US Mobile Games Trend in 2024: Full Breakdown

Mia Mello

Mia MelloHey everyone, here’s a breakdown of the US Mobile Games Trend in 2024, pulled from a recent industry report by FoxData.

Read the full report here: US Mobile Gaming 2024: Growth Drivers, User Logic, and Monetization Trends

…

In 2024, the US GDP reached a record $29.2 trillion, with quarterly growth rates ranging from 2.5% to 3.1% and an annual real growth of 2.9% (nominal growth 5.3%), reflecting continued strong economic expansion.

As of January 2023, the U.S. had about 311 million internet users and 246 million social media users, with projections estimating 331 million social media users by 2028. Social network penetration is expected to reach 95.71%, with many Gen Z users spending over four hours daily on these platforms.

The U.S. social media user base is projected to grow by 26 million (+8.55%) from 2024 to 2029, reaching a peak of about 330 million users and highlighting the continued importance of social platforms.

As of March 2025, Facebook leads with 56% of all social media website visits, followed by Pinterest (16.73%) and X/Twitter (11.73%).

In 2023, U.S. mobile game revenue reached $23.3 billion (30% of the global total) and rebounded strongly after a 2022 decline, with Q1 2024 revenue rising 15% year-over-year to over $6.4 billion.

Downloads in 2024 are expected to stay level with 2023, with hyper-casual, simulation, and action games remaining the most popular, as the U.S. continues to lead the world in mobile game revenue.

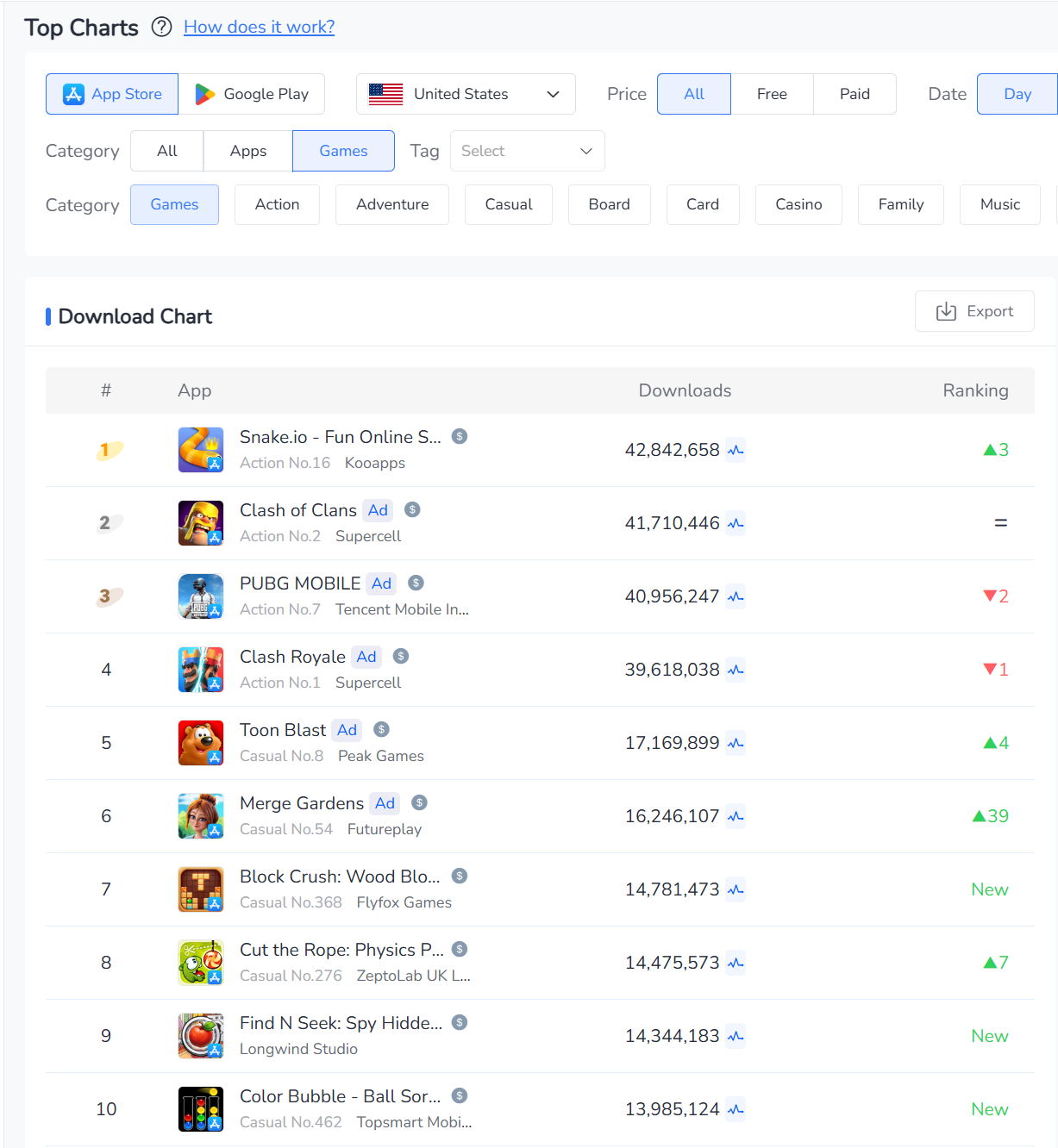

U.S. Game Downloads Top 10 in 2024 | Source: FoxData

In 2024, the U.S. mobile gaming market is dominated by light casual and puzzle games such as Snake.io, Cut the Rope, and Merge Gardens, which attract users with low barriers to entry, short play cycles, and high replayability suited to fragmented time.

Meanwhile, established titles like Clash of Clans, Clash Royale, and PUBG Mobile maintain strong user acquisition and retention through structured PvP systems, alliances, and seasonal updates.

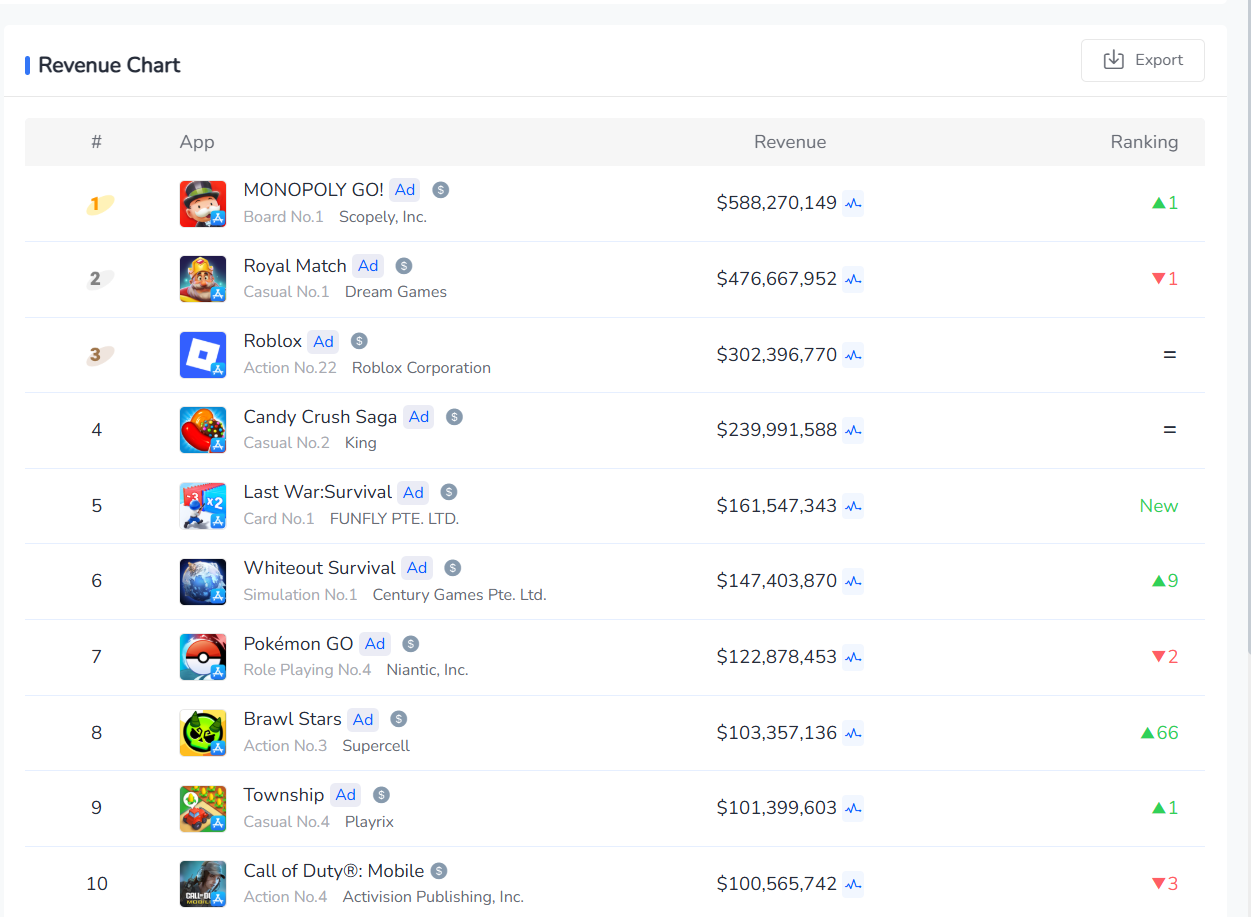

U.S. Game Revenue Top 10 in 2024 | Source: FoxData

Unlike the dominance of light casual games in downloads, the top-grossing U.S. mobile games in 2024 rely on deep gameplay, social loops, and psychological monetization tactics.

Titles like MONOPOLY GO!, Royal Match, and Candy Crush drive spending through social mechanics, time pressure, and goal-setting triggers.

Platform products such as Roblox thrive on user-generated content and virtual economies, while emerging strategy and simulation games like Whiteout Survival, Last War: Survival, and Township leverage resource management and long-tail content to sustain strong monetization.

Localization Preference: U.S. players show a strong preference for IP-based games, which drive revenue through in-app purchases, ads, and merchandise, as seen with titles like Marvel Future Fight.

Popular themes such as science fiction, adventure, and magic resonate well due to their imaginative appeal and storytelling potential.

Marketing Trend: U.S. users prefer creative, entertaining ads that incorporate familiar local cultural themes like “sexy beauties” and “gangster bosses” to capture attention.

In addition to mainstream platforms such as Facebook, Instagram, YouTube, and X, marketers should also leverage popular local apps like Twitch for effective outreach.

User Acquisition and Advertising

In the first half of 2024, U.S. mobile game ad spend exceeded $650 million, with strategy and RPG games leading investment (35% and 28%) and generating high ROI, especially on YouTube, which captured over 60% of their budgets.

Puzzle games dominated ad Share of Voice on platforms like AppLovin and Unity, while board games like MONOPOLY GO! spread spending more evenly, and strategy games favored TikTok and Meta for additional reach.

MONOPOLY GO! has generated over $2.8 billion globally and achieved a 22% advertising ROI in the U.S., where it spent $100 million on digital ads and drove $2.2 billion in in-app purchases.

By mid-2024, it led ad Share of Voice across major platforms like AdMob and AppLovin, while Match Factory! also rose significantly in ad prominence, ranking among the top advertisers.

Gaming Topics / Online Hotspots: Expanded Analysis

With rising mobile gaming penetration, related content like guides, short videos, live streams, and fan creations has moved beyond core gamers to become mainstream on social media.

Short video platforms such as TikTok, YouTube Shorts, and Instagram Reels drive viral growth through simple, fast-paced, and easily repurposed content, making them essential channels for brand marketing and global expansion.

In H1 2024, U.S. gaming-related searches shifted from just game titles to intent-driven queries like recommendations, character strategies, and viral challenges, reflecting a move toward player-driven content exploration. This evolution in search behavior opens up more targeted content marketing opportunities by aligning with users’ active discovery habits.

TikTok Gaming Topic Trends and Evolution: In Q1–Q2 2024, top-performing U.S. gaming ads on TikTok used relatable, challenge-driven, and urgent call-to-action phrases like “Only 1% can beat this” and “Download Now,” appealing to the impulsive and curious behavior of young users. Ads that combined challenge with clear benefits achieved 26%–43% higher engagement than standard formats, highlighting the effectiveness of this creative approach.

User-Generated Content (UGC) is now the main way brands get ahead: Nearly half (48%) of Gen Z users discover games through UGC on TikTok rather than official ads, making user-generated content the primary driver of awareness and engagement. Titles like MONOPOLY GO! and Royal Match benefit from abundant unofficial videos and micro-narratives, while platform games like Roblox leverage continuous UGC to boost brand recall and reduce cold-start marketing costs, prompting brands to prioritize partnerships with influencers and creators.

To stand out amid marketing noise, brands should:

Align gaming trends with their audience

Localize copy to evoke emotion and relevance

Drive engagement through co-creation tools like duet challenges and UGC templates.

Shifting from feature-focused messaging to immersive, experience-driven storytelling.

…

End of thread.

Subscribe to my newsletter

Read articles from Mia Mello directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by