Stake it & Make it EP3: APY Updates, Bribes, Votes and More

Mowreez

MowreezALPH accumulation phase is on. I woke up this morning with one thought: "I need to earn some ALPH." So, even if the ALPH-USD valuation dips, my portfolio would be fine. While, trading doesn't offer guaranteed income, that won't deter me from trying to stack some ALPH while we navigate through this market lull.

Today, let's dive into some strategic moves I'm considering to secure some ALPH:

#1 BTFD with BTC gains

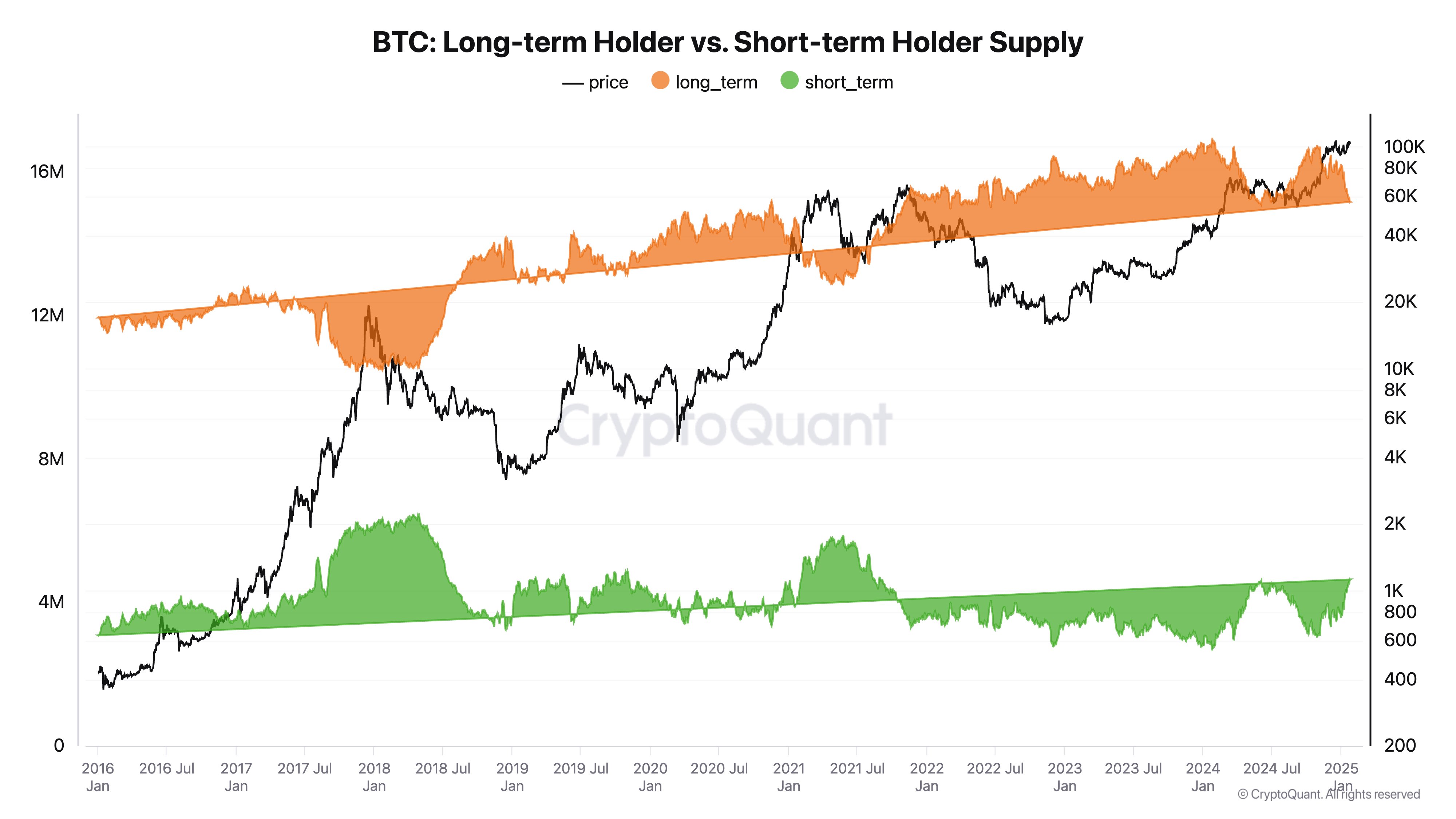

Following a recent post by Crypto Quant creator Ki Young Ju (@ki_young_ju) / X, research suggests that long-term BTC holders are selling, while short-term holders (retail investors) are buying. He describes this as “the definition of a bull market.”

Okay, enough of me shilling ALPH, let’s make some money on-chain.

#2 Locking EX to earn BRIBE MONEY.

You read that correctly. Alephium is home to Elexium Finance’ VE DEX (Vote-escrowed). By locking the protocol token $EX, you get to vote on their live pools and earn BRIBE MONEY.

When you lock your $EX tokens, you can decide how long you want to stake them. The longer you stake, the more voting power you gain. Be careful with your choice tho, as unstaking early will lead to a haircut!

To summarize:

Get some $EX tokens.

Lock them in the protocol (Create Lock here).

Vote for the pool with the highest vAPR.

Vote again in the next epoch.

This is the simplest way to earn APY. Just remember to support the ALPH-EX pool for good protocol management. Please check The 80-20 strategy.

As we can see, for this epoch- ALPH-WBNB, ALPH-ABX and ABX-EX has the juiciest vAPRs.

#3 LP Staking on Elexium Finance

I hope you're familiar with LP staking, but if not, here's a quick overview.

Liquidity Pools are the funds used by AMMs (automated market makers). DEXes like AYIN and Elexium Finance use these pools to facilitate swaps. Liquidity Providers supply two assets of equal value to be paired together and earn APY (rewards) for doing so.

Unlike on EVM chains, where you have to worry about wallet drains, contract approvals and expensive gas fees, on Alephium, you only need to be concerned about Impermanent Loss (IL). Essentially, when someone makes a swap, the DEX uses your LP, and the LP adjusts its ratio. Depending on the direction, you might end up with more of one token and less of the other. This isn't considered a loss immediately; it's just a paper loss until you break your LP, making it permanent. That's why it's called impermanent loss.

If you want to experiment and see the outcomes before getting into LP staking, you can visit this IL Calculator. I've used it many times and learned a lot from it.

Once you're ready to try it out and take some risks, the place to go is Elexium Finance. The house of massive APYs.

First let’s find the best APY pools. Here are my top 3:

ALPH/APAD at 97.28% APY

ABX/EX at 75.86% APY

ALPH/EX at 63.66% APY

Actually, you don't have to choose just one pool. You can average the APY of all three. After all, it's APAD, ABX, EX, and ALPH. They are all easy to hold. (Again, NOT FINANCIAL ADVICE).

Here are the steps to provide ALPH/APAD LP:

Get some APAD. Make sure to do the math. You need half of the value in APAD, half in ALPH.

Go to https://www.elexium.finance/liquidity and click “ADD LIQUIDITY”

Select the tokens. Pairs will appear down below. Make sure to choose “VOLATILE” pair and click “NEW DEPOSIT”

From here, just enter your numbers and click “DEPOSIT”. It should prompt your wallet to sign the transaction.

Now you have the vALPH-APAD LP, but that will not earn APY until you stake them. Headout to DASHBOARD tab and click “stake”. Upon doing so, it will prompt your wallet to sign a transaction.

You're done. All you need to do is manage your LP by claiming the rewards and possibly reinvesting them to the pool. The choice is yours. It’s passive income.

PRO TIP: Keep a journal of everything. Record the date, approximate time, ALPH used to buy APAD, ALPH used for staking, etc.

BONUS: APAD’s Prediction Market, Rocket Range

Rocket Range is the newest and one of the hottest dapps on Alephium. It's a platform for predicting the price of ALPH, and the game includes statistical probabilities that might give you an advantage.

Let’s take a look at this current live round:

Pot money: 238.61 ALPH

Favorites: Down 4%+ at x2.2, with 101 ALPH bets.

Favorable Odds: Up 4%+ at x9, with only 24 ALPH bets.

My Empirical Strategy.

I can categorize my bet as DOWN, NEUTRAL or UP.

I will bet either the two DOWNs, or the two UPs, but never the “No Change”.

Let’s assume that’s 1 ALPH each. (2 ALPH per day. Total of 60 ALPH per month)

In the example above, I got better odds betting on the TWO UPS.

NOTE: It’s hard to predict the market, even with the perfect lines and all, you’ll never really know what the outcome is. And so, by betting empirically, you increase your chances of ending on the upside.

Statistical Outcomes (theory):

Empirically speaking, If I bet on two UPs, I am betting at an EQUAL RANGE as the two DOWNS, but the rewards are entirely DIFFERENT.

UP 1-4% + Up 4%+ = Betting anything greater than 1% (infinite to the upside)

DOWN 1-4% + Down 4%+ = Betting anything 1% and lower (infinite to the downside)

Betting on “NO CHANGE” only lets you bet on (-1%, 0, and +1%), and the rewards are the same as betting on the upside. If there are 3 outcomes—UP, NEUTRAL, and DOWN—then betting 2 ALPH on neutral in this scenario is not a favorable choice.

Disclaimer: I haven’t back tested this. This is only for studying purposes. From our latest interview with KrK0d3r, when they back tested the strategies, “No Change” ends up being more frequent than the others.

My Volatility Strategy

Categorize the betting into VOLATILE and NON-VOLATILE events.

Volatile Event: Bet on Down 4%+, and Up +4% at the same time.

Non-volatile Event: Bet on Down 1-4% Up 1-4% at the same time. Some will even use a 2nd wallet to bet on “NO CHANGE”. But just keep in mind that you should not exceed 2 ALPH (position size) as for our example.

TIP: it is important to manage betting size and stay with it at all means. Greed can fvck everything up and we are professional gamblers, lol. (not financial advice)

Take note, that the odds here are different than the first strategy. I would say, study Volatility Index, learn how to use RVI Indicator. (Relative Volatility Index) and use it to increase your chances.

There are many more strategies to explore. You can even use two wallets and bet against one outcome. And just avoid the outcome that has the worst odds. Easy!

Well, thank you for joining my gambling class, I’ll see you guys the next time! Oh, don’t be shy to share your stories and strategies! I’d love to hear them and learn from them too!

See you on the next one, cheers! 🥂

Disclaimer:

Listen up, you glorious band of crypto gamblers, because this is the part where we get all serious for a hot second. What you've just read was just some juicy info, not your golden ticket to Lambo land. (Although it might have been!!)

Now, here's the deal:

This isn't financial advice. If you're looking for that, maybe go find some dude in a suit who charges by the hour and doesn’t cuss from time to time.

Got questions about where to stash your cash? Talk to a real financial wizard, not me. I’m here for the memes and moonshots.

I’m definitely not promising you'll strike it rich with this info. Hell, I’m not promising anything at all except maybe some laughs.

Before you YOLO your life savings into the next shiny token, do your own damn homework. I mean it!!

If the market decides to take a dump and you end up crying over your lost ALPH, remember: I told you so. I’m not your safety net, and use what’s inside that helmet.

Crypto's wild, unpredictable, and it loves to keep you on your toes. It's like a roller coaster, but you're blindfolded and the tracks might not be finished yet!

So, fck it, enjoy the ride, but for the love of Cheng and Satoshi, don't bet the farm on what you read here. Past gains? They're just history, and history's full of tales where the hero didn't always win. (Matter of fact, most heroes you know are all dead.) Now, go forth, tread carefully, and maybe, just maybe, you'll come out the other side not just richer, but wiser.

Subscribe to my newsletter

Read articles from Mowreez directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Mowreez

Mowreez

Your friendly ALPH neighborhood.