Instant Loan Against Residential Property – LAP Loan Apply Online in Minutes (2025 Update)

Harsh Jain

Harsh Jain

Discover the Power of Property: LAP Loans in 2025 Made Simple

In 2025, your property can do more than just provide shelter — it can unlock powerful funding without selling or disturbing your asset. Whether you’re a salaried professional needing quick cash for a family emergency or a self-employed individual seeking business capital, a LAP Loan (Loan Against Property) is your smartest option.

Let’s explore this secure, high-value loan in a simple, human way — so you can take confident financial steps ahead.

What is a LAP Loan?

LAP stands for “Loan Against Property” — a secured loan where you mortgage your residential, commercial, or rented property to get a high loan amount at a low interest rate (ROI). This is different from a personal loan, where no asset is pledged.

You don’t lose ownership, and you can still use your property while enjoying funds for:

Higher education

Wedding expenses

Home renovation

Business expansion

Debt consolidation

Medical emergencies

In short: LAP = Your property = Your power

Types of Properties Eligible for LAP

Wondering what kind of properties are allowed for LAP loans in India?

Self-occupied residential properties

Commercial properties like shops or offices

Rented buildings

Vacant plots (some lenders allow)

Make sure the property has a clear title, no legal disputes, and is within the approved municipal area.

LAP Loan Options for Salaried & Self-Employed Individuals

LAP for Salaried Individuals:

If you are working in a private firm, government job, or MNC, and your salary is at least ₹25,000/month , you’re eligible!

This is often called Salaried LAP, and it’s great for:

Handling home expenses

Paying off existing high-interest loans

Managing children’s school or college fees

Many salaried users ask:

“How to apply for a loan against property for salaried individuals?”

The answer is: Online portals, bank websites, or loan aggregators allow 100% digital LAP loan application online options.

LAP for Self-Employed Individuals:

Running a business? You can apply even without a fixed monthly salary. All you need is:

Property in your name

Income documents (ITR or business proof)

Stability in business for 2–3 years

These LAP loans are ideal for:

Expanding your business

Funding working capital

Buying machinery or raw materials

Tip: Want to know how to apply for a loan against property for self-employed individuals? Simply visit your preferred lender’s website and apply online — most offer no branch visits now.

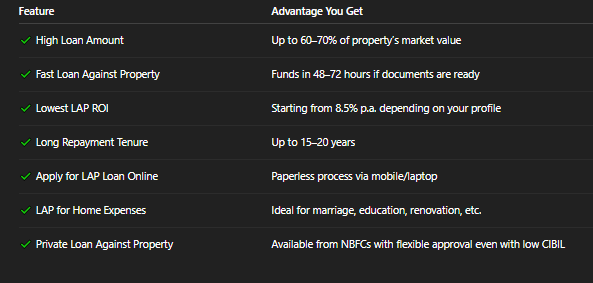

Key Benefits of LAP Loan in 2025

LAP Loan Eligibility Criteria

For Salaried Professionals:

Age: 21–60 years

Income: ₹25,000/month or more

Stable job history (1+ years)

CIBIL score above 650 (preferred)

Property ownership proof

For Self-Employed:

Age: 25–65 years

Business operation history: 2+ years

Income tax returns or bank statements

Clear property ownership

Note: If you meet the basic LAP eligibility, most banks allow you to apply for a loan against property online and get pre-approval in minutes.

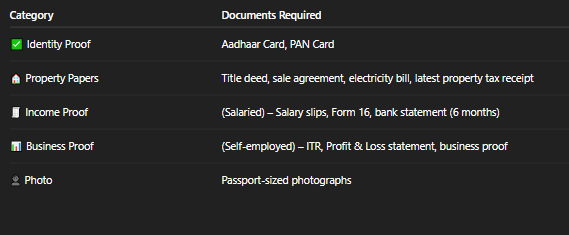

LAP Loan Documents Required in India

Here’s a ready list of common documents you’ll need:

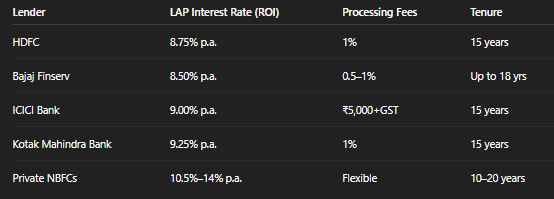

LAP ROI in 2025: Interest Rate Comparison Table

Want the best deal? Use a Loan Against Property ROI Comparison calculator before applying!

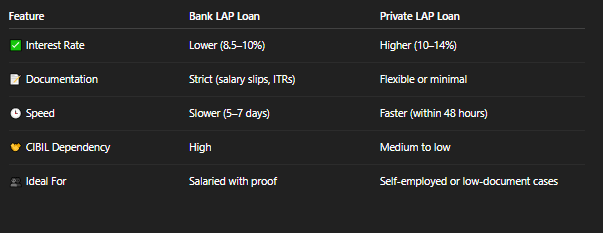

Bank vs Private LAP Loans — Which is Better?

Step-by-Step LAP Loan Process (2025 Edition)

Choose a lender or aggregator website

Click on “LAP Loan Apply Online.”

Fill in your basic details and upload documents

Property valuation and legal checks happen next

Receive a sanction letter

The loan is disbursed to your bank account

No need to visit the branch — your loan against property mortgage is processed from home.

FAQs — Loan Against Property in 2025

Q1. Can I get a LAP loan without a salary slip or ITR?

Yes. Some private loan against property lenders offer approval based on the property and alternative documents.

Q2. What is the ROI for LAP in India right now?

LAP ROI starts from 8.50% p.a. for salaried, and around 10–14% p.a. for self-employed individuals.

Q3. Is LAP better than a personal loan?

Absolutely. LAP gives you higher loan amounts, lower interest, and longer repayment tenure.

Q4. Which banks give the best LAP loan for salaried individuals?

HDFC, ICICI, Axis Bank, and Kotak are popular choices for salaried LAP in 2025.

Q5. What are the charges involved in LAP loan?

You may have to pay:

Processing fee (0.5%–1%)

Legal & valuation fees

Stamp duty (varies by state)

Foreclosure/prepayment charges (in some cases)

Final Takeaway: Turn Property into Progress in 2025

If you’re still sitting on your property without leveraging it, you’re leaving money on the table.

A Loan Against Property (LAP) offers quick funds, lowest ROI, and long-term repayment — all with minimal risk and maximum control.

Whether you’re salaried or self-employed, you can now apply for LAP loan online in minutes, compare offers, and receive approval from the comfort of your home.

Ready to Raise Funds on Your Property?

Apply Now for LAP Loan

Lowest Interest Rate in India

Fast, Hassle-Free, 100% Online

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!