Home Loan Without Income Proof or Heavy Documents – Instant Online Apply in 2025!

Harsh Jain

Harsh Jain

Dreaming of your own house but stuck with a low income, missing ITR, or no CIBIL score? You’re not alone. In 2025, thousands of Indians with ₹10K–₹40K salaries are getting instant home loan approvals online , with minimum documentation, low interest rates, and no income proof required.

Skip the queues. Forget paperwork. Let trusted platforms like Investkraft, Upwards, and Fullerton India get you a home loan — faster, smarter, and stress-free.

Why Users Are Ditching Traditional Banks in 2025

People search daily for:

“Home loan online without documents”

“Which bank gives a home loan without a salary slip?”

“Instant home loan approval 2025”

Because the old way is broken. Long queues, heavy documents, rejections — nobody wants that.

Here’s what Investkraft loan partners offer:

Apply in 1 minute — No salary slip needed

Real-time eligibility check — even with low CIBIL

Compare 30+ offers instantly

Minimum docs, maximum trust

How to Apply for a Home Loan Online (Step-by-Step)

Go to Investkraft.com

Click ‘Apply Now for Home Loan’

Enter mobile number, income & property details

Upload PAN + Aadhaar (optional: bank statement)

Choose from lenders like Upwards, Fullerton, Axis Bank, etc.

Get instant approval or a pre-approved offer

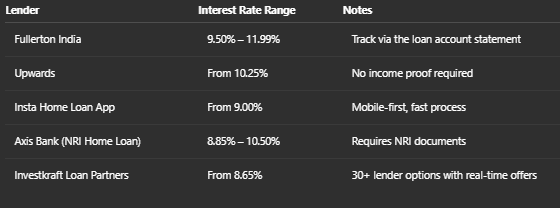

Real Interest Rates You Can Get in 2025

Documents Required for Instant Home Loan

In 2025, lenders don’t need bulky files. Most offer a home loan with minimum documentation:

PAN Card + Aadhaar

Property Paper (Sale Agreement)

Optional: Salary slip or bank statement (only for high loan amounts)

Need a home loan without income proof? Yes — it’s possible with Investkraft and NBFC tie-ups.

Charges to Know Before You Apply

Users often ask:

What is an incidental charge in a home loan?

How much is the processing fee?

Here’s a breakdown:

Processing Fee: 0.25% — 1.5%

Incidental Charges: For valuation/legal (₹2,500–₹5,000 approx)

Prepayment Charges: Mostly NIL (for floating rates)

Stamp Duty: State-wise applicable

Popular Types of Home Loans in 2025

Whether you’re buying, building, or renovating — there’s a loan for that:

Ready Property Home Loan

Home Construction Loans

Top-Up Loan on Home Loan

NRI Housing Loan (See Axis Bank NRI documents)

Investment Property Loan

Loan Against Property (Apply for LAP Online)

Calculate Before You Borrow

Use free tools before applying:

Faircent EMI Calculator

Home Loan Interest Rate Calculator

Housing Loan EMI Calculator

Home Loan Eligibility Calculator — How much loan can I get on ₹40,000 salary?

Example: For a ₹40K salary, you can get ₹22–28 Lakhs with flexible EMI tenure.

Real Story: How Ravi Got ₹20 Lakh Loan on ₹12K Salary

Ravi, 23, works in digital marketing, earning ₹12,000/month. Banks rejected him due to no ITR.

He:

Visited Investkraft.com

Uploaded PAN & Aadhaar only

Got matched with an Upwards Loan offer in minutes

Loan of ₹20 Lakhs approved, disbursed in 3 days

Today, Ravi pays an EMI of ₹9,870/month and even took a top-up loan for home interiors!

Trusted Platforms That Make It Possible

Investkraft — Best home loan offer comparison site

Fullerton India — Track your loan via the account statement portal

Upwards — Famous for no-income-proof loan models

Insta Home Loan App — Fastest disbursal for salaried & self-employed

All of these are available through home loan application online portals. No office visit required.

5 Most Searched FAQs (2025 Edition)

Q1: Can I get a home loan without a salary slip in India?

Yes. NBFCs like Upwards offer loans based on Aadhaar, PAN & property details only.

Q2: What are the total charges on the home loan?

Processing fee (0.25%-1.5%), incidental charges, and stamp duty. Most have no foreclosure fees.

Q3: Which bank’s home loan interest is lowest in 2025?

SBI, Axis, and Investkraft partners start at 8.65%.

Q4: Is a home loan available on a ₹10K–₹20K salary?

Yes, for small ticket size loans (₹5L–₹15L), especially in Tier-2/Tier-3 cities.

Q5: What is needed to apply online for a house loan?

PAN, Aadhaar, mobile number, and basic property details.

Final Words: Your Homeownership Dream Is 1 Click Away

Whether you’re salaried, self-employed, or just starting, 2025 is the best time to apply for a home loan online.

No big paperwork. No awkward questions. Just:

Instant offer check

Minimum documents

Lowest home loan interest rate

Apply now for a home loan from anywhere in India

Click. Compare. Get Approved. Start your journey at Investkraft today!

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!