Sneakers Market 2030: Innovations in Sustainable Footwear

Georgie Bill

Georgie BillThe global sneakers market was valued at USD 78.59 billion in 2021 and is expected to reach USD 128.34 billion by 2030, expanding at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. Market growth is driven by the rising popularity of fashionable yet comfortable footwear, increased penetration of e-commerce platforms, and growing consumer interest in health and fitness.

An increasing preference for branded, stylish, and innovative sneakers across various age groups, combined with higher disposable incomes, is fueling industry expansion. However, the availability of counterfeit products from local manufacturers poses a challenge to market growth. Still, the demand for customized and functional sneakers presents lucrative opportunities for companies in the sector. The rise in health-conscious behavior and the population’s engagement in fitness-related activities further contributes to the growing demand for sneakers. Young consumers, in particular, are increasingly drawn to products that support active and sports-oriented lifestyles.

The COVID-19 pandemic had a negative impact on the sneakers market, largely due to global lockdowns and halted manufacturing operations. Sales sharply declined as retail stores closed and consumer demand dropped. For example, Nike reportedly lost USD 17 billion in market valuation, as China—one of its key markets—was significantly affected. However, sneakers remain widely used not only for sports but also for casual, everyday wear. Typically made with rubber or synthetic elastic soles, modern sneakers are now mostly composed of synthetic materials, which on average emit approximately 14 kg of CO₂ per pair during production.

Order a free sample PDF of the Sneakers Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

The Asia Pacific region held the largest share of the global sneakers market in 2021. North America is projected to experience the fastest CAGR of 5.6% over the forecast period, driven by shifting consumer lifestyles, greater fashion awareness, and increased spending power. In the U.S., in particular, demand for sneakers continues to grow steadily.

By product type, the mid-top sneaker segment is expected to record the fastest growth, with a CAGR of 6.9% from 2022 to 2030. While originally designed for sports such as basketball and tennis, mid-top sneakers are now widely popular among skaters and fitness enthusiasts, especially in emerging markets. Their comfort and versatility are increasing their appeal.

Based on distribution channel, the online segment is forecast to expand at the fastest rate, with a CAGR of 5.8% during the forecast period. Rising internet usage, combined with flexible payment options, discounts, and product reviews, are making online platforms a preferred shopping method. Online pricing is often lower due to promotional offers and exclusive sales.

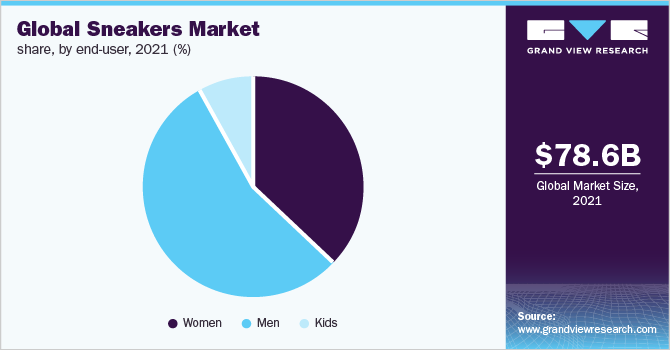

By end-user, the women’s segment is projected to grow at the fastest CAGR of 5.5% through 2030. Brands are increasingly targeting female consumers by offering inclusive sizing, personalized design features, and fashion-forward collaborations. For instance, Nike Inc., Reebok, and Skechers USA Inc. have developed strategies aimed at empowering women through both product design and marketing. A notable initiative includes Nike’s Air Max collaboration with Virgil Abloh, first showcased during Paris Fashion Week Fall 2018, which introduced a “fantasy sneaker destination for women.”

Market Size & Forecast

2021 Market Size: USD 78.59 Billion

2030 Projected Market Size: USD 128.34 Billion

CAGR (2022-2030): 5.2%

Asia Pacific: Largest regional market in 2021

North America: Fastest growing regional market

Key Companies & Market Share Insights

Leading players in the sneakers market are expanding globally and consistently launching new designs to cater to rising demand. These initiatives are expected to enhance competition and drive further market growth.

Examples of recent developments include:

Adidas AG and Gucci (Guccio Gucci S.p.A.) unveiled a collaborative footwear collection in July 2022, focusing on the iconic Gazelle silhouette.

In December 2021, Chloé SAS launched the Nama sneaker, designed with 40% recycled materials by weight, reflecting the company’s commitment to sustainability.

In March 2020, ASICS introduced the Metaracer, its first carbon-plate running shoe, through a VR showroom. This model features improved stability, a redesigned mesh upper, and an optimized toe-spring shape to reduce strain during long-distance runs.

Adidas AG also partnered with Team Vitality in November 2019 to launch the VIT.01 limited-edition sneaker, reinforcing its position as an innovative and trend-setting sportswear brand.

Key Players

Nike Inc.

Adidas AG

New Balance Athletics, Inc.

ASICS Corp.

Kering SA

Skechers USA, Inc.

Under Armour Inc.

VF Corp.

Puma SE

Relaxo Footwears Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global sneakers market is undergoing robust growth, driven by evolving consumer preferences, rising health awareness, and the blending of fashion with functionality. With a projected CAGR of 5.2% from 2022 to 2030, the industry is expected to exceed USD 128 billion by 2030. While challenges such as counterfeit products persist, the growing popularity of customized, sustainable, and tech-enhanced sneakers offers promising opportunities. Key players are responding with continuous innovation, strategic collaborations, and targeted product offerings. As consumer demand for style, performance, and sustainability grows, the global sneakers market is set to remain dynamic and competitive in the coming years.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by