Loan Against Mutual Funds (2025) – Best Platforms, ELSS Support, Wedding Funds & Easy EMI Explained!

Harsh Jain

Harsh Jain

In 2025, when unexpected financial needs arise, there’s no need to break your investments. Instead, opt for a digital loan against mutual funds (LAMF) — a quick, collateral-backed way to get cash without compromising your portfolio.

Whether you’re planning a big wedding, managing medical expenses, or need funds for a business, LAMF is the modern solution you didn’t know you needed.

What is LAMF, and why is it trending in 2025?

LAMF stands for Loan Against Mutual Funds. It’s a facility where you can pledge your mutual fund units and get an instant loan, all online. Your investments continue to earn returns while you meet urgent cash needs.

Unlike traditional loans, LAMF doesn’t require heavy paperwork or income proof. It’s digital, fast, and perfect for self-employed professionals, freelancers, or low-salaried earners.

Stay invested, borrow smartly.

How Does a Loan Against a Mutual Fund Work?

A lot of users ask: How does a loan against a mutual fund work?

Here’s the simple flow:

Log in to a lender or fintech app.

Choose the mutual fund folios you want to pledge.

A lien is placed on your units (you still own them).

The loan is disburseddirectly into your bank account.

The process is 100% paperless and takes just a few minutes.

Best part: Your mutual funds keep growing — you just can’t redeem them until the loan is repaid.

Who Can Apply for Loan Against Mutual Funds?

Anyone who is:

An Indian resident above 18 years of age

Holding mutual funds in a demat or statement format

Has KYC-compliant investments

In short, who can apply for a loan against mutual funds?

Almost every retail investor! Whether you’re a salaried employee or self-employed professional, if you own eligible mutual fund units, you can apply.

Digital Loan Against Mutual Funds Interest Rate — 2025 Update

The digital loan against mutual fund interest rate is far more affordable than personal loans or credit card EMIs.

Factors that impact your rate include:

Type of mutual fund (equity/debt/ELSS)

Loan amount and tenure

Relationship with the lender

Many users prefer LAMF over unsecured loans because of this lower interest structure.

LAMF Eligibility & Documents — What You Need

To apply, you must meet the LAMF eligibility & documents requirements:

Basic Eligibility:

You must be the primary holder of the folio.

A mutual fund scheme must be approved by the lender.

Mutual funds should not be under lock-in (except ELSS post 3 years).

Required Documents:

PAN Card

Aadhaar Card

Mutual Fund Statement (PDF/demat)

Bank account proof (for crediting the loan)

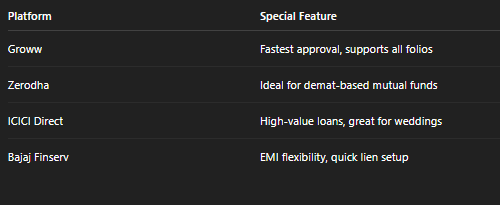

Platforms like Groww, Zerodha, and ICICI Direct handle everything digitally, making the process super smooth.

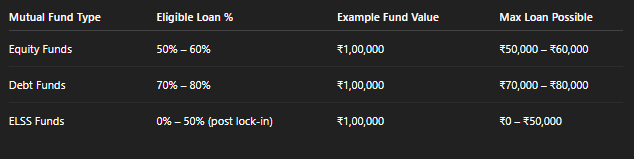

Loan Against Mutual Funds Eligibility Calculator — Know Your Limit

Before applying, use a loan against mutual funds eligibility calculator. It tells you how much loan you’re eligible for based on the fund value and type.

This helps with planning and budgeting the loan amount.

Loan Against Mutual Funds for Wedding Expenses

Big Indian weddings often bring financial pressure. Instead of liquidating your SIPs or redeeming mutual funds, why not take a loan against mutual funds for your wedding?

It’s cheaper than wedding loans

No income proof or salary slip needed

Available within hours — even on the weekend

So, whether it’s booking a venue, catering, or honeymoon expenses, LAMF can be your financial backup without compromising long-term wealth.

Can You Take a Loan Against ELSS Mutual Funds?

Yes, but only after the 3-year lock-in period. This is called a loan against ELSS mutual funds.

Once ELSS funds become eligible, you can pledge them just like any other equity fund and get up to 50% of the fund value as a loan.

Make sure:

Your ELSS is in approved folios

The lock-in period is complete

Why Choose Digital Loan Against Mutual Fund in 2025?

100% Online: Apply anytime, anywhere

No Extra Documents: PAN + Aadhaar is enough

Secure: You don’t sell funds, only pledge

Affordable Interest: Much lower than credit cards

Fast Disbursal: Get money in minutes

Platforms to Apply for Digital LAMF

Final Thoughts — Is LAMF Right for You?

If you’re someone who:

Needs quick money

Doesn’t want to redeem investments

Do you have mutual funds in your name

Then, a Digital Loan Against Mutual Fund in 2025 is your best option.

It’s secure, flexible, and smarter than personal loans in many cases.

So instead of selling your future for today’s needs, borrow smartly and keep your investments working for you.

FAQs

Q1. Is income proof required for LAMF?

No. You only need PAN, Aadhaar, and mutual fund proof.

Q2. Can I use this loan for any purpose?

Yes. Be it marriage, education, travel, or business — use it freely.

Q3. Is the process really 100% online?

Yes. You can apply, get approval, and receive funds — all digitally.

Q4. Can I foreclose the loan early?

Absolutely. Most lenders offer zero or minimal foreclosure charges.

Q5. How long does it take to get the money?

Usually within a few hours or on the same day.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!