Instant Loan Against Mutual Funds in India 2025 – Lowest Interest, Fast Processing, No CIBIL Required!

Harsh Jain

Harsh Jain

In 2025, financial needs can come knocking anytime — be it for a family wedding, medical emergency, business growth, or unexpected bills. The good news? You don’t have to liquidate your mutual fund investments. Instead, you can unlock their value through a Loan Against Mutual Funds (LAMF) — one of the smartest, fastest, and most affordable funding options available today.

This article is your complete guide to loan against mutual funds in India, explaining how it works, who can apply, current interest rates, digital options, and answers to real-world questions people are searching for right now.

What is Loan Against Mutual Fund (LAMF)?

Loan Against Mutual Funds (LAMF) is a type of secured loan where you pledge your mutual fund units as collateral to get instant money from banks or NBFCs. You don’t need to redeem or sell your investments — they stay intact, continue to grow, and you get access to liquidity when you need it most.

Still wondering what a loan against a mutual fund?

It’s like borrowing money against your assets without losing ownership — a win-win.

How Does a Loan Against a Mutual Fund Work?

Here’s how a loan against a mutual fund works in 2025:

Choose Mutual Fund Units to pledge (equity or debt).

Apply online or offline with a bank, NBFC, or fintech lender.

The lender evaluates your fund’s value and approves up to 80–90% of its NAV.

The loan is disbursed instantly or within 24–48 hours.

You repay in flexible EMIs, and your funds are unpledged after repayment.

It’s safe, fast, and paperless, especially with digital loans against mutual funds.

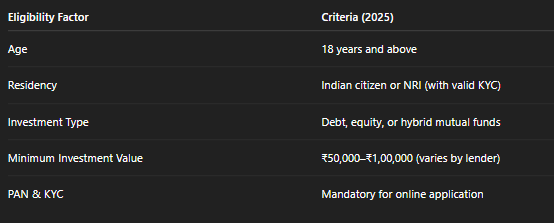

Eligibility Criteria for Loan Against Mutual Funds

Here’s the latest loan against mutual funds eligibility guide:

LAMF eligibility is simple and ideal for salaried individuals, self-employed professionals, and even small business owners.

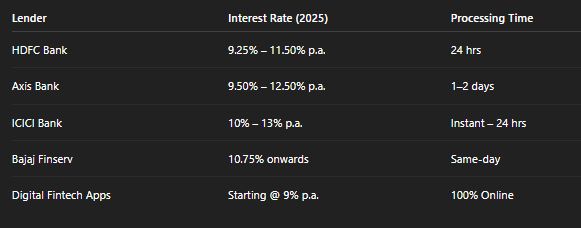

Latest Interest Rates on Loan Against Mutual Funds (2025)

Here’s a comparison of the loan against mutual funds interest rate today from top banks and NBFCs:

You can even get an instant digital loan against a mutual fund interest rate quote on many platforms now.

Apply for Digital Loan Against Mutual Fund — 100% Online

Gone are the days of paperwork. In 2025, applying for a digital loan against a mutual fund is as easy as ordering food online.

Step-by-Step Process:

Go to the lender’s official website or app.

Log in using PAN or mutual fund folio.

Select the mutual fund units to pledge.

Choose loan amount & tenure.

E-sign the agreement and receive money in your account!

Platforms like Groww, Zerodha, and CAMS-backed portals now support loan against mutual funds online processing.

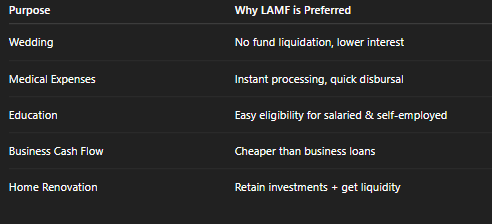

Top Use Cases — Why Indians Are Taking Loans Against Mutual Funds in 2025?

People across India are opting for LAMF instead of personal loans or credit cards because it offers better terms.

Most searched queries in 2025:

Can I get a loan against mutual funds for wedding expenses?

Is it better than a personal loan for emergencies?

Can self-employed professionals apply?

What’s the current loan against shares interest rate vs mutual funds?

Here’s why LAMF is becoming popular:

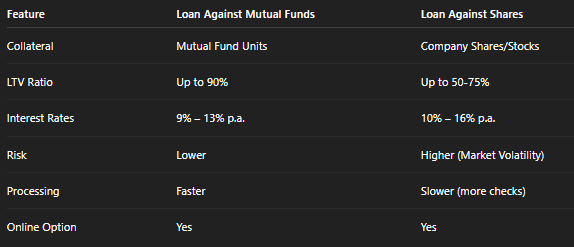

Many users ask: “Should I choose a loan against a mutual fund or a loan against shares?”

Let’s compare both:

Verdict: If you want lower risk and higher value, go with loan against mutual fund units.

Features of Loan Against Mutual Funds You’ll Love

Still deciding? Check these features of the loan against mutual funds that make it 2025’s smartest loan option:

No need to sell investments

Interest is charged only on the used amount

Continue earning returns on pledged funds

A 100% digital journey is possible

Instant top-ups on existing loans

Also, loan against mutual funds explained clearly on most lender websites now includes video walkthroughs and calculators.

FAQs — Most Asked Questions in 2025

Q1. Is a loan against mutual funds safe?

Yes, your units remain invested, and no ownership is transferred. You continue earning returns.

Q2. How much loan can I get?

You can get up to 90% of NAV value of pledged funds, depending on the lender.

Q3. Can I take this loan without CIBIL?

Some fintechs offer loan against mutual funds without CIBIL if fund value is high.

Q4. Is it available for SIP mutual funds?

Yes, as long as they are in your demat/folio and can be pledged.

Q5. What happens if I don’t repay?

The lender has the right to liquidate the pledged units to recover the dues.

Final Thoughts — Why LAMF is the Smartest Move in 2025

If you have mutual fund investments and need quick cash without disrupting your wealth creation goals, a loan against mutual funds is your best friend in 2025. With zero paperwork, low interest, and instant approval, it’s becoming the preferred choice over traditional loans.

Whether you’re planning a wedding, facing an emergency, or looking to manage short-term expenses, go the smarter route — unlock your investments instead of breaking them.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!