Web Scraping Grocery Prices from San Francisco Stores

John Bennet

John Bennet

Introduction

San Francisco’s grocery retail landscape is a complex, fast-evolving market influenced by high living costs, cultural diversity, and the growing shift toward online shopping. This report applies Web Scraping Grocery Prices from San Francisco Stores to examine competitive pricing strategies and market behavior across three major retailers—Safeway, Whole Foods Market, and Trader Joe’s—during Q1 2025 (January 1 to March 31). The goal is to Extract Grocery Product Prices From All San Francisco Store outlets efficiently and accurately, focusing on 50 essential grocery items spanning five key categories: dairy, produce, meat, bakery, and pantry staples. Using the Grocery Price Dataset from San Francisco Stores, the study reveals real-time price trends, retailer positioning, and implications for shoppers and policymakers. These insights help industry stakeholders understand local competition, manage pricing strategies, and respond effectively to consumer needs in one of America’s most unique and expensive grocery markets.

Methodology

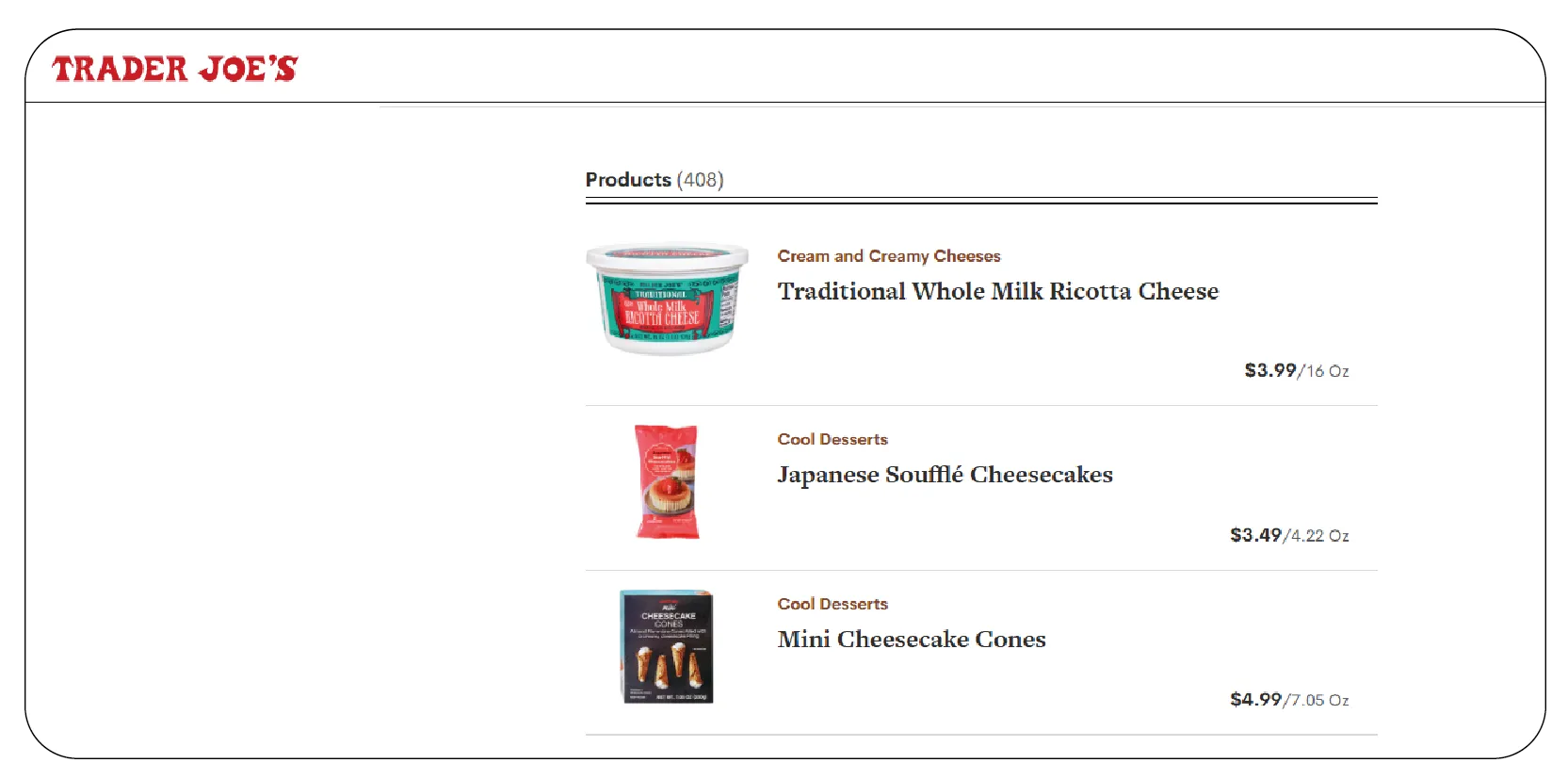

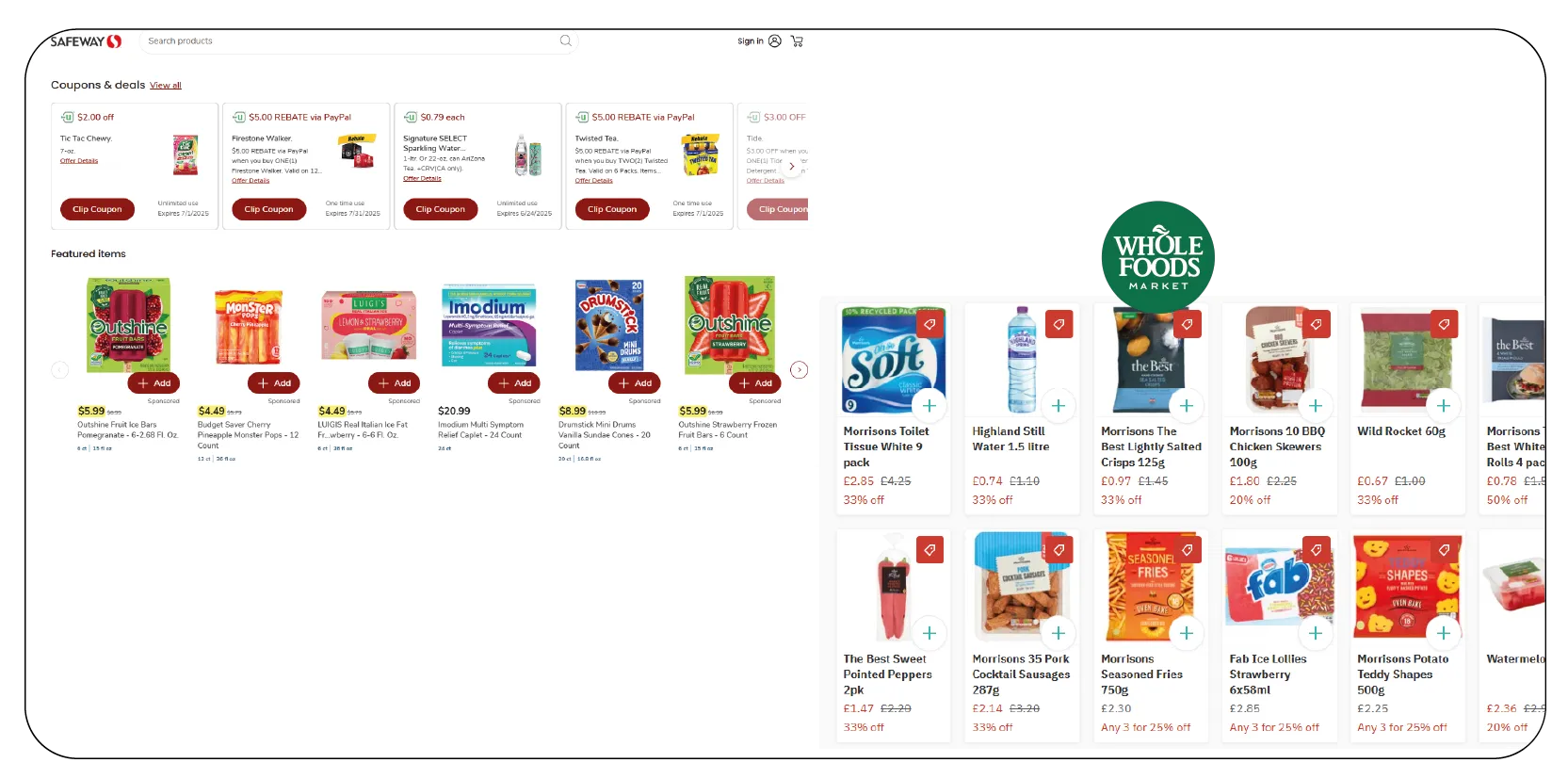

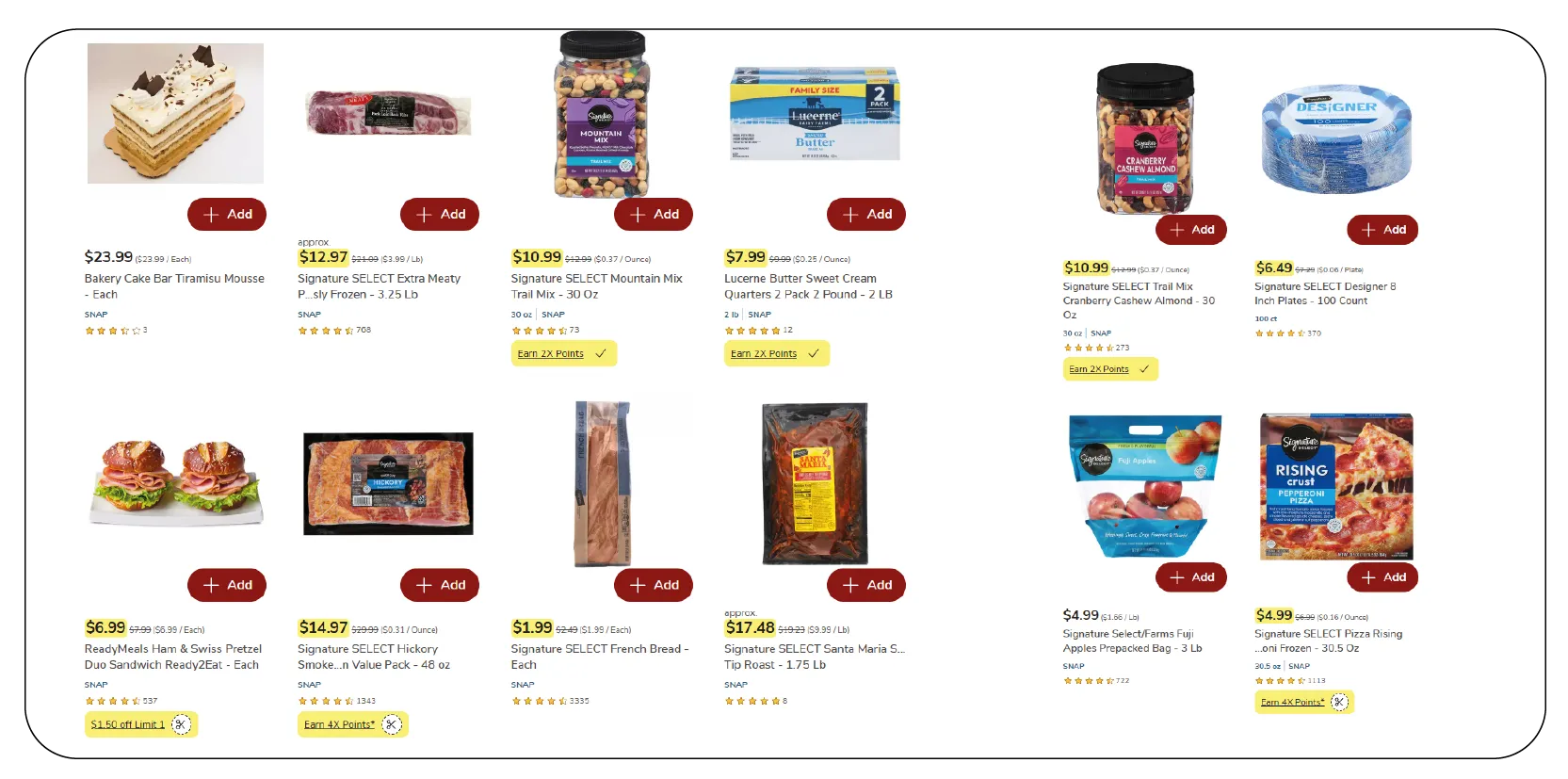

Price data was collected daily from Safeway, Whole Foods Market, and Trader Joe’s online platforms using advanced techniques for Scraping San Francisco Grocery Chain Prices. The dataset includes prices for 50 commonly purchased items, offering a well-rounded snapshot of grocery pricing behavior. Categories covered include dairy (e.g., milk, cheese), produce (e.g., apples, avocados), meat (e.g., chicken breast, ground beef), bakery (e.g., bread, bagels), and pantry staples (e.g., rice, pasta). Efforts to Extract Grocery Prices from San Francisco Supermarkets were powered by Python-based tools such as BeautifulSoup and Selenium. The scraped data was cleaned, standardized, and prepared for robust analysis. This comprehensive effort in Grocery Store Data Extraction From San Francisco enabled insights into daily average prices, fluctuations, promotional discounts, and comparisons to USDA national retail averages for 2025—revealing local trends and price competitiveness among top grocery retailers in San Francisco.

Grocery Price Comparison Table

| Item | Category | Safeway ($) | Whole Foods ($) | Trader Joe’s ($) | National Avg. ($) |

| 1 Gallon Whole Milk | Dairy | 4.99 | 6.29 | 3.99 | 4.50 |

| 1 lb Cheddar Cheese | Dairy | 5.49 | 7.99 | 4.49 | 5.20 |

| 1 lb Apples (Fuji) | Produce | 2.29 | 3.49 | 2.49 | 2.10 |

| 1 lb Avocados | Produce | 2.99 | 3.99 | 2.79 | 2.80 |

| 1 lb Chicken Breast | Meat | 6.99 | 8.99 | 6.49 | 6.49 |

| 1 lb Ground Beef (80/20) | Meat | 7.49 | 9.49 | 6.99 | 7.00 |

| 1 Loaf White Bread | Bakery | 2.49 | 3.99 | 2.29 | 2.30 |

| 6 Bagels (Plain) | Bakery | 4.29 | 5.49 | 3.99 | 4.00 |

| 1 lb White Rice | Pantry Staples | 1.99 | 2.79 | 1.89 | 1.80 |

| 1 lb Pasta (Spaghetti) | Pantry Staples | 1.79 | 2.49 | 1.69 | 1.60 |

Explanation of Grocery Price Comparison Table

The table presents average prices for ten representative grocery items across Safeway, Whole Foods Market, and Trader Joe’s in San Francisco, compared to national averages from USDA data for Q1 2025. Safeway offers competitive pricing in dairy and pantry staples, aligning with its mass-market appeal and frequent promotions. Whole Foods commands premium prices, particularly for meat and produce, reflecting its focus on organic and high-quality products. Trader Joe’s consistently offers the lowest prices across most categories, emphasizing its value-driven approach. San Francisco prices are 10-15% higher than national averages, driven by the city’s high logple, chicken breast averages $6.99 at Safeway and $8.99 at Whole Foods, compared to the national average of $6.49, highlighting regional cost disparities.

istics costs and affluent consumer base. For exam

Promotional Frequency Table

| Category | Safeway (% Discounted) | Whole Foods (% Discounted) | Trader Joe’s (% Discounted) |

| Dairy | 35% | 15% | 20% |

| Produce | 40% | 10% | 25% |

| Meat | 30% | 12% | 18% |

| Bakery | 25% | 8% | 15% |

| Pantry Staples | 45% | 10% | 22% |

Explanation of Promotional Frequency Table

This table shows the percentage of items in each category that were discounted at least once per week during the study period. Safeway leads in promotional activity, with 45% of pantry staples and 40% of produce items discounted weekly, reflecting its strategy to attract cost-conscious consumers. Whole Foods has the lowest promotional frequency, with only 8-15% of items discounted, consistent with its premium positioning. Trader Joe’s maintains moderate promotional activity, balancing value with consistent pricing. The high promotional frequency in produce and pantry staples suggests retailers target these categories to drive sales volume, as they are frequently purchased staples.

Analysis of Findings

Pricing Strategies

The analysis reveals distinct pricing strategies among San Francisco’s top grocery chains. Safeway’s competitive pricing and frequent promotions cater to value-driven shoppers, offering lower prices on staples like milk ($4.99 vs. $6.29 at Whole Foods) and pasta ($1.79 vs. $2.49 at Whole Foods). Whole Foods, by contrast, embraces premium pricing, especially in meat ($9.49 for ground beef vs. $6.99 at Trader Joe’s), targeting health-conscious, affluent consumers. Trader Joe’s positions itself as the price leader, offering consistent value across categories (e.g., $3.99 for milk, $1.69 for pasta). These differences highlight the power of using services to Extract Grocery Prices from San Francisco Stores to track and interpret retailer positioning effectively.

Regional Price Dynamics

San Francisco grocery prices remain 10–15% above national averages, driven by logistics, real estate, and local demand. For instance, avocados average $2.99–$3.99 in the city, compared to $2.80 nationally. These insights, enabled through Web Scraping Grocery Price Data, show how regional economic factors and consumer preferences influence pricing structures.

Promotional Trends

Promotions are deployed with strategic precision. Safeway leans on aggressive discounting, particularly in produce and pantry staples, to drive store traffic and compete with discounters. Whole Foods maintains its premium perception with minimal promotions. Trader Joe’s balances low base pricing with modest deals to maintain loyalty. These findings reflect how Quick Commerce Grocery & FMCG Data Scraping can reveal promotion-based targeting across consumer segments.

Consumer Implications

Consumers can take advantage of the pricing and promotional variations uncovered through steps to Scrape Grocery & Gourmet Food Data . Budget-minded shoppers may gravitate toward Safeway or Trader Joe’s, while wellness-oriented buyers may remain loyal to Whole Foods despite higher costs. Access to detailed pricing data empowers San Franciscans to optimize spending amid the city’s high cost of living.

Market Trends

Online grocery adoption has surged, making Supermarket Data Scraping Services essential for tracking evolving market behavior. As digital platforms expand, so does the value of granular, real-time insights. A 2.8% price increase in Q1 2025 mirrors national inflation, but deeper insights—such as sharper increases in meat prices due to supply chain issues—highlight the importance of targeted category analysis.

Implications for Stakeholders

Retailers

Retailers can use these insights to refine pricing and promotional strategies. Safeway could expand promotions in meat to compete with Trader Joe’s, while Whole Foods might consider targeted discounts in produce to attract price-sensitive organic shoppers. Trader Joe’s could maintain its value proposition while exploring loyalty programs to enhance customer retention. Web scraping enables continuous monitoring of competitors, allowing retailers to adapt to market shifts in real time.

Policymakers

The 10-15% price premium in San Francisco raises affordability concerns, particularly for low-income households. Policymakers could use this data to assess food access disparities and explore subsidies or incentives for retailers to offer competitive pricing in underserved areas. The high promotional frequency in pantry staples suggests potential for targeted interventions to ensure essential goods remain affordable.

Consumers

Consumers benefit from transparency in pricing and promotions, enabling cost-effective shopping decisions. Tools like price comparison websites, powered by web scraping, can help San Francisco residents identify the best deals across retailers, maximizing value in a high-cost market.

Future Research Directions

Future studies could expand to include additional retailers (e.g., Walmart, Target) or incorporate consumer purchasing patterns to understand demand elasticity. Analyzing loyalty program data or customer reviews could provide deeper insights into consumer preferences. Additionally, extending the study period beyond Q1 2025 could reveal seasonal trends, such as holiday-related price fluctuations. Integrating web-scraped data with machine learning models could enhance predictive analytics for pricing and inventory management.

Conclusion

This analysis of web-scraped grocery price data from San Francisco retailers highlights the competitive dynamics and diverse strategies shaping the market. Safeway’s promotional focus, Whole Foods’ premium positioning, and Trader Joe’s value-driven approach each cater to distinct consumer segments. Regional price premiums further reflect San Francisco’s unique economic landscape. The Grocery Store Dataset used in this study offers clear insights into pricing patterns and promotional behavior, supporting strategic decisions. Grocery Data Scraping Services enable continuous, real-time access to this type of market intelligence. Retailers can refine pricing and stocking strategies, policymakers can address affordability challenges, and consumers can make informed, budget-conscious decisions. As online grocery shopping continues to expand, the value of accurate, structured pricing data will only increase. Web scraping stands out as a vital method for generating such insights and navigating the ever-changing grocery retail environment in San Francisco.

At Product Data Scrape, we strongly emphasize ethical practices across all our services, including Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to transparency and integrity is at the heart of everything we do. With a global presence and a focus on personalized solutions, we aim to exceed client expectations and drive success in data analytics. Our dedication to ethical principles ensures that our operations are both responsible and effective.

Source >>https://www.productdatascrape.com/web-scraping-grocery-prices-san-francisco-retail-insights.php

#WebScrapingGroceryPricesFromSanFranciscoStores #ExtractGroceryPricesFromSanFranciscoSupermarkets #GroceryStoreDataExtractionFromSanFrancisco #ExtractGroceryPricesFromSanFranciscoStores #ScrapeGroceryAndGourmetFoodData #QuickCommerceGroceryAndFMCGDataScraping

Subscribe to my newsletter

Read articles from John Bennet directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by