Credit Guarantee Scheme for Startups (CGSS) – May 2025 Update

intern shekunj

intern shekunj

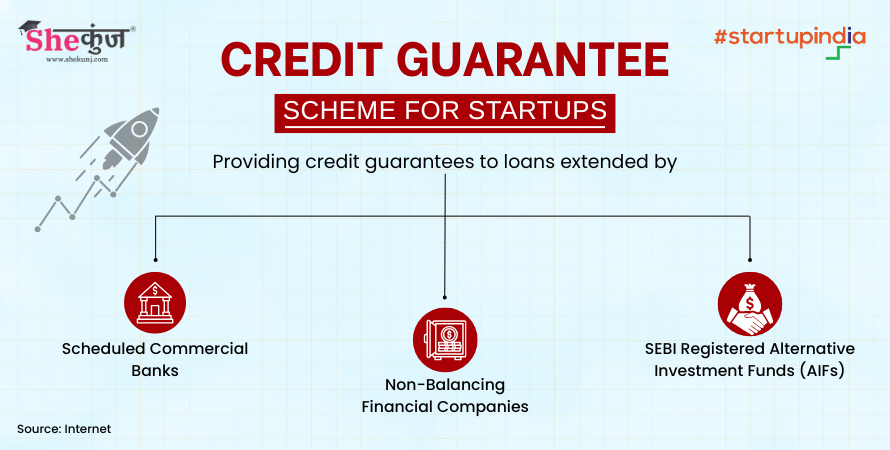

The Credit Guarantee Scheme for Startups (CGSS) is a flagship initiative by the Government of India to improve credit accessibility for DPIIT-recognized startups. By offering credit guarantees to lenders, it encourages financial institutions to fund innovative businesses that may not have traditional assets or credit histories.

Key Features

Credit Guarantee Limit Increased: The maximum guarantee cover has been increased to ₹20 crore per startup.

Reduced Guarantee Fee: For startups in 27 identified focus sectors, the annual guarantee fee has been reduced to 1% (from the usual 2%).

Flexible Tenure: Loan tenures are flexible and aligned with the startup’s repayment capacity, subject to lending norms.

Eligibility Criteria

For Startups:

Must be recognized by DPIIT.

Should maintain a stable revenue stream, supported by audited financials for the past 12 months.

Must have no loan defaults or be classified as an NPA.

Must be certified as eligible by the lending institution.

For Lending Institutions:

Must be a Scheduled Commercial Bank, NBFC (rated at least BBB, net worth ₹100 crore or more), or a SEBI-registered AIF.

Should be registered under the scheme to issue guarantees.

Application Process

For Startups:

Obtain DPIIT recognition.

Approach a registered lending institution.

Undergo assessment based on CGSS norms.

Once approved, the lender applies for guarantee cover with the NCGTC.

For Lenders:

Submit board resolution and undertaking to register with NCGTC.

Access the CGSS portal to manage applications and guarantees.

Focus Sectors (27 in total)

Includes key strategic and high-growth areas like:

Aerospace & Defence

Biotechnology

Pharmaceuticals & Medical Devices

Capital Goods

Chemicals & Petrochemicals

Food Processing

IT & ITES

Education Services

Financial, Legal, and Environmental Services

Automotive, Electronics, Construction, Tourism, and more

Scheme Impact (as of Dec 2024)

Loans Guaranteed: 257

Total Value: ₹601.86 crore

Jobs Created: Over 20,000

Coverage: 18 states, with strong outreach in Tier II & Tier III cities

Support for: 19 Export-Oriented and 19 Import-Substitution units

Subscribe to my newsletter

Read articles from intern shekunj directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by