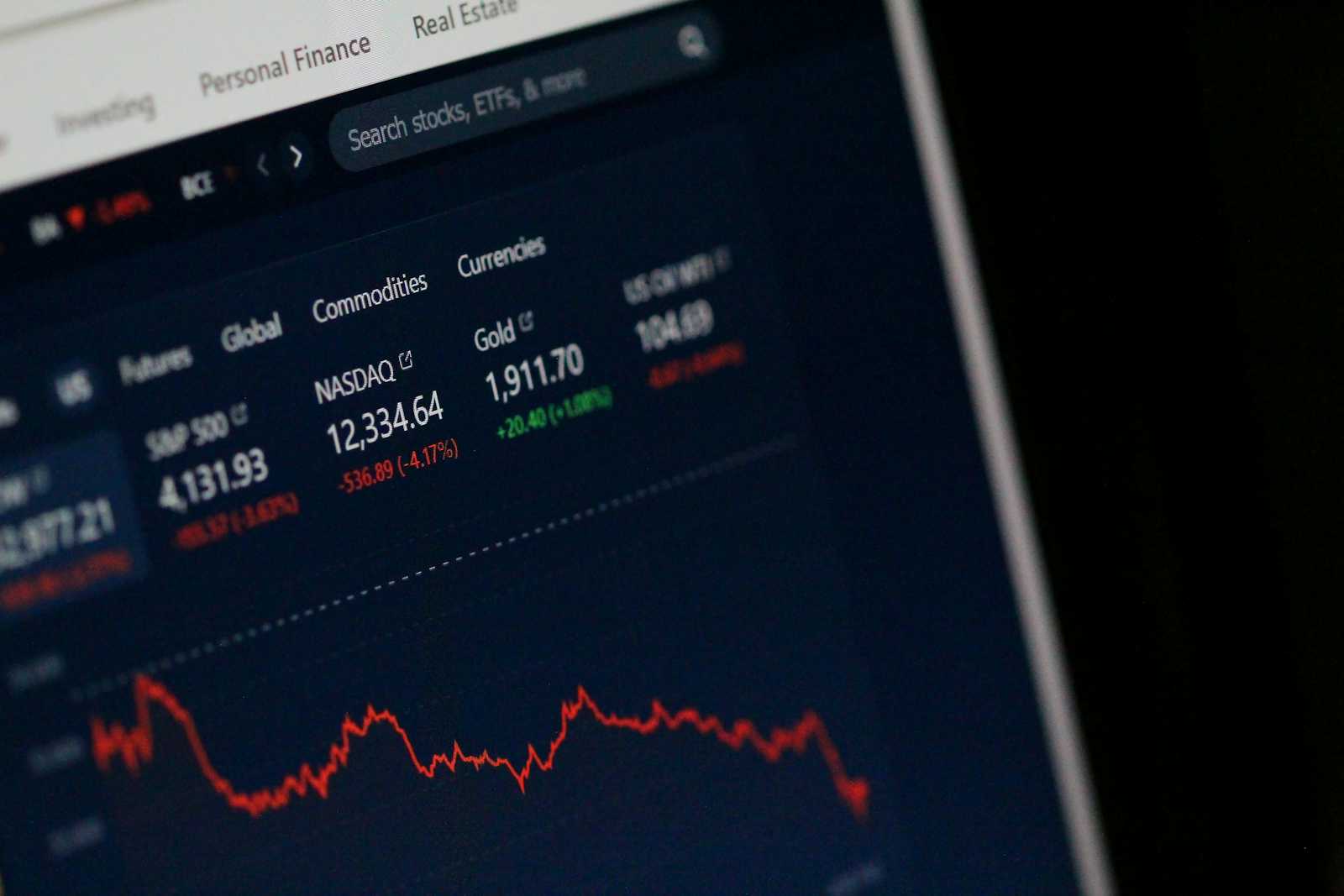

The stock market is a reflection of human behavior—fear, greed, excitement, and anxiety drive the rise and fall of asset prices. Investors often let emotions influence their decisions, which can lead to buying high in moments of excitement or selling low out of fear. This emotional rollercoaster can result in missed opportunities and poor investment choices.

Common emotional biases that affect investors include:

Fear of Missing Out (FOMO): The urge to buy when everyone else is jumping in, leading to inflated asset prices.

Loss Aversion: The tendency to fear losses more than valuing gains, which can cause investors to hold onto losing stocks too long or avoid risk altogether.

Overconfidence: Believing you can predict the market with certainty, which leads to taking excessive risks.

2. How Emotions Impact Investment Decisions

When the market is volatile, emotions run high. This is when impulsive decisions are most common. Investors may panic and sell during a downturn, fearing further losses, or chase hot stocks during a bull market, hoping to capitalize on the momentum. These decisions can derail long-term strategies.

During market downturns, for example, loss aversion can cause investors to panic-sell their stocks at a low point, locking in losses. On the flip side, during periods of strong growth, greed or overconfidence can lead to making risky, unbalanced investments, chasing high returns without considering the underlying risks.

3. Mastering Your Emotions: Strategies for Better Investing

While emotions will always be a part of investing, the key to success is learning to manage them. Here are some strategies to help you stay disciplined and focused:

1. Stick to a Plan

Having a clear investment strategy helps take the emotion out of the decision-making process. Whether you’re investing for retirement, education, or a major purchase, a well-thought-out plan provides a framework to follow during both market highs and lows. This allows you to stay focused on your long-term goals, even when short-term fluctuations make you uneasy.

2. Diversify Your Portfolio

A diversified portfolio helps reduce risk and limit the impact of market volatility. By spreading investments across different asset classes—stocks, bonds, real estate, and others—you protect yourself from drastic losses in any single area. A well-balanced portfolio gives you more confidence to ride out market downturns.

3. Set Realistic Expectations

While investing offers opportunities for growth, it also involves risk. Set realistic expectations and understand that returns fluctuate over time. By acknowledging that there will be ups and downs, you’ll be less likely to panic when the market experiences a downturn or become overly excited when it’s doing well.

4. Practice Patience

Investing is a long-term game. The best investors are often the ones who are patient and resist the urge to make impulsive decisions based on market noise. Let time and compounding work in your favor. If you stick to your plan, the market will reward your patience in the long run.

5. Avoid Market Timing

Many investors try to time the market—buying when prices are low and selling when they’re high. However, predicting short-term market movements is incredibly difficult and often results in missed opportunities. Instead of timing the market, focus on staying invested and consistent, regardless of market conditions.

4. Building Mental Toughness in Investing

Investing requires mental resilience. You will face market downturns, volatility, and unexpected changes in the economy. Building mental toughness means staying grounded and sticking to your plan, even when the market is acting irrationally. Here are some tips:

Avoid Information Overload: Constantly checking market news can heighten emotions. Limit your exposure to unnecessary information.

Focus on the Long Term: Keep your eye on your long-term goals rather than short-term market movements.

Learn from Mistakes: Every investor makes mistakes, but the key is to learn from them and avoid repeating the same errors.

Final Thoughts

Mastering the psychology of investing is just as important as understanding the numbers. Emotions like fear, greed, and excitement are natural, but when they drive your investment decisions, they can lead to poor outcomes. By sticking to a plan, diversifying, practicing patience, and staying focused on your long-term goals, you can weather the ups and downs of the market with confidence.

Remember, successful investing isn’t about predicting the future—it’s about managing your emotions and staying disciplined through the journey.

For more information visit Merry Mind.

Subscribe to my newsletter

Read articles from Arnab Kabasi directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by