Deep Delta Neutral Fixed PT Yield on Sonic with Euler

Yield Dev

Yield Dev

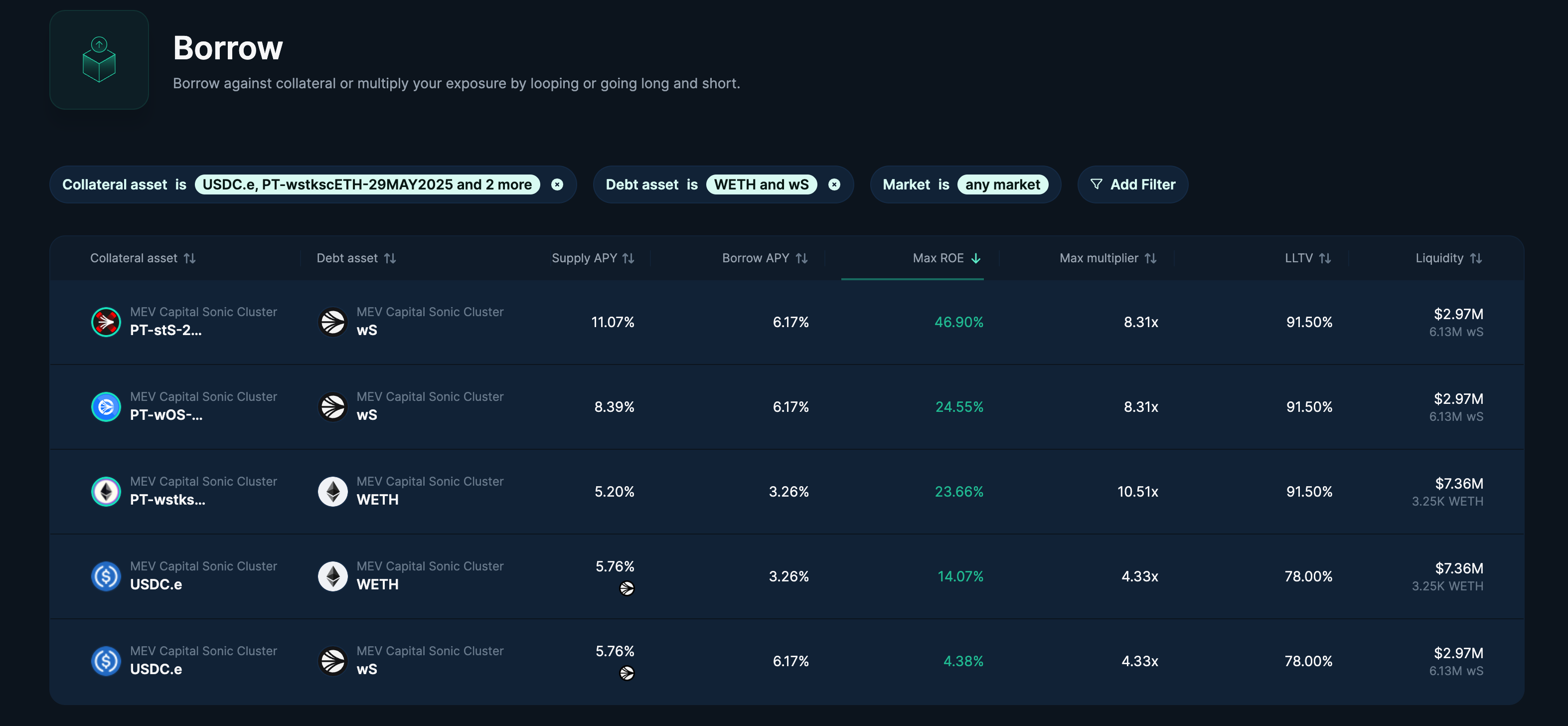

Euler's MEV cluster supports liquidity for going leverage long many of the Pendle PT fixed yield tokens available on sonic.

Accessing leverage in the form of of the PT's underlying token allows for massive leverage on the fixed rate, providing huge positive carry to be short the PT rate.

For example there are two markets for PT tokens on $S staked tokens which earn a fixed yield by selling the variable yield and points exposure of the underlying staked S.

One is the the PT-stS token and the other is the PT-wOS token which earn fixed yield on $S from the beets and origin protocol respectively.

The Euler MEV vault enables these PT tokens to be used as collateral to borrow the PT's underlying $S token in the form of wS (wrapped Sonic). Providing an 8.31x max multiplier on your capital to execute this trade. The PT-stS trade is particularly interesting as it trades at a APY of 11.07% and expires in 57 days.

With wS borrowing at a rate of 6.17%, the maximum return on equity for this position sits at 46.89% assuming the the actual rate of borrowed wS is realized at its current rate.

A nice extra return if you already have an allocation to $S exposure in your portfolio.

However, what if you don't want exposure to the price of $S but still want to participate in this trade?

Due to the unique design of the Euler lending market and the configuration of the MEV cluster, capital allocators can easily participate in this yield while remaining delta neutral.

Since the wS lending vault allows both USDC and PT-stS to be used as collateral, the positions equity can be entirely allocated to USDC thus funding the the entire purchase of PT-stS with a wS loan. This neutralizes all price exposure since the PT-stS will settle to S at maturity and the liability amount is denominated in wS, with the over collateraliztion requirement of the loan being satisfied by our USDC equity.

In this way, we participate in the carry trade without the currency exposure risk. The LTV settings of the wS vault allow us to borrow wS at a 77% max LTV against USDC and 88% max LTV against the PT-stS portion of our position.

We can calculate our max capital multiplier for a multi collateral position like this in this way. (Assuming 100% of our equity is in cash):

$$(M - 1) = 0.77 + 0.88(M - 1)$$

Our liquidation LTV is also a function of our multiple, as we must weight the LLTV of USDC (78%) and the LLTV of PT-stS (91.5%)

$$\text{LiquidationLTV}_{weighted} = \frac{0.78 + 0.915(M - 1)}{1 + (M - 1)}$$

The max weighted LTV allows us to run this trade at a multiple of 7.42x our starting capital. Since it's delta neutral, it won't lose USD value based on price moves from the underlying wS token. However, we still need to manage our collateralization ratio to that we do not violate the over collateralization requirements as the price of wS rises.

Note that as the price of wS rises, the LTV of the position will rise much more quickly than the weighted LLTV. This position requires tight risk management.

To allow for some headroom, assume we run this trade at 7x our starting capital. We simply need our capital in the USDC.e vault earning it's variable yield, 5.76% at the moment. We can then borrow 7x our starting capital worth of wS, paying 6.17 currently and immediately swap it for PT-stS for a fixed yield of 11%. These PT-stS are immediately deposited as collateral.

our returns, in APY, are then.

$$(11 - 6.17) \times 7 + 5.76 = 39.57$$

Using the EVC batch we can easily construct this trade to execute in a single transaction and remain in compliance with our collateral requirements. We simply batch all the transaction data for the individual trade operations outline above, including the swap, into a single evc.batch() call. This process is illustrated, in depth, in this blog post

The flexibility of EVC for batching transactions allows an on chain trader to easily and quickly use a single transaction to open, close and manage a position such as this one.

An advanced capital allocator, could farm this delta neutral yield while waiting to go long $S by having a script ready to swap some or all of the USDC collateral for more PT-stS in an instant.

A wise risk manager would have a script and a keeper bot ready to deleverage the position by swapping some of the PT-stS for wS and paying back some or all of the loan, reducing the liquidation risk if the price rises.

A technical degen might have a script to increase the leverage as the price of wS falls to maintain a capital multiplier of 7x.

All of this position management can be scripted out and executed via evc batch in a single transaction execution while maintaining the capital compliance of the position.

This delta neutral fixed rate trade can be executed across any PT asset whose underlying is borrowable against both USDC and the PT, for example WETH based PT's are also suitable for this trade.

For technical help, visit https://Yielddev Studio

Subscribe to my newsletter

Read articles from Yield Dev directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by