Understanding CrossFi: How It Differs from Traditional Financial Systems

Kehinde Sodiq

Kehinde SodiqTable of contents

INTRODUCTION

The world of finance is undergoing a radical transformation with the emergence of new technologies and innovative approaches to managing money. One of the most exciting developments in recent years is the rise of CrossFi, a revolutionary concept that challenges the foundations of traditional finance. This article delves into the key differences between CrossFi and traditional finance, exploring how CrossFi is reshaping the financial landscape and offering unique advantages to users worldwide.

Understanding Traditional Finance

Traditional finance, also known as TradFi, refers to the conventional financial system that has been in place for centuries. This system is characterized by centralized institutions, such as banks, stock exchanges, and government regulators, that act as intermediaries in financial transactions [1].

Key features of traditional finance include:

Centralized control: Financial institutions and governments have significant control over monetary policies and financial services.

Intermediaries: Banks and other financial institutions act as middlemen in transactions, often charging fees for their services.

Limited accessibility: Many traditional financial services are not easily accessible to everyone, particularly in underbanked or developing regions.

Slow processing: Cross-border transactions and complex financial operations can take days or even weeks to complete.

Regulatory compliance: Financial institutions must adhere to strict regulations, which can sometimes limit innovation and increase costs.

Introducing CrossFi

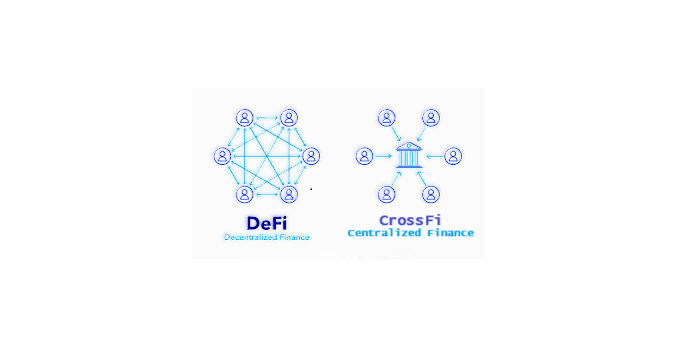

CrossFi, short for Cross-Chain Finance, is an innovative approach to financial services that leverages blockchain technology and decentralized finance (DeFi) principles across multiple blockchain networks [2]. It aims to create a seamless, interoperable financial ecosystem that transcends the limitations of individual blockchain platforms.

Key characteristics of CrossFi include:

Interoperability: The ability to transfer assets and execute transactions across different blockchain networks.

Decentralization: Removal of central authorities and intermediaries in financial transactions.

Smart contracts: Automated, self-executing agreements that facilitate trustless transactions.

Liquidity aggregation: Pooling liquidity from various sources across different chains to improve efficiency and reduce costs.

Cross-chain yield farming: The ability to earn rewards by providing liquidity or staking assets across multiple blockchain networks.

Key Differences Between CrossFi and Traditional Finance

1. Centralization vs. Decentralization

Traditional Finance: Relies on centralized institutions and authorities.

CrossFi: Operates on decentralized networks, reducing the need for intermediaries.

2. Accessibility

Traditional Finance: Often limited by geographical boundaries and regulatory restrictions.

CrossFi: Offers global accessibility to anyone with an internet connection.

3. Transaction Speed

Traditional Finance: Can be slow, especially for cross-border transactions.

CrossFi: Enables near-instantaneous transactions across different blockchain networks.

4. Cost Efficiency

Traditional Finance: Often involves high fees due to intermediaries and regulatory compliance.

CrossFi: Generally offers lower fees due to reduced overhead and automated processes.

5. Transparency

Traditional Finance: Limited transparency, with information often siloed within institutions.

CrossFi: High transparency through public blockchain ledgers and open-source smart contracts.

6. Innovation Speed

Traditional Finance: Slow to innovate due to regulatory constraints and legacy systems.

CrossFi: Rapid innovation driven by open-source development and community governance.

7. Asset Interoperability

Traditional Finance: Limited ability to seamlessly transfer or use assets across different systems.

CrossFi: Enables fluid movement and utilization of assets across various blockchain networks.

Unique Advantages of CrossFi

Enhanced Liquidity: By aggregating liquidity from multiple chains, CrossFi can offer better rates and reduced slippage for traders and investors [3].

Increased Efficiency: Cross-chain interoperability allows for optimized routing of transactions, reducing costs and improving speed.

Expanded Investment Opportunities: Users can access a wider range of assets and financial products across different blockchain ecosystems.

Improved Risk Management: The ability to diversify assets across multiple chains can help mitigate risks associated with single-chain vulnerabilities.

Financial Inclusion: CrossFi's accessibility can bring financial services to underbanked populations worldwide.

Composability: The interoperable nature of CrossFi allows for the creation of complex financial products that leverage the strengths of multiple blockchain networks.

Reduced Counterparty Risk: Smart contracts and decentralized protocols minimize the risk of default or manipulation by centralized entities.

Why CrossFi is Revolutionary

CrossFi represents a paradigm shift in the world of finance for several reasons:

Borderless Finance: It eliminates geographical and jurisdictional barriers, creating a truly global financial system.

Democratization of Finance: By removing intermediaries and centralized control, CrossFi empowers individuals to have full control over their financial assets.

Programmable Money: Smart contracts enable the creation of sophisticated financial instruments and automated processes that were previously impossible or prohibitively expensive.

Interoperability: CrossFi solves the problem of blockchain silos, allowing for seamless interaction between different blockchain ecosystems.

Financial Innovation: The open and composable nature of CrossFi fosters rapid innovation and the development of novel financial products.

Transparency and Trust: The use of public blockchains and open-source smart contracts increases transparency and reduces the need for trust in centralized institutions.

CONCLUSION

CrossFi represents a revolutionary approach to finance that addresses many of the limitations and inefficiencies of traditional financial systems. By leveraging blockchain technology, smart contracts, and cross-chain interoperability, CrossFi offers enhanced liquidity, increased efficiency, expanded investment opportunities, and improved financial inclusion.

While challenges remain, particularly in terms of regulation and security, the potential of CrossFi to reshape the global financial landscape is immense. As the technology matures and adoption grows, we can expect to see continued innovation and the development of new financial products and services that were previously unimaginable.

The rise of CrossFi marks a significant step towards a more open, efficient, and inclusive financial system that empowers individuals and businesses worldwide. As we move forward, it will be crucial for stakeholders across the financial industry to engage with and understand the implications of this transformative technology.

REFERENCES

Barone, A. (2023). Traditional Finance (TradFi) Explained. Investopedia.

Schär, F. (2021). Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets

From banks to DeFi: the evolution of the lending market.

Subscribe to my newsletter

Read articles from Kehinde Sodiq directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Kehinde Sodiq

Kehinde Sodiq

Software Developer | | Blockchain Developer | | Web3 Technical Writer | | DLTAfrica | | Coding enthusiast | | Lifelong learner