Sports Betting Market 2030: A Closer Look at Consumer Preferences

Georgie Bill

Georgie BillGlobal Sports Betting Market Overview

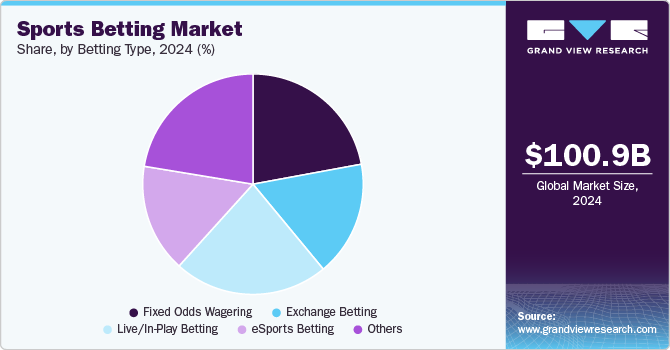

The global sports betting market was valued at USD 100.9 billion in 2024 and is projected to reach USD 187.39 billion by 2030, expanding at a CAGR of 11% from 2025 to 2030. This strong growth is primarily driven by increasing access to the internet and mobile devices, enabling users to conveniently place bets through digital platforms.

Legalization and regulation of sports betting in several countries have further contributed to market expansion by enhancing consumer trust and encouraging new players to enter the industry. Moreover, the adoption of secure digital payment systems has improved accessibility, particularly in emerging markets. Additionally, the growing popularity of live sports and global tournaments continues to attract a broad demographic of users across various regions and age groups.

Technology and User Experience Driving Market Evolution

One of the major trends shaping the industry is the rise of in-play or live betting, where users place bets during ongoing matches. This type of betting is gaining traction due to its interactive, real-time nature, enabling users to react to changing odds and match dynamics. To enhance the experience, operators are integrating live streaming and real-time data analytics, making betting more engaging and immersive.

The industry is also seeing increasing adoption of artificial intelligence (AI) and machine learning (ML) for personalized betting experiences, risk analysis, and automated odds adjustments. These technologies are transforming traditional betting into a more data-driven and customized environment.

Order a free sample PDF of the Sports Betting Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

Europe held the largest revenue share of approximately 48% in 2024. The region's mature regulatory environment, strong digital infrastructure, and high engagement with online platforms drive this dominance. Mobile apps and live betting are particularly popular, with football leading as the most bet-on sport, followed by tennis and basketball.

Based on platform, the offline segment contributed significantly to revenue in 2024, especially in regions like Europe and Australia with well-established gambling infrastructures. Traditional betting shops, casinos, and racetracks remain attractive for customers who value in-person interactions, cash transactions, or a social betting environment.

By sports type, the football segment led the market in 2024 due to its massive global fanbase and the consistent hosting of both domestic and international tournaments. Major events such as the FIFA World Cup, UEFA Champions League, and national leagues attract extensive betting activity throughout the year.

In terms of betting type, live/in-play betting emerged as the dominant segment in 2024, owing to its interactive features and the ability to place bets during a live game. This type of betting is especially popular in football and tennis, where frequent in-game events present continuous opportunities for engagement.

Market Size & Forecast

2024 Market Size: USD 100.9 Billion

2030 Projected Market Size: USD 187.39 Billion

CAGR (2025-2030): 11%

Europe: Largest market in 2024

Key Companies & Market Share Insights

Leading players in the market include 888 Holdings Plc, Bet365, Betsson AB, and Churchill Downs Incorporated, among others.

888 Holdings Plc offers a wide range of online sports betting services under brands like Betfair and 888sport, focusing on pre-match and live betting across multiple sports. The company strengthened its position in Europe and Latin America by acquiring William Hill's international operations, expanding its customer base and sportsbook offerings.

Bet365 is a private company operating an extensive online sportsbook, offering thousands of weekly events, live streaming, in-play markets, and early cash-out features. With strong market presence in Europe, particularly in the UK and Spain, Bet365 is also actively expanding into newly regulated markets such as parts of the U.S. and Latin America. The company relies on its proprietary technology to support multi-device functionality.

Betsson AB operates several brands, including Betsson, Betsafe, and NordicBet, offering fixed-odds, live betting, and virtual sports through region-specific platforms. Licensed in Sweden, Colombia, and Peru, the company is focused on Latin American expansion and enhancing mobile and cross-platform integration.

Churchill Downs Incorporated provides sports betting services via TwinSpires and BetAmerica, focusing on U.S. markets such as Pennsylvania and Michigan. Known for its horse racing operations, the company integrates these with sports betting and utilizes custom promotions tailored to local audiences.

Emerging market participants include Entain plc, Flutter Entertainment Plc, and IGT.

Entain plc owns brands like Ladbrokes, Coral, bwin, and Sportingbet, offering online and retail betting across the UK, Europe, and the U.S., often through its BetMGM joint venture with MGM Resorts. The company emphasizes responsible gaming and real-time player protection alongside product innovation such as bet builders and personalized content.

Flutter Entertainment Plc owns major brands including Paddy Power, Betfair, FanDuel, and Sportsbet. It operates in Europe, Australia, the U.S., and Latin America, with FanDuel holding a strong position in the U.S. Flutter continues to expand through acquisitions and features like live streaming, early payouts, and cross-sport promotions.

IGT (International Game Technology) delivers sports betting technology via its PlaySports platform, supporting both retail and mobile sportsbooks across the U.S. and Canada. IGT offers modular solutions, including hardware and software for odds management, ticketing, and risk control, all designed to integrate seamlessly with casino systems and regulatory requirements.

Key Players

888 Holdings Plc

Bet365

Betsson AB

Churchill Downs Incorporated

Entain plc

Flutter Entertainment Plc

IGT

Kindred Group Plc

Sportech Plc

William Hill Plc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global sports betting market is on a trajectory of strong growth, projected to reach USD 187.39 billion by 2030, fueled by digital accessibility, legalization, and the adoption of advanced technologies. The rise of in-play betting, mobile platforms, and AI-driven personalization is reshaping the user experience and broadening the industry's appeal across diverse demographics.

Europe currently leads the market, but other regions are rapidly catching up as regulations evolve and new digital entrants emerge. Leading companies like Bet365, 888 Holdings, Betsson, and Flutter Entertainment continue to innovate, while emerging players leverage localized strategies and technological integration to gain a competitive edge. As the industry matures, success will increasingly hinge on technology-driven engagement, responsible gaming, and the ability to deliver secure, seamless, and interactive experiences for a global user base.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by