NodeOps Network: Mint and burn strategies

NodeOps

NodeOps

Static mint and burn: the old guard

In the early days of decentralized networks, many Protocols adopted static mint and burn models to manage token supply. In these systems, tokens are minted (created) and burned (destroyed) according to fixed rules, often tied to user activity on the network or time. For example, a Protocol might mint a set number of tokens per block and burn a certain percentage of transaction fees.

Well-known examples include the NFT standards, such as ERC-721, which allows smart contracts to implement static burn-and-mint mechanics, where burning an NFT according to set criteria allows minting of a new one, again based on fixed conditions. For example, a game player might burn 3 level 1 NFTs to mint 1 level 2 NFT. All players can expect to burn and mint in this ratio.

Similarly, Binance Smart Chain (BSC) uses a static burn for its BNB token by destroying a portion of gas fees with every transaction. This mechanism is transparent but follows a fixed schedule, only changeable via governance votes, so it doesn’t adjust dynamically to market demand or network congestion.

While static mint and burn models are simple and easy to understand, their rigidity limits adaptability, leaving Protocols unable to adapt to real-world volatility. When demand surges or slumps, static models can lead to runaway inflation or insufficient incentives for network participants. Such a scenario is intolerable for certain systems, especially in DePIN, where a hardware provider relies on the incentives to ensure an ROI (return on investment).

Dynamic mint and burn: a new standard

Dynamic mint and burn models offer an adaptive approach. Instead of rigid rules, these systems adjust token issuance and burning in response to real-time network conditions, like demand, usage, and price signals.

A well-known example of dynamic mint and burn is the Uniswap V2 protocol. Uniswap V2 utilizes mint and burn functions for its liquidity provider (LP) tokens, wherein tokens are minted when liquidity is supplied and burned when liquidity is withdrawn. The amount of LP (liquidity provider) tokens minted or burned is not fixed — it depends on:

The current reserve ratios of the pool.

The amount of tokens deposited or withdrawn.

The total supply of LP tokens.

Within DePIN, the most well-known dynamic mint and burn Protocol is probably Helium Network. Helium applies a burn-and-mint equilibrium (BME) model with dynamic burning and regulated minting (rMdB). $HNT is burned (destroyed) as Data Credits (DC) are generated; this event is triggered by users paying fees for data usage on the Helium Network. Infrastructure suppliers are rewarded in minted Helium tokens (that is, the Protocol creates new Helium tokens). $HNT is emitted on a predetermined schedule and distributed to infrastructure providers. So, while the mint rate is fixed, the burn rate is determined by real-time network usage and HNT market price.

The burn algorithm links the price of $HNT to USD to enable real-market conditions to control the burn rate. As the token:USD rises, less Helium must be burned to produce the equivalent in USD amount of Data Credits: with the opposite being true when demand is low. This adds resilience to the Protocol, allowing it to respond to market swings. By pegging the token value to an external indicator such as USD, the outcome is that the incentives translate into more meaningful rewards for infrastructure contributors.

Helium Network’s approach may still evolve. Recent proposals have introduced mechanisms where the regulated mint rate may be tweaked.

Pre-defined mint: dynamic burn — an inflationary risk?

DePin projects such as Helium rely on emission-based inflation rewards to bootstrap the supply side, that is, to attract the crowd-sourced physical infrastructure they serve consumers with. The built-in assumption is that, as demand rises, inflation will be controlled through token burn.

Recognising the risk of inflation, DePIN projects tend to adjust their emissions schedule over time. For example, Helium’s HIP-20 applies a 2-year halving schedule to decay the emission rate to attempt to mitigate inflation.

Essentially, most DePIN BME Protocols apply an rMdB approach, regular (sometimes decaying) mint with dynamic burn. They are betting long that the token price stabilizes at a high enough token/USD value so that even as emissions and, therefore, rewards taper off, the supply side continues to enjoy an ROI, and so, continues to provide resources to the network.

NodeOps Network: Why dynamic mint and dynamic burn are the future of DePIN Compute

At NodeOps Network, we have recognised that a fixed issuance approach, even with a regulated decay schedule, embeds a risk in the economic design. That is, the standard BME design, rMdB (regulated mint; dynamic burn), emits tokens at a rate that doesn’t consider the demand side. At the worst extreme, where demand never takes off, the token economy becomes inflationary.

At NodeOps Network, we agree with the premise outlined by Volt Capital: static models are too blunt for the fast-changing landscape of Web3 and Compute. By embracing dynamic mint and dynamic burn (dMdB), NodeOps Network can ensure fair rewards, sustainable growth, and robust network health, no matter how the market evolves.

At a high level, $NODE emissions are managed with optimal control theory to steer the system towards an ideal state. Think of it like homeostasis for an economy: in the same way your body responds to external cooling or warming to maintain its ideal temperature, dynamic emissions provide a lever to control runaway inflation. Working together with dynamic burn, we believe that the NodeOps Network tokenomics model nurtures a sustainable equilibrium that balances growth and scarcity.

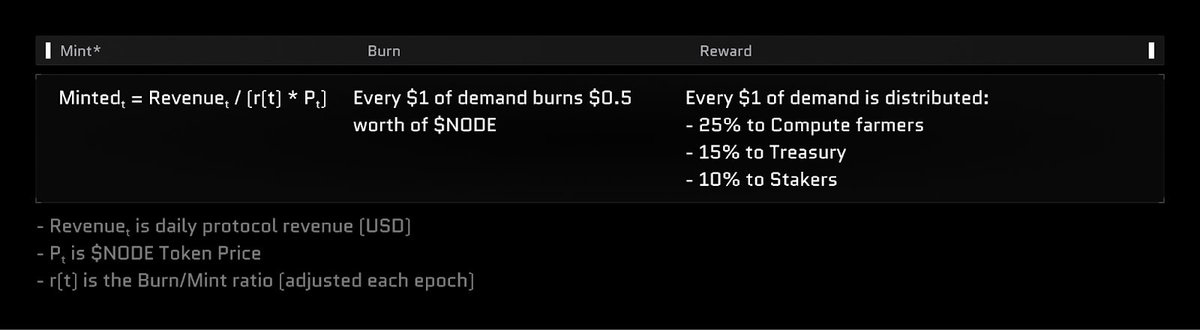

NodeOps Network Protocol’s dynamic mint; dynamic burn

NodeOps Network’s tokenomics model ensures that the $NODE supply only expands when backed by economic activity. Mint is controlled by a Burn/Mint ratio that may be adjusted dynamically based on token velocity, revenue velocity, and staking participation, enabling optimal dynamic control. See Table 1 for the formula.

The token emissions schedule kicks off with an initial Burn/Mint ratio of 0.20 to stimulate early growth and tightens emissions over time. This ensures early suppliers and stakers are fairly rewarded without long-term oversupply risk.

Given that the dM, dynamic mint must respond to the wider ecosystem, it's not possible to present a fixed emissions decay schedule; however, see Table 2 to understand what the current models predict within their given boundaries.

Are you in?

At NodeOps Network, we’re convinced that the future of decentralized Compute infrastructure depends on the adaptability enabled by dynamic mint and dynamic burn mechanics (dMdB). We’re building NodeOps Network with this vision: accessible Compute for all, incentives aligned, and tokenomics that work for everyone.

Subscribe to my newsletter

Read articles from NodeOps directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by