Why Composability is the Backbone of the DeFi Revolution

Ihuoma Anosike

Ihuoma Anosike

When you pay for an Uber ride using PayPal or log into the Airbnb app with your Facebook account, you’re taking advantage of the composability of these applications. These seamless integrations make our digital lives more convenient by allowing different systems to work together effortlessly. In the decentralized finance (DeFi) ecosystem, composability takes on an entirely new dimension.

In DeFi, composability enables protocols to interoperate seamlessly, allowing developers to build financial systems by combining existing tools. It’s the reason why DeFi has evolved from a niche experiment to a multi-billion-dollar ecosystem. Much like putting together Lego blocks to form complex and cohesive structures, DeFi’s composability creates financial innovations far greater than the sum of their individual components.

But how does this really work? And why is it such a game-changer for DeFi? Let’s break it down.

What is Composability in DeFi?

Composability refers to the ability of DeFi protocols to interact, integrate, and build upon one another without friction. Each protocol is designed as a modular component, enabling developers to stack functionalities like smart contracts, liquidity pools, and yield optimization strategies into more complex systems. It enables protocols to interoperate seamlessly and create financial innovations far greater than the sum of their individual components. Think of each protocol as a building block, designed to interact with others without needing extra glue.

This modularity is where the popular term “money Legos” comes from. With composability, a lending protocol can connect to a decentralized exchange (DEX) to borrow and lend funds, or a yield optimizer can plug into a liquidity pool to help users maximize returns.

A visual comparison of Traditional Finance vs. DeFi Composability

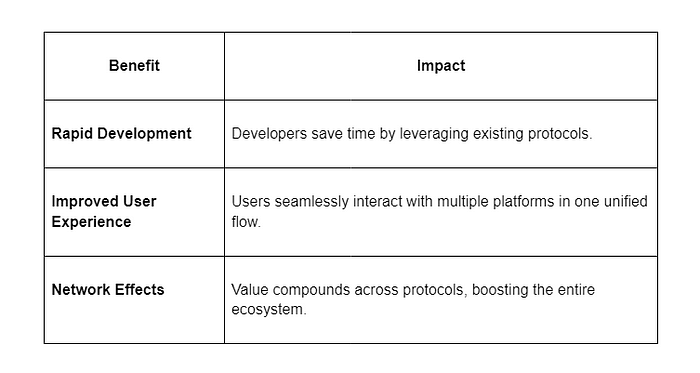

Why It Matters

Composability is the secret behind DeFi’s rapid growth. Instead of reinventing the wheel, developers can reuse and integrate existing tools, saving time and unleashing creativity.

Layered Interactions in Action

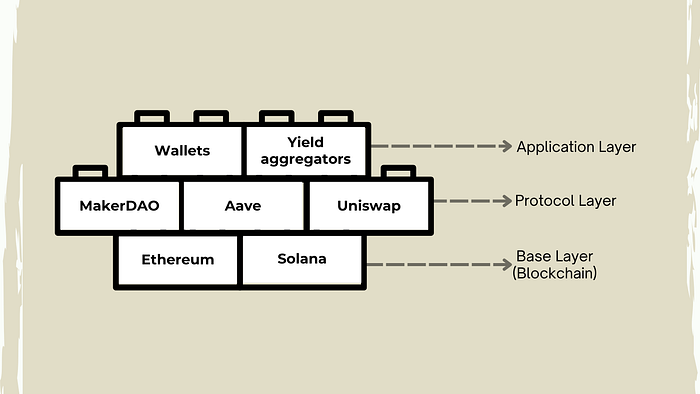

In DeFi, layered interactions aren’t just a feature, they’re the foundation for ecosystem growth. Composability ensures that protocols can seamlessly build upon each other, driving liquidity efficiency, synergistic functionalities, and capital optimization.

Consider two types of interactions:

Intra-chain Composability: Protocols on the same blockchain interact to unlock specialized features.

Cross-chain Composability: Enabled by interoperability solutions like Axelar or Wormhole, assets and functionalities flow across blockchain ecosystems.

Composability is why DeFi feels like an interconnected web rather than a bunch of disconnected apps. These interactions turn individual protocols into interconnected networks that amplify user value and protocol utility.

A layered architecture showcasing intra-chain and cross-chain interactions in DeFi

Case Studies of Composability Driving Innovation

Kamino Finance + Orca

A perfect example of the synergy in composability is the interconnection between Kamino Finance and Orca showcasing how two protocols can collaborate to enhance DeFi experiences. Kamino Finance exemplifies intra-chain composability by automating liquidity strategies for Orca, a Solana-based Automated Market Maker (AMM).

How it Works

Orca, a decentralized exchange on Solana, introduced concentrated liquidity pools which allow liquidity providers (LPs) to focus their funds within specific price ranges, maximizing capital efficiency. However, managing these pools manually requires constant monitoring and rebalancing.

This is where Kamino steps in to dynamically automate liquidity management for Orca’s pools by adjusting positions based on real-time market conditions, and optimizing yield for LPs while minimizing impermanent loss.

Why It Matters:

LPs benefit from improved yields without active management.

Orca attracts more liquidity, while Kamino offers automated solutions that simplify DeFi for users.

By working together, these protocols demonstrate how composability amplifies DeFi’s utility.

Axelar’s Cross-Chain Composability

Axelar is a perfect example of cross-chain composability by enabling seamless asset transfers and interoperability between ecosystems like Ethereum, Cosmos, and Solana.

How it Works

Axelar’s network uses decentralized validators and a universal gateway to facilitate secure cross-chain communication. Developers can integrate cross-chain functionalities directly into their protocols using Axelar’s APIs.

Why It Matters

Users can lend assets on one chain and farm yields on another, unlocking opportunities that were previously separated.

Protocols gain access to a broader user base and liquidity pools across multiple ecosystems.

Axelar’s cross-chain capabilities pave the way for use cases like multi-chain lending markets and cross-chain gaming economies, showcasing the vast potential of composability.

Challenges in Composability

While composability is transformative, it’s not without challenges:

Technical Risks: Smart Contract Vulnerabilities in one protocol can cascade through interconnected systems, leading to systemic risks. For example, the 2021 Compound exploit, where a bug in a single smart contract caused significant losses across users.

Interoperability Hurdles: Differences in consensus mechanisms, token standards, and architecture complicate cross-chain integrations. Although projects like Axelar and Wormhole are advancing solutions, true interoperability remains a work in progress.

Scalability Concerns: Increased composability can strain blockchain networks, especially during periods of high activity. Optimizations like Layer 2 scaling solutions and modular architectures can help address these bottlenecks.

The Future of Composability in DeFi

Modular Ecosystems

Frameworks like the Cosmos SDK are leading the charge in modular design, making it easier for blockchains to integrate seamlessly. These tools are simplifying the development of interconnected systems, paving the way for a composable future.

Evolving Cross-Chain Solutions

Advancements in cross-chain protocols will redefine composability. Protocols like Axelar and Wormhole are constantly innovating, making cross-chain interactions smoother. The goal is a world where users can move between chains as easily as clicking a button.

A Bold Vision

Composability is paving the way for a borderless financial future, where DeFi isn’t just a fragmented collection of protocols but a cohesive, global system from multi-chain DAOs to cross-chain gaming economies.

Conclusion

Composability is the engine of DeFi innovation. By enabling protocols to integrate like modular components, it’s creating a financial system that’s more efficient, accessible, and innovative than ever before unlocking unparalleled opportunities for developers, users, and the broader financial ecosystem. Composability proves that the whole is indeed greater than the sum of its parts.

Reference

Subscribe to my newsletter

Read articles from Ihuoma Anosike directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Ihuoma Anosike

Ihuoma Anosike

Content/Technical Creator @WIB_Africa || Front-end developer, open-source advocate, and Web3 advocate. I love technical writing, especially writing about Web3.