What Are Layer 0, Layer 1, and Layer 2 Blockchain Networks? Explained!

Yuvraj Singh

Yuvraj Singh

Introduction

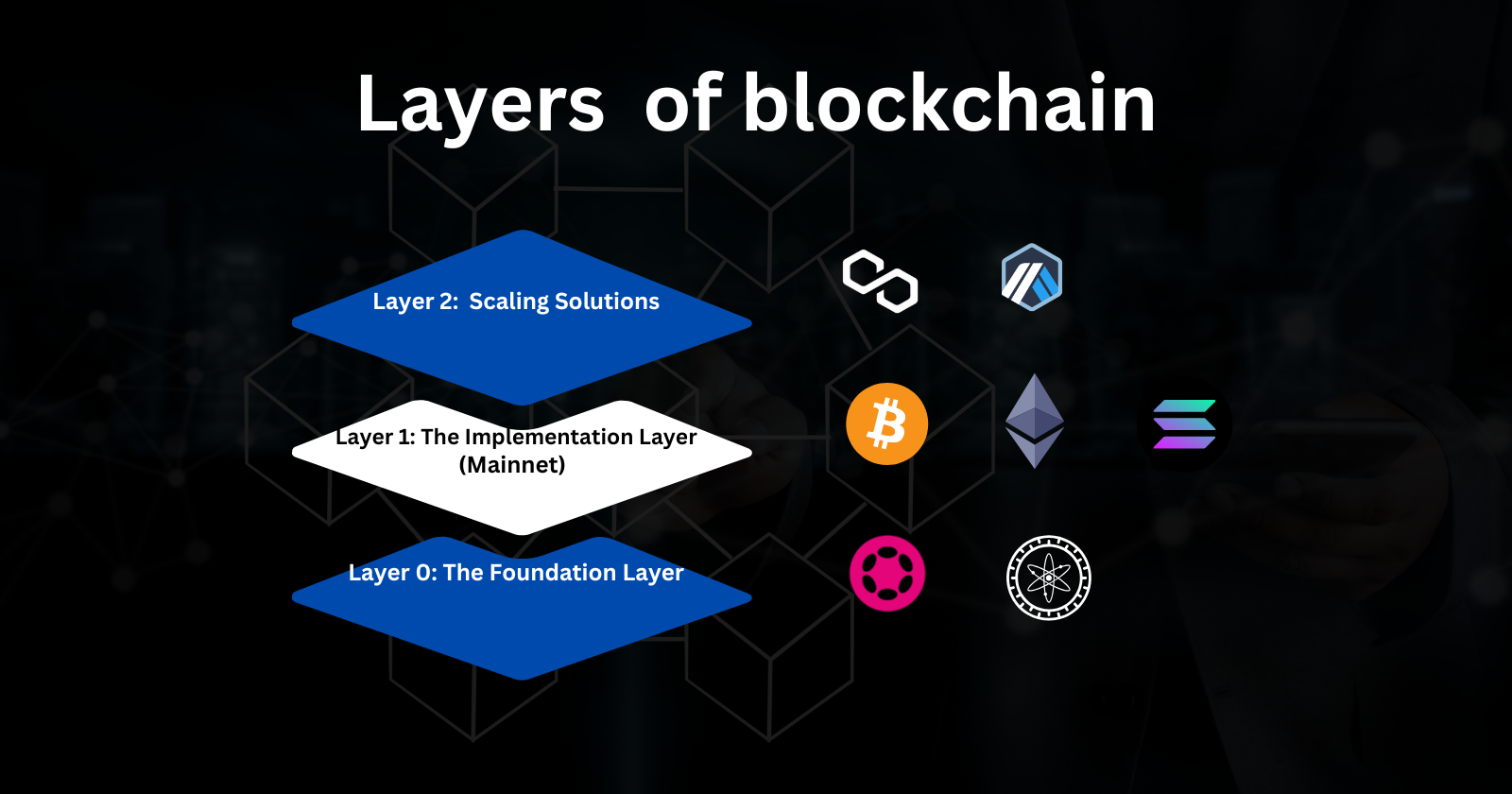

Bitcoin, Ethereum, and Solana are examples of Layer 1 blockchains.

Polygon, Bitcoin Lightning, and Arbitrum? Those fall under Layer 2 blockchains.

And as for Layer 0 blockchains—well, they're not “really” used that much. Examples include Polkadot and Cosmos.

Gosh! 90% of the blogs and explainer videos I came across said exactly this (along with their use cases, which I’ll discuss shortly). Yet, I struggled. I couldn’t visualize how adding a “layer” on top of an old blockchain actually helps. That is, until I stumbled upon a video that called it a “protocol.” That’s when everything started to click!

So, whether you've been working with blockchains for a while or just heard someone on a tutorial casually mention L0, L1, and L2—leading you to quickly Google for answers—I hope my newly learned interpretation helps you digest this concept better.

Let’s dive in!

Wait. If We Already Had Bitcoin, Why Did We Even Need Other Chains?

That’s the first question I had. If bitcoin, currently almost at an all time high at the time of writing this article - seems to be working, why did developers even bother with other chains?

Here are some reasons why new chains became necessary:

Broader use cases

Bitcoin (BTC) was designed with a singular goal in mind: to create a decentralized currency. And that’s about it. But over time, people realized that blockchain technology had the potential for so much more.

Developers wanted to create decentralized applications (dApps) and execute complex programmable logic (smart contracts)—things that weren’t possible with Bitcoin’s architecture. To achieve this, a new chain, Ethereum, was introduced.

Scalability issues

Bitcoin’s transaction throughput is limited (around 7 transactions per second) due to its block size and proof-of-work consensus mechanism.

To put this into perspective: centralized payment networks like Visa can process 65,000 transactions per second. Clearly, this makes blockchain impractical for large-scale, real-time use.

New chains like Solana and Avalanche were created to tackle scalability, boasting the ability to process thousands of transactions per second to support real-time applications.

Other Areas of Improvement

Bitcoin’s limitations didn’t stop at scalability. It also suffers from:

High energy consumption: The PoW mechanism is notoriously energy-intensive.

High transaction costs: As more people use Bitcoin, congestion increases, making transactions slower and more expensive.

Newer blockchains were developed to address these pain points, introducing innovations like energy-efficient consensus mechanisms (e.g., proof-of-stake) and lower transaction costs.

As you can see, with each blockchain built to address a specific problem, newer chains emerged to tackle issues that the previous ones either didn’t focus on or couldn’t solve.

And hence we ended up with multiple chains, each and every focusing on providing a better experience and focusing on a way to make the previous one better.

We’re currently in an exploration phase, where developers, researchers, and the entire blockchain ecosystem are working to create the most efficient and scalable chains possible.

Will one blockchain emerge as the ultimate solution, combining the best of all? Maybe.

Or will we enter a world where multiple chains coexist, with each one tailored for a specific use case? That’s also possible. (Much more likely in my opinion)

Only time will tell. But today, we live in a world of multiple chains, multiple problems, and countless solutions being proposed and built every day.

Understanding Layer 0 & Layer 1 chains

Alright, before we proceed, let’s try to visualize these so-called layers. Each layer in the blockchain ecosystem has a specific architecture and plays a distinct role. These layers consist of protocols and technologies that perform unique functions within the system.

In simple terms, protocols are sets of rules and standards that dictate how data is transmitted, received, and processed between devices, systems, or applications. Think of them as the "instructions" that ensure everything in the blockchain ecosystem works seamlessly together.

Layer 0: The Foundation Layer

Layer 0 refers to the underlying infrastructure that supports blockchains, enabling the creation of multiple independent networks.

Key Characteristics:

Network Backbone: It includes protocols for communication between multiple blockchains and the physical layer of nodes.

Interoperability: Focuses on enabling blockchains to communicate with one another.

Scalability: Provides the framework to build multiple Layer 1 blockchains on top of it.

Example:

- Polkadot: Uses the Relay Chain to connect various Layer 1 chains.

What Layer 0 Is Bitcoin Built On?

Answer: None.

Remember, layers are not a “product” or a specific chain—they’re an implementation. Bitcoin was created before the concept of Layer 0 was formalized. As a result, its architecture is self-contained, lacking modern features like interoperability or cross-chain communication provided by Layer 0 solutions such as Polkadot or Cosmos.

If anything, Bitcoin’s "Layer 0" could be considered the global internet and hardware infrastructure that supports its network.

Layer 1: The Base Blockchain (Mainnet) a.k.a The Implementation Layer

This layer is the main blockchain network where transactions are processed, blocks are created, and consensus mechanisms are implemented.

Key Characteristics:

Consensus Protocols: Governs how nodes agree on the state of the ledger (e.g., PoW, PoS).

Native Functionality: Includes features like token issuance and smart contracts.

Security: Responsible for the network’s decentralization and resistance to attacks.

Example:

- Bitcoin: Uses the Bitcoin Protocol and Proof Of Work (PoW) consensus

In short, Layer 1 defines the blockchain's rules and operations—the very foundation of how the network works.

Why was Layer 1 not enough?

The Blockchain Trilemma.

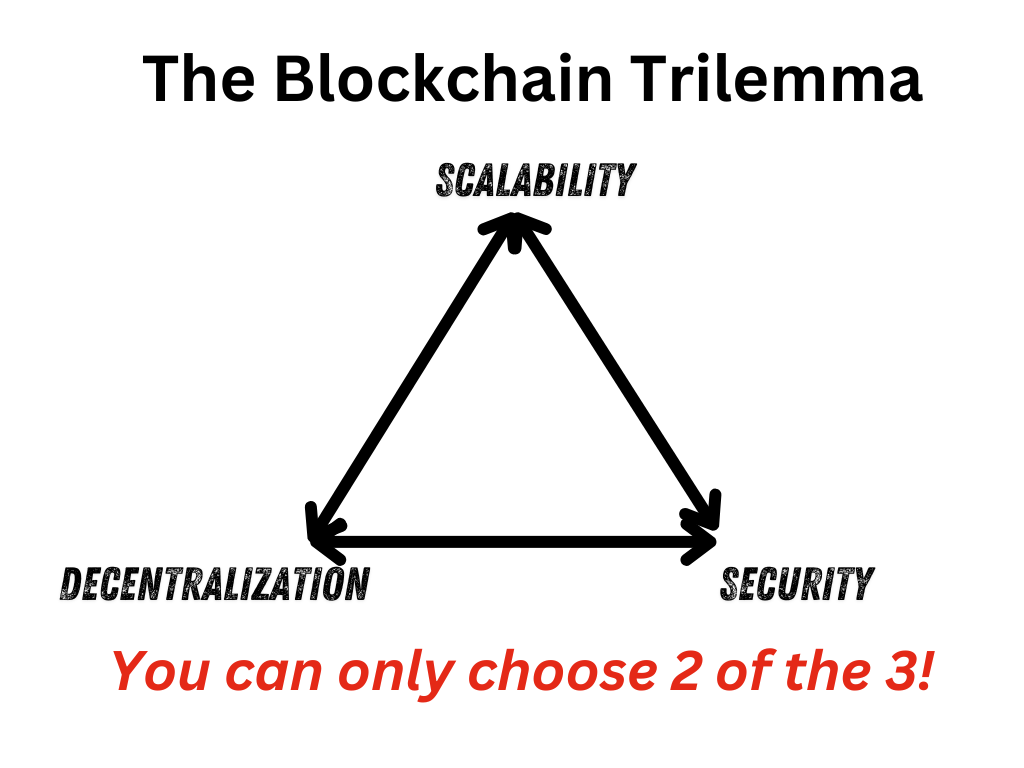

Every blockchain network is built upon three main pillars:

Decentralization: No central entity should control the network, and anyone should be able to participate.

Scalability: The number of transactions the network can process per second (the higher, the better).

Security: How secure the network is against attacks or manipulation.

The Blockchain Trilemma (also known as the CAP Theorem) states that only two out of the three pillars can be fully achieved. The third pillar will inevitably be compromised.

For most Layer 1 blockchains, the priority has been Decentralization and Security, leaving Scalability as the trade-off.

What Does a Lack of Scalability Mean for Blockchains?

A lack of scalability means that as more people use the network, it becomes congested. Interacting with the blockchain (writing to it) becomes:

Time-consuming: Transactions take longer to process.

Expensive: Higher fees are charged due to increased demand on the network.

Think of it like a highway:

When there are just 5-6 cars, everyone reaches their destination on time.

But when hundreds or thousands of cars flood the same road, traffic builds up, and what once took minutes now takes hours.

This congestion was one of the major pain points for Layer 1 blockchains, prompting the introduction of Layer 2 solutions to tackle the scalability crisis.

Layer 2: Scaling Solutions

Layer 2 refers to protocols or technologies built on top of Layer 1, to enhance the blockchain's scalability, speed, and functionality.

So, How Does Layer 2 Help in "Handling More Traffic"?

At its core, the Mainnet (Layer 1) blockchain offloads a portion of its traffic to Layer 2 chains. Users interact with these Layer 2 solutions, which process transactions much faster and at lower costs.

Once processed, these transactions are batched together and written back to the underlying Layer 1 blockchain.

This batching mechanism ensures that while Layer 2 chains focus on speed and efficiency, the security and decentralization of the system remain anchored to Layer 1.

Why Not Just Scale Layer 1 Directly?

Scaling Layer 1 is possible, but only to a certain extent.

Remember the Blockchain Trilemma? Scaling Layer 1 inherently compromises either security or decentralization, which are non-negotiable pillars for most blockchain networks.

How Does Layer 2 Achieve Faster Transactions?

Layer 2 solutions employ various protocols and methods to enable faster transaction times without sacrificing the integrity of Layer 1.

Here are some examples:

Lightning Network (Bitcoin): Facilitates fast, low-cost transactions by operating off-chain.

Polygon (Ethereum): Acts as a sidechain, offering faster and cheaper transactions for Ethereum users.

Optimistic Rollups/Arbitrum: Aggregates transactions off-chain and submits them to Ethereum in batches.

The unique strategies each Layer 2 project employs to handle transactions off-chain are fascinating and deserving of their own deep dives. However, their shared goal of scaling Layer 1 is what categorizes them as Layer 2 solutions.

Wrapping It Up

I truly enjoyed writing this article. It took hours of research to clarify these concepts, and honestly, typing everything down and condensing my notes into a simple breakdown has solidified my understanding.

If you have a question or want to share your thoughts, feel free to reach out! I’d love to connect with like-minded individuals navigating this exciting and transformative technology.

Subscribe to my newsletter

Read articles from Yuvraj Singh directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yuvraj Singh

Yuvraj Singh

A Software developer with a passion for building products that users love, with a passion for exploring different technology spaces! Currently exploring: Web3