Apply for Instant Loan in India 2025 – Get Funds Online Without Income Proof, CIBIL or Delay (Fast Approval)

Harsh Jain

Harsh Jain

Needed Just ₹3000 for an Emergency — Got It in 5 Minutes Without Documents

In 2025, Indians will no longer wait in long queues or beg banks for small personal loans. Whether it’s a medical emergency, urgent rent, or business needs, instant loan apps and instant fund platforms are solving real money problems — fast.

Just like Aarti from Pune, who searched “get instant fund online no salary slip” and got ₹10,000 in her bank within 6 minutes. No CIBIL. No paperwork.

Let’s dive into the world of insta loans and discover how you can access instant funds online in India.

Why People in India Are Turning to Instant Loans in 2025

Searches like:

“loan app instant approval”

“Instant fund app 3000 rupees”

“Get an instant loan without documents.”

…have exploded in volume across Google because people want:

Quick ₹3000–₹50000 for emergencies

Hassle-free funds without income proof

Same-day disbursal without paperwork

Banks still ask for ITR, payslips, and CIBIL scores. But instant loan websites in India now offer paperless approval with fast EMI options.

What Is an Instant Loan or Insta Fund in 2025?

An instant loan (or insta fund) is a small-ticket online credit offered by RBI-regulated NBFC-backed apps like KreditBee, Investkraft, MoneyTap, and LazyPay.

Key Features:

Amount: ₹3000 to ₹2 lakh

Approval Time: 3–10 minutes

Documents: Aadhaar + PAN only

EMI Flexibility: 3 to 24 months

Full online process

These loans are great for:

Gig workers & freelancers

Low-income salaried people

Students needing tuition or gadgets

Housewives needing emergency cash

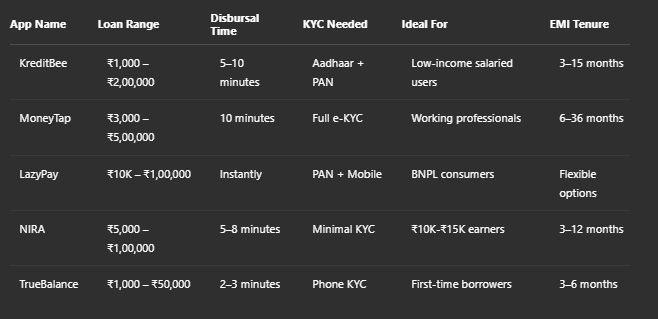

Top 5 Instant Loan Apps in India (2025) — Updated Comparison

These platforms offer instant loan approval with no heavy documentation. Many are instant personal loan apps paperless and support users with no income proof.

Who Can Apply for Instant Loans in India?

These apps are designed for:

Salaried employees earning ₹10K–₹25K/month

Freelancers & gig economy workers

College students (some apps support them)

Homemakers with regular utility bills

Individuals with a zero or low CIBIL score

Whether you’re looking for a 3000 instant loan or an insta credit loan of ₹50000, there’s an app ready for you.

How to Get Instant Fund Approval in 5 Minutes

Here’s how you can apply for an instant personal loan online in India:

Step-by-Step Guide

Download a trusted loan app like KreditBee, NIRA, or LazyPay

Register using your mobile number & OTP

Complete paperless KYC using Aadhaar + PAN

Select loan amount (₹3K to ₹2L)

Choose an EMI plan

Submit & wait for instant approval

Receive money in your bank account

These apps are perfect for quick cash loans and online payday loans for working Indians in 2025.

Real Use Cases — Where Instant Loans Help

₹3000 borrowed by students for exam fees

₹15000 borrowed by freelancers to buy laptop parts

₹25000 borrowed by housewives to pay medical bills

₹50000 taken by self-employed to cover GST dues

These instant funds apps act as safety nets for real people.

EMI Options with Instant Loans

Most apps offer:

3, 6, 9, 12, 18, or 24-month EMI plans

Transparent interest rates

Auto-debit reminders

Prepayment options with low/no charge

You can also find instant personal loans with EMI options via trusted platforms like MoneyTap and KreditBee.

Choosing the Best Instant Loan Website in India

Before applying, ask yourself:

Do they charge processing fees upfront? (Avoid!)

Is the app RBI-registered or partnered with a legal NBFC?

What are the reviews and disbursal speed?

Use Investkraft to discover only trusted instant loan apps and avoid scams.

Avoid These Common Mistakes

Don’t install unverified loan apps from unknown developers

Don’t apply to multiple apps in a day — it drops your digital score

Don’t hide income or job status — it leads to rejection

Never pay upfront loan guarantee fees

FAQs — Instant Funds & Loans in India (2025)

Q1. Can I get an instant loan without documents?

Yes. Apps like KreditBee or LazyPay require only Aadhaar + PAN for eKYC.

Q2. I have a low income. Can I still apply?

Yes. Apps like NIRA and TrueBalance approve loans for low earners, too.

Q3. How much instant money can I get?

Loan ranges from ₹3000 up to ₹2 Lakh based on eligibility.

Q4. Are instant loans safe in India?

Yes, if taken from RBI-recognized or NBFC-backed apps listed by Investkraft.

Q5. Can students get instant funding?

Some apps like TrueBalance support students and gig workers.

Final Words: Instant Funds, Real Solutions — Powered by Investkraft

Whether you need:

₹3000 for recharge or groceries

₹20000 for bills or rent

₹2 lakh for family emergency

You can now get it instantly using trusted apps in 2025 — all via an instant personal loan app for high amounts or short-term loans without a credit check.

Use Investkraft to:

Discover the best online loans with instant approval

Access only safe, RBI-backed options

Get expert help choosing the right app for your profile

Apply today, get funds within 5 minutes — no paperwork, no delay!

Subscribe to my newsletter

Read articles from Harsh Jain directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Harsh Jain

Harsh Jain

Passionate about finance, I help individuals make informed investment decisions. At InvestKraft, I focus on simplifying financial concepts, optimizing investment strategies, and driving growth through data-driven insights. Let’s build wealth smartly!