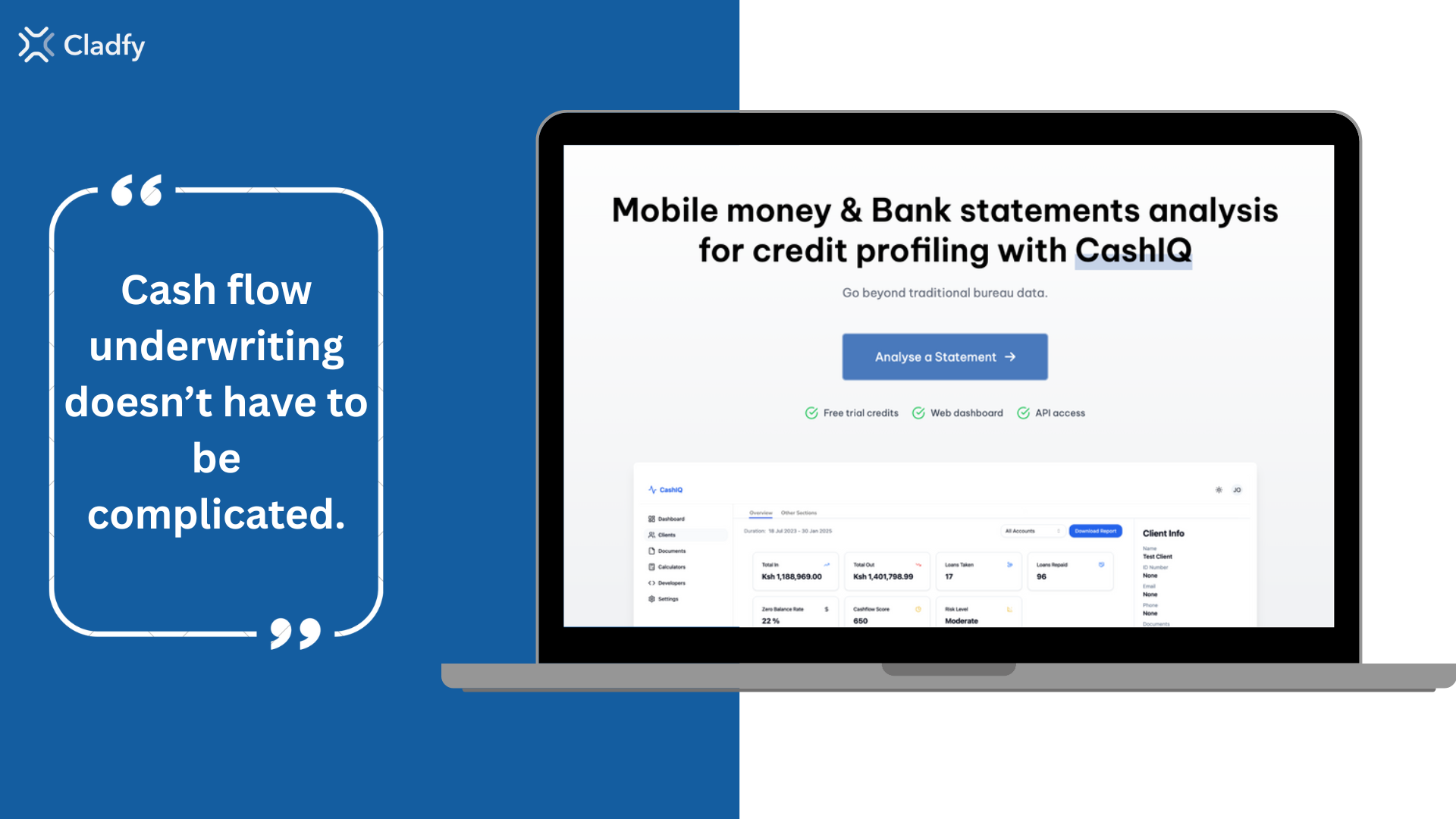

Cash Flow Underwriting Doesn’t Have to Be Complicated

Cladfy Blog

Cladfy Blog

Someone recently said something that stuck with us at Cladfy: "No credit analyst has ever been fired for using ‘number of days with a negative balance’ as an attribute."

That’s it. That’s the blog.

…Okay, not quite. But this one-liner captures a fundamental truth that too many overlook in the rush to build sophisticated credit models.

Why Start Simple?

When we talk about cash flow underwriting—especially in the age of alternative data and AI—it’s easy to default to complexity. Buzzwords like machine learning, behavioral risk scoring, and synthetic variables dominate the conversation.

But at the core of effective underwriting lies one thing: intuitive signals that make sense. Not just to data scientists and engineers, but to credit analysts, execs, and even the borrowers themselves.

Attributes like:

Number of days with a negative balance – A straightforward proxy for financial strain.

Current balance – A snapshot of liquidity at any point in time.

Time since highest or lowest balance – Indicates stability, volatility, and financial direction.

Monthly net inflow volatility – Tells you how predictable someone’s income is.

Average end-of-month balance – Reflects long-term cash discipline and surplus capacity.

Each of these is defensible. Explainable. Operationally sound.

From Intuition to Infrastructure

You don’t need a PhD to make these work. You need clean cash flow data, a clear objective, and a willingness to stay grounded in reality. With just 3 to 5 of these intuitive metrics, you can build an underwriting model that:

✅ Predicts default risk effectively

✅ Holds up in credit committee discussions

✅ Aligns with real-life financial behavior

✅ Lays the foundation for more advanced modeling later

And once you’ve established trust and consistency with these basics, the doors open to more sophisticated features—transaction classification, seasonality modeling, merchant-specific behavior, etc.

Don’t Overthink It. Just Start.

Cash flow underwriting is not a mystery. It’s just underutilized. And part of the reason is that people think it has to be complicated to be credible.

It doesn’t.

In fact, the more intuitive your starting point, the more scalable your approach becomes. You build buy-in. You build understanding. And ultimately—you build better credit outcomes.

👉 Want to see how we help lenders do this at scale?

Visit cladfy.com/cashiq to learn more about how we turn cash flow data into actionable credit intelligence.

Subscribe to my newsletter

Read articles from Cladfy Blog directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by