Understanding Liquidity Pools in Web3

Ani

Ani

Liquidity pools in the context of traditional finance evolved over centuries, rooted in mechanisms designed to ensure that buyers and sellers can transact with minimal price volatility and at the right time. These mechanisms laid the foundation for the more modern, decentralized liquidity pools found in today’s digital finance (DeFi). In the early stages of financial markets, liquidity was primarily provided by market makers, typically wealthy individuals or institutions, who were willing to hold inventories of assets (stocks, bonds, commodities) and facilitate trades by ensuring there were always both buyers and sellers for each asset. In the 17th century, the Amsterdam Stock Exchange (established in 1602) was one of the first venues where market makers helped provide liquidity by buying and selling stocks of the Dutch East India Company. This early form of liquidity provision was crucial in establishing stock trading as a viable form of investment. As financial markets grew throughout the 20th century, exchanges like the New York Stock Exchange (NYSE) (founded in 1792) and the London Stock Exchange (LSE) (founded in 1801) became central hubs for securities trading. These exchanges facilitated liquidity by creating centralized venues where buyers and sellers could meet.

During the 1960s to 1980s, institutional investors such as mutual funds, pension funds, and hedge funds began playing a more significant role in managing large pools of capital. These funds were used to buy and sell a variety of assets, providing additional liquidity to financial markets. Mutual funds and Exchange-Traded Funds (ETFs), for example, pooled capital from individual investors and made it easier for smaller investors to access large-scale liquidity. The creation of the SPDR S&P 500 ETF in 1993 by State Street Global Advisors allowed institutional investors to pool their capital and give individual investors access to liquidity through the trading of ETF shares. In the 1970s, money market funds emerged as a way for investors to earn interest while providing liquidity to short-term debt markets. These funds pooled capital from many individual investors and invested in low-risk, short-term debt instruments like Treasury bills, certificates of deposit (CDs), and commercial paper. The Vanguard Prime Money Market Fund, launched in the 1970s, became one of the largest money market funds, pooling capital and providing liquidity to short-term debt markets.

In the 1980s and beyond, derivatives markets like futures, options, and swaps created sophisticated ways to hedge risks and add liquidity to underlying assets. These markets allowed traders to take positions on assets without directly buying or selling the asset itself, increasing liquidity and providing more ways to trade. The Chicago Mercantile Exchange (CME) became a major hub for the trading of derivatives, offering futures contracts on commodities, financial instruments, and even stock indexes, which provided added liquidity and price discovery. The 2008 global financial crisis highlighted the importance of liquidity in maintaining financial stability. Central banks stepped in to provide liquidity to the banking system through quantitative easing (QE) and other monetary policy tools. By buying assets such as government bonds, central banks created "liquidity pools" to stabilize financial markets and prevent a collapse of the banking system. The U.S. Federal Reserve implemented QE to inject liquidity into the economy by purchasing U.S. Treasury bonds and mortgage-backed securities (MBS). This action helped stabilize the financial system and provided banks with more liquidity to operate.

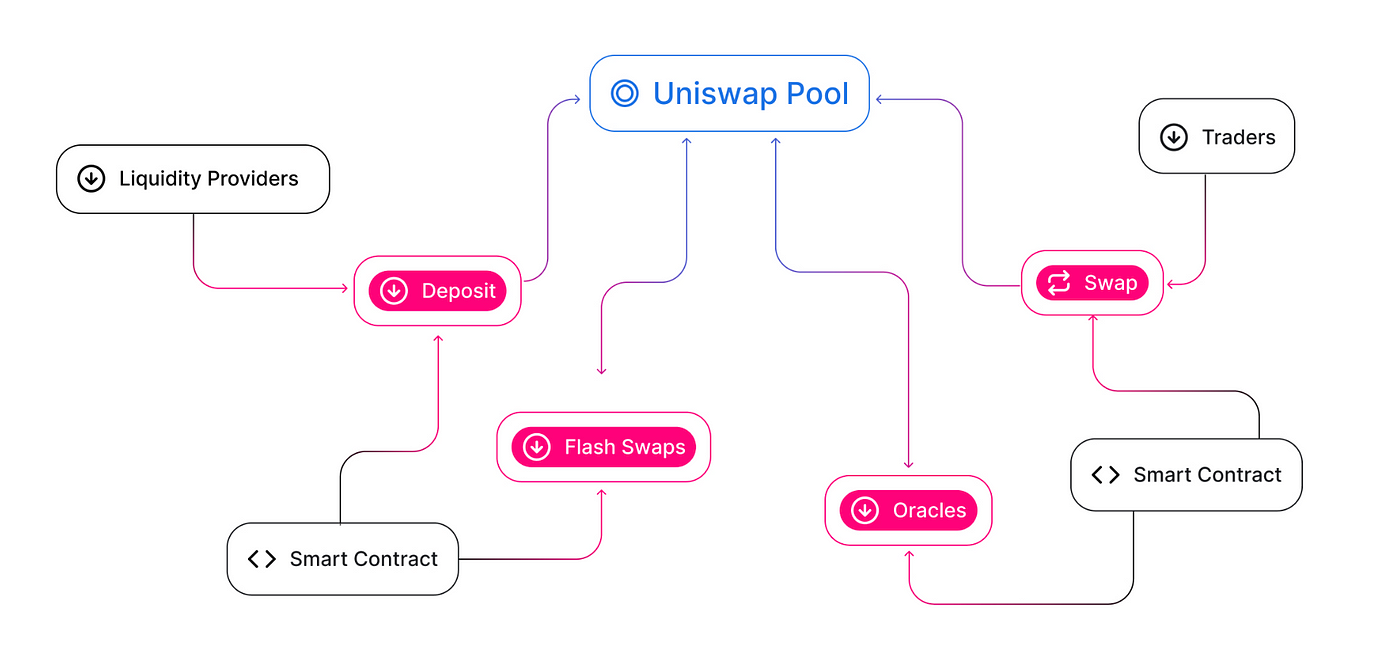

A liquidity pool in Web3 refers to a collection of funds locked into a smart contract to facilitate decentralized trading, lending, and other financial activities on blockchain networks. It’s a foundational concept in decentralized finance (DeFi), enabling platforms to function without relying on traditional intermediaries like banks or centralized exchanges.

At its core, a liquidity pool provides liquidity (available assets) for decentralized exchanges (DEXs) or other DeFi protocols, allowing users to trade assets efficiently. Popularized by platforms like Uniswap and Balancer, liquidity pools have become integral to the success of the decentralized ecosystem.

Liquidity pools eliminate the need for traditional financial intermediaries like banks, brokers, or centralized exchanges. Instead, they use smart contracts to automate transactions and ensure trustless operations. This reduces costs, speeds up processes, and democratizes access to financial tools.

Decentralized Exchanges (DEXs): Platforms like Uniswap rely on liquidity pools for trading, replacing the traditional order book model with an automated market maker (AMM).

Trustless Transactions: Users can trade directly from their wallets without trusting a centralized entity with custody of their funds.

Liquidity pools enable 24/7 trading without the constraints of traditional market hours. Unlike centralized systems, which can experience downtime due to technical or operational issues, DeFi platforms operate as long as the blockchain they’re built on is running. This ensures constant liquidity and access for users worldwide.

Anyone with internet access and compatible assets can participate in liquidity pools, whether as a trader, liquidity provider, or investor. This inclusivity empowers individuals in regions with limited access to traditional financial systems, fostering global financial inclusion. Liquidity pools provide access to global markets for individuals who may lack bank accounts but have access to cryptocurrency. They allow seamless trading and liquidity provisioning across borders without additional fees or delays.

Traditional exchanges rely on order books where buyers and sellers must match their orders. This process can lead to delays, especially for low-volume assets. Liquidity pools eliminate this dependency by enabling instant trades based on the pool’s available liquidity and AMM pricing model. Even obscure tokens with limited trading activity can find liquidity through pools, fostering a more vibrant and diverse market.

Liquidity pools offer opportunities for users to earn passive income by becoming liquidity providers (LPs). In return for supplying assets to the pool, LPs earn a share of the transaction fees and, in many cases, additional rewards in the form of governance or incentive tokens.

Yield Farming: Many DeFi platforms introduce farming programs where LPs can stake their LP tokens to earn even higher rewards.

Compounding Rewards: By reinvesting earnings, LPs can maximize their returns over time.

In traditional finance, centralized entities or whales (large holders of assets) can manipulate markets by controlling liquidity. Liquidity pools, governed by smart contracts and often decentralized communities, mitigate this risk by spreading liquidity among many participants and operating transparently.

Liquidity pools enable innovative financial products and services that were not feasible in traditional systems, such as:

Token Swaps: Instant swapping between tokens without needing a counterpart.

Synthetic Assets: Creating and trading assets that mirror real-world commodities, stocks, or other financial instruments.

Flash Loans: Borrowing assets instantly without collateral, provided the loan is repaid within the same transaction block.

Liquidity pools help bootstrap new projects and tokens by providing initial liquidity, enabling seamless trading and adoption from day one. Projects can create liquidity pools to ensure users can easily buy and sell their tokens, fostering early adoption. Many platforms distribute governance tokens to LPs, encouraging decentralized decision-making and long-term community involvement. In centralized systems, trading and financial activities can be restricted by governments or institutions. Liquidity pools, hosted on decentralized blockchains, are resistant to censorship, ensuring that users retain their financial sovereignty. Liquidity pools increase the usability of tokens within an ecosystem. By locking tokens in pools, they gain immediate utility as tradeable and yield-generating assets. Even highly volatile tokens find utility and stability when paired in liquidity pools, as they facilitate trading and incentivize holders to provide liquidity.

How does it work?

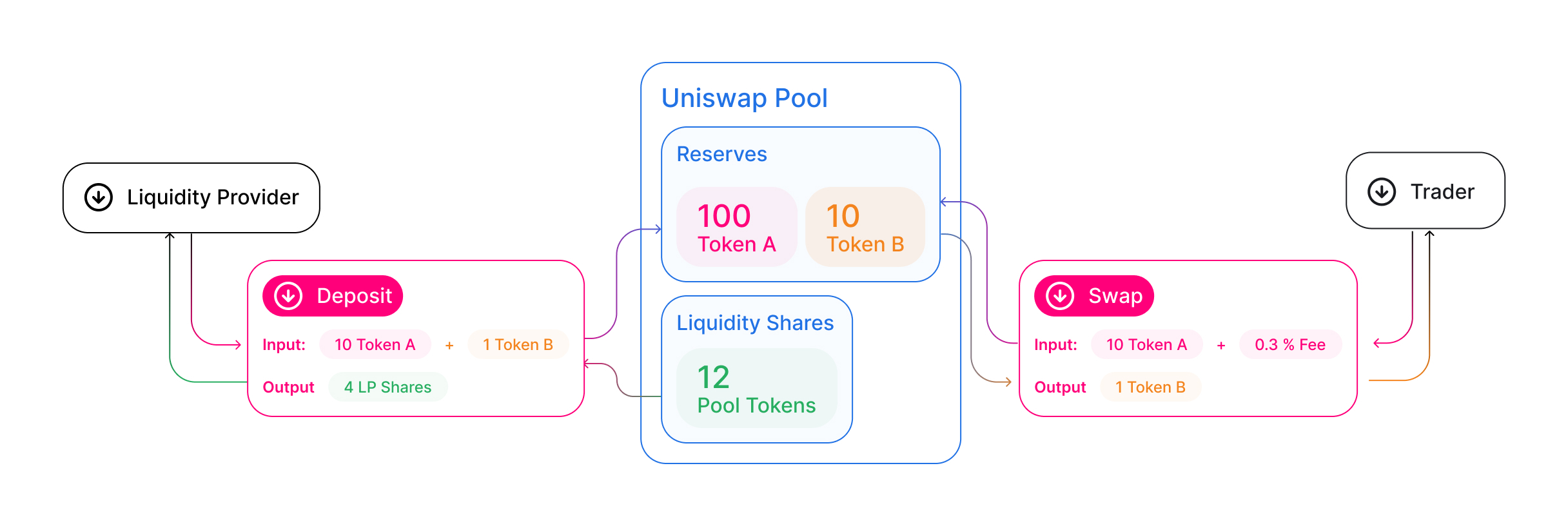

A liquidity pool typically consists of two assets paired together (e.g., ETH/USDT). These pools operate using Automated Market Makers (AMMs), which determine the price of assets within the pool based on supply and demand using mathematical formulas.

Example of AMM Formula:

One common formula is the constant product formula:

$$x⋅y=k$$

Where:

x and y are the quantities of the two assets in the pool.

k is a constant.

When a user trades, the AMM adjusts the asset quantities, ensuring the product k remains constant. This model ensures liquidity at any price point.

Steps for Trading:

A user sends one asset (e.g., ETH) to the pool.

The pool provides the equivalent value of the other asset (e.g., USDT) based on the AMM formula.

The trade is executed instantly via the smart contract.

Starting and Participating in a Liquidity Pool

Starting a Pool:

Identify a platform supporting liquidity pools (e.g., Uniswap, PancakeSwap, Balancer).

Choose a pair of assets and decide the initial liquidity ratio.

Deposit the assets into the smart contract to initialize the pool.

Pay the associated gas fees for the transaction.

Participating in an Existing Pool:

Select a pool and review its metrics (e.g., volume, fees, and liquidity).

Deposit an equal value of the two assets into the pool.

Receive liquidity provider (LP) tokens, which represent your share of the pool.

Risks Associated with Liquidity Pools

While liquidity pools offer significant opportunities, they also come with inherent risks. Understanding these risks is crucial for anyone looking to participate as a trader, investor, or liquidity provider (LP).

Impermanent Loss

Impermanent loss occurs when the price of the assets in a liquidity pool changes relative to their price when you initially deposited them. The loss is "impermanent" because it only materializes if you withdraw your assets before the prices revert. Suppose you deposit 1 ETH and 100 USDT into a pool (assuming ETH is priced at $100). If ETH’s price rises to $200, the AMM adjusts the pool's asset ratio to maintain balance. When you withdraw, you might receive less ETH than expected, and the value of your holdings may be lower than if you had simply held the assets separately.

Who is Most Affected?:

LPs in volatile asset pairs are more susceptible.

Pools with stablecoins or correlated assets (e.g., USDC/DAI) experience minimal impermanent loss.

Mitigation:

Opt for pools with stable or correlated assets.

Monitor asset prices and withdraw strategically when the market stabilizes.

Smart Contract Risks

Liquidity pools rely on smart contracts, which are vulnerable to bugs, coding errors, or malicious exploits. A single vulnerability can lead to a complete loss of funds in the pool. For example, exploiters can use large, instant loans to manipulate the pool’s pricing algorithm, draining assets called Flash Loan Attack. Another classic vulnerability called reentrancy attack where an attacker repeatedly calls a function before its initial execution is completed. In 2020, the Harvest Finance hack exploited an imperfection in the protocol, leading to a loss of over $24 million.

Mitigation:

Participate in pools from reputable platforms that undergo regular audits.

Diversify your liquidity across multiple pools to reduce exposure.

Slippage and Price Impact

Large trades can cause significant changes in the price of assets within the pool. This is especially prevalent in pools with low liquidity.

Slippage: The difference between the expected price of a trade and the actual price executed.

Price Impact: For large trades, the AMM may shift the pool’s asset ratio significantly, causing unfavorable trading conditions.

Mitigation:

Trade in high-liquidity pools where slippage is minimal.

Break large trades into smaller chunks to reduce price impact.

Market Volatility Risks

Crypto markets are notoriously volatile, and sudden price swings can impact the value of your pool holdings or trading activities. A sudden market crash might cause users to withdraw funds all together, depleting liquidity and leading to higher slippage for trades.

Mitigation:

Choose pools with stable or less volatile assets if you’re risk-averse.

Keep a close eye on market conditions and adjust your strategy accordingly.

Regulatory Risks

Regulatory frameworks for DeFi are still evolving. Participating in liquidity pools can expose users to legal and compliance risks, especially in regions with unclear or restrictive crypto regulations.

Potential Issues:

KYC/AML compliance requirements may conflict with the anonymous nature of DeFi.

New laws could classify LP tokens or governance tokens as securities, subjecting participants to additional legal obligations.

Jurisdictional Risks:

- Some countries may outright ban or heavily regulate DeFi platforms, leaving users in legal limbo.

Mitigation:

Stay informed about the regulations in your jurisdiction.

Consider using platforms that comply with regional laws and offer transparency.

Liquidity Mining Risks

Liquidity mining, where platforms offer extra rewards (e.g., governance tokens) to incentivize LPs, can sometimes lead to unsustainable economic models.

Risks:

High rewards may attract short-term participants, leading to "farm and dump" behavior where tokens lose value rapidly.

Protocols offering unrealistic returns may collapse, leaving LPs with worthless assets.

Mitigation:

Focus on protocols with sustainable reward models.

Diversify your positions across different pools and platforms.

Governance and Protocol Risks

DeFi platforms often allow governance token holders to vote on changes. While this promotes decentralization, it can also introduce risks.

Potential Issues:

Governance takeovers: A whale or coordinated group could gain control of the protocol and implement self-serving changes.

Poor decision-making: Ineffective governance decisions may lead to changes that negatively impact liquidity providers or traders.

Mitigation:

Participate in governance if you hold tokens.

Choose platforms with robust and active communities.

Platform-Specific Risks

Every DeFi platform operates differently, and some may have unique risks.

Unforeseen Risks:

Algorithmic errors in the AMM formula.

Failures in price oracles leading to incorrect pricing.

Dependency on Blockchain:

- Congestion or high gas fees on the underlying blockchain (e.g., Ethereum) can make transactions prohibitively expensive.

Mitigation:

Research the platform thoroughly before depositing assets.

Prefer platforms with a proven track record and robust infrastructure.

Rug Pulls and Exit Scams

Rug pulls occur when the creators of a liquidity pool or DeFi project withdraw all liquidity or funds, leaving participants with worthless assets. Unscrupulous developers launch a pool with enticing rewards, then drain the funds once liquidity is locked in.

Signs of Potential Rug Pulls:

Anonymous or unverifiable team members.

Lack of audits or transparency about smart contracts.

Lack of project expansion and clear roadmap ahead.

Mitigation:

Avoid newly launched or unaudited projects.

Choose established platforms with strong reputations.

Governance of Liquidity Pools

Governance of liquidity pools is crucial for maintaining the integrity, functionality, and adaptability of DeFi ecosystems. By balancing decentralization with effective decision-making structures, liquidity pools can ensure sustainable growth while empowering their communities to shape their future. As such, it’s a much bigger topic to be covered in this article, so I’ll probably take it up in a following article. Let’s cover a few case studies in the meantime:

Uniswap : Uses UNI tokens for governance, allowing the community to vote on key protocol upgrades and treasury allocations. A highly decentralized model, but participation rates remain a concern.

Balancer: Balancer’s governance allows LPs to vote on pool parameters, incentivization strategies, and protocol improvements. Known for its innovative approach to managing multi-asset pools.

SushiSwap: SushiSwap's governance is notable for its community-driven decision-making and frequent use of governance tokens to shape the protocol's future.

Regulations and Legalities

KYC/AML Compliance: Some jurisdictions may require Know Your Customer (KYC) and Anti-Money Laundering (AML) measures for liquidity providers and DeFi protocols.

Taxation: Earnings from liquidity pools are often classified as taxable income or capital gains.

Securities Laws: In certain regions, LP tokens or governance tokens might be classified as securities, subjecting them to stringent regulations.

Consumer Protection: Protocols must ensure transparency about risks to protect participants from fraud or misinformation.

Use Cases of Liquidity Pools

Decentralized Exchanges (DEXs)

Liquidity pools power automated market makers (AMMs), which are the backbone of decentralized exchanges. Instead of relying on traditional order books, AMMs use liquidity pools to execute trades based on mathematical formulas.

Uniswap is one of the most popular DEXs, utilizing liquidity pools for trading various token pairs like ETH/USDT or DAI/USDC. Traders benefit from continuous liquidity, while liquidity providers earn a share of transaction fees. Uniswap’s innovative AMM model sparked the growth of DeFi and inspired similar platforms. Similar to Uniswap, Sushiswap adds features like yield farming and governance participation for liquidity providers. SushiSwap incentivizes liquidity providers through its native token, SUSHI.

Yield Farming and Liquidity Mining

Liquidity pools enable yield farming, where participants earn rewards by staking their assets in pools. Liquidity mining further incentivizes users by distributing governance tokens to liquidity providers.

PancakeSwap, a leading DEX on the Binance Smart Chain, rewards LPs with CAKE tokens. Users can "farm" additional rewards by staking LP tokens in Syrup Pools, amplifying their earnings. Curve Finance specializes in stablecoin pools, allowing users to earn yields by providing liquidity to pairs like USDC/DAI or USDT/USDC. Curve’s CRV token is distributed as a reward, with higher rewards for users who lock their tokens for governance participation.

Cross-Chain Swaps

Liquidity pools enable seamless asset transfers across different blockchains, breaking down silos between ecosystems.

ThorChain emerged as a cross-chain liquidity protocol that allows users to swap assets like BTC, ETH, and BNB without relying on centralized exchanges. Liquidity pools facilitate swaps by using native assets on both chains, ensuring trustless and efficient transactions. Multichain (formerly AnySwap) offers liquidity pools to bridge assets across multiple blockchains, including Ethereum, Binance Smart Chain, and Avalanche.

Synthetic Asset Creation

Liquidity pools are used to back synthetic assets, which are tokenized representations of real-world assets like stocks, commodities, or indices.

Synthetix enables the creation of synthetic assets (Synths) like sUSD (synthetic USD) and sBTC (synthetic Bitcoin). Liquidity pools ensure the collateralization of these Synths, allowing users to trade them on decentralized platforms. Mirror Protocol allows users to mint and trade synthetic assets that track the price of real-world stocks, such as mTSLA (mirrored Tesla). Liquidity pools enable trading and collateralization, providing exposure to traditional markets in a decentralized manner.

Lending and Borrowing Protocols

Liquidity pools also support lending and borrowing platforms, where users deposit assets to earn interest or borrow against their deposits.

Aave operates liquidity pools where users can lend assets like ETH, DAI, or USDC and earn interest. Borrowers can use their deposits as collateral to borrow other assets, creating a decentralized credit market. Compound allows users to supply assets into liquidity pools and earn COMP tokens as rewards. The protocol dynamically adjusts interest rates based on supply and demand in the pool.

Token Launchpads and Initial DEX Offerings (IDOs)

Liquidity pools play a critical role in token launchpads, where new projects launch their tokens and ensure liquidity from day one. Balancer’s liquidity pools are used for token launch events, offering flexible weight configurations for new tokens and stable assets. Projects can set up weighted pools to control price discovery during token launches. Polkastarter uses liquidity pools for IDOs, enabling projects to raise funds while providing liquidity for their tokens.

Stablecoin Stability and Arbitrage

Liquidity pools help maintain the stability of stablecoins by facilitating arbitrage opportunities and reducing price deviations.

Curve Finance’s stablecoin-focused liquidity pools minimize slippage and impermanent loss, making them ideal for stablecoin trades. Arbitrage traders help keep stablecoin prices aligned across platforms by leveraging Curve’s efficient pools. MakerDAO (DAI)’s liquidity pools on platforms like Uniswap and Curve ensure stable and efficient trading, helping maintain its peg to the US dollar.

Revenue Generation for DAOs and Protocols

Protocols can create liquidity pools to generate revenue for their treasuries, ensuring sustainable growth and development.

Yearn Finance’s Vaults use liquidity pools to optimize yield farming strategies, generating revenue for the protocol and its users. Governance ensures that funds are reinvested in development and user incentives. Bancor’s liquidity pools not only generate fees but also protect LPs from impermanent loss through its single-sided staking mechanism.

Insurance in DeFi

Liquidity pools are being used to back decentralized insurance protocols, where participants earn rewards by providing collateral for insurance claims.

Nexus Mutual uses liquidity pools to underwrite insurance policies for smart contract risks. Liquidity providers earn returns from premiums paid by users seeking coverage. InsurAce pools provide coverage for risks like smart contract failures, stablecoin de-pegging, and more, offering diversified risk management options.

Gaming and NFTs

Liquidity pools are now being integrated into gaming and NFT platforms, enabling new financial models within these ecosystems.

Axie Infinity’s liquidity pools allow users to trade AXS and SLP tokens, which are core to the game’s economy. Liquidity providers earn fees from the vibrant trading activity driven by the game’s popularity. Rarible pools facilitate liquidity for trading NFTs, ensuring users can buy and sell digital art seamlessly. The protocol rewards participants with RARI tokens for providing liquidity.

Variations of Liquidity Pools

Liquidity pools have evolved beyond the basic structures used in early decentralized finance (DeFi) protocols. Over time, developers and researchers have introduced various innovations, tailoring liquidity pools to specific use cases, improving capital efficiency, and reducing risks.

Dynamic Pools: Pools like Balancer allow more than two assets and adjust the weight of each asset dynamically.

Stablecoin Pools: Pools such as Curve optimize for minimal slippage when trading stablecoins.

Incentivized Pools: Platforms offer additional token rewards to attract liquidity providers.

The variations of liquidity pools highlight the rapid innovation in the DeFi space. From simple single-asset pools to complex hybrid and concentrated pools, these structures cater to diverse use cases, offering tailored solutions for trading, lending, yield generation, and more. Real-world examples like Uniswap v3, Curve, Bancor, and Balancer demonstrate the growing utility of liquidity pools, while research-driven innovations promise even greater efficiency and functionality in the future. As DeFi evolves, liquidity pools will remain central to its success, driving financial inclusion and innovation.

Liquidity pools are a cornerstone of DeFi, driving decentralization and innovation in the financial world. While they offer lucrative opportunities, it’s crucial to understand the associated risks and navigate the evolving regulatory landscape carefully. By doing so, users can leverage this revolutionary technology to unlock the full potential of decentralized finance.

Subscribe to my newsletter

Read articles from Ani directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by