Breakdown of the Digital Banking System Architecture

Henry Ha

Henry Ha

What is conceptual architecture?

“Conceptual architecture is a high-level view of how a landscape of systems hangs together. It’s a way of explaining, at an abstract level, the fundamentals of an architecture.”

The hidden architecture of digital banking is revealed here. We’re exploring simplified systems that keep your money flowing smoothly, so forget technical jargon and complex diagrams.

Think of digital banking as a busy city. Smooth skyscrapers (front-end apps) and hidden networks (middleware) connect your actions to bustling marketplaces (back-end systems) where financial magic happens. These markets handle everything from storing your cash to processing payments, all guided by clever traffic lights (APIs) ensuring everything flows seamlessly.

Why does it matter? Understanding conceptual architecture is like a city map. You’ll feel confident finding services like sending money and appreciating the hidden infrastructure that keeps everything running.

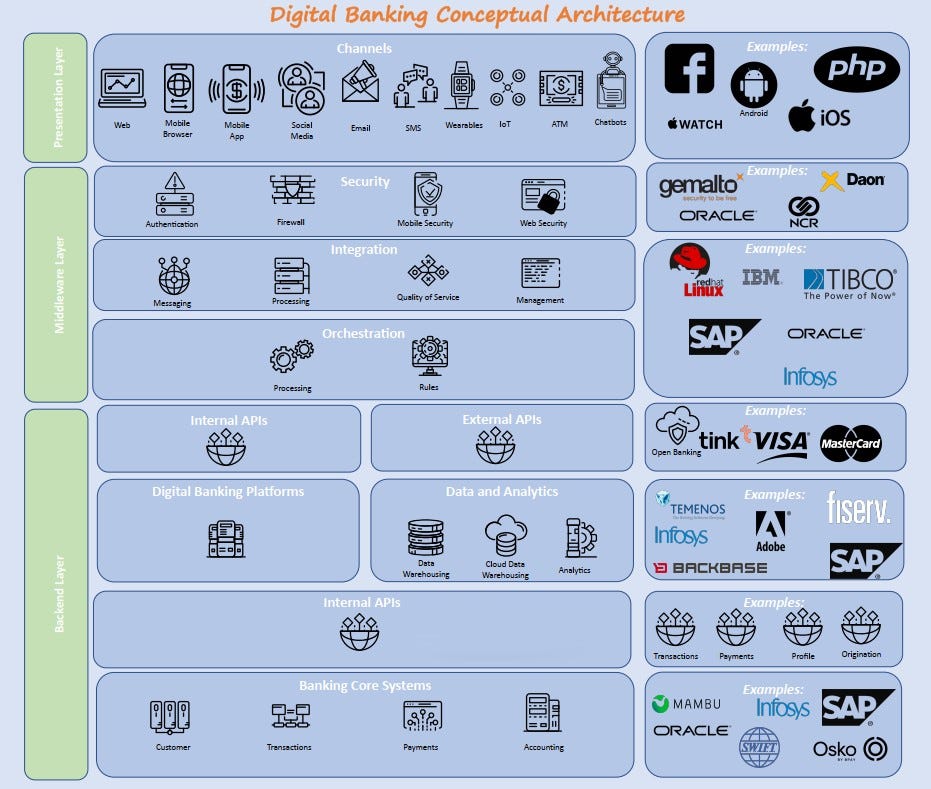

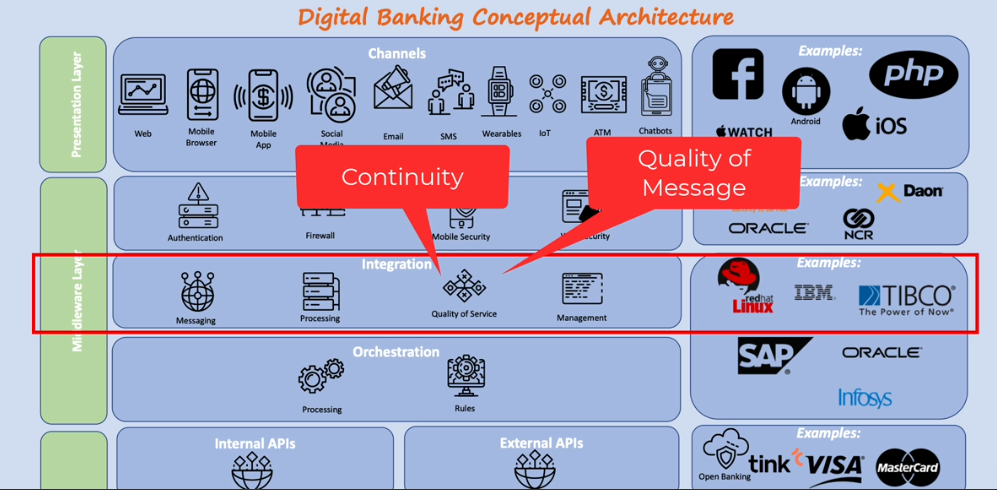

No need for complicated diagrams or software names. Core building blocks include the front-end presentation layer, the back-end workhorses, and the middleware that links them together. Digital banking becomes magical with this simplified understanding (see image).

Digital banking conceptual architectural

Imagine being confused, frustrated, and unable to find your bank in this city. Our map makes navigation easy. You’ll know where to go for specific tasks, appreciate the unseen workhorses, and help others find their way.

Next, we’ll examine how these layers work together to simplify digital banking. Get ready to see this invisible city come alive!

The Presentation Layer (Front end)

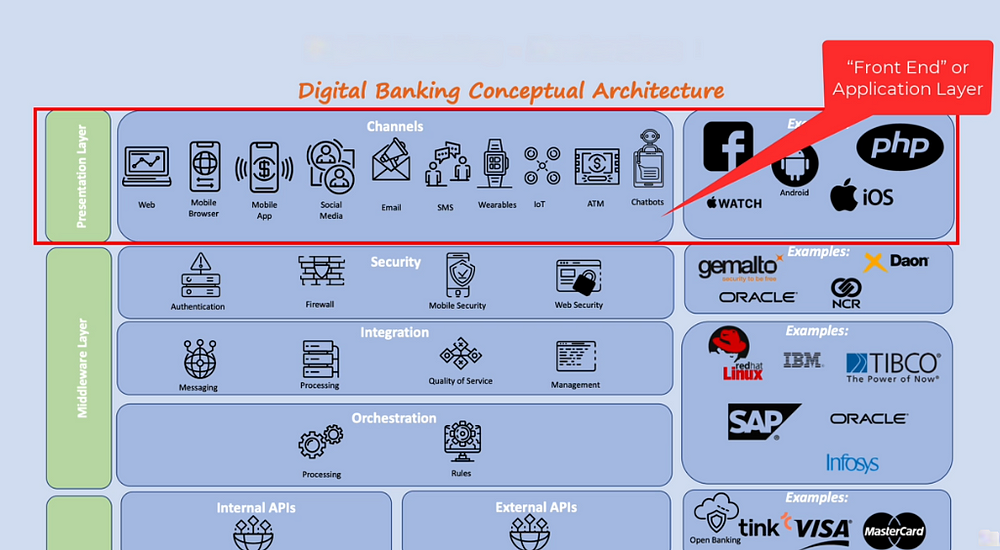

The presentation layer’s (front-end) position in the Digital Banking architecture

This is where our digital channels, which include online, mobile, and SMS, as well as the Internet of Things (IoT), live.

Although digital banking is largely focused on offering digital channels, you may find a human channel here as well, whether it’s frontline bankers or support workers available to assist consumers with their digital banking needs.

There are logic levels within the presentation layer, such as presentation logic and business logic. This is where the logic for an app, such as an Android mobile banking app, is localised and distributed to each user or customer’s device.

Front-end of an app

Assume that the presentation layer has logic for this diagram.

In the next article, I’ll go over the presentation layer, or more particularly front ends for mobile banking apps, to give you a better knowledge of how front ends and presentation layers function.

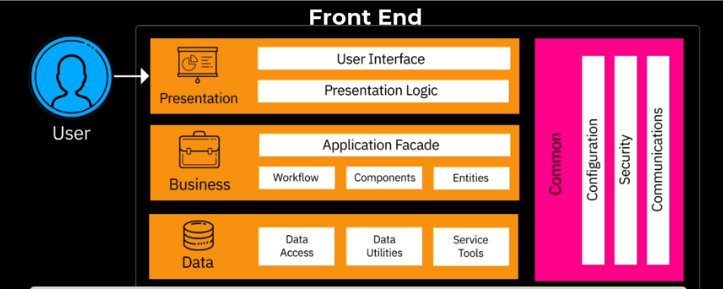

The Middleware Layer

The presentation layer’s (front-end) position in the Digital Banking architecture

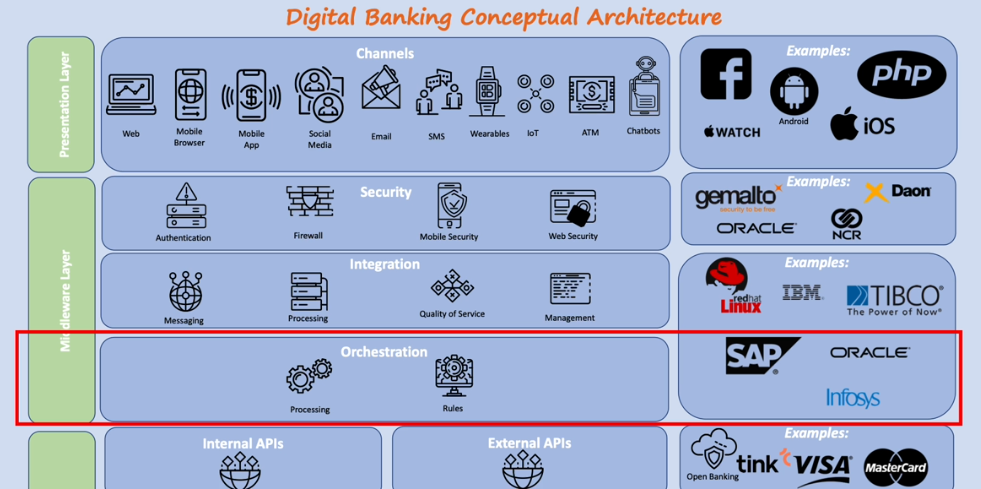

This layer includes three key sublayers — security, integration, and orchestration.

1. The Security Sublayer

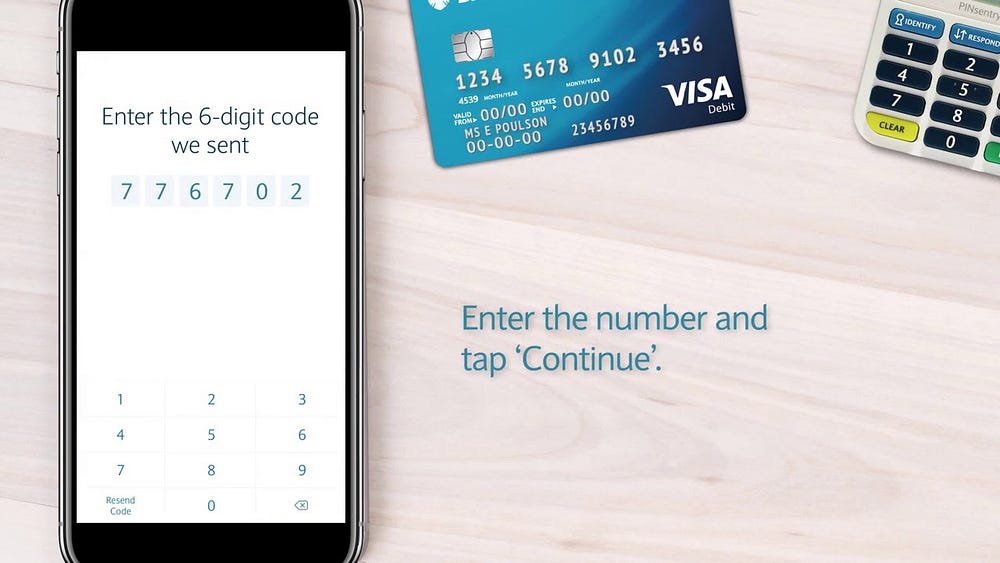

This sublayer includes functionality to authenticate customers when they log into banking apps or websites. For example, when a customer logs into a bank’s mobile app, they are typically prompted to enter credentials like a PIN or password. The authentication system validates whether these match what is on file for that user. If valid, the customer is granted access. If not, access is denied.

Source: Barclays UK

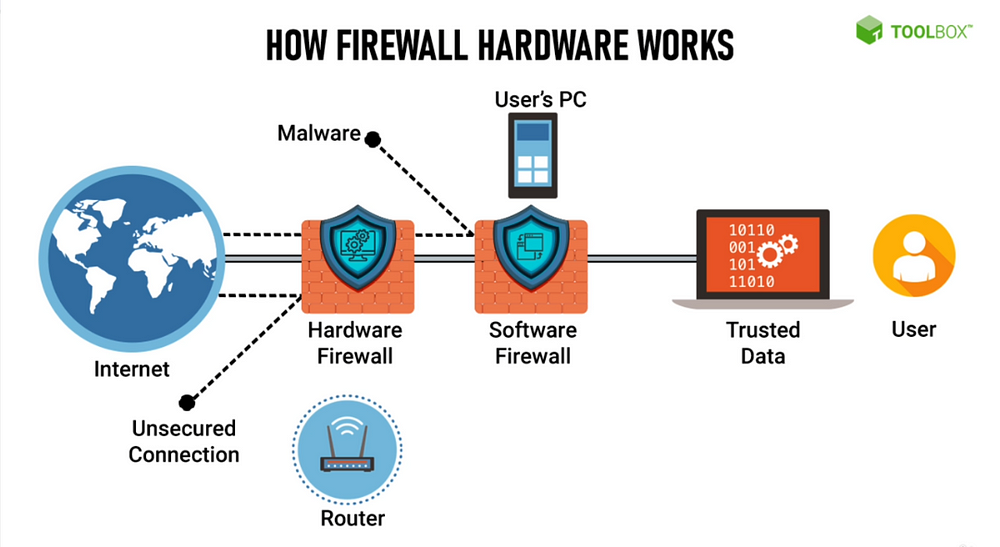

Banks also utilize firewall technologies, much like you have on your home computer. With large volumes of connection requests coming in daily, banks need safeguards to allow legitimate traffic while blocking malicious attempts. Banks hold tremendous funds and enable global payment systems, making them prime targets for cyber threats. Robust security is essential.

How firewall hardware works. Source: Toolbox

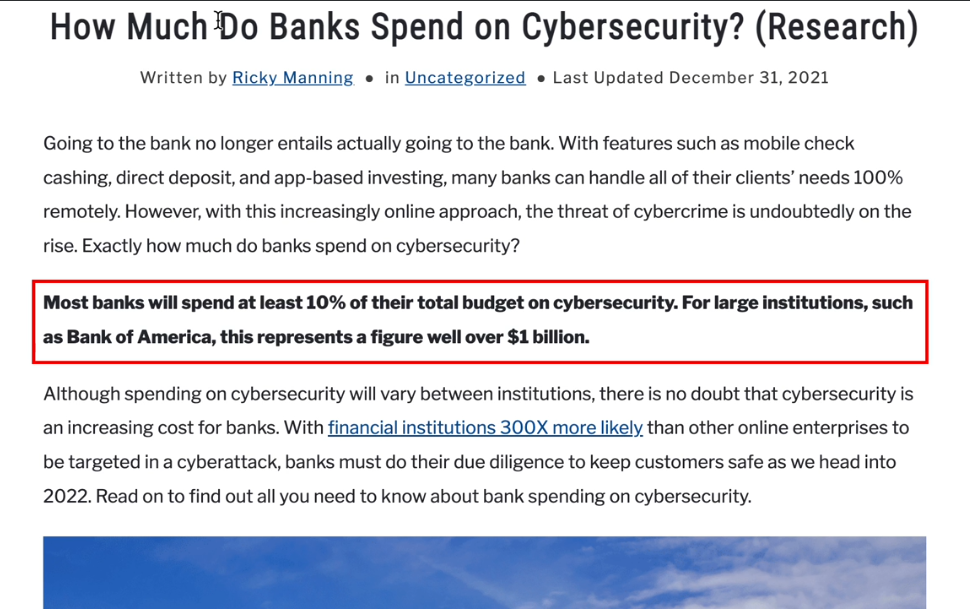

How much do banks spend on cybersecurity? Source: Nowires

Another threat banks guard against is when customers’ own devices become compromised by things like malware, keystroke loggers, or other infections. This can turn their devices into vectors to attack bank systems.

Banks operate pristinely clean technology environments, and they need to not only be the custodians of trillions of dollars of customer deposits and funds but also responsible for the global payment system and provide liquidity for our economies. Therefore infected customer devices pose risks of spreading issues into banking infrastructure and potentially causing massive systemic issues.

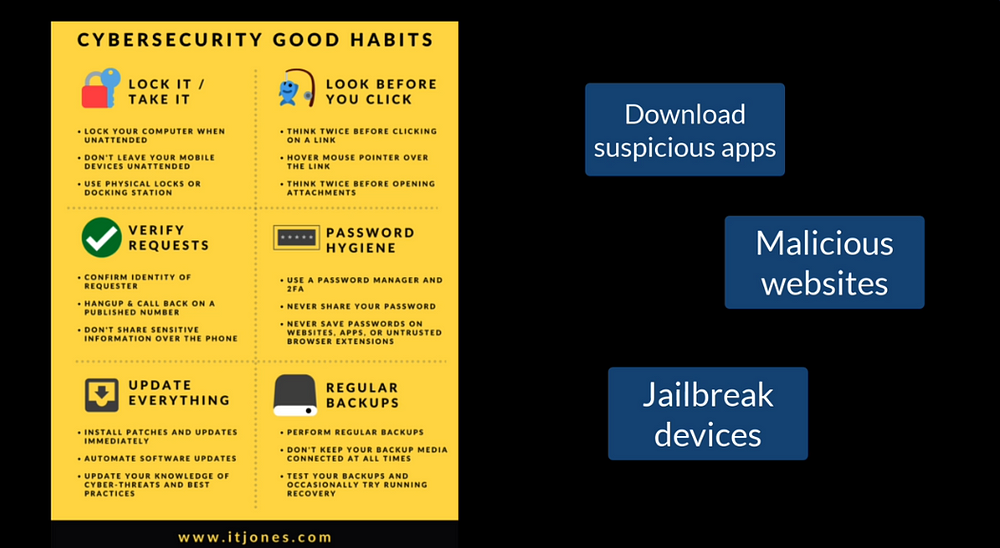

Source: itjones.com

2. The Integration Sublayer

Intergration Sublayer

This sublayer acts as a translator, taking in requests from front-end systems, interpreting them, and passing them on to back-end systems in the proper formats. It ensures correct syntax, protocols, and service levels so that messages can be smoothly processed.

3. The Orchestration Sublayer

Orchestration Sublayer

This sublayer receives the translated requests from integration and executes appropriate actions like retrieving customer data or processing payments. It coordinates activity across the architecture, similar to a central nervous system.

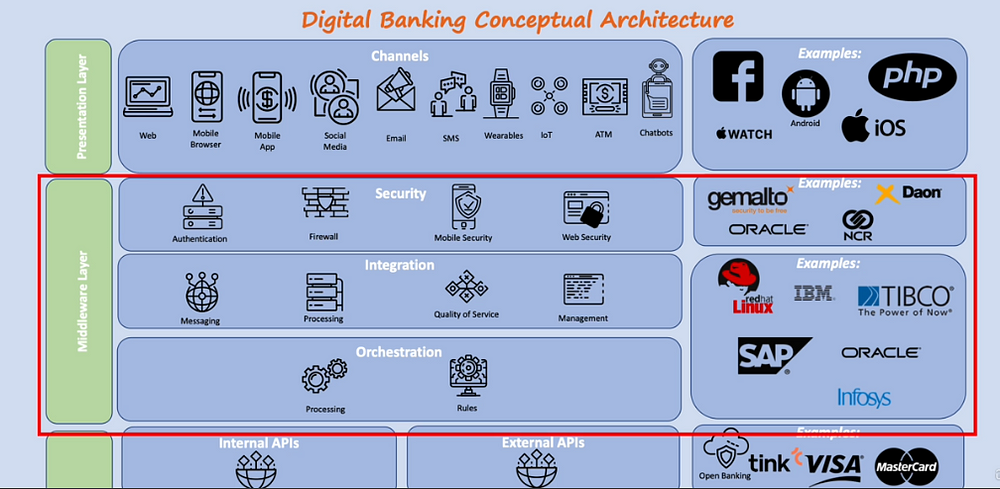

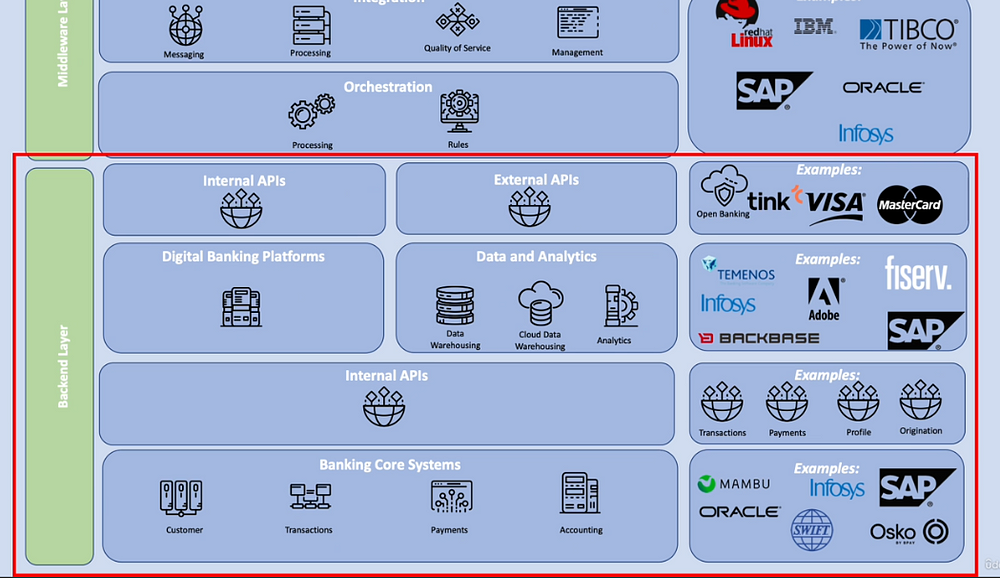

The Backend Layer

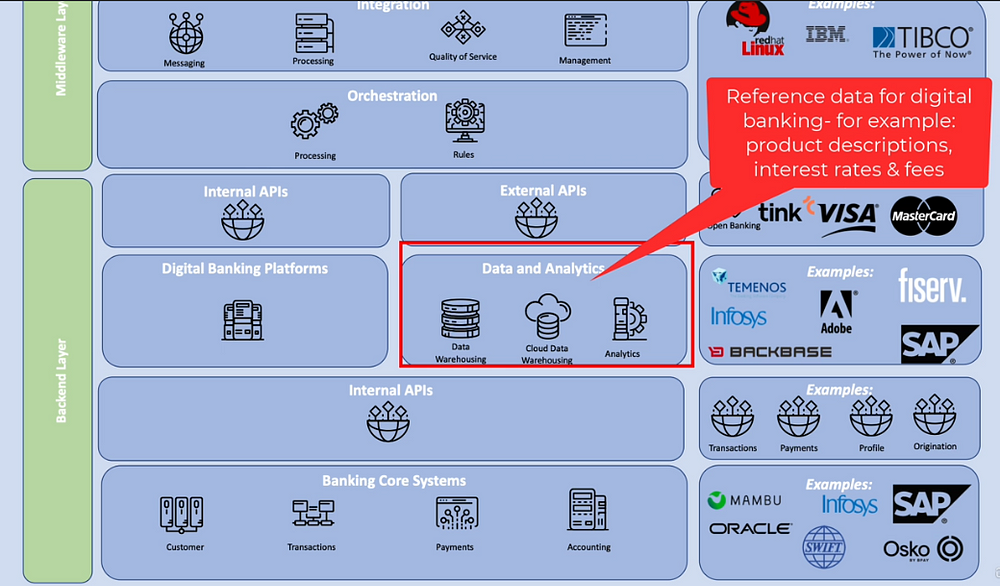

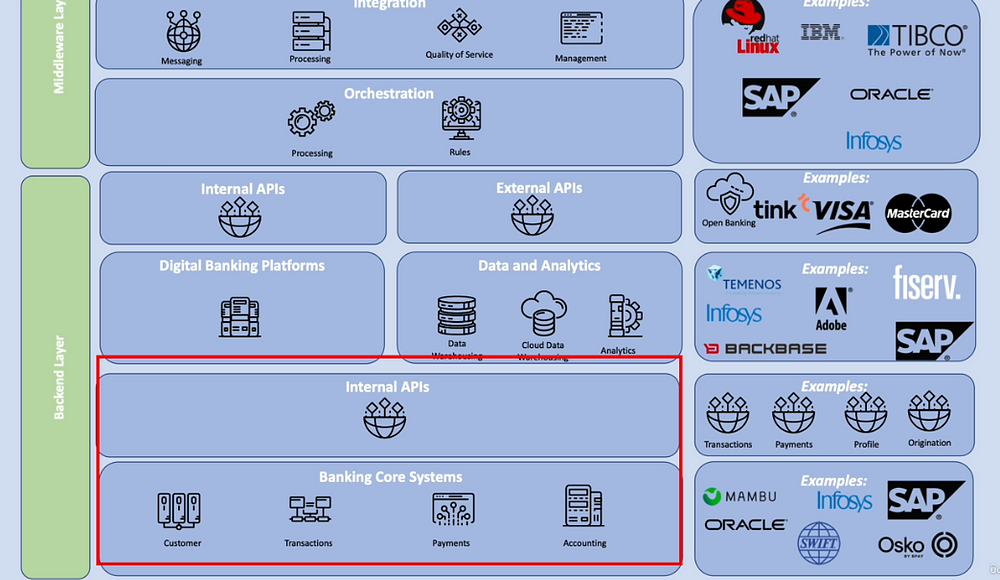

This layer has four key sublayers — APIs, digital banking platforms, Data and Analytics, and Core Banking Systems.

Backend layer

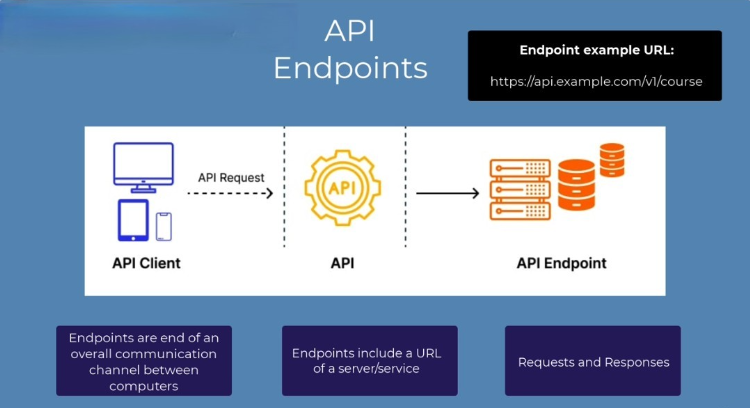

1. APIs (Application Programming Interfaces) Sublayer

APIs act as pipes for requesting data or actions between systems. There are internal APIs within the bank and external APIs connecting to outside systems. APIs have an initiation endpoint that receives requests, and a processing endpoint that handles the requests and returns responses.

The orchestration sublayer will initiate a request at the first or initiation endpoint. The final endpoint receives and processes the request somewhere else before returning a response back to the orchestration sublayer.

For example, when a customer views a transaction detail in their banking app, the orchestration sublayer initiates a request to the initiation endpoint API. That passes it to the transactions system to retrieve the data, which then flows back through the API pipe’s final endpoint and returns the response to the orchestration sublayer to display in the app. Key internal APIs enable services like payments, balances, alerts, etc.

2. Digital Banking Platform Sublayer

This platform aggregates all the bank’s products and services and packages them into services the internal APIs can use. It connects customer-facing channels to the underlying core systems. This sublayer also manages data and analytics specifically related to digital banking usage to understand customer behaviours.

Digital Banking platforms

3. Data and Analytics Sublayer

Here, reference data, transaction data, and analytics help operate digital banking platforms and understand customer activity patterns. This powers the functionality and personalization of digital banking services.

4. Banking Core Systems

These systems form the heart of banking operations, spanning accounts, transactions, payments, accounting, interest calculations, etc.

Core banking systems are enormously complex, having been built up incrementally over decades. The interdependencies are so convoluted that banks describe it as a “spaghetti tree” architecture. Remarkably, many global banks still rely on mainframe systems implemented back in the 1970s-80s.

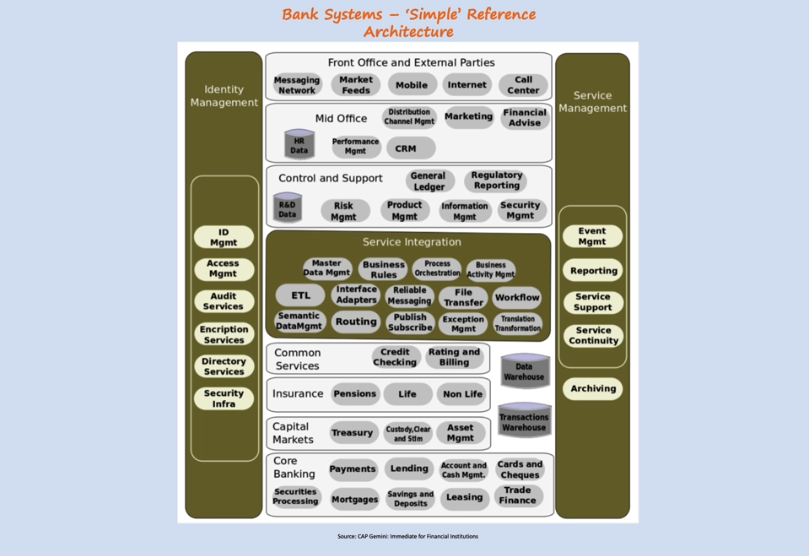

While real bank system diagrams span entire whiteboards, this is a simplified reference architecture summarizing key digital banking components.

Source: CAP Gemini

Summary

Through this blog series, we’ve mapped out the core layers powering seamless digital banking. Think of it as an invisible city allowing you to navigate complex financial services with ease.

We introduced the Front-End “skyscrapers” " middleware “transit networks”, and Back-End “markets” working harmoniously behind the scenes. Understanding this simplified landscape provides clarity, like having a map to avoid getting lost.

You now appreciate the hidden systems enabling your digital banking experience, from security protocols to legacy mainframes. While this high-level tour is an oversimplification, it aims to demystify the sophisticated coordination driving simplicity for the customer.

Subscribe to my newsletter

Read articles from Henry Ha directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Henry Ha

Henry Ha

Data Scientist, write about: Tech & Business & Lifeskills