Caught in a Tax Trap? Why You Need a Criminal Tax Lawyer in NYC

Thorgood Law

Thorgood LawIntroduction

Think of your taxes like a fragile glass maze — one misstep can shatter everything. For many people, tax time is already stressful. But when those problems escalate into criminal territory, the stakes skyrocket. That’s where a criminal tax lawyer comes into play. Whether you’re navigating IRS scrutiny or facing charges, having the right legal expert on your side — especially a trusted criminal tax attorney NYC or New York tax defense attorney — can protect your financial future and your freedom.

This article simplifies the complex world of criminal tax law so you know what to expect and how to act. We’ll even break down unique concepts like lease incentive tax treatment, and how that can unexpectedly pull businesses into legal trouble.

What Is Criminal Tax Law?

Criminal tax law refers to violations of the tax code that involve deliberate wrongdoing — think tax evasion, filing false returns, or obstructing the IRS. While civil issues deal with unintentional mistakes, criminal tax cases focus on intent. If the IRS believes you meant to cheat the system, the matter becomes criminal, and penalties become much more severe.

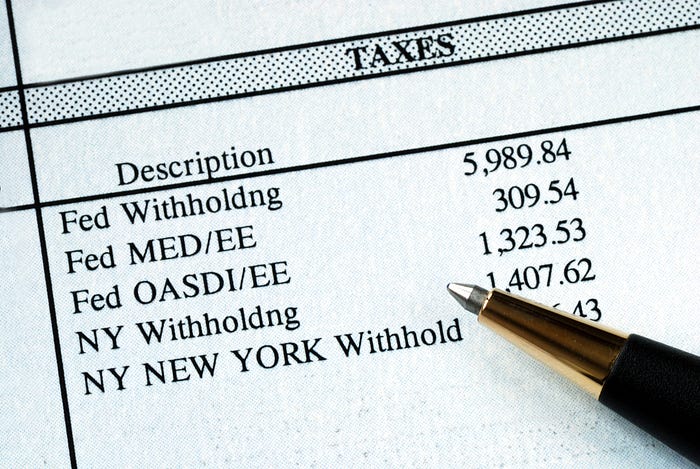

Common Criminal Tax Offenses

Some common offenses include tax evasion, intentionally failing to file tax returns, submitting false documents, or underreporting income. Business owners might also get into trouble for not paying employment taxes or misclassifying workers. Any of these actions — especially if repeated or involving large amounts — can trigger an investigation and potential criminal charges.

When Does a Tax Issue Turn Criminal?

A tax problem becomes criminal when the IRS believes there was intent to defraud or deceive. One late return might not be a big deal, but a pattern of false reporting, hiding income, or creating fake deductions shows willfulness. That’s what separates an honest mistake from a crime. The IRS uses forensic accountants and investigators to spot these patterns — and once they do, you’re no longer in civil territory.

Why You Need a Criminal Tax Lawyer

When you’re facing a criminal tax matter, having a criminal tax lawyer is like having a firefighter when your house is on fire. They understand the intricate tax laws, know how the IRS prosecutes these cases, and can craft a strategy to protect your rights and minimize damage. Without one, you’re navigating a legal maze blindfolded.

Traits of a Great Criminal Tax Attorney NYC

Choosing a skilled criminal tax attorney NYC can make or break your case. The best ones bring a combination of sharp legal insight, familiarity with IRS practices, and courtroom confidence. They also need to be great communicators, both with clients and government agencies. NYC’s legal landscape is tough — you need someone who’s even tougher.

How a New York Tax Defense Attorney Builds Your Case

A New York tax defense attorney dives deep into your financial records, analyzes the IRS’s evidence, and looks for errors, overreach, or procedural missteps. They might bring in forensic accountants or negotiate with prosecutors to reduce charges. They aim to either dismiss the case or settle it favorably before trial.

The IRS Criminal Investigation Division: What You Should Know

The IRS Criminal Investigation Division (CID) isn’t your average government office. These agents are law enforcement officers who investigate suspected tax crimes. They carry badges and firearms, and they don’t show up unless the IRS has serious concerns. If you hear from CID, it’s a flashing red warning light to call a lawyer immediately.

Facing Tax Charges in NYC? Here’s What to Do

If you’re under investigation:

Do not talk to the IRS or CID agents without your attorney present.

Preserve all documents — never delete emails or shred paperwork.

Seek immediate counsel from a criminal tax attorney near NYC.

Avoid making statements that could be interpreted as an admission.

Silence and preparation are your best allies at this stage.

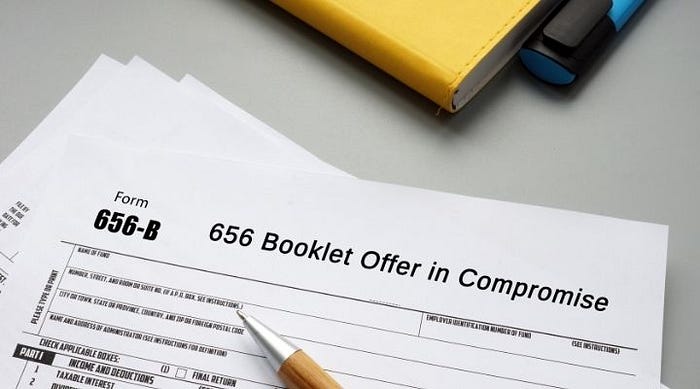

The Role of Lease Incentive Tax Treatment in Business

Lease incentive tax treatment might sound like accountant-speak, but it has real-world implications. When a landlord offers financial perks — like cash payments or property upgrades — to get a business to sign a lease, those incentives need to be reported correctly for tax purposes.

Misreporting or misunderstanding how to treat these incentives can trigger an audit or worse, an investigation. That’s why it’s crucial to have an experienced tax professional or attorney guide you through the process.

Real-Life Examples of Criminal Tax Cases

Consider a New York restauranteur who hid cash earnings to avoid taxes. Eventually, employees tipped off the IRS, leading to a full-blown investigation. The owner was convicted of tax evasion and served 18 months in prison.

In another case, a corporate executive misreported lease incentives and overstated deductions. The discrepancy triggered an audit that uncovered falsified documents, resulting in criminal charges.

These examples show how even small decisions can snowball into major legal battles if handled poorly.

Penalties You Could Face for Tax Crimes

Tax crimes come with severe consequences. A conviction can lead to large fines, restitution payments, and jail time. You might also lose professional licenses, business privileges, or contracts. Beyond legal penalties, the emotional and reputational damage can be devastating.

For example, tax evasion can bring up to five years in prison and a $250,000 fine per offense. Filing a false return? That’s up to three years. And these penalties stack if there are multiple violations.

The Legal Process: From Investigation to Trial

The process typically starts when the IRS flags suspicious returns. CID then opens a case, conducts surveillance, interviews witnesses, and may issue subpoenas. If enough evidence is found, the Department of Justice gets involved and formal charges are filed. Your attorney may negotiate a deal or proceed to trial. The entire journey can take months — or even years.

Civil vs Criminal Tax Issues: Know the Difference

The main distinction lies in intent and consequence. Civil issues stem from errors or oversight, leading to penalties and interest. Criminal issues involve willful misconduct and lead to prosecution. If you’re unsure where your situation falls, consulting a New York tax defense attorney is your safest bet.

How to Avoid Tax Trouble in the First Place

Avoiding criminal tax problems begins with accurate record-keeping and honesty in reporting. Work with reputable accountants, review your filings thoroughly, and ask questions when unsure. If you run a business, educate yourself on employer obligations and seek legal advice when major financial decisions — like lease incentives — are involved.

Finding a Criminal Tax Attorney Near NYC

To find a reliable criminal tax attorney near NYC, start by researching online reviews, bar associations, and professional directories. Look for lawyers who specialize in criminal tax law and have a track record of defending similar cases. Interview multiple candidates and choose one who listens well, explains clearly, and gives you confidence.

Conclusion

Criminal tax issues aren’t just a legal headache — they can become life-changing disasters. Whether you’re being audited, investigated, or formally charged, the right criminal tax lawyer can be your strongest defense. If you’re in New York, having an experienced criminal tax attorney NYC or New York tax defense attorney on your side can protect your livelihood, your reputation, and your freedom.

Tax trouble doesn’t disappear on its own. Take control today — before the IRS takes control for you.

Frequently Asked Questions (FAQs)

1. What does a criminal tax lawyer do exactly? They specialize in defending individuals or businesses accused of tax crimes, guiding them through investigations, negotiations, and, if necessary, court proceedings.

2. How do I know if I need a criminal tax attorney near NYC? If the IRS has contacted you about potential fraud or opened a criminal investigation, it’s time to speak with a lawyer.

3. What is lease incentive tax treatment?

It refers to how financial or property-related incentives given in lease agreements are reported and taxed. Incorrect reporting can lead to penalties or investigations.

4. Can a New York tax defense attorney help with state and federal matters?

Yes, many are qualified to handle both types of cases, ensuring consistent and informed legal support.

5. What’s the difference between a CPA and a criminal tax attorney?

A CPA manages finances and tax filings; a criminal tax attorney defends you in legal matters when those filings become the subject of investigation or prosecution.

Subscribe to my newsletter

Read articles from Thorgood Law directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Thorgood Law

Thorgood Law

At Thorgood Law Firm in New York, we are IRS attorneys dedicated to bringing legal counsel to taxpayers across the United States. Our attorneys represent individuals and businesses across the country on matters relating to their taxes and on disputes they have with the IRS or New York State taxing authorities.