Business Loan for Machinery Purchase – Compare Top Banks, Interest Rates & Apply Instantly in India

Harsh Jain

Harsh Jain

Kickstart Your Business Growth with the Right Machine Loan in 2025

Are you a business owner struggling to upgrade or buy new industrial equipment due to a lack of funds? Or perhaps a startup looking for a machinery loan to launch your first production line? In 2025, getting a machinery loan in India has become faster, easier, and more accessible than ever before — even for small businesses and first-time borrowers.

With improved digital approval systems, flexible EMIs, and competitive machinery loan interest rates, you can now finance your machinery purchase without heavy documentation or long waits. Whether you need a machine loan for a new business, a loan for industrial machinery, or a term loan for machinery, this guide will help you explore your best options.

Why Machinery Loans Are Vital for Modern Businesses

Whether it’s textile, manufacturing, agriculture, or construction , machines are at the core of every industry. But modern machines cost lakhs or even crores. That’s where a business loan for machinery purchase comes in. These loans:

Help businesses upgrade outdated equipment

Increase productivity

Reduce labor dependency

Offer tax benefits

Improve overall efficiency

And the best part? In 2025, you can easily apply for a machinery loan online and get approval in just a few clicks!

What Is a Machinery Loan?

A machinery loan or machine loan is a type of business loan designed specifically to help companies buy new or used machinery, equipment, or tools. This can include:

CNC machines

Printing presses

Industrial equipment

Kitchen equipment for food startups

Tools for fabrication, construction, etc.

Such loans are also known as machinery term loans or business loans for industrial machinery and are offered by both banks and NBFCs in India.

Who Can Apply for a Machine Loan in India?

If you’re wondering how to get a machinery loan or whether you’re eligible, here’s what you need to know. The following are eligible:

MSMEs & SMEs

Startups with a working prototype

Traders & retailers

Manufacturing units

Service-based businesses using machinery

Even if you’re a startup or a small business, there are now machinery loan providers in India offering loans without heavy documents or income proof.

Documents Required to Apply for a Machinery Loan

Although document needs may vary, here are the common documents required for a machine loan in India:

PAN Card

Business registration proof

Bank statements (6–12 months)

Machinery quotation/invoice

ITR or GST returns (optional for some lenders)

Some fintech lenders even offer machinery loans without ITR or detailed financials, especially under government-backed MSME schemes.

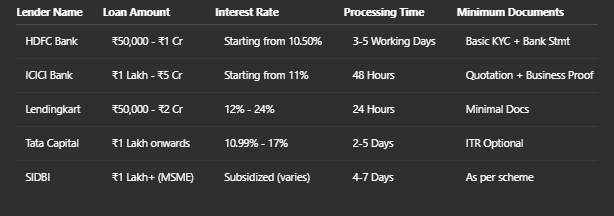

Comparison Table: Top Machinery Loan Providers in India (2025)

Types of Machinery Loans in India

Understanding the types of loans can help you choose better:

Term Loan for Machinery: Long-term loan repaid in EMIs over 1–5 years.

Working Capital Loan: For running operations and minor upgrades.

Loan Against Machinery: Use existing equipment as collateral.

Business Loan: A general-purpose loan that can include machinery purchase.

Government-Subsidized Machinery Loans: Offered under schemes like CGTMSE, PMEGP, and Mudra.

How to Apply for a Machinery Loan Online (Step-by-Step)

Still wondering how to apply for a machinery loan in India? Here’s a simple process:

Choose a lender: Bank, NBFC, or online platform

Check eligibility: Age, business age, turnover, credit score

Fill application: Online form with basic details

Upload documents: Business proof, bank statements, etc.

Get approval: Most approvals come within 1–3 working days

Disbursement: Funds are transferred directly to your account

Real Example: How a Delhi Startup Got a Machine Loan Without Income Proof

Ravi, a 27-year-old startup founder from Delhi, wanted to buy a digital fabric printer worth ₹3.5 lakhs. With zero ITR and just 8 months in business, traditional banks rejected him. He applied through a fintech NBFC offering machine loan finance with relaxed eligibility. He got the money in 48 hours with just his GST certificate, PAN card, and a machinery quotation.

Human Touch: Why This Isn’t Just About Machines

This isn’t just about loans or equipment. It’s about your dream — to build a scalable, profitable business. Machines are the backbone of that dream. And with the right financial support in 2025, even small business loans or working capital loans can help you create jobs, deliver better services, and grow exponentially.

Final Tips Before You Get a Machinery Loan

Compare interest rates before applying

Check if the lender has hidden charges

Always read the pre-closure terms

Choose a lender who offers flexible EMIs

If possible, look for schemes that offer subsidies

FAQs on Machinery Loans in India (2025)

Q1. What is the interest rate on machinery loans in 2025?

A: Rates start from 10.50% and may go up to 24%, depending on credit profile and lender.

Q2. Can startups get machinery loans without ITR?

A: Yes. Many fintech lenders offer loans without ITRs, especially for GST-registered businesses.

Q3. What is the maximum loan amount I can get for machinery purchase?

A: It ranges from ₹50,000 to over ₹5 crore, based on business size and collateral.

Q4. Is collateral required for machine loans?

A: Not always. Many loans are unsecured. However, larger loans may need collateral or hypothecation of the machinery.

Q5. How quickly can I get a machinery loan in India?

A: Approval can be as fast as 24–48 hours with digital lenders.

Conclusion: Invest in Machines, Unlock Your Business Potential

Don’t let funds stop your growth. The right machine loan at the right time can completely transform your business. From textile mills to food startups, from MSMEs to tech units — every sector relies on machinery. Choose a reliable machinery loan provider, compare your options, and take the leap.

So if you’re ready to get a machinery loan in India, now is the best time to apply at Investkraft.com online and scale your operations in 2025.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!