2025 LAP Loan Guide: How to Apply, Compare Rates & Get Fast Approval for Salaried & Self-Employed

Harsh Jain

Harsh Jain

Owning a property in 2025 isn’t just about bricks and walls — it’s a hidden source of funds. If you’re salaried or self-employed, your home or shop can help you raise instant capital. With the growing popularity of Loan Against Property (LAP) in 2025, both salaried and self-employed Indians are unlocking instant funds without selling their valuable assets. This updated guide covers everything you need to know about LAP loans in India, including interest rates, eligibility, required documents, fees, and how to apply online.

Let’s explore how to tap into your property’s potential to meet urgent personal or business needs.

What is a LAP Loan? Meaning & Full Form

LAP stands for Loan Against Property, a type of secured loan where you mortgage your immovable property to borrow funds. You can get a LAP loan against residential property, commercial space, or land.

LAP loan full form: Loan Against Property

Whether you’re a salaried employee or self-employed business owner, this financing option offers quick access to high-value funds at competitive rates.

Who Can Apply for a Loan Against Property?

Wondering who can avail of a loan against property? Here’s a breakdown:

Salaried professionals (government or private sector)

Self-employed individuals (business owners, freelancers, consultants)

Property owners looking to raise capital

Your income, credit score, and ownership documents play a key role in determining loan against property eligibility.

LAP Loan for Salaried Individuals in 2025

A loan against property for a salaried person is a great option for large expenses like education, wedding, or medical bills. You can raise substantial amounts at lower rates compared to personal loans.

Top benefits:

Longer tenure up to 20 years

Lower EMI burden

High loan-to-value (LTV) ratio

Salaried LAP meaning: A property-backed loan offered to salaried individuals with stable monthly income.

Use Cases:

Home renovation

Child’s education

Debt consolidation

LAP for Self-Employed: Boost Business Without Selling Property

A loan against property for self-employed individuals is ideal for business expansion, working capital, or even personal events like a family wedding.

Key features include:

Flexible documentation (bank statements, ITRs)

Acceptance of multiple income sources

Options for LAP loan against property owned by a business

Loan against property for self-employed individuals for weddings and business is a top trend in 2025, thanks to easy online processing.

Key Features of LAP in 2025

Whether you’re applying through a bank or NBFC, loan against property features for salaried individuals and self-employed individuals include:

Funding of up to 70% of the market value

Tenure from 5 to 20 years

Fixed or floating interest rates

Quick disbursal with verified documentation

Many lenders also offer instant loans against property through digital KYC and e-signature services.

LAP Loan Eligibility Checklist

LAP eligibility depends on:

Age (21 to 65 years)

Type of property (residential/commercial)

Credit score (650+ preferred)

Monthly income or business profits

How to apply for a loan against property for salaried individuals:

Choose a bank or NBFC

Check eligibility using online calculators

Submit application & documents

Get the property evaluated

Receive disbursal in 3–5 days

How to apply for loan against property for self-employed individuals follows a similar process with added documents like ITR and GST returns.

Documents Required for LAP Loan (2025)

For salaried applicants:

Aadhaar and PAN card

Latest salary slips

Form 16 or ITR

Property documents

For self-employed:

Business proof (registration/license)

ITR for the last 2 years

Bank statements (6–12 months)

Property ownership papers

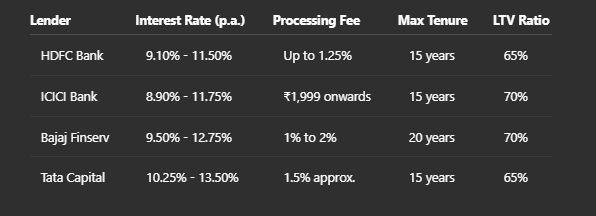

LAP Rates in India — 2025 Comparison Table

Looking for a loan against property ROI comparison? Here’s a quick breakdown of popular lenders in 2025:

Compare these offers for a better deal. Loan against property comparison helps you choose the right lender for your specific needs.

LAP Fees and Charges Breakdown

Understanding loan against property fees and charges for salaried individuals is crucial before signing the dotted line.

Processing Fee: 0.5% to 2%

Property Valuation Fee: ₹5,000 to ₹15,000

Legal Charges: Depends on property value and location

Prepayment Charges: 0% (floating rate) to 4% (fixed rate)

Always verify hidden costs while comparing LAP offers.

Step-by-Step Procedure of Loan Against Property

Select a lender and check LAP eligibility

Submit documents and fill application form

Property inspection and valuation

Loan sanction and agreement

Fund disbursal to your account

Most banks now provide the option to apply for a loan against property online via mobile or desktop.

Types of Property Accepted for LAP Loans

Loan against residential property (self-occupied or rented)

Loan against immovable property (registered plots, flats)

Loan against property mortgage (no disputes or encumbrances)

Real Story: From Property to Purpose

Raj, a graphic designer from Delhi, used his ancestral home to get a private loan against property and fund his sister’s wedding. “I didn’t want to break FDs or take high-interest loans. LAP gave me freedom without sacrifice,” he says.

Top 5 FAQs on LAP Loan in 2025

Q1. What is LAP in loan terms?

LAP stands for Loan Against Property, where you borrow by keeping your property as mortgage.

Q2. Can I get a LAP loan without income proof?

Some NBFCs offer a no-income-proof LAP loan for specific cases, but documentation is usually required.

Q3. What type of property is eligible?

Residential, commercial, or land — as long as it’s free from legal issues.

Q4. Is LAP better than a personal loan?

Yes, because of lower interest rates, higher loan amounts, and longer tenure.

Q5. Can I raise LAP for weddings or medical expenses?

Yes, it’s one of the most common purposes for both salaried and self-employed borrowers.

Final Words: Let Your Property Work for You

With rising costs and life goals, using your property wisely can be a game-changer. A loan against property LAP is more than a loan — it’s an opportunity to fund your dreams without losing your asset.

Whether it’s for home expenses, education, or business growth, explore India’s best LAP options in 2025, and apply online today. Because your property deserves to do more than just sit there — it should build your future.

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!