How US Tariffs Are Affecting the Global Insurance Industry

Beinsure Media

Beinsure Media

Global growth is slowing at a time of large macroeconomic regime shifts. Extreme policy uncertainty is set to persist, the main driver being US goods tariffs.

Trade wars and protectionism leave no winners, but over the longer term will relocate trade and production globally. In this more fragmented world, firms and consumers face greater risks, including more volatile exchange rates and asset prices, heightened further by new developments in the Middle East conflict.

According to Swiss Re Institute‘s World Insurance sigma, global GDP growth (inflation adjusted) is expected to slow to 2.3% in 2025 and 2.4% in 2026 from 2.8% in 2024. Beinsure analyzed the report and highlighted the key points.

The global insurance industry is expected to follow the trend with total premiums expected to slow to 2% this year from 5.2% in 2024, picking up marginally to 2.3% in 2026.

“While insurers’ profitability outlook is still benefiting from rising investment income, we expect tariffs to slow global GDP growth, and consequently weigh on insurance demand,” says Jérôme Haegeli, Swiss Re’s Group Chief Economist.

In the long term, US tariff policy is another move towards more market fragmentation, which would reduce the affordability and availability of insurance, and so diminish global risk resilience.

EMEA insurers, while not directly impacted by US tariffs, face considerable exposure to secondary effects, according to Fitch Ratings’ report.

These tariffs, along with related geopolitical tensions and retaliatory measures, are expected to slow global economic growth and contribute to financial market volatility.

This will place pressure on insurers’ investment performance and underwriting outcomes.

Tariffs in the single digits aim to transform a supply chain but double-digit tariffs are destructive, intended to replace supply chains. The great majority of goods consist of components from different sources, like autos and homes.

Tariffs will be a stagflationary shock for the US

The volatile nature of US policy changes under the current administration has ushered in a paradigm shift of diminished confidence in the US government, eroding its status as a “safe haven” for global capital.

After several years of the fastest growth in the US (compared to Canada, UK, Germany, Italy, France, Japan, Australia) post-pandemic, US GDP growth is forecast at 1.5% this year (slowing from 2.8% in 2024).

Consequently, Swiss Re Institute has lowered growth expectations for most major economies in 2025.

US tariffs impact the primary insurance industry through premium growth, claims and investment returns, with differing effects by geography. We see the greatest and most direct impact on non-life claims severity in the US, most notably in US motor and construction.

Outside the US, tariffs are more likely to be disinflationary, reducing pressure on claims.

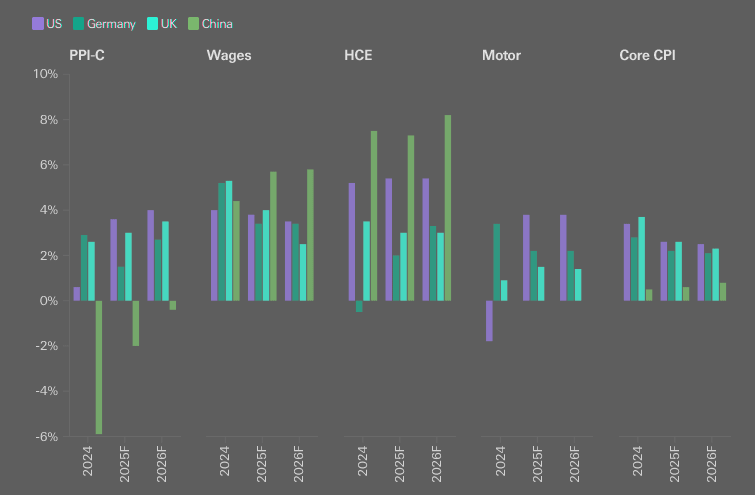

CPI inflation by market and sub-category, year-on-year

Source: Swiss Re Institute

As global supply chains become less efficient and domestic US industries more protected from international competition, US inflation will likely move structurally higher on average.

US consumers will be hit hardest by US’ tariff policy and cut their spending as a consequence of higher prices. This in turn will weigh on US growth which mostly depends on household consumption.

Later in 2026, Swiss Re Institute forecasts a rebound from the 2025 tariff shock, with somewhat firmer growth of 1.8% as the US economy adjusts to a “new normal” of higher tariff rates, supported by a stabilisation in labour market conditions.

J.P. Morgan recently examined how US tariffs could affect the insurance sector. The analysis shows that personal lines insurers, such as those offering auto and home insurance, face higher direct risks than commercial insurers or reinsurers.

Tariffs have raised the costs of auto parts, vehicles, and building materials. These inputs are central to underwriting in personal lines.

Higher repair costs and rising used car prices are expected to narrow their profit margins.

Commercial insurers face different risks and often operate with broader geographic exposure, making them less sensitive to tariff-driven price increases.

Over the medium to long term, however, the reduced flow of goods, services, capital and people is expected to pose a structural headwind to potential growth.

In Europe, policy uncertainty alone will weigh on economic activity, and result in unchanged growth at 0.8% this year.

US-EU trade negotiations are the main risk to the baseline outlook. However, weaker 2025 growth could give way to a brighter picture in 2026.

A more expansionary fiscal stance by the new German government as well as supportive credit conditions due to further interest rate cuts from the ECB should push euro area growth to 1.3% next year.

Meanwhile, China’s GDP growth is expected to slow to 4.7% compared to 5.0% in 2024 as tariffs and persistent uncertainty disrupt economic activity.

The risks and costs of the accelerating fragmentation of economies and markets may be serious for insurance.

Trade barriers and supply chain disruption or reshoring may push up inflation for prolonged periods, feeding into higher claims costs.

Restrictions on cross-border capital flows for re/insurers can lead to inefficient capital allocation and higher capital costs, ultimately leading to higher insurance prices and possibly curtailing the insurability of peak risks.

Subscribe to my newsletter

Read articles from Beinsure Media directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Beinsure Media

Beinsure Media

Beinsure.com — digital media platform focused on insurance, InsurTech, cybersecurity, investments, and blockchain technologies. It aims to demystify the complexities of these industries by providing the latest news, ratings, reviews, and insights. Beinsure serves a global audience interested in finance, insurance, and technology, offering an integrated platform for both industry professionals and the general public. The content is curated to inform and educate readers about market trends, investment opportunities, and technological advancements in the insurance and InsurTech sectors. Beinsure is a professional digital outlet that offers comprehensive coverage, in-depth analyses, and trusted reviews, and covers a wide range of topics related to insurance and technology.