Loan Against Property Fees & Charges 2025 – Complete Breakdown for Salaried & Business Profiles

Harsh Jain

Harsh Jain

Whether you’re a salaried individual facing urgent medical expenses or a business owner seeking fast working capital, Loan Against Property (LAP) in India 2025 has emerged as a top-tier financing option. With lower interest rates, longer tenures, and high-value disbursements, it’s the smartest way to unlock the hidden value of your real estate.

Let’s uncover everything you need to know — from loan against property eligibility and documents for salaried individuals to LAP loan processing fee and ROI comparison — in this updated 2025 guide.

What Exactly is a LAP Loan in 2025?

A Loan Against Property (LAP) is a secured loan where you mortgage your residential or commercial property to raise funds , without selling it. It’s ideal for:

Salaried employees needing funds for weddings, education, or medical emergencies

Self-employed professionals looking for business growth, machinery purchase, or working capital

Because it’s backed by your property, a loan against property in India offers better terms compared to personal or unsecured loans.

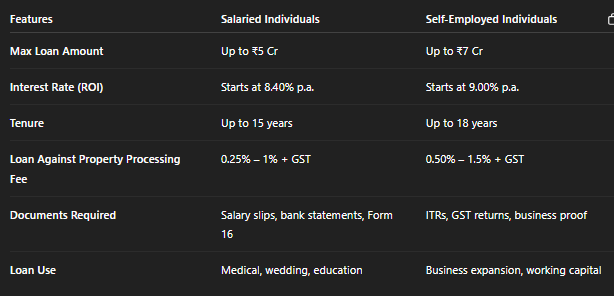

Key Features of Loan Against Property — Salaried vs Self-Employed Individuals

Want a fast loan against property? Opt for NBFCs with digital KYC and minimal documentation.

Eligibility & Documents — Salaried vs Self-Employed Borrowers

Loan Against Property for Salaried Individuals (Wedding, Medical Needs & More)

If you’re employed and want a loan against property for medical expenses or a wedding, here’s what you need:

Age: 21 to 60 years

Minimum Salary: ₹25,000/month

Loan Against Property Eligibility and Documents for Salaried Individuals:

PAN & Aadhaar Card

3 Months’ Salary Slips

Last 6 Months’ Salary Account Statements

Form 16 or Income Tax Returns

Property Title Deed

Salaried LAP meaning*: A secured loan issued to salaried individuals based on income + property value.*

How to Apply for a Loan Against Property for Self-Employed Individuals

Planning business expansion or cash flow improvement? LAP is ideal.

Age: 25 to 65 years

Minimum Turnover: ₹10 Lakhs annually

LAP Loan Documents Required for Self-Employed:

PAN & Aadhaar

2–3 Years ITR

GST Filings (if applicable)

1-Year Bank Statements

Business Registration/Proof

Property Papers

Tip*: A LAP loan legal associate can help ensure error-free documentation and faster approvals.*

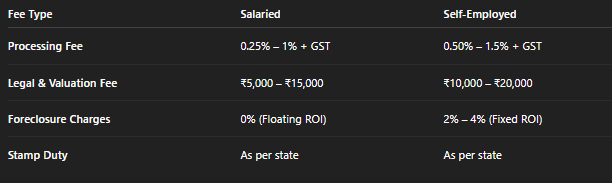

Complete Loan Against Property Fees Breakdown (2025)

Understanding loan against property charges for salaried individuals and self-employed professionals helps avoid hidden surprises.

Ask for a full fee breakup before signing to ensure you know all the loan against property processing fees and charges upfront.

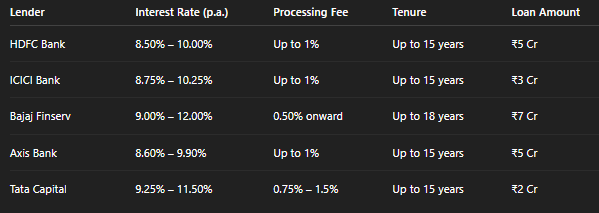

Updated Loan Against Property ROI Comparison (Top Lenders — 2025)

Compare top banks and NBFCs in India offering LAP loans with best interest rates and low fees:

Use online loan against property ROI comparison tools to find the lowest rate based on your profile.

LAP Benefits by Profile — Who Should Opt in 2025?

Best Use Cases for Salaried Individuals:

Wedding: Avoid draining your savings — opt for a loan against property for salaried individuals for wedding needs.

Medical: In case of emergencies, LAP disbursal is quicker than many insurance processes.

Education: Get long-term funding for higher education at a lower interest.

LAP Advantages for Self-Employed:

Business Expansion: Open new outlets, upgrade machinery, or buy inventory.

Working Capital: Better ROI than overdrafts or credit lines.

Asset Leveraging: Tap into your property’s value without giving up ownership.

Pro tip: LAP offers loan against property features for self-employed individuals that are flexible and scalable.

Step-by-Step Guide to Get an Easy Loan Against Property in 2025

Check Eligibility for a Loan Against Property based on income, age, and property ownership

Choose a lender with competitive loan against property rates for comparison

Submit LAP loan documents required online or offline

Property valuation & legal checks happen within 2–4 working days

Loan sanctioned and disbursed in 3–7 days

Apply for an easy loan against property with pre-approved offers to skip lengthy verification.

Top 5 FAQs — LAP in India (2025 Edition)

1. What’s the current loan against property processing fee in 2025?

It ranges from 0.25% to 1.5% + GST, depending on applicant profile and lender policies.

2. Can I get a LAP loan without income proof?

Yes, some NBFCs offer loans against property without income proof, mainly if you own high-value property and have a good repayment history.

3. Is LAP ideal for salaried people with medical needs?

Yes, loan against property for salaried individuals for medical expenses is a popular use case withfast disbursal.

4. What’s the difference in charges for salaried vs self-employed LAP applicants?

Generally, loan against property fees and charges for salaried individuals are slightly lower than those for self-employed due to risk perception.

5. How can I compare different LAP offers?

Use a reliable loan against property ROI comparison website or consult a LAP loan legal associate.

Conclusion: Use Your Property to Fulfil Big Goals in 2025

A Loan Against Property (LAP) isn’t just a loan — it’s a way to finance your dreams without selling your assets. Be it medical urgency, a wedding, or business expansion, your property can now be your financial superpower.

Understand your loan against property eligibility and documents, compare lenders, and watch how your owned asset turns into liquid funds — faster and cheaper than ever before.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!