Network Forensics Market Trends: The Demand for Enhanced Forensic Analytics

Georgie Bill

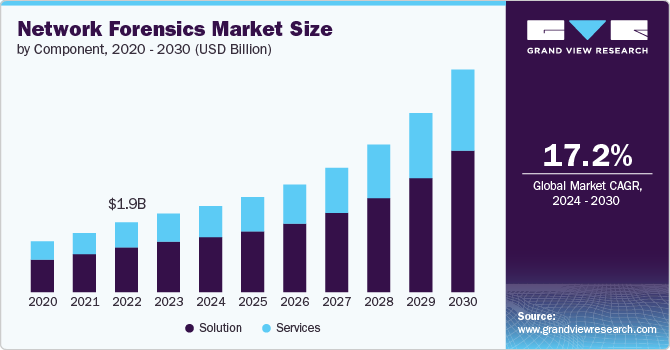

Georgie BillThe global network forensics market was valued at USD 2.20 billion in 2023 and is forecasted to reach USD 6.23 billion by 2030, growing at a compound annual growth rate (CAGR) of 17.2% from 2024 to 2030. This significant growth is largely driven by the rapid proliferation of Internet of Things (IoT) devices and interconnected infrastructure across industries. Many IoT devices lack robust security frameworks, creating new vulnerabilities that require advanced security monitoring solutions.

Network forensics solutions play a vital role in overseeing IoT environments by capturing and analyzing network traffic to detect malicious activity. These tools help identify threats such as unauthorized access, malware, and data manipulation, thereby ensuring the integrity and security of interconnected systems that are increasingly critical to business operations.

The network forensics market comprises solutions and services designed to monitor, capture, store, and analyze network traffic to investigate cybersecurity incidents and breaches. These technologies enable organizations to trace cyberattacks, mitigate risks, and comply with regulatory requirements. Real-time visibility into network activity also supports the detection of both insider and external threats.

Order a free sample PDF of the Network Forensics Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

North America held the dominant revenue share of over 36% in 2023, with the United States experiencing frequent and sophisticated cyber threats such as ransomware and advanced persistent threats (APTs). This has driven the demand for advanced network forensics tools to effectively respond to and manage such incidents.

By component, the solution segment accounted for over 63% of the market in 2023, driven by the increasing prevalence of complex threats like data breaches and ransomware. These solutions enable real-time monitoring to detect suspicious behavior and prevent attacks.

In terms of deployment, the on-premises segment represented more than 64% of the market in 2023 and is expected to maintain its lead through 2030. On-premises deployment offers organizations greater control and customization, particularly important for industries with specialized security demands.

By organization size, large enterprises made up over 69% of the market in 2023, and this dominance is projected to continue. Large enterprises manage complex, widespread networks and require robust tools to detect irregularities and mitigate potential threats effectively.

For application, the endpoint security segment captured a market share of over 33% in 2023. With the rise in cyberattacks targeting endpoints such as laptops and mobile devices, there is a growing need for sophisticated solutions to counter threats like phishing, ransomware, and malware.

By end use, the BFSI sector (banking, financial services, and insurance) held the largest share of over 23% in 2023. The sensitivity of the data handled in this sector makes it a primary target for cyberattacks, necessitating the use of network forensics to protect against unauthorized access and data breaches.

Market Size & Forecast

2023 Market Size: USD 2.20 Billion

2030 Projected Market Size: USD 6.23 Billion

CAGR (2024-2030): 17.2%

Leading Region in 2023: North America

Key Companies & Market Share Insights

Several leading companies are pursuing strategic initiatives such as product innovation, partnerships, and acquisitions to strengthen their market presence:

Palo Alto Networks and IBM (May 2024): Formed a partnership to deliver AI-driven cybersecurity services. IBM will integrate Palo Alto’s security platforms, while Palo Alto will acquire IBM’s QRadar SaaS assets and utilize IBM's watsonx LLMs to enhance its AI capabilities.

Cisco (June 2024): Launched new AI-powered features within its Security Cloud platform, including Cisco Hypershield and next-generation firewalls, aimed at strengthening defenses in hybrid and modern data environments.

Palo Alto Networks (May 2024): Unveiled AI-enhanced security solutions such as AI Access Security and AI Runtime Security. These tools use machine learning and generative AI to address threats like zero-day vulnerabilities and DNS hijacking, helping businesses secure their AI infrastructure.

Key Players

Cisco Systems, Inc.

IBM Corporation

Symantec Corporation (Broadcom Inc.)

Trellix

RSA Security LLC

Palo Alto Networks, Inc.

LogRhythm, Inc.

Viavi Solutions Inc.

NIKSUN

Fortinet, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The network forensics market is poised for significant growth, driven by the rising complexity and volume of cyber threats, especially in IoT and endpoint environments. As digital transformation accelerates across industries, the need for robust, real-time network traffic analysis and threat detection becomes increasingly critical. North America continues to lead in adoption, while large enterprises and the BFSI sector remain the primary users of these solutions. With strategic collaborations and AI-driven innovations emerging from major players, the market is set to evolve rapidly, offering more intelligent and integrated security frameworks to organizations worldwide.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by