Vegan Yogurt Market Analysis: Regional Insights and Consumer Preferences

Georgie Bill

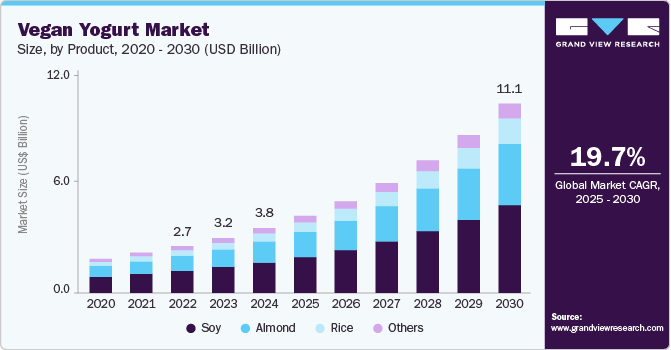

Georgie BillThe global vegan yogurt market was valued at USD 3.82 billion in 2024 and is projected to reach USD 11.11 billion by 2030, growing at a CAGR of 19.7% from 2025 to 2030. Increasing consumer interest in dairy-free products, particularly among millennials worldwide, is driving the demand for plant-based nutritional offerings such as vegan yogurts.

Vegan yogurt is rich in probiotics and beneficial gut bacteria, supporting digestive health. Rising health awareness and the prevalence of conditions like milk allergies in developed regions of North America and Europe have further boosted spending on plant-based products. Dairy consumption has been declining over decades, with each generation consuming less milk than the previous one. The growing adoption of vegan diets is encouraging consumers to replace traditional dairy products with alternatives like vegan yogurt, which provides similar digestive benefits and, in some cases, additional nutrients.

Certain varieties of vegan yogurt, such as flax milk yogurt and hemp yogurt, contain natural omega-3 fatty acids and fiber. Many others are fortified with vitamins and minerals to enhance their nutritional value. Vegan yogurts maintain a rich, smooth, and creamy texture similar to conventional yogurt, requiring minimal adjustment in taste and consistency.

Manufacturers are innovating with new bases and flavors to make vegan yogurt mainstream. Vegan yogurt is derived from plant-based milks from nuts, seeds, and grains. Common nuts include coconut, macadamia, hazelnut, pistachio, pili, almond, and cashew. Seeds used include soy, flax, and hemp, while grains include oats.

Order a free sample PDF of the Vegan Yogurt Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

By region: Europe held the largest share of 50.2% in 2024. In developed economies such as Germany, the UK, and France, a positive consumer outlook toward plant-based foods, supported by social media and television campaigns, is expected to maintain the region’s dominance.

By product: The soy yogurt segment led the market with a revenue share of 46.9% in 2024. Soy-based yogurts are gaining popularity as a protein-rich alternative to dairy yogurt and offer health benefits such as reduced cholesterol and blood sugar levels, driving demand.

By distribution channel: Hypermarkets, supermarkets, and convenience stores dominated the market in 2024. Major retailers including Walmart, Target, 7-Eleven, SPAR, Aldi, Carrefour, and Lidl reach large customer bases globally. For example, Target is expected to open around 26 new stores across the U.S., reflecting the growing consumer preference for non-dairy yogurt products.

Market Size & Forecast

2024 Market Size: USD 3.82 Billion

2030 Projected Market Size: USD 11.11 Billion

CAGR (2025-2030): 19.7%

Europe: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies are expanding product portfolios and consumer reach through innovative launches and online distribution channels. For instance, General Mills Inc. introduced a dairy-free line of French-style yogurt under its Oui brand. Other key players include Daiya Foods Inc., Nush Foods, Danone, and others.

Nush Foods is a UK-based company specializing in plant-based, dairy-free yogurts. It was the first UK producer of nut milk yogurts, available in flavors such as raspberry, vanilla fudge, and natural.

Daiya Foods Inc., based in Canada, offers dairy-free, gluten-free, and soy-free plant-based yogurt alternatives. Its products are available in over 25,000 grocery stores across North America and internationally.

Key Players

Hain Celestial

Danone

General Mills Inc.

Stonyfield Farm, Inc.

Daiya Foods.

Good Karma Foods

Hudson River Foods

Nancy's.

Kite Hill Store

COYO Pty Ltd.

Chobani, LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global vegan yogurt market is set for rapid expansion, driven by growing consumer awareness of plant-based diets, declining dairy consumption, and innovations in plant-based ingredients and flavors. With Europe leading the market and Asia Pacific emerging as the fastest-growing region, combined with increased investments in online and offline distribution channels, the market is projected to reach USD 11.11 billion by 2030. The trend highlights significant opportunities for product innovation, health-focused offerings, and market diversification.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by