Need Cash Fast? Get Instant Personal Loan Online Without Documents or Proof

Harsh Jain

Harsh Jain

Are you stuck with a low income or a bad credit score? Don’t worry — you’re not alone. Thousands of Indians today are turning to smarter, faster solutions to access funds without the stress of traditional banking. Whether you’re a salaried employee earning ₹10,000 or a small business owner without proof of income, you can still get an instant personal loan online — no bank visit, no long queues, and absolutely no paperwork hassle.

What’s the Problem Today?

Most people face one of these roadblocks:

Low monthly salary (like ₹10,000–₹20,000)

Low CIBIL score or no credit history

No ITR, salary slip, or bank statement

Self-employed with no formal proof

Sound familiar? The good news: digital lending apps in India now offer instant personal loans without CIBIL, no income proof, and even loans without a bank statement or salary slip.

Whether you’re located in Delhi NCR, Lucknow, Nagpur, Indore, or Guwahati, the process is the same: 100% online and instant.

Why Online Personal Loans Are the New Go-To in 2025

The rise of online personal loan application platforms in India is changing the game. Here’s why they’re booming:

Instant approval within 5 minutes

1-hour loan disbursement

No need to visit a bank

Approval even with a low CIBIL or a low salary

Available across major cities and small towns

Apps offering cash loans, instant funds, and instant personal loans are now trusted alternatives to traditional banking — faster, paperless, and available 24/7.

Who Can Apply for an Instant Personal Loan?

Salaried professionals with ₹10,000+ monthly income

Self-employed individuals without ITR

People with bad credit history or a low CIBIL score

Small business owners in urgent need of funds

Even if you’re looking for a quick personal loan or quick money loans, you can now apply for a personal loan online from your smartphone.

Many users also search for:

Insta Loan without income proof

Instant Personal Loan for self-employed without proof

Easy loan approval without a CIBIL check

Key Features of Instant Personal Loan Apps

Disbursal amount: ₹5,000 to ₹5,00,000

Tenure: 3 months to 5 years

Minimal documents

Available even with poor credit

Simple EMI calculator tools

Personal Loan Instant Approval System

24/7 access

Some apps that offer a high approval rate: KreditBee, Nira, CASHe, PaySense, Navi, and MoneyTap.

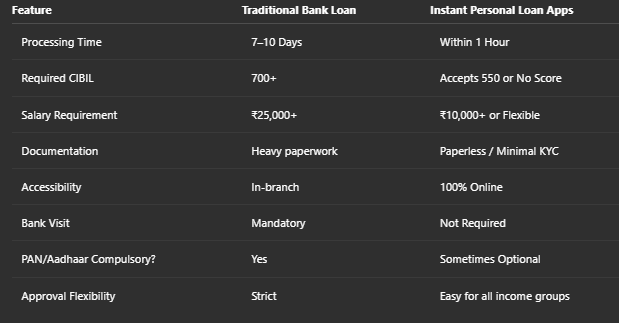

Comparison Table — Traditional Bank vs Instant Personal Loan Apps

Download any top personal loan app in India (KreditBee, Navi, etc.)

Register using your mobile number

Fill in KYC details (Aadhaar, PAN — optional in some cases)

Mention your income (₹10,000+ or business earnings)

Choose loan amount and EMI

Submit and wait for instant personal loan approval

Funds credited to your account — most within 1 hour

Real User Example

Suman, a 28-year-old marketing executive from Lucknow, earns ₹12,000/month and has a 580 CIBIL score. Traditional banks rejected her loan application. She turned to a personal loan app that offered a personal loan without a CIBIL check. Within 30 minutes, ₹25,000 was disbursed — no documents, no questions, no bank visit.

Similarly, a small shop owner from Indore needed funds for stock. No income proof? No problem. Using a quick personal loan app, he got ₹35,000 within an hour.

Top Benefits of Going Digital

No awkward conversations at bank counters

Instant cash loans are available 24/7

Apply with minimal documentation

Get approval even with a low score or no salary slips

Personal loan with ₹10,000 salary is no longer a dream

Apps offer customized solutions for:

Self-employed without proof

Freelancers or gig workers

Students or early learners

Unorganized sector workers

Expert Tips to Maximize Approval Chances

Use your active bank account with digital salary credit

Keep UPI or net banking enabled for KYC checks

Don’t apply to multiple apps at once

Start with smaller loan amounts

Build a credit score with timely repayment

Frequently Asked Questions (FAQs)

Q1. Can I get a personal loan with a ₹10,000 salary in India?

Yes. Many online platforms now offer instant personal loans to users with low monthly income starting at ₹10,000. Approval depends on your profile.

Q2. What if my CIBIL score is poor or zero?

You can still apply for an instant personal loan without a CIBIL. Many NBFCs and digital lenders rely on alternative checks.

Q3. Is it safe to apply for a personal loan online?

Yes, if you use a reputed RBI-registered NBFC app. Always check reviews and ensure secure data practices.

Q4. Can I apply without a salary slip or a bank statement?

Yes, some platforms allow a loan without a bank statement or salary slip if you have digital footprints like UPI or app-based transactions.

Q5. How fast can I get disbursed loan money?

If approved, loan disbursement happens within 1 hour, sometimes even in 5–10 minutes.

Final Words — Get Funded Fast, No Paperwork, No Delay

In 2025, don’t let low salary, bad CIBIL, or missing documents stop you. With the rise of digital lending, you can get the best personal loan online in India with:

Quick approval

Flexible EMI

No bank visits

From salaried employees in Delhi NCR to small business owners in Guwahati, millions are already benefiting. Apply now. Get funds in minutes. Change your life today.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!