Loan Against Property in India for Medical, Wedding & Business Needs – Online Apply in India

Harsh Jain

Harsh Jain

Looking to meet big financial goals without selling your home or shop? Whether you’re a salaried employee dealing with rising expenses or a self-employed individual managing cash flow gaps, a Loan Against Property (LAP) can be your safest and smartest financial move in 2025.

In this detailed guide, we’ll cover everything — from interest rates, eligibility, and documents, to how to apply for a loan against property online with instant approvals.

What Exactly is a Loan Against Property?

A Loan Against Property or LAP loan is a secured loan where you pledge your owned property — be it residential, commercial, or even a plot — to borrow money from a bank or NBFC.

Unlike personal loans, where interest rates are high and tenure is short, loan against property in India offers lower interest rates, longer tenure, and higher loan amounts, making it ideal for medical expenses, home needs, weddings, or even business expansion.

When Should You Choose LAP?

People across India are now shifting from credit cards and personal loans to fast loan against property solutions. Here’s when it makes sense:

Planning a big wedding

Urgent medical treatment

Renovating your home

Need working capital for your business

Paying for higher education

With easy access to an immediate loan against property, even time-sensitive needs can be met without stress.

LAP for Salaried vs Self-Employed: Who Can Apply?

Whether you’re a salaried professional or a small business owner, you can apply for LAP if you own a property. Let’s break it down:

LAP for Salaried Individuals

Steady monthly income

Use LAP for home expenses, renovation, or medical bills

Want to know how to apply for a loan against property for salaried individuals? Read on!

LAP for Self-Employed Individuals

Running a business or freelance career

Use LAP for medical expenses, business expansion, or emergencies

Many lenders now offer loans against property for self-employed individuals for medical expenses

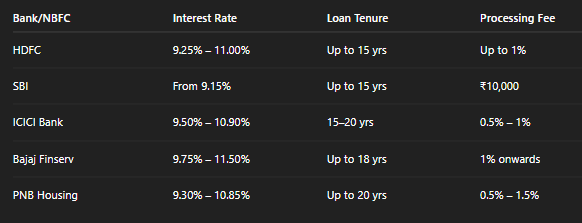

Latest LAP Interest Rates in India (2025)

Compare before you apply — each bank offers different loan against property features for self-employed individuals and salaried borrowers.

Key Benefits of Applying for LAP in India

High loan amount (up to ₹5 crore+)

Long repayment period (up to 20 years)

Lower EMIs compared to personal loans

Retain property ownership

Suitable for salaried & self-employed

If you’re searching “how to raise a loan against property”, the answer lies in understanding the eligibility, documentation, and application process.

Step-by-Step: How to Apply for a Loan Against Property Online

Looking for an online loan against property? Here’s how to do it in 2025 without visiting a branch:

How to Apply for LAP Online:

Visit the official bank/NBFC website

Choose the LAP section

Click “Apply for loan against property online.”

Fill in basic personal and property details

Upload KYC & income documents

Get pre-approval within 30 mins

Final disbursal within 3–7 working days

Now, even an instant loan against property is possible through platforms with 100% digital processing.

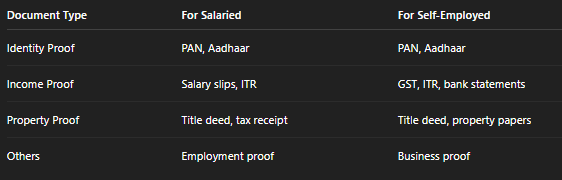

Required Documents for LAP Application

If you’re unsure how to apply for LAP, most lenders will guide you at every step during the online process.

Understanding Common LAP Terms

Let’s clear up common confusion:

LAP Loan Against Property: Loan taken by pledging property

Salaried LAP Meaning: LAP offered to salaried individuals based on income stability

Loan Against Property LAP India: Refers to LAP products offered by Indian banks/NBFCs across cities

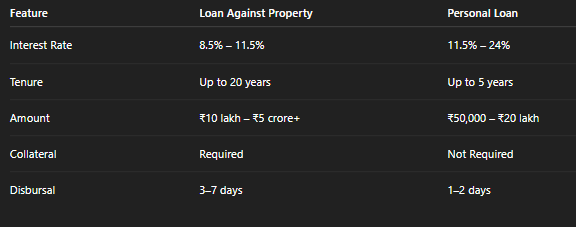

LAP vs Personal Loan — Which Should You Pick?

Verdict:

Choose Loan Against Property for high loan amounts, better rates, and longer tenures.

Go for a Personal Loan only if you need small, short-term funds quickly without pledging assets.

Use Cases of LAP in India (Real-World Examples)

Ramesh (Salaried, Pune) — Used loan against property for home expenses like renovation and furniture

Sneha (Entrepreneur, Delhi) — Applied for lap loan against property to fund her startup

Amit (Freelancer, Mumbai) — Got an instant loan against property after applying online for a family medical emergency

Important Tips Before You Apply

Always compare banks for interest rates and charges

Use a LAP EMI calculator for better planning

Don’t go beyond 60% of your property’s value

Read about foreclosure or prepayment charges

Frequently Asked Questions (FAQs)

1. How fast can I get a loan against property in India?

With digital processing, you can now get an immediate loan against property in as little as 48 hours.

2. Can I apply for LAP without a job?

If you’re self-employed with stable income and proper documents, yes — many lenders offer loan against property features for self-employed individuals.

3. Is a LAP better than a personal loan?

Yes, if you want a bigger loan at a lower rate and can pledge property. LAP also offers longer repayment flexibility.

4. How to apply for a loan against property for salaried individuals?

Choose a lender, fill online form, submit documents like salary slips, PAN, Aadhaar, and property proof — done!

5. What is the procedure for a loan against property?

From checking eligibility to online application, document submission, property valuation, and loan disbursal — it’s a smooth 5–step journey now.

Final Thoughts: Turn Your Property into Power

In 2025, don’t let your owned assets stay idle. Use them smartly.

Whether you’re salaried or self-employed, taking an online loan against property gives you quick access to big funds at affordable rates — all while keeping ownership intact.

With growing digital platforms and simplified approvals, you can now apply for LAP with ease and get your financial goals on track without delays.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!