Apply Now for Wedding Loan Online – Instant Marriage Loan with Minimum Documents & Low Interest (India 2025)

Harsh Jain

Harsh Jain

Start Your Dream Wedding Without Financial Stress

Planning a wedding in 2025? You’re not alone in wondering how to manage expenses without draining savings. From venue bookings and designer outfits to catering and photography, Indian weddings often come with big price tags. That’s where a personal loan for marriage can be your perfect backup.

Whether you’re a salaried individual, a freelancer, or a business owner, getting an instant personal loan online for wedding expenses is easier than ever — no collateral, minimum documents, and fast approval, especially if you apply smartly through trusted platforms like Investkraft.

Let’s explore everything you need to know about wedding loans, including interest rates, eligibility, documents, how to apply, and which options give you low-interest marriage loans in India in 2025.

What Is a Marriage Loan?

A marriage loan or wedding personal loan is a type of unsecured personal loan you can use specifically to fund marriage-related expenses. It does not require any security or collateral and is typically disbursed within 24–48 hours of approval.

People search for:

personal loan for a wedding

loan for marriage

personal loan for wedding expenses

These loans are flexible, quick, and can cover anything from a destination wedding to simple ceremonial arrangements.

Why People in India Need a Wedding Loan in 2025

Here’s what most borrowers want:

No need to touch long-term savings or sell investments

Manage urgent expenses instantly

Get low interest rates on personal wedding loans

Flexible EMIs that suit salary-based repayment

Fast and online process from apps like Investkraft

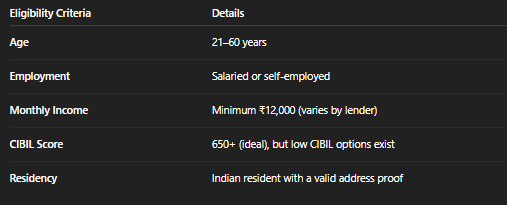

Who Can Apply for a Wedding Loan?

Even with low income or no income proof, some lenders offer instant personal loans online with relaxed documentation.

Documents Required for Marriage Loan in India

People often search: marriage loan documents, or what documents are needed for a wedding loan.

Here’s the usual list:

PAN Card

Aadhaar Card / Passport / Voter ID

Bank statements (last 3–6 months)

Salary slips (for salaried applicants)

Business proof (for self-employed)

Wedding invitation card (optional)

Pro Tip: If you apply via the Investkraft personal loan section, you may get a pre-approved loan with minimal documents.

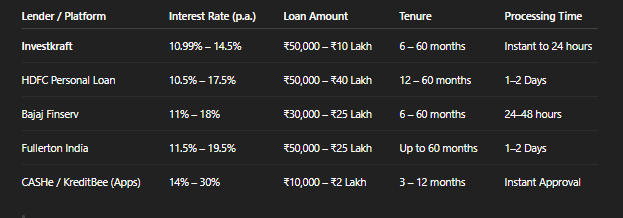

Marriage Loan Interest Rate & Charges in 2025

Searches like “wedding loan interest rate” or “marriage loan interest” are frequent. Here’s a quick look:

Comparison Table: Marriage Loan Interest Rates 2025

Note: Interest rates are dynamic and based on your credit score, income, and lender policy.

How to Apply for a Wedding Loan Online Instantly?

Users often search: apply for a wedding loan, apply for an online personal loan, or an instant personal loan online.

Here’s the simplified step-by-step process:

1. Choose a Trusted Platform Like Investkraft

Visit the Investkraft website and go to Personal Loan > Wedding Loan section.

2. Fill in Your Basic Details

Name, PAN, income, employment type, mobile number.

3. Upload Minimum Documents

Digital KYC is enabled, so Aadhaar + PAN may be enough.

4. Check Eligibility Instantly

Use the wedding loan eligibility calculator to see offers based on your profile.

5. Get Instant Approval

Loans can be approved in minutes and disbursed within hours.

Human Touch: Real-Life Example

Ritika Sharma, a 27-year-old marketing executive from Delhi, had a modest salary but dreamed of a destination wedding. She didn’t want her parents to bear the full cost. Through Investkraft, she applied for a ₹3 lakh personal wedding loan and got it disbursed within 24 hours , with just PAN, Aadhaar, and a salary slip.

Thanks to the instant approval and low interest, I had my dream wedding without stressing over savings.” — Ritika, 2025

Who Should Consider a Marriage Loan?

Couples planning a big or destination wedding

Individuals managing wedding expenses alone

Salaried professionals with limited savings

People with urgent cash needs before the wedding

Users searching for personal wedding loans with low documentation

Key Benefits of Wedding Loans in 2025

Instant disbursal within 24 hours

Minimum documentation

No collateral needed

Flexible EMI plans

Trusted platforms like Investkraft

FAQs: Wedding & Marriage Loan in India 2025

1. What is the interest rate on marriage loans in India?

It starts from 10.99% p.a., depending on your profile and lender. Platforms like Investkraft offer competitive wedding loan interest rates.

2. Can I get a personal loan for wedding expenses without income proof?

Yes, some lenders offer no-income-proof personal loans using alternate verification like bank statements or digital footprints.

3. How much loan can I get for a wedding?

Anywhere between ₹25,000 to ₹40 Lakhs based on your eligibility and credit history.

4. What documents are required to apply for a wedding loan?

Usually, Aadhaar, PAN, and income proof. Some lenders accept minimum KYC only.

5. Where can I apply for an instant wedding loan online in India?

You can apply via Investkraft or apps like CASHe, KreditBee, or through bank websites such as HDFC, ICICI, Axis, etc.

Final Words: Apply Smart & Stress-Free

Weddings are once-in-a-lifetime, but your finances don’t have to suffer because of them. Thanks to digital lending platforms, you can now apply for personal loans for wedding expenses in minutes, with low interest rates, minimal paperwork, and quick approval.

Use trusted platforms like Investkraft’s personal loan section, compare offers, and pick the best option for your dream day.

Big weddings need big plans — not big debt. Choose smart, apply online, and celebrate stress-free!

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!