The Effects of Capital Gains Tax on Investment and Wealth Accumulation

Pallav Kumar Kaulwar

Pallav Kumar Kaulwar

Introduction

The capital gains tax (CGT) is a levy imposed on the profit derived from the sale of assets such as stocks, real estate, and other investments. This form of taxation is often debated for its impact on investment behavior, wealth accumulation, and economic growth. Proponents argue that capital gains taxes promote fairness by taxing unearned income, while critics claim they discourage investment and hinder wealth accumulation. This research critically examines the effects of capital gains tax on investment decisions, financial markets, and long-term wealth accumulation.

Understanding Capital Gains Tax

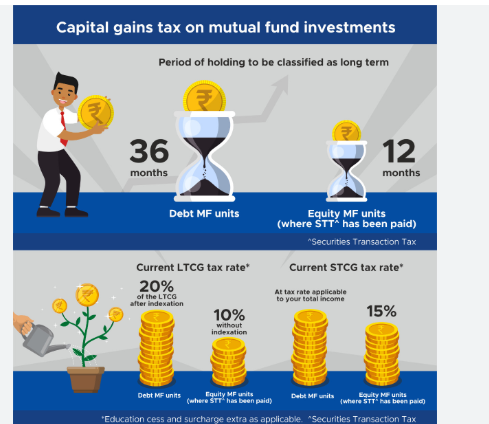

Capital gains tax is applied to the profit realized when a capital asset is sold for a higher price than its purchase cost. The tax rate may vary based on the holding period of the asset, with long-term gains often taxed at lower rates to incentivize investment.

Key features of capital gains tax include:

Short-Term vs. Long-Term Gains: Short-term gains are typically taxed at higher rates, while long-term gains enjoy preferential tax treatment.

Exemptions and Deductions: Some jurisdictions offer tax exemptions on primary residences, retirement accounts, or small-scale investments.

Step-Up in Basis: In some tax systems, inherited assets are valued at their fair market price at the time of inheritance, reducing the capital gains tax burden for heirs.

Impact on Investment Decisions

Capital gains taxes can significantly influence investor behavior and capital allocation. Several key effects include:

Lock-In Effect: Investors may delay selling assets to avoid capital gains tax, resulting in inefficient capital allocation. This behavior can reduce market liquidity and prevent resources from flowing to higher-yield investments.

Risk Appetite Reduction: Higher capital gains tax rates can discourage risk-taking, as investors anticipate lower post-tax returns on high-growth investments.

Influence on Portfolio Diversification: Investors may hesitate to rebalance portfolios or shift capital between asset classes due to the immediate tax consequences of selling profitable holdings.

Entrepreneurship and Innovation: Capital gains tax can affect startups and entrepreneurial ventures by discouraging venture capital investments, particularly when investors expect substantial tax liabilities on successful exits.

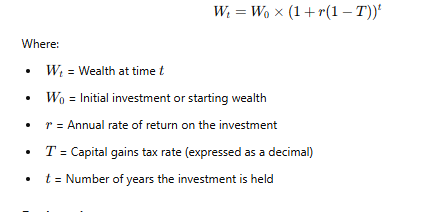

Impact on Wealth Accumulation

The long-term effects of capital gains tax on wealth accumulation are complex and depend on various factors:

Compound Growth Impact: Since capital gains tax reduces the net return on investments, it slows the power of compounding, impacting overall wealth accumulation.

Income Inequality: Critics argue that preferential tax rates on capital gains disproportionately benefit high-net-worth individuals, exacerbating income inequality. Wealthy investors often derive substantial income from capital assets, giving them tax advantages over wage earners.

Wealth Preservation Strategies: High-net-worth individuals may employ tax strategies such as tax-loss harvesting, offshore accounts, or trusts to minimize CGT liability and preserve wealth.

Generational Wealth Transfer: The "step-up in basis" rule can significantly reduce capital gains tax burdens on inherited wealth, contributing to the accumulation of intergenerational wealth.

Empirical Evidence on Capital Gains Tax Effects

Empirical studies reveal diverse outcomes of capital gains taxation:

United States: The 2003 capital gains tax cut significantly boosted investment in financial markets, yet the benefits were largely concentrated among affluent investors.

Canada: Adjustments to CGT rates showed minimal impact on middle-class investment behavior but affected high-net-worth individuals’ capital deployment strategies.

European Union: Countries with lower CGT rates, such as the Netherlands, have seen increased venture capital activity, while nations with higher CGT rates experience slower investment growth.

Balancing Capital Gains Tax for Economic Growth

To mitigate the negative effects of capital gains tax while ensuring fair wealth distribution, policymakers may adopt several strategies:

Indexing for Inflation: Adjusting asset values for inflation ensures that investors are taxed only on real gains rather than nominal increases.

Incentives for Long-Term Investment: Offering lower tax rates for long-term investments can reduce speculative behavior and encourage stable capital growth.

Exemptions for Essential Assets: Exempting primary residences or retirement savings from capital gains tax can protect low- and middle-income investors.

Progressive Taxation Structure: Introducing higher rates for ultra-high gains can ensure equitable tax contributions without stifling overall investment.

Conclusion

The capital gains tax is a crucial policy tool with far-reaching implications for investment behavior, financial markets, and wealth accumulation. While excessive taxation can deter investment and hinder economic growth, carefully designed policies can minimize negative effects while promoting social equity. By striking a balance between revenue generation and investor incentives, policymakers can create a system that fosters sustainable economic prosperity and equitable wealth distribution. Thoughtful reforms, such as indexing for inflation and promoting long-term investment, can enhance the capital gains tax's role in fostering economic stability and wealth accumulation.

Subscribe to my newsletter

Read articles from Pallav Kumar Kaulwar directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by