₹40,000 Salary? Here's How You Can Get a ₹50 Lakh Home Loan in 2025 – Lowest EMI & Fast Disbursal

Harsh Jain

Harsh Jain

Want a Big Home Loan on a Small Salary? Here’s Your 2025 Roadmap

Securing a ₹50 lakh home loan on a modest ₹40,000 salary may sound impossible. But in 2025, it’s absolutely within reach! With instant online home loan application approval, a fully paperless process, and a boom in digital lending platforms, salaried professionals can now enjoy housing home loan benefits without the old-school hassles.

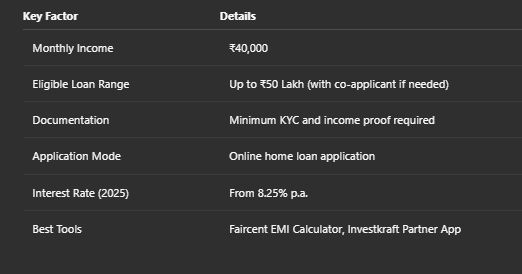

Quick Snapshot

How You Can Qualify for a ₹50 Lakh Loan on ₹40K Monthly Salary

Lenders assess multiple factors, not just income:

Your CIBIL score and credit history

Whether you add a co-applicant

Loan tenure

Your existing EMIs

Online lenders like Upwards, Fullerton India, and Faircent now offer tailored instant home loan solutions with minimal processing charges and competitive interest rates.

Documents Needed for Instant Approval

To get a paperless home loan process for salaried employees, keep the following ready:

Aadhaar/PAN (KYC)

Last 6 months’ salary slips

Bank statement

Form-16 or ITR

Property documents (if applicable)

Apply via trusted house loan apps or platforms like site: investkraft.com to speed things up.

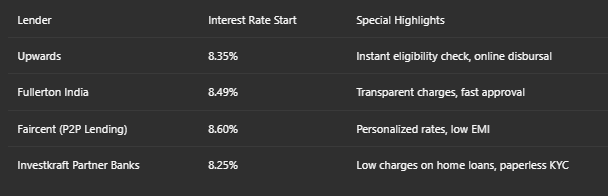

2025 Interest Rate Comparison Table

Wondering which bank home loan interest is low? Always compare before applying!

Choose the Right Loan Type for Your Needs

Different loan types cater to different goals:

Housing home loan: For a ready-to-move property

Loan for building a house on own land: Disbursed in stages

Top-up loan on home loan: For those already servicing a loan

Each has benefits. For example, top-up loan benefits for existing home loan customers include lower interest rates and no need for new documents.

Online Application is the New Norm

Gone are the days of physical paperwork. The instant online home loan application approval process includes:

Eligibility check using tools like the Faircent EMI Calculator

E-verification of KYC & income

Real-time offer generation from lenders

Approval & disbursal in under 72 hours

Platforms like Investkraft partner with apps to offer one-click loan processing.

Fixed vs. Floating Interest Rate: Understand the Difference

Confused about what interest rate suits you?

Fixed: Great for long-term EMI stability

Floating: Changes with market rates (can save money if rates drop)

Knowing the difference between fixed and floating home loan rates is key to choosing the best repayment plan.

What Are the Charges Involved in 2025?

Many borrowers ask, What are the charges for a home loan? Here’s a breakdown:

Processing Fees: 0.5% — 1%

Incidental Charges: Includes technical/legal verification. Always clarify what is incidental charges are in a home loan before signing.

Insurance Charges: Optional loan protection

Prepayment Penalty: Nil for floating rate loans

Transparency is crucial — all charges are shared on platforms like Investkraft.

Smart Tools to Help You Plan

Use these to calculate eligibility and compare offers:

Check home loan eligibility calculator online (Investkraft or Upwards)

Faircent EMI Calculator to estimate monthly EMIs

Compare offers with home loan investment planners

Home Loan on a ₹40K Salary: Real Talk

Yes, you CAN qualify for a high-value loan with a low income. Here’s how:

Opt for a longer tenure (20–30 years)

Add a spouse or parent as a co-applicant

Choose lenders who specialize in home loan amount eligibility for ₹40k income earners

Your income isn’t the only factor — smart planning plays a huge role.

Home Loan as an Investment in 2025

A home isn’t just a shelter; it’s an asset. In 2025:

Property prices are rising

Tax benefits on home loans still apply (Sec 80C, 24B)

EMI structures are more manageable

So yes, home loan investment is smarter than ever before.

Top 5 FAQs

Q1. Can I apply for a home loan with only ₹40K salary?

Yes, especially if you add a co-applicant or extend the loan term.

Q2. Is there a benefit in applying through a house loan app?

Absolutely. You get instant offers, status tracking, and minimal documentation.

Q3. What documents are needed for an online home loan application?

Basic KYC and income proof. The process is fully paperless.

Q4. How do I know if the charges are fair?

Use platforms like Investkraft.com that display all charges on a home loan.

Q5. Which loan type suits property construction?

Opt for a loan for building a house on your land with stage-wise disbursal.

Final Word

Getting a home loan of ₹50 lakh in 2025 is no longer just for high-income earners. With a paperless home loan process, low interest rates from partners like Fullerton India and Upwards, and platforms like Investkraft, your dream home is just an application away.

Take the first step today: Apply for a home loan online and build your future on solid ground!

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!