Complete Guide: Loan Against Property in India for Self-Employed – Interest Rates, EMI & Eligibility 2025

Harsh Jain

Harsh Jain

Mere paas property hai, par jab paisa chahiye, toh bank documents maangta hai.

If this sounds familiar, you’re not alone. Whether you’re a salaried employee struggling to get a home loan without income proof or a self-employed entrepreneur with limited documentation, your property can be the key to unlocking fast funds. In 2025, loan against property (LAP) options have become simpler, faster, and more flexible , even without submitting income proof!

This comprehensive LAP guide for 2025 covers how you can get an instant loan against property online, eligibility criteria for salaried and self-employed individuals, documents required for home loan alternatives, and top tips to maximize your borrowing potential.

What Exactly is a Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where you pledge your residential or commercial property as collateral to avail a lump sum amount. This loan is perfect for large financial needs like home renovation, medical emergencies, business expansion, or even debt consolidation.

Unlike personal loans, LAP offers lower interest rates, higher loan amounts, and longer repayment tenures up to 15–20 years. Plus, in 2025, many lenders will offer home loans without income proof or with minimal documentation — a game changer for salaried employees and self-employed professionals.

LAP Loan Highlights — What’s New in 2025?

Who Can Apply for a Loan Against Property Without Income Proof?

For Salaried Employees:

If you have property but don’t have formal salary slips or ITR, you can still qualify for LAP. Banks and NBFCs consider alternative proofs such as:

Bank statements (6–12 months)

Rental agreements or utility bills

Co-applicant’s income or property ownership

Property valuation report

This flexibility enables salaried individuals with low or irregular income to apply now for a home loan online or LAP with minimum documentation.

For Self-Employed Professionals:

Are you self-employed with no ITR or audited balance sheets? Many NBFCs now offer LAP loans based on:

Existing property ownership documents

Business vintage and reputation

Bank transaction history

Co-applicant’s profile

This means you can access funds for business expansion, emergency medical needs, or personal use — even if your paperwork is limited.

Step-by-Step: How to Apply for a Loan Against Property Online in 2025?

Compare Lenders Offering LAP with No Income Proof: Use online platforms to find lenders with the lowest interest rates and easiest eligibility criteria.

Check Your Eligibility: Age, property ownership, and KYC documents are the basics.

Use a Home Loan or LAP EMI Calculator: Plan your budget by entering loan amount, tenure, and expected interest rate.

Fill Application Form Online: Upload property ownership proof, KYC documents, and any alternative proofs.

Instant Loan Approval: Get approval in 24–48 hours, often without branch visits.

Property Valuation: Physical or digital inspection of your property.

Loan Disbursal: Funds credited directly to your bank account within 2–4 working days.

Why Choose a Loan Against Property Over a Personal Loan?

Lower Interest Rates: LAP interest rates in 2025 start as low as 8.50% p.a., much less than unsecured personal loans.

Higher Loan Amounts: Borrow anywhere from ₹2 Lakhs to ₹7 Crores+ based on your property value.

Flexible Repayment Tenure: Up to 15–20 years EMI options reduce monthly burden.

Use for Any Purpose: From home construction loans and wedding expenses to business working capital.

Understanding LAP Interest Rates in 2025

Interest rates depend on factors like:

Property type (residential vs commercial)

Loan amount and tenure

CIBIL score (optional but beneficial)

Lender policies

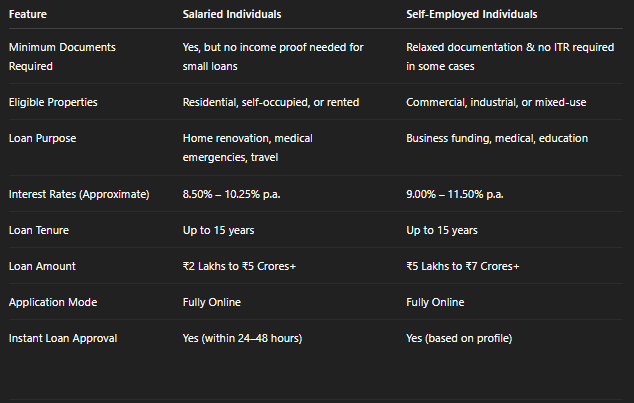

Current LAP rates:

Salaried Individuals: 8.50% to 10.25% p.a.

Self-Employed Individuals: 9.00% to 11.50% p.a.

Use an Online Home Loan Interest Rate Calculator or Loan Against Property Interest Rate Calculator to estimate your monthly EMI accurately.

Calculate Your EMI Using LAP EMI Calculator India

Planning your finances before applying is essential. Use a free EMI calculator by entering:

Desired loan amount

Loan tenure (years)

Expected interest rate

This gives instant details on EMI, total interest payable, and overall repayment amount — helping you budget better.

Best LAP Loan Options for Salaried and Self-Employed in 2025

For Salaried Individuals:

LAP for home renovation or medical expenses without income proof

Instant loan against property for personal needs

Top-up loan on existing home loan or LAP

For Self-Employed Individuals:

Loan against property for business expansion

Working capital through LAP

Balance transfer and loan top-up features

Documentation Required for Home Loan & LAP Without Income Proof

Property ownership documents (title deed, municipal tax receipts)

KYC documents (Aadhaar, PAN, passport, voter ID)

Bank statements for last 6–12 months

Utility bills or rent agreements (alternate proof)

Co-applicant income proofs (if applicable)

No ITR or salary slip? Many lenders accept these alternate proofs for loan approval in 2025.

Pro Tip: Boost Your Eligibility by Adding a Co-Applicant

Adding a spouse, parent, or family member with a stable income or good credit history can improve your chances of instant loan approval and even secure a better interest rate.

Frequently Asked Questions (FAQs) — Loan Against Property Without Income Proof 2025

1. Can I get LAP without salary slips or ITR?

Yes, many lenders approve LAP using property valuation, alternate income proofs, and co-applicant profiles.

2. What is the maximum tenure for LAP?

Up to 15–20 years depending on the lender and your age.

3. Is Loan Against Property better than a personal loan?

Definitely! LAP offers lower interest rates, higher loan amounts, and longer repayment periods.

4. Can I apply for LAP online in India?

Yes, most banks and NBFCs provide a fully digital LAP application process.

5. What types of properties are eligible for LAP?

Residential, commercial, self-occupied, rented, or mixed-use properties owned by you or your family.

Final Thoughts: Unlock Your Property’s Potential with Instant LAP in 2025

Whether you are searching for an instant home loan online, a home loan with minimum documentation, or a no-income-proof home loan, a Loan Against Property is your smartest option in 2025.

With the benefits of minimal paperwork, online application, quick approval, flexible tenure, and affordable interest rates, your property is no longer just a shelter — it’s your gateway to instant funds for life’s big expenses.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!