Apply Wedding & Travel Loan Instantly – Best Personal Loan Offers for Women & Salaried

Harsh Jain

Harsh Jain

When Life Demands Urgency, Money Shouldn’t Take Time

Emergencies don’t wait for documents. Whether you’re self-employed, a homemaker, planning your daughter’s wedding, or just craving a vacation, funds shouldn’t be hard to access. Traditional banks often say no due to CIBIL issues or missing income proof.

That’s why 2025 is seeing a boom in instant personal loans online — quick approvals, easy eligibility, no credit check, and minimal documents.

Let’s discover how you can apply online personal loan instantly and get fast cash without unnecessary delays.

Who Benefits from Instant Personal Loans in 2025?

1. Instant Personal Loan for Self-Employed Professionals

Are you a freelancer, shop owner, designer, or consultant? If yes, banks often hesitate due to irregular income. But with new-age NBFCs and digital lenders, you can now get a loan for self-employed individuals using just your bank statements, GST details, or invoices.

No salary slips. No CIBIL hassles. Just quick disbursal loan solutions.

2. Personal Loan for Women — Empowering Dreams

From homemakers to female entrepreneurs, financial freedom is for every woman. Now, personal loans for women are designed with relaxed eligibility, lower interest, and quick online approval.

Even personal loan options for housewives are available, whether for education, household needs, or family emergencies.

No regular income? No problem. Apply online and get funds within days.

3. Wedding Loan Without Credit Score Check

Planning a wedding in India is no small feat. Venue, décor, outfits, and guest lists can add up fast. With a personal loan for marriage, you can now pay for your big day without dipping into long-term savings.

Fast funds, zero collateral, and no CIBIL check required.

4. Travel Loan Online — For Vacations and Urgent Trips

Need a break? Or have a sudden travel emergency? A travel loan online can provide you with instant funds to book tickets, accommodations, or cover other trip expenses.

Apply online, upload basic KYC, and enjoy instant loan approval for your next adventure.

5. Personal Loan for Education or Upskilling

Taking up a course or certification? Many platforms now offer personal loans without income proof or collateral for upskilling, education, or professional certifications.

No more putting your career goals on hold.

Why Apply Online Personal Loan Instantly?

Here’s why millions of Indians now prefer online instant loans over traditional banks:

No Income Proof Needed in many cases

Loan Without CIBIL — Low credit score? Still eligible

100% Digital Application Process

Instant Loan Approval — within 5 minutes to 48 hours

Quick Funds Transfer to your bank account

Flexible Usage — Use it for travel, wedding, business, or personal needs

No Collateral or Guarantor Needed

Documents Required for Instant Loan Without Salary Slip

If you’re applying for a loan as a self-employed individual, you don’t need salary slips. Just a few basic documents:

Aadhaar Card + PAN Card

Bank Statements (last 6–12 months)

GST Registration or Business Proof (if available)

Recent Passport Size Photo

Alternate income proofs (optional)

Many fintech platforms now provide loans without income verification if you have an active bank account and decent transaction history.

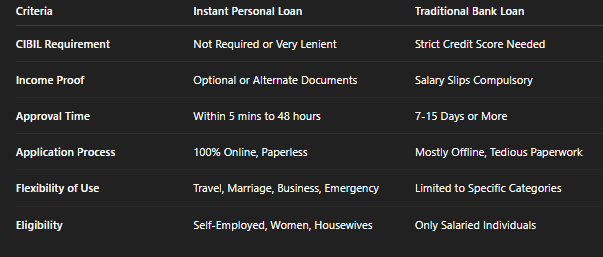

Instant Loan vs Traditional Loan — A Quick Comparison

How to Apply Online for an Instant Personal Loan in 2025?

Follow these simple steps to get an instant cash loan without CIBIL or income proof:

Choose a Trusted Platform: Use portals like InvestKraft or licensed NBFCs with high approval rates.

Select Loan Type: Choose from options like personal loan for women, marriage loan, travel loan online, or loan for self-employed.

Fill Out Basic Details: Enter name, mobile number, Aadhaar, PAN, etc.

Upload Soft Copies of the Required Documents: KYC + bank statement + business proof.

Submit and Wait: Most platforms provide instant approval or decision within 24 hours.

Get Funds Directly in Your Bank: No branch visit, no delay.

Real Stories — Trust from Real People

As a small bakery owner, getting a traditional loan was impossible. With an online loan for the self-employed, I got ₹1.5 lakh approved in 2 days and upgraded my kitchen. — Neha, Pune

I’m a housewife and got ₹50,000 without any income proof for my son’s school admission. Personal loan for housewife works! — Sangeeta, Jaipur

We used an instant loan for marriage to book our wedding venue. Super quick, no tension. — Ravi & Priya, Delhi

Frequently Asked Questions (FAQs)

Q1. Can I apply online personal loan instantly without CIBIL?

Yes, many NBFCs offer loans without a CIBIL check or approve applicants with low scores.

Q2. Is income proof mandatory for online loans?

Not always. You can get a personal loan without income proof using alternate documents like bank statements.

Q3. What is the approval time for instant loans?

Instant personal loans usually have immediate best vehicle loan online or approval within 24–48 hours.

Q4. Are housewives eligible for personal loans?

Yes. Many lenders provide personal loans for housewives with relaxed conditions.

Q5. Is it safe to apply for a loan online?

Absolutely. Use only secure and RBI-compliant platforms for safety and fast service.

Final Words: Your Freedom, Your Funds — Apply Today!

Whether you’re self-employed, a homemaker, a newlywed, or simply need urgent money, don’t let income proof or CIBIL issues stop you.

With the rise of instant personal loan approval platforms, you can now apply online personal loan instantly and get the money you need , without income slips, without a credit score, and without stress.

Use platforms like InvestKraft to explore customized personal loan options in 2025 with minimal paperwork and high approval rates.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!