Looking for a Home Loan in 2025? Compare Top Banks, EMI Rates & Apply Without Heavy Documents!

Harsh Jain

Harsh Jain

Turning Your Dream Home Into Reality in 2025: Here’s How to Do It Stress-Free!

Owning a home is a significant milestone, but the journey to buying or building your dream property should be exciting, not overwhelming. Whether you’re looking to purchase a ready-to-move-in property or embark on the exciting venture of building your own house, the first step is securing a hassle-free home loan. In 2025, securing a home loan in India is easier than ever, with flexible terms, low rates, and minimal paperwork.

In this guide, we’ll walk you through everything you need to know about securing a home loan for building or buying a property, including current rates, eligibility, the best lenders, types of loans available, and a simple, online loan application process.

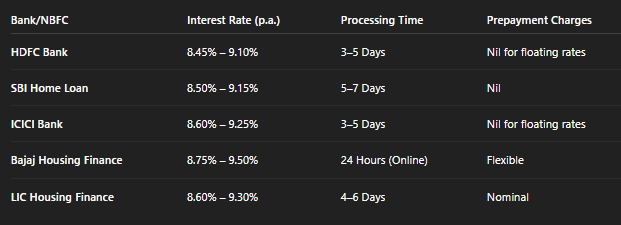

Current Home Loan Interest Rates in India 2025 — Compare the Best Deals!

Interest rates are crucial when deciding which home loan is best for you. In 2025, Indian banks and NBFCs are offering competitive interest rates to make home loans more affordable. These rates start as low as 8.45% per annum, with attractive options for both fixed and floating-rate loans.

Home Loan Interest Rates Comparison

Tip: Always compare current home loan interest rates before applying. Rates vary based on your profile, city, and lender, so check online tools to find the best deal.

How to Check Your Home Loan Eligibility in Minutes — No Hassle!

In 2025, banks will have made it simple to check your home loan eligibility online in just a few minutes. By filling in basic details, such as your monthly income, age, existing liabilities, and the property’s value, you can instantly know how much you are eligible to borrow.

For example, if your monthly salary is ₹40,000, you can typically qualify for a home loan between ₹15 to ₹25 lakhs, depending on the lender and city. Use online calculators provided by your bank to get a quick estimate.

Required Documents for Home Loan Approval in 2025 — Minimal Paperwork!

Worried about heavy paperwork? Fear not! In 2025, applying for a home loan is easier than ever with minimal documentation and quicker approval times. Most banks require the following documents:

PAN Card & Aadhaar Card (for KYC)

Salary slips or income proof

Bank statements for the last 6 months

Property documents (if applicable)

Passport-size photographs

Pro Tip: If you’re employed, banks may offer pre-approved home loans online with minimal paperwork, making the process even quicker!

Exploring the Different Types of Home Loans Available in India 2025

Choosing the right home loan depends on your specific needs. Here are the most common types of home loans available in India:

1. Home Purchase Loan

This loan is for buying a new or resale property.

2. Home Construction Loan

If you’re building a new home, this loan helps fund the construction.

3. Plot + Construction Loan

This loan is a combination of land purchase and construction costs.

4. Top-Up Loan on Home Loan

Borrow extra funds on your existing home loan.

5. Balance Transfer

Transfer your existing loan to a lender offering better rates.

For Builders: Home Construction Loan Interest Rates and How to Apply

If you’re planning to build a home, construction loans come with specific interest rates and terms that cater to your unique needs. These loans usually offer higher flexibility in terms of disbursements, which can be a game-changer for construction projects.

How to Apply for a Top-Up Loan on Your Existing Home Loan

Need extra funds for renovations, educational expenses, or medical bills? A Top-Up Loan on your existing home loan could be the solution. It’s easy to apply for, especially if:

You’ve been repaying your existing home loan on time.

Your income supports higher borrowing.

Your credit score is healthy (700+).

Most banks offer competitive rates for top-up loans, which are typically much lower than personal loans, and the process is simple since you don’t need to provide any new property documents.

What Can You Expect With a ₹40,000 Monthly Salary?

If your salary is ₹40,000, you can usually qualify for a home loan ranging from ₹15 to ₹25 lakhs, depending on your credit score and the city in which you live.

Loan Amount: ₹15 — ₹25 Lakhs

Tenure: Up to 30 years

EMI: ₹10,000 — ₹15,000/month

Many banks provide custom home loan eligibility for a ₹40,000 monthly income, especially for young salaried individuals looking to invest early.

Apply for a Home Loan Online — Fast, 100% Digital Process!

Thanks to digital advancements, the home loan process in 2025 is faster than ever. You no longer need to visit bank branches or stand in long queues. The entire application process can be done online, allowing you to:

Fill in basic details (income, city, loan amount).

Upload minimal documents.

Compare loan offers.

Receive approval in 24–72 hours.

Bonus Tip: Many lenders offer faster processing for existing customers, allowing for quicker disbursal and a more streamlined experience.

Why It Matters

Your home should reflect the hard work you’ve put into building your future. The dream of owning your property should never be held back by cumbersome paperwork. Thanks to today’s digital processes and the understanding nature of lenders, you can apply for a home loan with minimal hassle and enjoy quicker, personalized solutions.

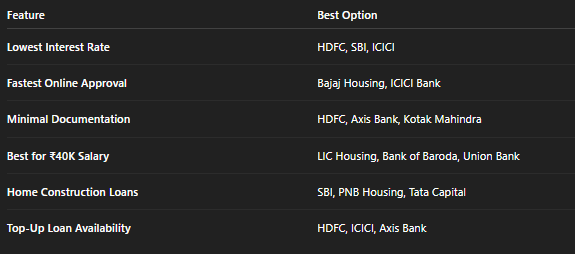

Quick Comparison Table: Best Home Loan Deals in 2025

Top 5 FAQs on Home Loans in India 2025

1. What is the current home loan interest rate in India in 2025?

Interest rates start at 8.45% per annum, depending on the bank and your credit score.

2. Can I apply for a home loan online without visiting the bank?

Yes, most banks offer 100% digital home loan applications with instant approval and document upload options.

3. What documents are required for home loan approval?

Basic KYC (PAN, Aadhaar), income proof, bank statements, and property documents are typically required.

4. How much home loan can I get if my salary is ₹40,000/month?

You can generally qualify for a loan between ₹15 to ₹25 lakhs, depending on your income and credit profile.

5. What is a top-up loan, and how do I apply for one?

A top-up loan is additional funding on your existing home loan. Apply if you’ve been repaying the loan on time and meet the eligibility criteria.

Final Thoughts: Begin Your Homeownership Journey Today

2025 is the perfect time to make your dream home a reality. With affordable interest rates, fast approvals, and minimal paperwork, owning your property is more achievable than ever before. Whether you’re looking to build or buy, the process is designed to be easy, quick, and stress-free.

Start comparing options today, apply online, and take the first step toward owning your dream home — the journey begins now!

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!