Loan Against Property Explained: Boost Your Business Cash Flow with These 2025 Strategies

Harsh Jain

Harsh Jain

When Your Business Needs Cash, Think Smarter — Not Harder

Running a business in today’s fast-paced economy means cash flow isn’t just important — it’s critical. Whether you need to cover payroll, manage working capital, or seize a new growth opportunity, having access to funds at the right time can make or break your operations.

One often-overlooked yet powerful funding option is a Loan Against Property (LAP) — a secured loan that allows you to use your residential or commercial property to unlock funds. And in 2025, lenders have made the process faster, more flexible, and much easier than ever before.

Let’s explore how you can strategically use LAP to boost your business cash flow, how to qualify, the smartest ways to apply, and what real benefits it brings.

What Exactly is LAP? (Loan Against Property Meaning Made Simple)

A Loan Against Property is a type of secured loan where you pledge your immovable asset — be it a house, land, or commercial building — as collateral to a lender in exchange for funds.

Unlike a personal loan, a LAP loan against property comes with a lower interest rate, longer tenure, and higher loan amounts, making it ideal for business purposes.

Key Benefits:

Higher sanction amount than personal loans

Flexible repayment (up to 15–20 years)

Use for multiple purposes: expansion, inventory, machinery

Lower LAP interest rate starting from 8.5% annually

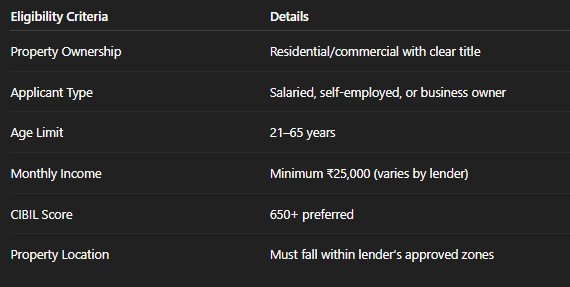

Who Can Apply? (Loan Against Property Eligibility in 2025)

Before you apply, it’s important to understand the current loan against property eligibility criteria. Though conditions vary slightly between lenders, here’s what most of them look for:

Even a loan against property for a salaried person is available with simple income proof and salary slips.

Why Business Owners Are Turning to LAP in 2025

Whether you’re dealing with rising costs, delayed client payments, or planning a bold expansion, instant property loan options through LAP can provide relief quickly and affordably.

Common Business Uses of LAP in India:

Working capital needs

Expansion or renovation

Clearing existing high-interest debts

Buying new machinery or raw material

Scaling marketing or operations

What makes LAP better than an unsecured loan is the faster disbursal, easy loan against property documentation, and lower interest burden, even for personal loan against property needs.

Instant Loan Against Property — How Fast Can You Get It?

In 2025, many banks and NBFCs will offer instant loans against property through digital portals. This means:

Eligibility check in 1 minute

Document upload online

Property verification within 48 hours

Loan disbursal in 3–7 working days

Several platforms now even offer the fastest loan against property approvals for urgent business needs , making it an ideal choice for entrepreneurs needing liquidity in a crunch.

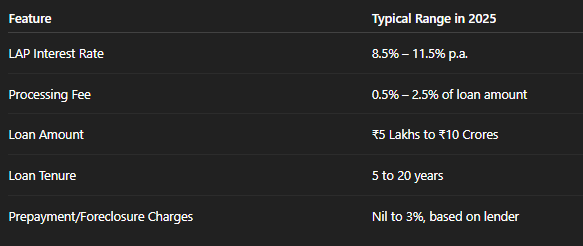

LAP Interest Rates, Processing Fee & Loan Amount Comparison

Tip: Always compare the loan against the property interest rates across lenders, especially for large loans.

Smart Financial Strategies to Use LAP Effectively in 2025

Here are real-world strategies you can use to maximize the benefit of your loan against property:

1. Improve Cash Flow with Working Capital Injection

Use easy loan against property funds to pay vendors, restock inventory, and stabilize day-to-day operations without touching profits or reserves.

2. Replace High-Cost Debt with LAP

Have expensive business credit cards or personal loans? Use LAP to consolidate them into a single low-interest loan and save lakhs over the tenure.

3. Fund Expansion or Renovation

Want to expand your warehouse, renovate your office, or launch in a new city? Fast loan against property gives you the flexibility and scale to fund growth.

4. Invest in Equipment or Machinery

Upgrading outdated equipment? Instead of leasing, invest upfront using instant property loan options with a longer tenure and tax benefits.

5. Stay Prepared for Emergencies

Even if your business is stable, having a pre-approved LAP ensures you’re ready to tackle unexpected downturns or crises with confidence.

Real Example — How LAP Helped a Business in 2025

Meet Priya, a boutique owner in Delhi. Her business saw a drop in cash flow due to a delay in supplier payments. She applied for a personal loan against property, using her home as collateral. Within 5 days, she got ₹15 lakhs at 9.25% interest. That timely fund saved her store from closing and helped her bounce back with better profits.

Lesson: Use property to your advantage — don’t let it stay idle.

Top 5 FAQs on Loan Against Property for Businesses

Q1. What is a LAP loan?

A: LAP (Loan Against Property) is a secured loan where you mortgage your property to raise funds for personal or business needs.

Q2. Can I apply for LAP if I am salaried?

A: Yes! Many banks offer a loan against property for a salaried person with minimal documentation and stable income proof.

Q3. How is a LAP different from a personal loan?

A: LAP has a lower interest rate, longer tenure, and higher loan limit since it’s backed by your property, unlike unsecured personal loans.

Q4. What is the minimum loan amount I can get?

A: The loan against property minimum amount usually starts at ₹5 lakhs, but can go up to ₹10 crores depending on property valuation.

Q5. How do I check eligibility for a loan against property?

A: You can use any bank or NBFC’s online calculator to check eligibility for a loan against property instantly based on your income and property details.

Final Words — Unlock the Value of Your Property in 2025

Your property isn’t just a physical asset — it’s a powerful financial tool. In 2025, more businesses are realizing the power of Loan Against Property to solve cash flow problems, fuel expansion, or refinance old loans smartly.

Whether you’re looking for a fast loan against property, a personal loan against property, or just want to explore your options, make sure you compare offers, understand your LAP interest rate, and loan against property eligibility carefully.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!