Home Loan Without Income Proof in 2025 – Apply Online & Get Approved with Just Basic KYC

Harsh Jain

Harsh Jain

Buying a home is a major milestone. But let’s face it — endless paperwork, hidden charges, and rigid eligibility criteria can be overwhelming. Thankfully, 2025 has brought a revolution in the home loan industry. Now you can apply for a home loan online with minimum documentation, get instant approval, and enjoy the lowest interest rates — all from your phone or laptop.

Whether you’re building your dream house or purchasing a ready property, India’s top lenders now offer online housing loan applications with faster processing, EMI calculators, and transparent deals.

Let’s explore how to apply, what documents are needed, which lenders are best, and how much you can borrow , especially if you earn ₹40,000/month.

Why Choose an Online Housing Loan Application in 2025?

Applying for a home loan online is no longer a trend — it’s a necessity in today’s fast-paced digital world. Here’s why:

Faster approvals with paperless processes

EMI calculators like the Faircent EMI Calculator for real-time repayment estimates

Convenient 24x7 access to check offers, upload documents, and track application

Customized home loan offers based on your income and credit behavior

With platforms like Investkraft loan services, borrowers can now compare lenders and get matched to ideal partners (Investkraft partner) who offer low interest and fast approval.

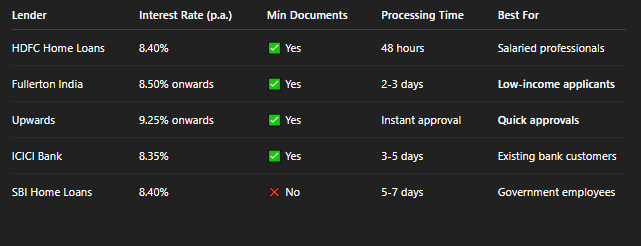

Home Loan Comparison Table — Top Online Offers (2025)

How Much Home Loan Can You Get on ₹40,000 Salary?

If your monthly salary is ₹40,000, you might be eligible for a home loan of up to ₹25–30 lakhs, depending on your credit score, other financial obligations, and location of the property.

Here’s a quick estimate:

Monthly salary: ₹40,000

Max EMI allowed (50%): ₹20,000

Tenure: 20 years

Interest Rate: 8.5%

Estimated loan amount: ₹24–27 lakhs

Use tools like the Faircent EMI calculator to adjust loan amount, tenure, and interest to match your monthly budget.

Documents Required for Home Loan (2025)

Gone are the days of carrying files full of papers. Today’s lenders require home loans with minimum documentation. Here’s what you typically need:

For Salaried Applicants:

PAN Card, Aadhaar Card

Salary slips for last 3 months

Bank statement (6 months)

Employment proof or ID card

Property documents (if ready)

For Self-Employed Applicants:

ITR (2–3 years)

Business proof (GST/Trade license)

CA-audited balance sheet

Bank statements

Tip: Some lenders like Upwards and Fullerton India offer loans with relaxed document checks.

Types of Home Loans Available Online

Knowing which types of home loans suit your needs is crucial:

Home Purchase Loan — For buying a new or resale property

Home Construction Loan — To build your home on your own land

Plot + Construction Loan — For purchasing land and building

Top-Up Loan on Home Loan — Extra funds on existing loan

Balance Transfer — Switch lenders to get lower rates

If you’ve already taken a loan, a top-up loan on your home loan helps finance renovation or urgent needs.

Fullerton India Loan Account Statement — How to Access?

If you’re an existing borrower, you can view your Fullerton India loan account statement online through their official customer login portal. You’ll find EMI due dates, outstanding balance, interest paid, and other essential info.

Best Home Loan Offers from Investkraft Partners

When applying through platforms like Investkraft, users get matched with curated lenders — called Investkraft partners — based on their income, CIBIL score, and location.

Benefits:

Pre-approved offers from trusted lenders

Competitive interest rates from 8.25% onwards

Paperless process with doorstep document pickup

EMI planning with built-in calculators

Don’t forget to compare the Upwards loan interest rate with other platforms for fast approval if you’re in urgent need.

How to Apply Now for a Home Loan Online (Step-by-Step)

Here’s how you can get started immediately:

Visit your preferred lender or aggregator site (e.g., HDFC, Fullerton, Investkraft)

Click on ‘Apply Now for Home Loan’

Enter basic details (name, income, employment type)

Upload scanned documents required for the home loan

Use the EMI calculator to choose a comfortable tenure

Submit & wait for verification

Once verified, you’ll get your loan sanctioned in 2–4 working days (some offer instant approval too).

Real-World Tips Before You Apply

Always check your credit score before applying

Keep income documents handy, even if the minimum documents are required

Read the home loan offer carefully for hidden charges

Use multiple EMI calculators (like the Faircent EMI calculator) to cross-verify

Opt for a longer tenure for a lower EMI burden, and prepay when possible

Final Thoughts — Make 2025 the Year You Own Your Home!

Whether you’re a young salaried individual earning ₹40,000/month or a business owner with limited documents, the doors to home ownership are now open wider than ever. With platforms like Investkraft loan, lenders like Fullerton India, and tools like the Faircent EMI calculator, you can take control of your financial journey with just a few clicks.

Stop waiting. Apply now for a home loan online and secure your dream home at the lowest interest rates with minimum documentation!

FAQs — Online Home Loans in 2025

1. Can I apply for a home loan online without income proof?

Some lenders may approve home loans with minimum documentation or alternative income proof, but terms may vary.

2. What is the interest rate for Fullerton India home loans?

As of 2025, Fullerton India home loan interest rate starts from around 8.50% per annum and varies based on your eligibility.

3. How do I use the Faircent EMI Calculator?

Visit Faircent’s official website, input the loan amount, tenure, and interest rate to view real-time EMI estimates.

4. What is a top up loan on a home loan?

A top-up loan is an additional loan amount you can borrow over your existing home loan, usually at the same interest rate.

5. How much loan can I get on a ₹40,000 salary?

You may be eligible for ₹25–30 lakhs, depending on your repayment capacity and interest rate.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!