Fast Loan Against Mutual Funds for Salaried or Self-Employed – Low Rates, No Stress (2025)

Harsh Jain

Harsh Jain

Got mutual funds or shares lying idle? In 2025, you won’t need to sell them for emergency funds. Just unlock instant liquidity with a digital loan against mutual funds or shares. Whether you need funds for a wedding, education, or financial planning, this modern credit solution — known as LAMF and LAS — lets you borrow without disturbing your investments.

This guide covers everything: from how to apply loan against mutual funds to LAMF eligibility, documents, limits, features, and even the best use cases.

What is LAMF in 2025 & How Does It Help?

LAMF, or Loan Against Mutual Funds, is a secure and fast digital credit line where you use your mutual fund holdings as collateral to borrow money, without selling or exiting your funds.

Likewise, Loan Against Shares (LAS) allows you to get funding against your equity shares digitally. This means your investments stay intact while you raise quick funds.

You continue earning returns

You avoid exit loads or capital gains taxes

You get fast cash with minimum paperwork

This entire process is now API-driven through LAMF APIs, making it faster and safer than ever.

Digital Loan Against Mutual Fund — How It Works

Applying for a digital loan against mutual funds online is now a 100% paperless and quick process:

Visit a platform offering LAMF loan services (e.g., Zerodha, Groww, banks, or NBFCs)

Log in with PAN and link your mutual fund account

Select eligible funds (Debt, ELSS, Equity, Hybrid, etc.)

Get a real-time loan offer based on NAV

Complete KYC digitally

Accept terms and receive funds instantly

You can even apply directly via your Demat app or AMC portal that supports LAMF API integration.

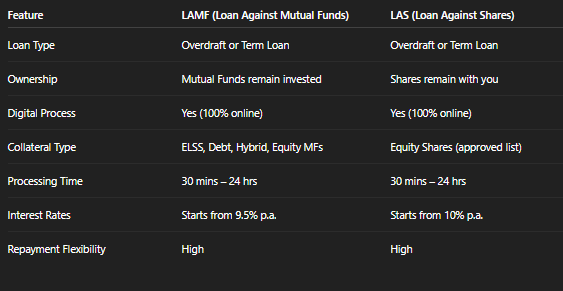

Top Features of Loan Against Mutual Funds & Shares (2025)

When Should You Use LAMF or LAS in 2025?

Loan Against Mutual Funds for Wedding

Big day coming up? Avoid taking personal loans with high interest. Use your funds to back a low-interest LAMF loan.

Loan Against Mutual Funds for Higher Education

Need to fund a degree or course? With A loan against mutual funds for higher education, you get a fast and affordable option without breaking your SIPs.

Loan Against Mutual Funds for Financial Planning

Why break your portfolio when you can apply for a loan against a mutual fund for short-term needs like relocation, travel, or new business setup?

Eligibility & Documents for LAMF in 2025

Getting a LAMF loan is easier than ever.

LAMF Eligibility (Basic Conditions):

Age: 21 to 65 years

An Indian resident with a valid PAN & Aadhaar

Owns eligible mutual funds or shares

Not a defaulter with the lender

LAMF Documents Required:

PAN Card & Aadhaar

Cancelled cheque

Mutual Fund Statement (latest)

KYC-compliant folio

No income proof required in most cases

Lenders use the loan against mutual funds eligibility and documents for automated verification. Some even provide a loan against mutual funds eligibility calculator for quick checks.

How Much Can You Borrow? — Loan Limits in 2025

The loan against mutual funds limit depends on:

NAV of your fund

Type of fund (Debt, Equity, ELSS)

Lender’s margin policy

You can borrow up to 70–80% of the fund value, with some lenders offering up to ₹5 Crores.

For LAS, the loan against shares interest rates and margin depend on the stock type. Most listed large-cap stocks qualify.

Digital Loan Against Mutual Funds Interest Rate & Charges

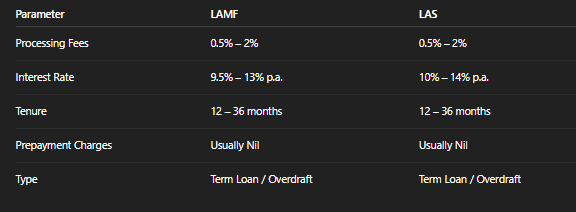

This flexibility makes a loan against mutual funds for financial needs a smart alternative to breaking investments or using credit cards.

Loan Against ELSS — Is It Allowed in 2025?

Yes, many lenders now offer loans against ELSS funds — provided they’re past the 3-year lock-in. Since ELSS is equity-oriented, expect slightly lower margins but higher loan amounts due to value appreciation.

ELSS holders often use this to unlock funds without disturbing tax-saving benefits.

Loan Against Securities (Shares & MFs) — FAQs for 2025

1. Who can apply for a loan against mutual funds in India?

Any Indian investor above 21 years with valid KYC and mutual funds (in their own name) can apply — salaried, self-employed, students, or homemakers.

2. Is income proof needed for LAMF or LAS?

No. Most digital platforms offer a loan against mutual funds without income proof, based only on your investment value.

3. How fast is the approval and disbursal?

With LAMF APIs, loans are approved within 30 minutes to a few hours and credited digitally.

4. What is the maximum limit for loan against mutual funds?

Up to ₹5 Crores for mutual funds and ₹10 Crores for shares (varies by lender and investment).

5. Is it safe to pledge mutual funds or shares for a loan?

Yes. Your units remain in your name. The lender only marks a lien, which is removed once repayment is made.

Conclusion: Smart Borrowing with LAMF & LAS in 2025

In today’s fast-paced world, why sell your investments when you can borrow against them? Whether you’re funding a wedding, education, or any financial goal, a loan against mutual funds or shares offers the flexibility, speed, and cost-effectiveness you need.

No income proof required

Instant approval via digital KYC

Funds within minutes

Keep earning returns on your portfolio

So in 2025, it’s not about “Should I sell?” It’s about “Why sell when you can just swipe?”

Apply now and unlock your wealth — without breaking it.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!